Barrier Level

Introduction

Barrier level ek finance term hai jo ek specific security ya financial instrument ki protection ki level ko define karta hai. Ye level us waqt istemal hota hai jab ek investor ya lender apni investment ya loan ki protection ko evaluate karna chahta hai.investors aur lenders ko unki investments ya loans ke risk ko evaluate karne mein madadgar hoti hai. Isliye, barrier levels ka calculation aur monitoring financial decision-making process mein ahmiyat rakhta hai.

Barrier Level Ki Ahmiyat

Barrier level ki ahmiyat yeh hai ke ye ek investment ya loan ki risk ko measure karne mein madad karta hai. Is level ka pata lagana, investors aur lenders ko samajhne mein madad deta hai ke unki investment ya loan ki kitni safety hai.

Barrier Level Ki Calculation

Barrier level ka calculation typically ek complex process hai jismein various factors consider kiye jate hain. Ye factors include karte hain asset's volatility, market conditions, interest rates, aur specific security ki characteristics.

Types of Barrier Levels

Barrier Level ki Examples

Barrier Level aur Risk Management

Barrier levels ki understanding risk management mein crucial role play karte hain. Investors aur lenders, apne investments ya loans ke risk ko analyze karne ke liye barrier levels ka istemal karte hain aur apni strategies ko us accordingly adjust karte hain.

Introduction

Barrier level ek finance term hai jo ek specific security ya financial instrument ki protection ki level ko define karta hai. Ye level us waqt istemal hota hai jab ek investor ya lender apni investment ya loan ki protection ko evaluate karna chahta hai.investors aur lenders ko unki investments ya loans ke risk ko evaluate karne mein madadgar hoti hai. Isliye, barrier levels ka calculation aur monitoring financial decision-making process mein ahmiyat rakhta hai.

Barrier Level Ki Ahmiyat

Barrier level ki ahmiyat yeh hai ke ye ek investment ya loan ki risk ko measure karne mein madad karta hai. Is level ka pata lagana, investors aur lenders ko samajhne mein madad deta hai ke unki investment ya loan ki kitni safety hai.

Barrier Level Ki Calculation

Barrier level ka calculation typically ek complex process hai jismein various factors consider kiye jate hain. Ye factors include karte hain asset's volatility, market conditions, interest rates, aur specific security ki characteristics.

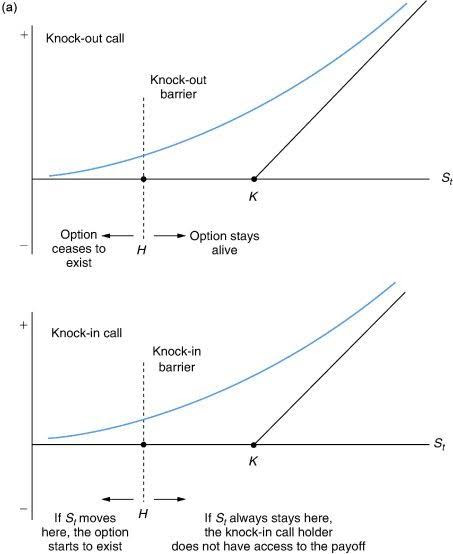

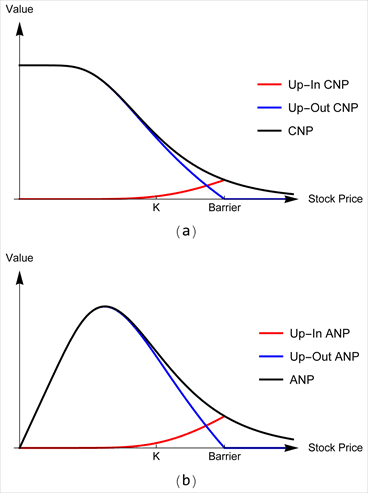

Types of Barrier Levels

- Downside Barrier Level: Ye level woh minimum price ya value hai jahan se security ya financial instrument ka price girne se pehle ek specific level tak ja sakta hai.

- Upside Barrier Level: Ye level woh maximum price ya value hai jahan tak security ya financial instrument ka price pahunch sakta hai.

Barrier Level ki Examples

- Equity Markets: Ek common example equity markets mein barrier level ka yeh hota hai ke ek stock ka price neeche ya upar ja sakta hai specific levels tak.

- Derivatives: Derivatives market mein bhi barrier levels ka istemal hota hai, jaise ki options ya futures mein.

- Bonds: Bonds mein bhi barrier levels define kiye jate hain, jaise ki issuer ki financial health ya economic conditions ke against.

Barrier Level aur Risk Management

Barrier levels ki understanding risk management mein crucial role play karte hain. Investors aur lenders, apne investments ya loans ke risk ko analyze karne ke liye barrier levels ka istemal karte hain aur apni strategies ko us accordingly adjust karte hain.

تبصرہ

Расширенный режим Обычный режим