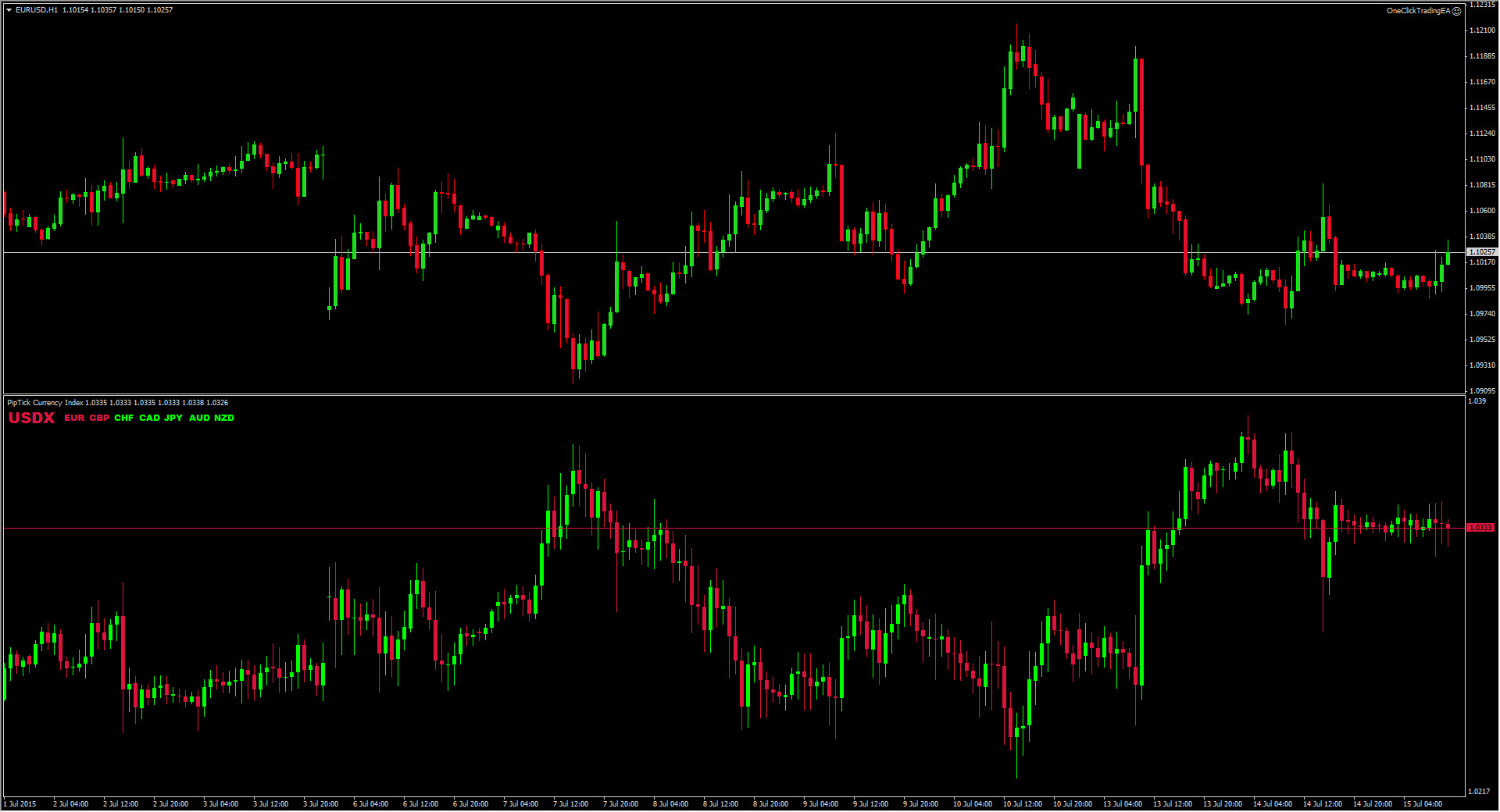

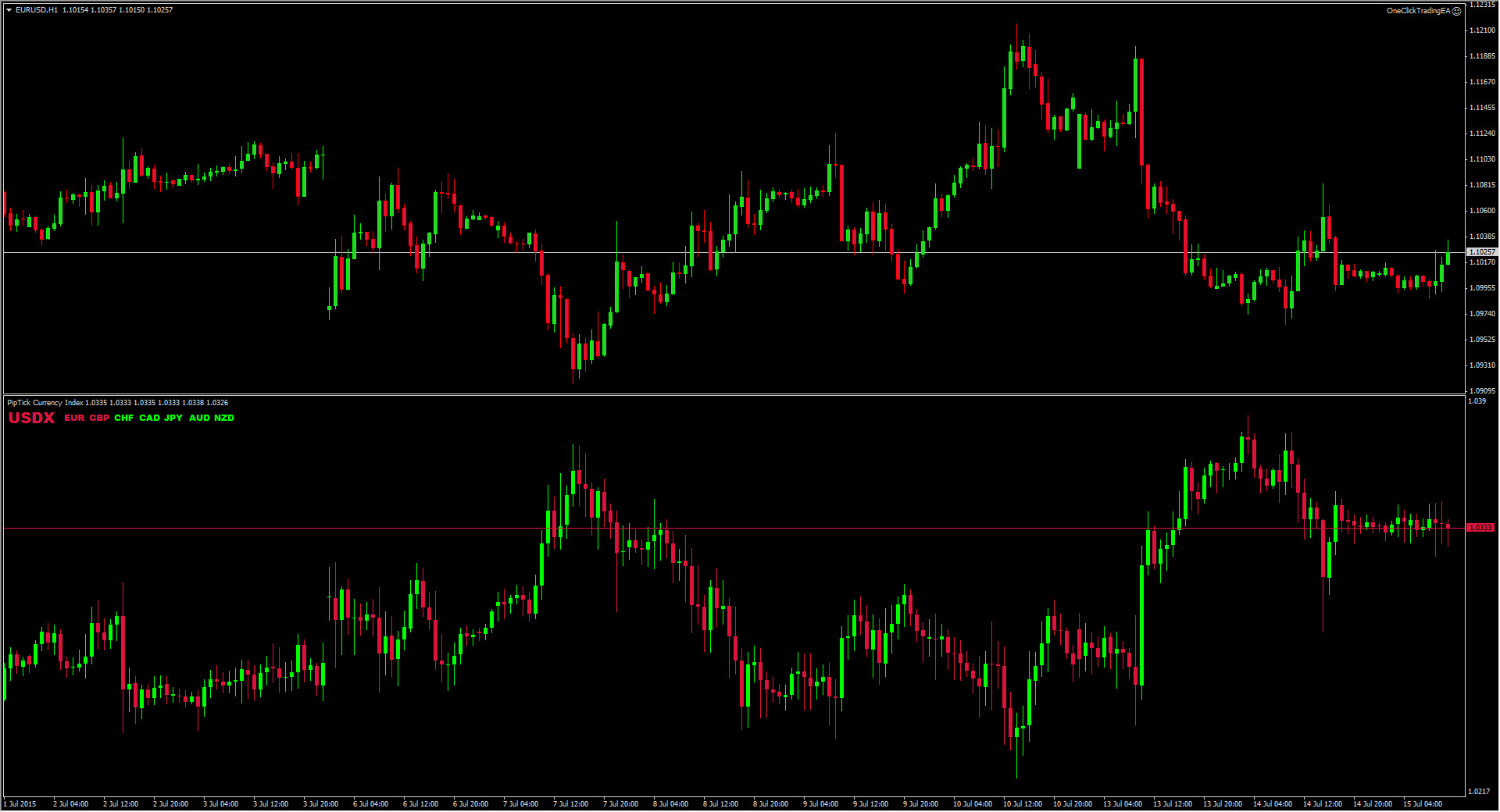

Currency Index aik composite measure hai jo aik currency ki qeemat ko doosri currencies ke selection ke muqable mein dikhata hai. Ye traders ko forex market mein ek currency ke performance ko mukhtalif forex pairs ke zariye dekhne mein madad deta hai, jisse unko forex market ke relative taqat ya kamzori ko samajhne mein madad milti hai. Ye concept currency relationships aur interdependencies ki fikr par mabni hai, jo global forex trading ke dynamics ko darust karta hai.

Significance of CI in Forex

Forex trading ke duniya mein, jahan currencies pairs mein trade ki jati hain, currencies ki relative taqat ko samajhna bohot zaroori hai. CI ek ahem tool ka kaam deta hai currency ki overall health ka andaza lagane ke liye, jo traders ko potential trading opportunities pehchanne mein madad karta hai aur risk ko effectively manage karne mein madad deta hai. CI ka tajziya karke, traders currency pairs ko trade karne ke liye, dakhilay aur nikalay ke time ko, aur apne trading portfolios mein resources ka taqseem karne ka faisla kar sakte hain.

Calculation Methods

Kai tarah ke methodologies hain CI ko calculate karne ke liye, har approach ek unique insight offer karta hai currency performance ke liye. Aik common method mein, individual currencies ko index ke andar weights diye jate hain jo factors jaise trade volume, economic significance aur geopolitical influence ke basis pe hote hain. Ye weights phir currencies ke value ko calculate karne ke liye istemal kiye jate hain relative to the basket of currencies.

Doosra approach currency pairs ka geometric mean ya harmonic mean istemal karne ko shamil karta hai index value nikalne ke liye. Ye method outliers aur extreme fluctuations ke asar ko lekar stable aur reliable currency strength ka measure deta hai.

Practical Applications

Currency Index ko forex trading mein bohot se practical applications milti hain, jo traders ko valuable insights provide karti hai aur unke decision-making process ko guide karti hai. Aik ahem application trend analysis mein hoti hai, jahan traders CI ka istemal karte hain taake currency strength ke trends ko samajh sakein. Index value ke changes ko track karke, traders emerging trends ko dekh sakte hain, currency movements ka momentum assess kar sakte hain, aur apni trading strategies ko mutabiq kar sakte hain.

Iske alawa, CI relative strength analysis ke liye aik powerful tool hai, jo traders ko ek hi index ke andar mukhtalif currencies ki performance ko compare karne mein madad deta hai. Ye muqablayi tajziya traders ko profit ke liye highest potential wale currency pairs ko pehchanne mein madad karta hai, sath hi un currencies ko bhi dekhta hai jo kamzor ya unstable signs dikhate hain.

Limitations of CI

Despite its usefulness, the Currency Index ke kuch limitations hain jinhe traders ko janibdari se samajhna chahiye. Aik limitation index basket mein shamil hone wali currencies ka selection ka hai. Mukhtalif indices alag-alag combinations of currencies istemal karte hain, jo index values aur interpretations mein farq paida karta hai. Iske alawa, index basket ka composition ke changes waqt ke sath index ki relevance aur accuracy par asar daal sakta hai ek currency ki strength ka measure karne ke liye.

Bunyadi tor par, Currency Index kuch nuances aur complexities ko capture karne mein nakami ka shikaar ho sakta hai, jaise regional economic factors, geopolitical events, aur market sentiment. Isliye traders ko is CI ko dusre technical aur fundamental indicators ke saath istemal karke currency movements aur market dynamics ko samajhne ka comprehensive approach apnana chahiye.

Currency Index ek ahem tool hai forex traders ke liye jo currency movements ko samajhne mein madad deta hai aur unko informed trading decisions lene mein madad karta hai. Ek basket ke saath mukhtalif currencies ke muqable mein currency strength ka ek comprehensive measure faraham karke, CI traders ko trends pehchane mein, relative strength ko assess karne mein aur risk ko effectively manage karne mein madad milti hai. Jabke index ke kuch limitations hain, uske practical applications aur analytical capabilities isko har forex trader ke arsenal mein lazmi banate hain.

Significance of CI in Forex

Forex trading ke duniya mein, jahan currencies pairs mein trade ki jati hain, currencies ki relative taqat ko samajhna bohot zaroori hai. CI ek ahem tool ka kaam deta hai currency ki overall health ka andaza lagane ke liye, jo traders ko potential trading opportunities pehchanne mein madad karta hai aur risk ko effectively manage karne mein madad deta hai. CI ka tajziya karke, traders currency pairs ko trade karne ke liye, dakhilay aur nikalay ke time ko, aur apne trading portfolios mein resources ka taqseem karne ka faisla kar sakte hain.

Calculation Methods

Kai tarah ke methodologies hain CI ko calculate karne ke liye, har approach ek unique insight offer karta hai currency performance ke liye. Aik common method mein, individual currencies ko index ke andar weights diye jate hain jo factors jaise trade volume, economic significance aur geopolitical influence ke basis pe hote hain. Ye weights phir currencies ke value ko calculate karne ke liye istemal kiye jate hain relative to the basket of currencies.

Doosra approach currency pairs ka geometric mean ya harmonic mean istemal karne ko shamil karta hai index value nikalne ke liye. Ye method outliers aur extreme fluctuations ke asar ko lekar stable aur reliable currency strength ka measure deta hai.

Practical Applications

Currency Index ko forex trading mein bohot se practical applications milti hain, jo traders ko valuable insights provide karti hai aur unke decision-making process ko guide karti hai. Aik ahem application trend analysis mein hoti hai, jahan traders CI ka istemal karte hain taake currency strength ke trends ko samajh sakein. Index value ke changes ko track karke, traders emerging trends ko dekh sakte hain, currency movements ka momentum assess kar sakte hain, aur apni trading strategies ko mutabiq kar sakte hain.

Iske alawa, CI relative strength analysis ke liye aik powerful tool hai, jo traders ko ek hi index ke andar mukhtalif currencies ki performance ko compare karne mein madad deta hai. Ye muqablayi tajziya traders ko profit ke liye highest potential wale currency pairs ko pehchanne mein madad karta hai, sath hi un currencies ko bhi dekhta hai jo kamzor ya unstable signs dikhate hain.

Limitations of CI

Despite its usefulness, the Currency Index ke kuch limitations hain jinhe traders ko janibdari se samajhna chahiye. Aik limitation index basket mein shamil hone wali currencies ka selection ka hai. Mukhtalif indices alag-alag combinations of currencies istemal karte hain, jo index values aur interpretations mein farq paida karta hai. Iske alawa, index basket ka composition ke changes waqt ke sath index ki relevance aur accuracy par asar daal sakta hai ek currency ki strength ka measure karne ke liye.

Bunyadi tor par, Currency Index kuch nuances aur complexities ko capture karne mein nakami ka shikaar ho sakta hai, jaise regional economic factors, geopolitical events, aur market sentiment. Isliye traders ko is CI ko dusre technical aur fundamental indicators ke saath istemal karke currency movements aur market dynamics ko samajhne ka comprehensive approach apnana chahiye.

Currency Index ek ahem tool hai forex traders ke liye jo currency movements ko samajhne mein madad deta hai aur unko informed trading decisions lene mein madad karta hai. Ek basket ke saath mukhtalif currencies ke muqable mein currency strength ka ek comprehensive measure faraham karke, CI traders ko trends pehchane mein, relative strength ko assess karne mein aur risk ko effectively manage karne mein madad milti hai. Jabke index ke kuch limitations hain, uske practical applications aur analytical capabilities isko har forex trader ke arsenal mein lazmi banate hain.

تبصرہ

Расширенный режим Обычный режим