Deliberation Candlestick Pattern

Introduction to Deliberation Candlestick Pattern:

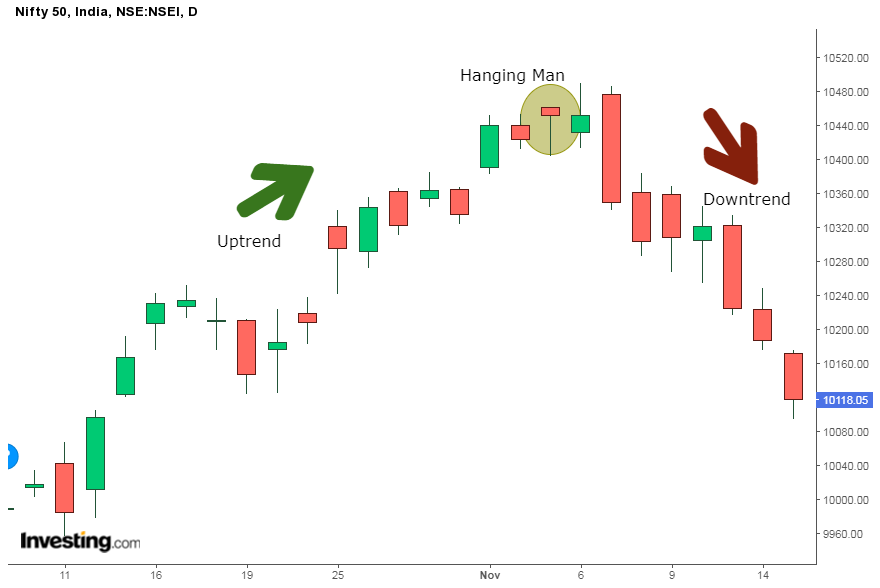

Deliberation candlestick pattern traders ki taraf se istemal hone wala aik powerful technical analysis tool hy jo market me potential reversals ko pehchanne me madadkarta hy. Isme teesri aik candlestick hoti hy jo indecision candle hoti hy. Ye pattern typically ek strong trend ke bad ban jati hy, jisse market me potential reversal ya consolidation ka indication ho sakta hy. Deliberation candlestick pattern ko analyze karte waqt kuch specific criteria ko dekhna zaruri hy. Sabse pehle, ye pattern uptrend ya downtrend me hona chahiye, kyunki ye price direction me possible reversal ka indication deta hy. Dusra candlestick, jo deliberation candle kehlata hy, chhota body aur lambi upper aur lower shadows wala hona chahiye, jisse indecision market me dikhaye. Antim candlestick bearish ya bullish hona chahiye jo price me reversal ko confirm karta hy.

Interpret The Deliberation Candlestick Pattern:

Deliberation candlestick pattern ko interpret karne ke liye, traders ko confirmation signals ki taraf dekhna chahiye aur usse any waly candlestick patterns ko analyze karna chahiye. Agar teesri candlestick reversal ko confirm karti hy, toh ye trend reversal ko strong karta hy. Iske sath hi pattern ke formation ke dauran volume ko bhi analyze karna zaruri hy. Agar deliberation candle ke dauran volume badhta hy, toh ye market participation ko darshata hy aur pattern ko credibility deta hy. Ye zaruri hy ki Deliberation candlestick pattern ko isolation me istemal na kiya jaye. Traders ko dusry technical indicators ko bhi consider karna chahiye aur isse aur candlestick patterns ko combine karna chahiye ta ke analysis accurate ho. For example, agar Deliberation pattern kisi significant support ya resistance level pe dikhe, toh isse reversal ki probability badhti hy.

Trading Strategies Using The Deliberation Candlestick Pattern:

Traders Deliberation candlestick pattern ka istemal kar ke various trading strategies ko implement kar sakty hy. Ek approach hy ki 3rd candlestick se confirmation ka wait karen aur reversal ki direction me trade enter karen. For example, agar trend bullish tha aur Deliberation pattern ban jata hy, toh traders Deliberation candle ke neeche wale confirmation candle ke bad short position enter kar sakty hy. Dusra strategy hy ki Deliberation pattern ko signal ki tarah istemal kar ke existing positions ko close karen aur profits le len. Agar ek trader ko uptrend me long position hy aur Deliberation pattern ban jata hy, toh ye trend reversal ka early warning ho sakta hy. Long position ko close karna aur further confirmation ka wait karna, potential losses se bachany me helpful ho ga.

:max_bytes(150000):strip_icc()/dotdash_Final_Hanging_Man_Candlestick_Definition_and_Tactics_Nov_2020-01-0a9ec4d589e7421783e202dc28a6ec85.jpg)

تبصرہ

Расширенный режим Обычный режим