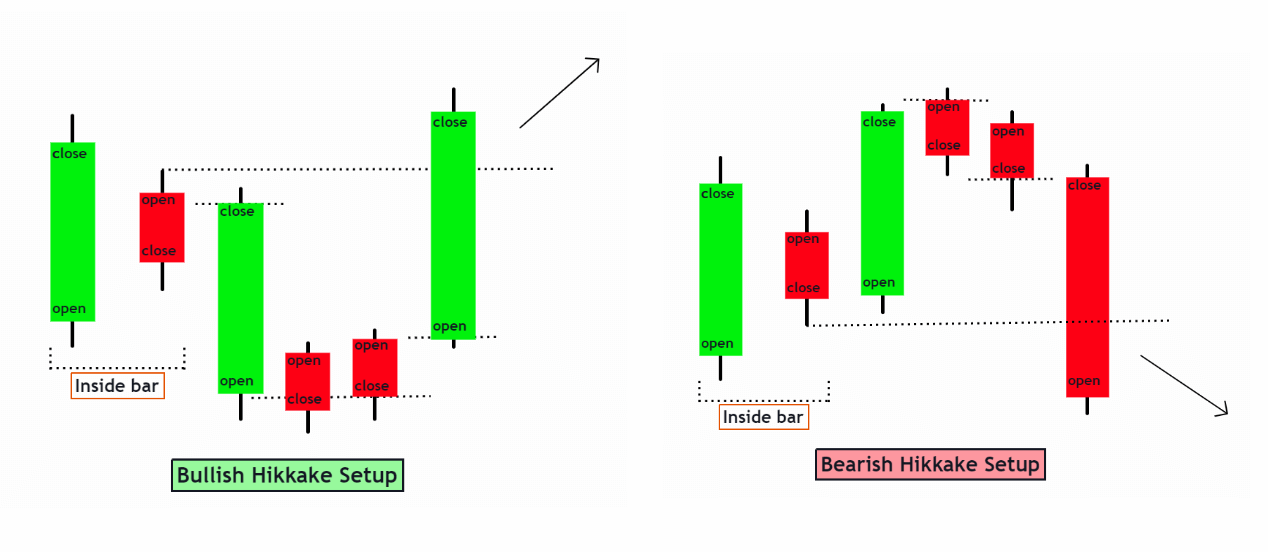

Dear fellow traders forex market mein koi bi candlestick pattern jo traders apni trading ky leye use kerty hein,market ki direction aur trend ko define kerti hein.kisi bi pattern ko apni trading per apply kerny sy pehly oss ki complete knowledge aur lerning hasil kerna bhout important hota hy. Hikkake pattern bi aesy bhout sary patter mein sy aik hy. Yeh hamain trend change hony ki clear indication provide kerta hai ky jab market continuously aik hi trend main movement kerti hai aur same trend main kei candles create kerti hai tou aesy time per agar aik aesi candle create ho jaye jo last three candles ko reverse order main break ker rehi ho tou, ess ka matlab hy kay ab market main previous trend end ho gya hay, aur market main trend change ho ker market reverse direction main new trend start kerny lagi hay. Jis ky according traders apni trade ko adjust ker sakty hein aur new order bi place ker sakty hein.

CHARACTERISTICS OF HIKKAKE CANDLESTICK PATTERN

My fellow traders jab bhi market ki movement main hikkake pattern create ho jaey tou hamain trend ky according open trades ko close ker lena chehye, aur new trend jo previous trend ky change hony per continue ki indication milti hai hamain ess per trade enter ker ky continue ker leni chehye, agar ham previous trend per trade continue rakhty hain kay ham hikkake pattern ko ignore ker dety hain tou, aesi condition mein hamara loss ki waja sey account wash ho sakta hay. Ess mein aapko maximum candlestick pattern long body wali milati hain, jin ko aap marobuzu candlestick ka naam dete hain. Yah candlestick pattern hamesha different important candlestick per consisted hota hay jis mein different important candlestick pattern ko technical analysis ko perfect karne ke liye kuchh indications provide kar rahi hoti hai. Jab aap is candlestick pattern ko properly learn karte hain aur apni trading per apply karte hain tou ess sey aap ko maximum advantages mil sakte hain. Market aksar side trend mein move hoti hai, sometime support or resistance ko hit karti hay, but market jis side par break karti hai woh support ko break kary ya resistance ko break kary woh phir same direction mein long move kar jati hai,aor apny trend ko further continue karti hai ya phr trend sy reverse move kar jati hai. Aesi condition mein pattern completion ki confirmation kay baghair trade place kerna traders kay leye risky ho sakta hay.

USAGE OF HIKKAKE CANDLESTICK PATTERN

jab bi hum kisi pattern ko follow kerty hein tu oss pattern ki past authentication ko lazmi confirm ker lena chehye ta ky kisi bi loss sy bacha ja saky.trader ko hamesa es baat ka khayal rakhna chaheye kay market aksar false break out b karti hai, aor trader agar aesy false break out mein trap ho jaein tou usko eska bhot loss ho sakta hai, aor uska account wash ho sakta hai. jo trader forex mein break out strategy ko use karty hain unko chaheye kay woh ess pattern par lazmi focus karein. traders ko best results ky leye patterns k sath apna experience bi zarur utilize karna chaheye tab hee unn ko acha profit hasil ho sakta hai or wo loss ay bach sakty hain.

CHARACTERISTICS OF HIKKAKE CANDLESTICK PATTERN

My fellow traders jab bhi market ki movement main hikkake pattern create ho jaey tou hamain trend ky according open trades ko close ker lena chehye, aur new trend jo previous trend ky change hony per continue ki indication milti hai hamain ess per trade enter ker ky continue ker leni chehye, agar ham previous trend per trade continue rakhty hain kay ham hikkake pattern ko ignore ker dety hain tou, aesi condition mein hamara loss ki waja sey account wash ho sakta hay. Ess mein aapko maximum candlestick pattern long body wali milati hain, jin ko aap marobuzu candlestick ka naam dete hain. Yah candlestick pattern hamesha different important candlestick per consisted hota hay jis mein different important candlestick pattern ko technical analysis ko perfect karne ke liye kuchh indications provide kar rahi hoti hai. Jab aap is candlestick pattern ko properly learn karte hain aur apni trading per apply karte hain tou ess sey aap ko maximum advantages mil sakte hain. Market aksar side trend mein move hoti hai, sometime support or resistance ko hit karti hay, but market jis side par break karti hai woh support ko break kary ya resistance ko break kary woh phir same direction mein long move kar jati hai,aor apny trend ko further continue karti hai ya phr trend sy reverse move kar jati hai. Aesi condition mein pattern completion ki confirmation kay baghair trade place kerna traders kay leye risky ho sakta hay.

USAGE OF HIKKAKE CANDLESTICK PATTERN

jab bi hum kisi pattern ko follow kerty hein tu oss pattern ki past authentication ko lazmi confirm ker lena chehye ta ky kisi bi loss sy bacha ja saky.trader ko hamesa es baat ka khayal rakhna chaheye kay market aksar false break out b karti hai, aor trader agar aesy false break out mein trap ho jaein tou usko eska bhot loss ho sakta hai, aor uska account wash ho sakta hai. jo trader forex mein break out strategy ko use karty hain unko chaheye kay woh ess pattern par lazmi focus karein. traders ko best results ky leye patterns k sath apna experience bi zarur utilize karna chaheye tab hee unn ko acha profit hasil ho sakta hai or wo loss ay bach sakty hain.

:max_bytes(150000):strip_icc()/dotdash-INV-final-Hikkake-attern-Mar-2021-01-0149db5e4f4c47e3ab22f36cc3613a37.jpg)

تبصرہ

Расширенный режим Обычный режим