++++Forex Trading Mein False Break++++

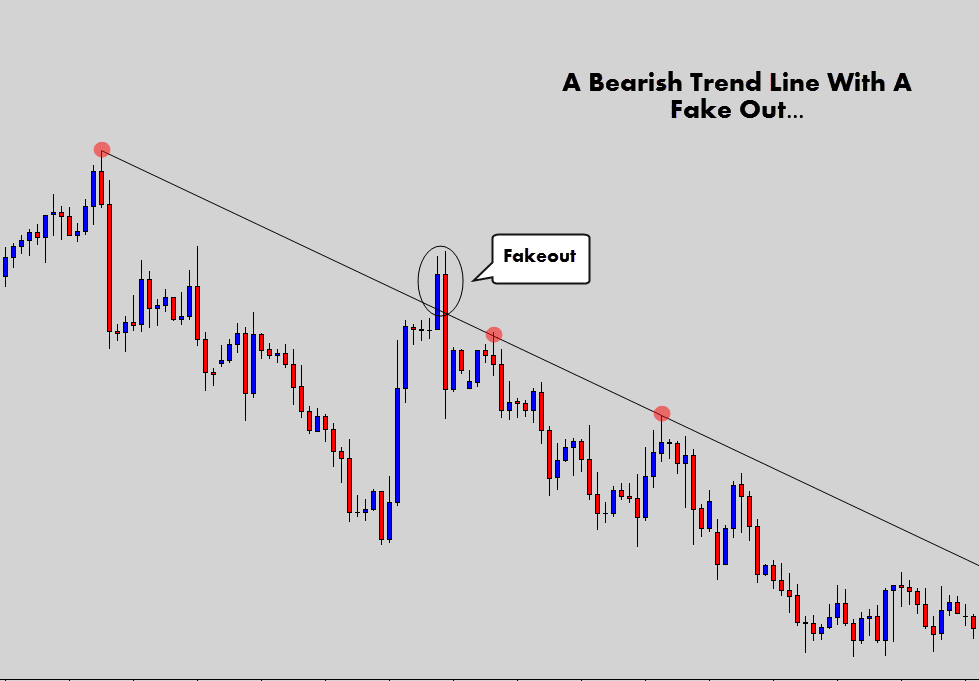

Forex trading mein "false break" ka matlab hota hai jab kisi financial instrument ka price ek specific level ko breach karta hai, lekin phir woh breach temporary hota hai aur price wapas us level se reverse ho jata hai. Yeh reversal ho sakta hai upward (jab price level ko break karta hai phir wapas neeche jaata hai) ya downward (jab price level ko break karta hai phir wapas upar jaata hai).

False break, traders ke liye confusing ho sakta hai, kyun ki initial break ko follow karte hue woh trading positions lete hain, lekin phir reversal se unka trade negatively affect ho sakta hai. False break hone ke kai reasons ho sakte hain, jaise ki market manipulation, temporary liquidity fluctuations, ya phir technical indicators ka misleading interpretation.

++++Forex Trading Mein False Break Ehem Nukaat++++

False breaks ko samajhne ke liye, traders ko kuch mukhya points ka dhyan rakhna zaroori hai:

Forex trading mein "false break" ka matlab hota hai jab kisi financial instrument ka price ek specific level ko breach karta hai, lekin phir woh breach temporary hota hai aur price wapas us level se reverse ho jata hai. Yeh reversal ho sakta hai upward (jab price level ko break karta hai phir wapas neeche jaata hai) ya downward (jab price level ko break karta hai phir wapas upar jaata hai).

False break, traders ke liye confusing ho sakta hai, kyun ki initial break ko follow karte hue woh trading positions lete hain, lekin phir reversal se unka trade negatively affect ho sakta hai. False break hone ke kai reasons ho sakte hain, jaise ki market manipulation, temporary liquidity fluctuations, ya phir technical indicators ka misleading interpretation.

++++Forex Trading Mein False Break Ehem Nukaat++++

False breaks ko samajhne ke liye, traders ko kuch mukhya points ka dhyan rakhna zaroori hai:

- Market Context: False breaks ki pehchan karne ke liye, traders ko market ka broader context samajhna important hai. Trend lines, support aur resistance levels, aur market sentiment ko analyze karna false breaks ko detect karne mein madad karta hai.

- Volume Analysis: Volume analysis bhi false breaks ko samajhne mein madadgar ho sakta hai. Agar break ke samay volume low hai, toh yeh indicate kar sakta hai ki break genuine nahi hai aur reversal hone ke chances hain.

- Price Action Patterns: Price action patterns, jaise ki pin bars, engulfing patterns, ya doji candles, false breaks ko detect karne mein madadgar ho sakte hain. Agar price action pattern ke saath break hone ke baad reversal signal milta hai, toh yeh false break hone ki sambhavna ko indicate karta hai.

- Confirmation Indicators: Traders ko confirmatory indicators ka istemaal karna chahiye false breaks ko confirm karne ke liye. Additional technical indicators, jaise ki RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), aur Stochastic Oscillator, break ko verify karne mein madad karte hain.

- Stop-loss Orders: Stop-loss orders ka istemaal karke, traders apne positions ko false breaks ke nuksan se bacha sakte hain. Stop-loss orders unhein protect karte hain agar price unexpected reversal ka samna kare.

- Risk Management: Har trading strategy ke saath sahi risk management plan hona chahiye. Position size ko control karna aur risk-reward ratio ko dhyan mein rakhna zaroori hai false breaks se bachne ke liye.

تبصرہ

Расширенный режим Обычный режим