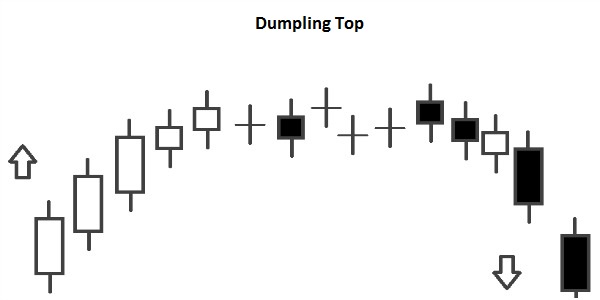

What is Dumpling Top Pattern:

Dumpling Top patteren aik takneeki tshkhisi namona hai jo aam tor par zar e mubadla ki mandiyon mein hota hai. yeh aik bearish reversal namona hai jo fashion mein up trained se down trained ki salahiyat mein tabdeeli ki tajweez karta hai. is namoonay mein mom btyon ka aik silsila shaamil hai jo Dumpling ke mutabiq aik herat angaiz shakal banata hai, jis ke nateejay mein cal hoti hai. namoonay ki shanakht aik fees really ke zariye ki jati hai jis ka mushahida istehkaam ki muddat ya side way motion ke zariye kya jata hai, jis ki wajah se aik gole Top tashkeel hoti hai. tajir aksar is tarz ki talaash karte hain kyunkay yeh taizi ki raftaar ke kamzor honay aur mumkina tor par neechay ki taraf anay walay bahao ke baray mein khabardaar karta hai.

Characteristics of Dumpling Top Pattern:

Dumpling Top patteren ki khasusiyat chand kaleedi salahiyaton ke zariye hoti hai jin ka istemaal khredar zar e mubadla ki mandiyon mein is ki mojoodgi se waaqif honay aur is ki tasdeeq karne ke liye karte hain. sab se pehlay, namona aam tor par taweel up trained ke baad kaghazi karwai karta hai, jo sarfeen mein thakawat ki nishandahi karta hai. jaisay hi namona samnay aata hai, sarmaya car chhootey mom btyon ke aik silsilay ki jaanch karte hain jo nai bulandion bananay mein nakaam rehtay hain, jis ki wajah se chouti par gole band hota hai. yeh istehkaam ka hissa jazbaat mein taizi se mandi ki taraf tabdeeli ka ishara dainay ke liye zaroori hai. mazeed bar-aan, hajam ki tashkhees patteren ki sadaqat ki tasdeeq mein aik achi position injaam deti hai, jis mein kharidari aur farokht ka hajam kam hota hai jo aksar Dumpling chouti ki tashkeel ke sath hota hai.

Trading With Dumpling Top Pattern:

Jab sarmaya car zar e mubadla ke chart mein Dumpling Top patteren ko dekhte hain, to woh aksar mumkina ulat palat ka faida uthany ke liye khareed o farokht ki taknik waza karte hain. aik ghair mamooli taknik yeh hai ke istehkaam ke marhalay ke douran nasb kardah madad ki satah ke tehat aik tabah talaash karkay namoonay ki tasdeeq ka intzaar karna hai. yeh kharabi aam tor par zawaal ke aaghaz ka ishara deti hai, jis se sarmaya karon ko fori pozishnon mein daakhil honay ka mauqa milta hai. mazeed bar-aan, tajir deegar takneeki alamaat ka bhi istemaal kar satke hain, jin mein rishta daar taaqat index ( rsi ) ya moving average shaamil hain, taakay isi terhan Dumpling Top patteren ki madad se paish kardah ulat nishaan ki toseeq ki ja sakay.

Risk Management when trading Dumpling Top Pattern:

Kisi bhi khareed o farokht ki hikmat e amli ki terhan, zar e mubadla baazaaron mein Dumpling Top patteren ki kharidari aur farokht ke douran rissk managment ahem hai. taajiron ko mutabadil un ki taraf jane ki soorat mein salahiyat ke nuqsaan ko mehdood karne ke liye forest all las orders muqarrar karne ki zaroorat hai. is namoonay ki noiyat ko mandi ke ulat jane ki alamat ke tor par dekhte hue, mohtaat rehna aur paishgi tijarat mein nah jana bohat zaroori hai. mazeed bar-aan, sarmaya car khatray ki numayesh ko kam karne ke liye mustaqil tor par pozishnon mein tosee ko bhi zehen mein rakh satke hain. nuqsaan se bachao ki hudood mein tarmeem karne aur ulat ki taaqat ko jhanchne ke liye qeemat ki karwai aur jama ki had ki tasdeeq ki nigrani bhi zaroori hai.

Limitations of Dumpling Top Pattern:

Agarchay Dumpling Top patteren zar e mubadla ki tijarat mein salahiyat ki tabdeeli ka aik qabil aetmaad ishara ho sakta hai, lekin yeh hamesha hudood ke baghair nahi hota hai. taajiron ko maloom hona chahiye ke koi bhi namona ya isharay faul proof nahi hain, aur ghalat intabahat ho satke hain. kamyabi ki tijarat ke mauqa ko khobsorat bananay ke liye deegar takneeki tshkhisi tools aur tasdeeq ke isharay ke sath Dumpling Top patteren ko jorna zaroori hai. mazeed bar-aan, bazaar ke halaat, khabron ke waqeat, aur mukhtalif bairooni awamil fees ki naqal o harkat par assar daal satke hain, jo patteren ki ifadiyat ko mutasir karte hain. taajiron ko kharidari aur farokht ke ikhtiyarat ke liye Dumpling Top patteren par mukammal tor par inhisaar karne se pehlay intibah aur ravayye ki mukammal jaanch partaal karne ki zaroorat hai.

Dumpling Top patteren aik takneeki tshkhisi namona hai jo aam tor par zar e mubadla ki mandiyon mein hota hai. yeh aik bearish reversal namona hai jo fashion mein up trained se down trained ki salahiyat mein tabdeeli ki tajweez karta hai. is namoonay mein mom btyon ka aik silsila shaamil hai jo Dumpling ke mutabiq aik herat angaiz shakal banata hai, jis ke nateejay mein cal hoti hai. namoonay ki shanakht aik fees really ke zariye ki jati hai jis ka mushahida istehkaam ki muddat ya side way motion ke zariye kya jata hai, jis ki wajah se aik gole Top tashkeel hoti hai. tajir aksar is tarz ki talaash karte hain kyunkay yeh taizi ki raftaar ke kamzor honay aur mumkina tor par neechay ki taraf anay walay bahao ke baray mein khabardaar karta hai.

Characteristics of Dumpling Top Pattern:

Dumpling Top patteren ki khasusiyat chand kaleedi salahiyaton ke zariye hoti hai jin ka istemaal khredar zar e mubadla ki mandiyon mein is ki mojoodgi se waaqif honay aur is ki tasdeeq karne ke liye karte hain. sab se pehlay, namona aam tor par taweel up trained ke baad kaghazi karwai karta hai, jo sarfeen mein thakawat ki nishandahi karta hai. jaisay hi namona samnay aata hai, sarmaya car chhootey mom btyon ke aik silsilay ki jaanch karte hain jo nai bulandion bananay mein nakaam rehtay hain, jis ki wajah se chouti par gole band hota hai. yeh istehkaam ka hissa jazbaat mein taizi se mandi ki taraf tabdeeli ka ishara dainay ke liye zaroori hai. mazeed bar-aan, hajam ki tashkhees patteren ki sadaqat ki tasdeeq mein aik achi position injaam deti hai, jis mein kharidari aur farokht ka hajam kam hota hai jo aksar Dumpling chouti ki tashkeel ke sath hota hai.

Trading With Dumpling Top Pattern:

Jab sarmaya car zar e mubadla ke chart mein Dumpling Top patteren ko dekhte hain, to woh aksar mumkina ulat palat ka faida uthany ke liye khareed o farokht ki taknik waza karte hain. aik ghair mamooli taknik yeh hai ke istehkaam ke marhalay ke douran nasb kardah madad ki satah ke tehat aik tabah talaash karkay namoonay ki tasdeeq ka intzaar karna hai. yeh kharabi aam tor par zawaal ke aaghaz ka ishara deti hai, jis se sarmaya karon ko fori pozishnon mein daakhil honay ka mauqa milta hai. mazeed bar-aan, tajir deegar takneeki alamaat ka bhi istemaal kar satke hain, jin mein rishta daar taaqat index ( rsi ) ya moving average shaamil hain, taakay isi terhan Dumpling Top patteren ki madad se paish kardah ulat nishaan ki toseeq ki ja sakay.

Risk Management when trading Dumpling Top Pattern:

Kisi bhi khareed o farokht ki hikmat e amli ki terhan, zar e mubadla baazaaron mein Dumpling Top patteren ki kharidari aur farokht ke douran rissk managment ahem hai. taajiron ko mutabadil un ki taraf jane ki soorat mein salahiyat ke nuqsaan ko mehdood karne ke liye forest all las orders muqarrar karne ki zaroorat hai. is namoonay ki noiyat ko mandi ke ulat jane ki alamat ke tor par dekhte hue, mohtaat rehna aur paishgi tijarat mein nah jana bohat zaroori hai. mazeed bar-aan, sarmaya car khatray ki numayesh ko kam karne ke liye mustaqil tor par pozishnon mein tosee ko bhi zehen mein rakh satke hain. nuqsaan se bachao ki hudood mein tarmeem karne aur ulat ki taaqat ko jhanchne ke liye qeemat ki karwai aur jama ki had ki tasdeeq ki nigrani bhi zaroori hai.

Limitations of Dumpling Top Pattern:

Agarchay Dumpling Top patteren zar e mubadla ki tijarat mein salahiyat ki tabdeeli ka aik qabil aetmaad ishara ho sakta hai, lekin yeh hamesha hudood ke baghair nahi hota hai. taajiron ko maloom hona chahiye ke koi bhi namona ya isharay faul proof nahi hain, aur ghalat intabahat ho satke hain. kamyabi ki tijarat ke mauqa ko khobsorat bananay ke liye deegar takneeki tshkhisi tools aur tasdeeq ke isharay ke sath Dumpling Top patteren ko jorna zaroori hai. mazeed bar-aan, bazaar ke halaat, khabron ke waqeat, aur mukhtalif bairooni awamil fees ki naqal o harkat par assar daal satke hain, jo patteren ki ifadiyat ko mutasir karte hain. taajiron ko kharidari aur farokht ke ikhtiyarat ke liye Dumpling Top patteren par mukammal tor par inhisaar karne se pehlay intibah aur ravayye ki mukammal jaanch partaal karne ki zaroorat hai.

تبصرہ

Расширенный режим Обычный режим