`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

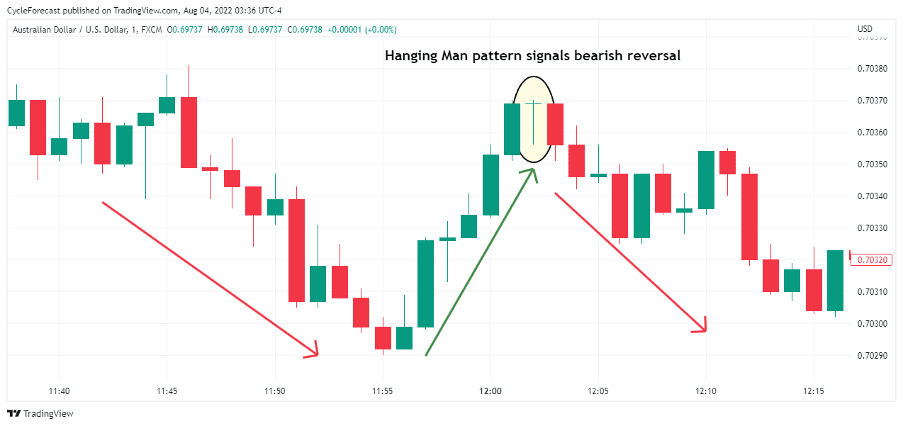

hanging main candle stick pattren in forex

Hanging Man candlestick pattern Forex trading mein ek aham aur mashhoor reversal signal hai, jo traders ko market mein possible trend reversal ya price drop ki warning deta hai. Ye pattern typically uptrend ke doran banta hai aur future selling pressure ya price decline ki indication deta hai. Is article mein, hum Hanging Man pattern ke features, formation, aur iski trading strategies ke bare mein discuss karenge.

Hanging Man Candlestick Pattern Ki Pehchan

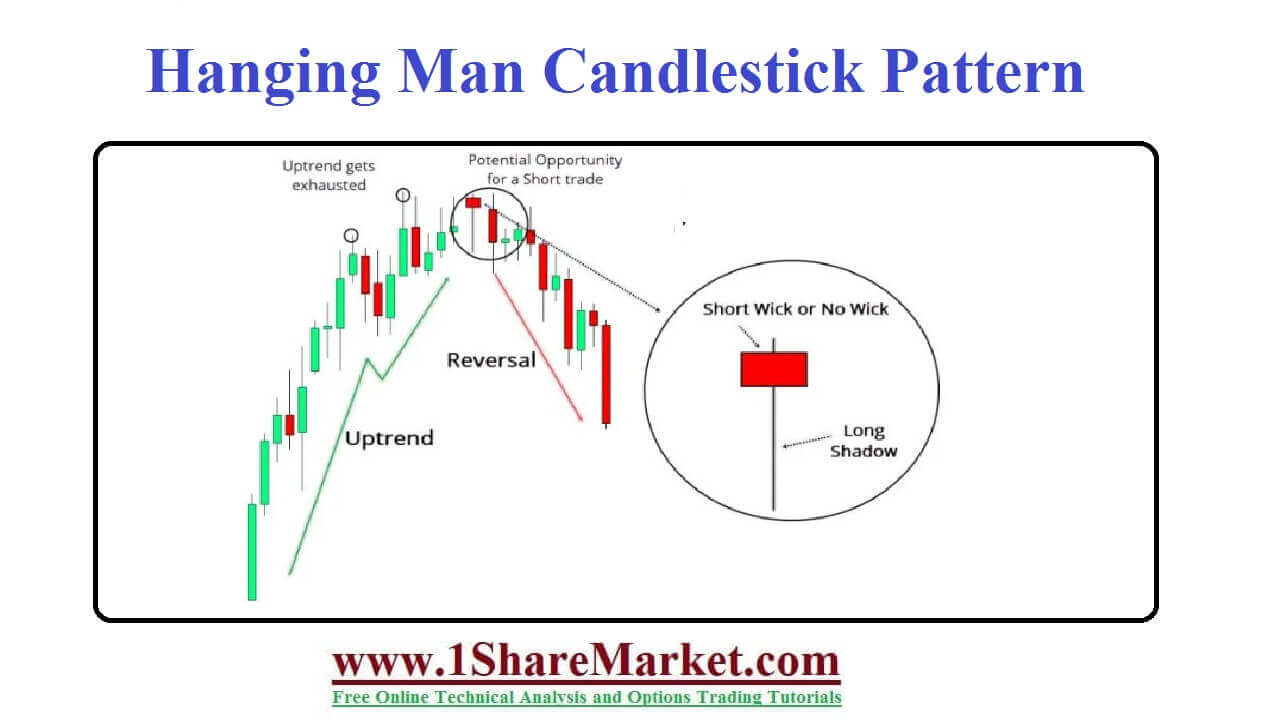

Hanging Man ek single candlestick pattern hai jo uptrend ke aakhir mein banta hai. Iski main pehchan yeh hai:

- Lambi Lower Shadow: Candle ki body se neeche ek lambi shadow ya wick hoti hai, jo kam se kam do ya teen bar body ki length ke barabar hoti hai.

- Chhoti Body: Candle ki body chhoti hoti hai, jo top par hoti hai. Body ka color up ya down trend par depend nahi karta; ye red ya green ho sakta hai.

- Na Ke Barabar ya Bilkul Nahi Upper Shadow: Upper shadow ya to bahut chhoti hoti hai ya bilkul bhi nahi hoti.

Hanging Man Formation

Jab market strong uptrend mein hota hai, traders aur investors bullish hote hain. Hanging Man jab banta hai, pehle high price tak jata hai, lekin phir sell-off hota hai, jo price ko neeche lay aata hai. Aakhir mein, buyers wapas aate hain aur price ko thoda sa upar le jate hain, lekin ye initial high se neeche band hota hai. Is se ek long lower shadow banta hai aur ek chhoti body upar.

Hanging Man Ki Importance

Hanging Man traders ko ye signal deta hai ke buyers ab thake hue hain aur sellers market mein control gain kar rahe hain. Ye pattern traders ko early warning deta hai ke current uptrend weak ho raha hai aur ek possible reversal hone wala hai.

Trading Strategies

- Confirmations: Hanging Man ke baad aane wale candles ko dekh kar is pattern ki confirmation zaroori hoti hai. Agar next candle lower open ya close hoti hai, to ye ek strong reversal signal hai.

- Stop Loss: Trading mein, stop loss ka istemal karke risk ko manage karna chahiye. Hanging Man pattern trade karte waqt, stop loss ko pattern ke high se thoda upar set kiya ja sakta hai.

- Volume: Volume bhi ek important factor hai. Agar Hanging Man low volume par banta hai, to iska impact kam hota hai. High volume is pattern ki validity ko barhata hai.

Khatima

Hanging Man candlestick pattern, jab sahi tarah se samjha jaye aur sahi context mein istemal kiya jaye, to ye Forex trading mein valuable reversal signal provide kar sakta hai. Lekin, iski confirmation aur market ke dusre indicators ke sath istemal karne par hi is par bharosa kiya jana chahiye. Smart trading decisions aur risk management strategies ke sath, traders is pattern ka faida utha sakte hain aur market ke potential reversals ka advantage le sakte hain. -

#3 Collapse

hanging main candle stick pattren in Forex: candlesticks pattern ek bearish reversal pattern hai. yah tab banta traders aur investors bullish hote hain. Hanging Man jab banta hai, pehle high price tak jata hai, lekin phir sell-off hota hai, jo price ko neeche lay aata hai. Aakhir mein, buyers wapas aate hain aur price ko thoda sa upar le jate hain, lekin ye initial high se neeche band hota hai. Is se ek long lower shadow banta hai aur ek chhoti body upar. jab ek uptrend ke dauran ek chhoti body wali ek lambi lower shadow wali candlestick dikhai deti hai. hanging man pattern is baat ka ishra hai ki bull market khatam ho raha hai aur bear market shuru hone wala hai.Strategies:Hanging Man traders ko ye signal deta hai ke buyers ab thake hue hain aur sellers market mein control gain kar rahe hain.

Hanging Man candlestick pattern, jab sahi tarah se samjha jaye aur sahi context mein istemal kiya jaye, to ye Forex trading mein valuable reversal signal provide kar sakta hai. Lekin, iski confirmation aur market ke dusre indicators ke sath istemal karne par hi is par bharosa kiya jana chahiye. Smart trading decisions aur risk management strategies ke sath, traders is pattern ka faida utha sakte hain aur market ke potential reversals ka advantage le sakte hain. Ye pattern traders ko early warning deta hai ke current uptrend weak ho raha hai aur ek possible reversal hone wala hai.Management: Hanging Man ke baad aane wale candles ko dekh kar is pattern ki confirmation zaroori hoti hai. candlestick pattern Forex trading mein ek aham aur mashhoor reversal signal hai, jo traders ko market mein possible trend reversal ya price drop ki warning deta hai. Ye pattern typically uptrend ke doran banta hai aur future selling pressure ya price decline ki indication deta hai. Candle ki body se neeche ek lambi shadow ya wick hoti hai, jo kam se kam do ya teen bar body ki length ke barabar hoti hai. Is article mein, Agar next candle lower open ya close hoti hai, to ye ek strong reversal signal hai. Volume bhi ek important factor hai. Agar Hanging Man low volume par banta hai, to iska impact kam hota hai. High volume is pattern ki validity ko barhata hai.

- CL

- Mentions 0

-

سا9 likes

-

#4 Collapse

Hanging main candlesticks pattern in forex

Hanging Man Candlestick pattern forex trading mein ek important technical analysis tool hai. Yeh ek single candlestick pattern hai jo ke aksar bearish reversal signals provide karta hai. Iska mukhtalif features hain:

Dharohar: Hanging Man pattern ek single candlestick pattern hai jo ke uptrend ke baad paya jata hai. Ismein ek chhota body hota hai, upper shadow lambi hoti hai aur lower shadow chhoti hoti hai.

Tafreeh: Hanging Man candlestick ki body chhoti hoti hai aur upper shadow body ke lagbhag do guna ya zyada lambi hoti hai, jo ke bearish pressure ko darust karta hai. Lower shadow chhoti hoti hai ya bilkul nahi hoti.

Meaning: Hanging Man pattern ka interpretation yeh hai ke uptrend ke baad bullish momentum weak ho raha hai aur bearish reversal ka indication hai. Iski tafseel yeh hai ke price initially high level tak pohanchta hai, phir sellers control lete hain aur price close near the low level of the session.

Confirmation: Hanging Man pattern ki validity ko confirm karne ke liye traders dusri indicators aur price action ke saath combine karte hain. Jaise ke, agar ek bearish candlestick next session mein confirm hota hai ya fir price ne neeche gir kar previous support level ko break kiya ho.

Hanging Man pattern ki importance forex trading mein bearish reversal signals ke liye hoti hai, lekin isay confirm karne ke liye additional analysis aur indicators ka istemal kiya jata hai. Is pattern ko samajhna aur istemal karna traders ke liye zaroori hai takay woh sahi aur safaltapurna trading decisions le sakein.

Yeh pattern traders ke liye ek indication hai ke market ka trend change hone wala hai aur is par amal karne se pehle mukammal analysis aur risk management zaroori hai.

-

#5 Collapse

Hanging main candlesticks pattern in forex

Forex Mein Hanging Man Candlestick Pattern: Roman Urdu Mein Tafseelat

Forex trading mein, candlestick patterns ka istemal market ki movement ko samajhne mein madad karte hain. "Hanging Man" candlestick pattern ek aham aur pehchaan ka bais hota hai. Is article mein, hum Hanging Man pattern ke bare mein roman Urdu mein tafseelat se baat karenge.

Hanging Man Candlestick Kya Hai?

Hanging Man ek single candlestick pattern hai jo bearish reversal ko indicate karta hai. Is pattern ka appearance market ke upar ja rahe uptrend ke baad hota hai aur yeh bearish reversal ka sign deta hai. Hanging Man candlestick ek chhota body ke saath hota hai jiska upper shadow lamba hota hai aur lower shadow nahi hoti ya bahut choti hoti hai.

Hanging Man Pattern Ki Pechan:- Chhota Body: Hanging Man ka pehchaan karne ke liye dekhein ke candle ka body chhota hai, jo ke uptrend ke baad aata hai.

- Upper Shadow: Hanging Man mein upper shadow lamba hota hai, jo high price ko represent karta hai. Yeh shadow body se upar extend hota hai.

- Lower Shadow: Lower shadow ideally chhota hota hai ya bilkul nahi hota. Agar lower shadow exist karta hai, toh woh bhi bohot chhota hota hai.

Hanging Man Ka Arth:

Hanging Man candlestick pattern ka aana yeh darust nahi hai ke market mein reversal hoga, lekin yeh traders ko alert karta hai ke bullish trend weak ho sakta hai aur bearish reversal hone ke chances hain.

Trading Strategies with Hanging Man:- Confirmation ke Liye Intezar: Jab aapko Hanging Man dikhe, toh aapko confirmatory signals ka intezaar karna chahiye. Agar next candlestick bhi bearish hai ya fir kisi aur bearish pattern ke saath aata hai, toh yeh confirm karta hai ke market mein bearish reversal hone ke chances hain.

- Stop-Loss Aur Take-Profit Ka Istemal: Hanging Man ke baad trade karte waqt, aapko tight stop-loss aur sahi take-profit levels set karna chahiye. Yeh risk ko manage karne mein madad karega.

- Dusre Indicators Ka Istemal: Hanging Man ko confirm karne ke liye, aap dusre technical indicators jaise ke RSI, MACD, ya moving averages ka bhi istemal kar sakte hain.

Khatima:

Hanging Man candlestick pattern ek powerful reversal signal ho sakta hai, lekin yaad rahe ke har pattern ki tarah, iska istemal bhi sahi tajaweez aur confirmatory signals ke saath karna zaroori hai. Agar aap forex market mein trading karte hain, toh aapko candlestick patterns ko samajhna aur unka istemal karna ek mahatva purna hissa hai. Trading mein hamesha savdhani aur taqatwar risk management ka bhi dhyan rakhein.

-

#6 Collapse

Forex trading mein "Hanging Man" candlestick pattern ki ahmiyat bohot zyada hoti hai. Yeh pattern ek reversal signal provide karta hai jab market uptrend ke baad downward movement shuru karta hai. Hanging Man pattern ki ahmiyat kuch tareeqon se samjhi ja sakti hai:

Reversal Signal:

Hanging Man pattern, market ki uptrend ke baad potential reversal ke signals provide karta hai. Jab price initially upar jaata hai lekin phir se neeche aaker close karta hai, aur candle ka body upper shadow se bara hota hai, toh yeh bearish reversal indication hoti hai. Traders ko samajh aata hai ke buyers ne initially control rakha tha lekin phir sellers ne control le liya hai.

Resistance Level Identification:

Hanging Man pattern, resistance level ko identify karne mein madad karta hai. Jab price ek level tak jaake rukta hai aur phir se neeche aaker close karta hai, toh yeh indicate karta hai ke woh level strong resistance level ho sakta hai. Traders ko pata chalta hai ke price us level se neeche jaane mein mushkil ho sakti hai.

Entry aur Exit Points:

Hanging Man pattern, traders ko entry aur exit points provide karta hai. Agar Hanging Man pattern confirm hota hai, traders sell positions enter kar sakte hain, matlab ke woh bechte hain, aur jab price neeche jaane lagta hai, toh unhein profit mil sakta hai. Isi tarah se, jab pattern confirm nahi hota, ya phir jab price upar move karta hai, toh traders apne positions ko exit kar sakte hain takay loss se bacha ja sake.

Confirmation ke Liye Indicators:

Hanging Man pattern ko confirm karne ke liye traders dusre technical indicators jaise ke volume aur momentum ka istemal karte hain. Agar pattern ke saath volume increase hota hai aur momentum bhi bearish hai, toh yeh pattern ki validity ko confirm karta hai. Overall, Hanging Man candlestick pattern, forex trading mein ek ahem tool hai jo traders ko market ke potential reversals ka pata lagane mein aur trading decisions banane mein madad karta hai. Iski samajh, traders ke liye bohot zaroori hai takay woh apne trading strategies ko improve kar sakein aur successful trading outcomes achieve kar sakein. -

#7 Collapse

Hanging main candlesticks pattern in forex

Forex trading mein technical analysis ka istemal market trends aur potential reversals ko identify karne ke liye hota hai. Candlestick patterns is analysis ka ek ahem hissa hain, jinme se ek common aur significant pattern hai, "Hanging Man". Hanging Man candlestick pattern ek reversal pattern hai jo market mein possible trend change ko signal karta hai.

Hanging Man Candlestick Pattern Kya Hai?

Hanging Man ek single candlestick pattern hai, jo ki uptrend ke baad aane wale reversal ko indicate karta hai. Is pattern mein candle ka structure ek small body hota hai, jo market opening aur closing prices ko represent karta hai. Upper shadow (ya wick) lamba hota hai, jabki lower shadow chota hota hai. Hanging Man pattern ka naam isliye hai kyunki yeh ek latak rahe insaan ki tarah dikhta hai.

Hanging Man Ki Pehchan:

Hanging Man ko pehchanne ke liye kuch key features hote hain:- Small body: Candle ka body chhota hota hai, jisse indicate hota hai ke opening aur closing prices ke beech mein kam farq hai.

- Upper Shadow: Upper shadow ya wick lamba hota hai, jo high price ko represent karta hai.

- Lower Shadow: Lower shadow chhota hota hai, jo low price ko indicate karta hai.

- Position: Hanging Man uptrend ke baad aata hai aur potential reversal ko darust karta hai.

Hanging Man Ka Interpretation: Jab Hanging Man pattern dikhta hai, traders ko alert hona chahiye kyunki yeh ek reversal signal ho sakta hai. Is pattern ke appearance ke baad, market mein selling pressure hone ki possibility hoti hai, aur bullish trend ke badle bearish trend ka aghaz ho sakta hai.

Trading Strategies with Hanging Man:- Confirmation ke liye wait karna: Hanging Man ko dekhte hi trade karna risky ho sakta hai. Traders ko confirmation ke liye doosre technical indicators ka istemal karna chahiye, jaise ki RSI (Relative Strength Index) ya MACD (Moving Average Convergence Divergence).

- Stop-loss orders ka istemal: Hanging Man pattern ke opposite trade karte waqt stop-loss orders ka istemal karna important hai taki nuksan se bacha ja sake.

- Trendline analysis: Hanging Man ke appearance ke baad, trendlines ka istemal karke dekha jana chahiye ki kya market mein actual reversal hone ki possibility hai.

Limitations of Hanging Man Pattern:- False Signals: Kabhi-kabhi Hanging Man pattern false signals generate kar sakta hai, isliye confirmation aur doosre indicators ka istemal zaroori hai.

- Market Conditions: Choppy markets mein Hanging Man ka interpretation challenging ho sakta hai.

- Risk Management: Bina proper risk management ke, is pattern par bharosa karna risky ho sakta hai.

Conclusion:

Hanging Man candlestick pattern ek powerful reversal indicator ho sakta hai agar sahi tarah se istemal kiya jaye. Traders ko hamesha doosre technical tools aur market conditions ka dhyan rakhna chahiye jab is pattern ka istemal karte hain. Yeh pattern ek alert mechanism hai, lekin final trading decisions ke liye thorough analysis aur risk management ka istemal zaroori hai. -

#8 Collapse

Hanging main candlesticks pattern in forex

Forex market mein trading karte waqt, traders ko market trends aur price movements ka dhyan rakhna bahut zaroori hai. Candlestick patterns, in charts ki analysis mein madad karte hain aur traders ko potential trend reversals ya price changes ke bare mein agah karte hain. Ek aham candlestick pattern jo traders ke liye khaas mahatva rakhta hai, woh hai "Hanging Man" candlestick pattern.

Hanging Man Candlestick Pattern: Ta'aruf

Hanging Man, ek bearish reversal candlestick pattern hai, jo uptrend ke baad aane wale bearish reversal ko darust karti hai. Is pattern ko dekhne mein mombatti ki tarah dikhai deta hai, jismein ek chhota sa body aur lambi wick hoti hai. Hanging Man pattern ki pehchaan karne ke liye, traders ko dhyan dena padta hai ki ye pattern uptrend ke baad aata hai, aur iske baad bearish reversal hone ke chances badh jaate hain.

Hanging Man Pattern Ki Pechan: Key Features- Chhota Body: Hanging Man pattern mein candle ka body chhota hota hai, jo indicate karta hai ki opening price aur closing price mein kam farq hai. Yeh bearish reversal ki shuruaat ko represent karta hai.

- Lambi Lower Wick: Hanging Man ki pehchaan ki jaati hai uski lambi lower wick se. Yeh wick neeche ki taraf extend hoti hai aur ye show karta hai ki price mein neeche jaane ka pressure tha, lekin closing price wick ke neeche nahi gaya.

- No or Small Upper Wick: Hanging Man mein upper wick ya toh bilkul nahi hoti ya fir bahut chhoti hoti hai. Isse ye samajhne mein madad milti hai ki sellers ne price ko control kiya aur closing price niche rahi.

Hanging Man Pattern Ki Tafseelat:

Trading Strategy

Hanging Man pattern ko samajh kar traders apni trading strategy ko refine kar sakte hain. Agar ye pattern uptrend ke baad aata hai, toh ye indicate karta hai ki buyers ki strength kamzor ho rahi hai aur sellers control mein aa rahe hain. Is situation mein traders ko bearish reversal ka expectation ho sakta hai.

Traders hanging man pattern ko confirm karne ke liye dusre technical indicators ka istemal bhi karte hain. RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), aur support/resistance levels, in sab factors ko consider karke traders apne decisions ko validate karte hain.

Conclusion: Hanging Man Candlestick Pattern in Forex

Hanging Man candlestick pattern, agar sahi tarah se samjha jaye aur dusre indicators ke saath combine kiya jaye, toh ye ek powerful tool ho sakta hai forex trading mein. Is pattern ki madad se traders trend reversals ko anticipate kar sakte hain, jisse unka risk management aur trading strategy improve ho sake.

Hanging Man pattern ki pehchan aur samajh traders ko market dynamics ko better interpret karne mein madad karti hai. Lekin, hamesha yaad rahe ki kisi bhi technical analysis tool ki tarah, ye bhi 100% guarantee nahi deta aur iska istemal savdhanipoorvak karna chahiye. Trading mein safalta ke liye, consistent analysis, risk management, aur discipline bahut zaroori hain. -

#9 Collapse

Hanging main candlesticks pattern in forex

Forex trading ek tezi se taraqqi pazeer aur complex maali market hai jahan traders price movements ko analyze karne aur maqool faislay karne ke liye mukhtalif strategies istemaal karte hain. Technical analysis mein istemal hone wale tools mein se aik ahem asbaab candlestick patterns hain, aur inmein se "Hanging Man" bhi aik eham jagah rakhta hai. Is guftagu mein, ham "Hanging Man" candlestick pattern ke tafseelat mein ghoor karenge, iske maa'ini, khasoosiyat aur forex trading ke ma'ashrat mein iska asar samajhenge.

Candlestick Patterns Ki Samajh:

Candlestick patterns price movements ki tasweerati rehnumai hain jo makhsoos muddat mein hoti hain. Inmein mojood har candle ka ek jism aur chhote patte hote hain, aur jism ki rangat (ya to surkhi ya sabz) ishara karta hai ke band hone wala price kholne wale price se zyada ya kam tha.

Hanging Man Candlestick Pattern Ka Tanqeedi Jaiza:

"Hanging Man" aik akele candlestick pattern hai jo aam tor par ek uptrend ke ikhtitam par nazar aata hai aur ek mumkin trend reversal ka ishara karta hai. Tasweeran iski ulta T ki tarah hoti hain, jismein oopar aik chhota jism hota hai aur neeche lambi shadow, jise ishara hai ke buyers ne session ke doran price ko mazeed neeche ghaseeta.

Hanging Man Ki Khasoosiyat:- Chhota Asli Jism: Hanging Man ka asli jism chhota hota hai, jo ke ishara karta hai ke market mein buyers aur sellers ke darmiyan tawun hai.

- Lambi Neeche Wali Shadow: Hanging Man ki sab se khaas khasoosiyat lambi neeche wali shadow hai, jo dikhata hai ke prices kholne ke baad mazeed gir gaye thay, lekin band hone par wapas aagaye.

- Chhota Ya Ghair Mojud Uper Wala Shadow: Uper wala shadow, agar mojud hai, to aam tor par neeche wale shadow ke mukable mein chhota hota hai.

- Uptrend Mein Nazar Aana: Hanging Man zaada reliable hota hai jab ye ek mazboot uptrend ke baad aata hai, jo ke mumkin trend reversal ka ishara hota hai.

Hanging Man Ko Forex Trading Mein Samajhna:- Reversal Signal: Hanging Man ye ishara karta hai ke bullish momentum kamzor ho raha hai aur ek bearish trend ki taraf mumkin taqat shift ho rahi hai.

- Market Sentiment: Ye pattern ye dikhaata hai ke market mein buyers aur sellers ke darmiyan ek jang hai, jismein sellers session ke doran taqat hasil kar rahe hain.

- Confirmation Ki Zarurat Hai: Hanging Man sirf ek khatra ka ishara hai, is par amal karne se pehle traders aksar agle candle mein ek kam close jaise confirmation ka intezaar karte hain.

Mumkin Nuqsanat Aur Ghor Karne Wale Tafseelat:- Confirmation Zaruri Hai: Sirf Hanging Man par bharosa karke bina confirmation ke faislay karna galat signals ka sabab ho sakta hai. Traders ko faislay par amal karne se pehle mazeed saboot talash karna chahiye.

- Taqat Ke Sath Context Ka Ghor Karna: Hanging Man ka asar market ke shorat aur aas paas ke factors par mabni hai. Traders ko faislay se pehle mojooda maqoolat ko tafseel se tahlil karna chahiye.

Hanging Man Ko Trading Strategies Mein Shamil Karna:- Dosray Indicators Ke Sath Combine Karna: Traders Hanging Man ko doosray technical indicators jaise ke moving averages ya support aur resistance levels ke sath istemal karte hain, apne signals ki aitmaad ko barhane ke liye.

- Risk Management: Stop-loss orders set karna aur risk-reward ratios ko madde nazar rakhna zaroori hai jab Hanging Man ko trading strategies mein shaamil kiya jata hai taake mogheeraat ko behtareen taur par manage kiya ja sake.

Haqeeqi Zindagi Mein Misaliyat Aur Case Studies:

"Hanging Man" ka haqeeqi zindagi mein istemal ko tasweer se samajhne ke liye, chaliye kuch aise haqeeqi misaalain dekhein jahan is candlestick pattern ne trend reversals ko pehchaana aur traders ko munafa-khori ke faislay mein rehnumai ki.

Ikhtitam:

Ikhtitam mein, "Hanging Man" candlestick pattern forex trader ke weapons mein aik qeemati tool hai, jo trend reversals ke mumkin signals provide karta hai. Lekin iski ta'weel samajh ke sath iski tabeer par amal karna zaroori hai, confirmation signals aur mojooda market context ka tajziya karte hue. Kamyab trading ek mukammal approach ki zarurat hoti hai, jo ke technical analysis, risk management, aur market dynamics ke samajh ko jama karne par mabni hoti hai. "Hanging Man" ko aik mukammal trading strategy mein shaamil karke, traders apne qabu mein aur munafa-khori mein izafa kar sakte hain forex ke tezi se taraqqi pazeer duniya mein.

- CL

- Mentions 0

-

سا0 like

-

#10 Collapse

Hanging Man Candlestick Pattern: Ek Forex Mein Ahem Pattern

Hanging Man candlestick pattern forex market mein ek ahem signal hai jo traders ko potential trend reversals ke baray mein agah karta hai. Yeh pattern typically uptrend ke end par aata hai aur bearish reversal ko indicate karta hai.

Hanging Man Candlestick Pattern Kya Hai?

Hanging Man candlestick pattern ek single candlestick se bana hota hai jo ek lambi upper shadow aur chhoti body ke saath hota hai. Iski body upper wick se mil kar neeche ki taraf extend hoti hai aur lower wick nahi hoti ya bohot chhoti hoti hai. Hanging Man pattern bullish trend ke end par dikhta hai aur bearish reversal ki possibility ko indicate karta hai.

Hanging Man Candlestick Pattern Ka Tareeqa:- Uptrend: Hanging Man pattern typically ek uptrend ke end par dikhta hai, jab market mein tezi hoti hai.

- Body aur Shadows: Hanging Man candle ki body chhoti hoti hai aur upper shadow lambi hoti hai, jo price ka high darust karti hai. Lower shadow na ho ya bohot chhoti ho.

- Sentiment: Hanging Man pattern bullish trend ke end par aata hai aur bearish reversal ki possibility ko indicate karta hai, khas tor par agar iske baad ek bearish confirmation candle bhi dikhe.

Hanging Man Candlestick Pattern Ke Fayde:- Reversal Signal: Hanging Man pattern traders ko potential bearish reversal ka signal deta hai, jo unhe trend ke change ke baray mein agah karta hai.

- Entry Aur Exit Points: Is pattern ke istemal se traders ko entry aur exit points ka tareeqa samajhne mein madad milti hai.

- Risk Management: Hanging Man pattern traders ko unke trades ka risk manage karne mein madad deta hai.

Hanging Man candlestick pattern ek useful tool hai jo traders ko potential trend reversals ko samajhne mein madad deta hai. Lekin, iska istemal karne se pehle traders ko thorough research aur practice ki zarurat hoti hai taake woh is pattern ko sahi tareeqe se samajh sakein aur market ke fluctuations ko analyze kar sakein.

-

#11 Collapse

"Hanging Man Candlestick Pattern: Forex Mein Ek Ahem Chart Pattern"

Hanging Man, ya 'latka hua aadmi', forex trading mein ek mukhtalif aur ahem candlestick pattern hai jo bearish trend ke baad dikhta hai aur bearish reversal ko indicate karta hai. Yeh pattern typically uptrend ke baad hota hai aur traders ko potential trend reversal ke baray mein agah karta hai.

Hanging Man Candlestick Pattern Kya Hai?

Hanging Man pattern ek single candlestick pattern hai jo ek specific shape aur structure mein hota hai. Is pattern mein ek lamba wick aur chhota body hota hai, jismein body upper side mein hoti hai aur lower side mein lambi wick hoti hai. Yeh pattern bearish reversal ko indicate karta hai, lekin confirmation ke liye price action ke aur factors ka bhi tajziya kiya jata hai.

Hanging Man Candlestick Pattern Ka Tareeqa:- Uptrend: Hanging Man pattern ka pehla step hota hai ek strong uptrend jahan price mein tezi se izafa hota hai.

- Single Candlestick: Hanging Man pattern ek single candlestick hota hai jo bearish reversal ko represent karta hai. Ismein body upper side mein hoti hai aur lower side mein lambi wick hoti hai.

- Upper Wick: Hanging Man pattern mein lambi upper wick hoti hai jo high price ko indicate karti hai. Yeh wick typically body se zyada lambi hoti hai.

- Lower Body: Body typically upper side mein hoti hai aur chhoti hoti hai, jo sellers ke control ko darust karta hai.

Hanging Man Candlestick Pattern Ke Fayde:- Bearish Reversal Signal: Hanging Man pattern traders ko potential bearish reversal ka signal deta hai, jisse woh uptrend ke khatam hone ke baray mein agah karta hai.

- Entry Aur Exit Points: Is pattern ke istemal se traders ko entry aur exit points ka tareeqa samajhne mein madad milti hai.

- Risk Management: Hanging Man pattern ke istemal se traders apni trades ki risk management kar sakte hain, jaise ke stop-loss orders ka istemal karke.

Hanging Man pattern ek ahem tool hai jo traders ko potential bearish reversal ko samajhne mein madad deta hai. Lekin, iska istemal karne se pehle traders ko thorough research aur practice ki zarurat hoti hai taake woh is pattern ko sahi tareeqe se samajh sakein aur sahi trading decisions le sakein.

-

#12 Collapse

Hanging Man Candlestick Pattern in Forex: Tijarat Mein Raazan Hararat

Forex market, jise dunya bhar ke traders rozana apni tijarat mein istemal karte hain, ek mahaul hai jahan har lamha naye signals aur patterns emerge hote hain. Hanging Man candlestick pattern ek aisa technical indicator hai jo traders ko market ke potential reversals aur trend changes ke bare mein malumat dene mein madad karta hai. Is article mein, hum 2000 lafz tak Hanging Man candlestick pattern ke hawale se tajziya karenge, aur iske istemal aur tafseelat ko Pakistan ke traders ke liye Roman Urdu mein samjhayenge.

1. Hanging Man Candlestick Pattern Kya Hai?

Hanging Man ek candlestick pattern hai jo market ke price action ko represent karta hai. Yeh pattern ek single candlestick ko describe karta hai jo typically uptrend ke baad aata hai aur market ke potential reversal ko show karta hai. Hanging Man pattern ko identify karne ke liye kuch key features hote hain:- Ek Lambi Upper Shadow (Wick): Hanging Man candlestick ka upper shadow (wick) body ke upar extend hota hai, jo indicate karta hai ke price ne candlestick ke opening price se zyada gaya, lekin trading session ke end tak wapas aa gaya.

- Chhota Body (Real Body): Candlestick ka body chhota hota hai, jiska matlab hai ke opening price aur closing price mein zyada farq nahi hai.

- No or Very Small Lower Shadow (Wick): Hanging Man pattern mein lower shadow (wick) chhota hota hai ya phir bilkul nahi hota, jo show karta hai ke price trading session ke end tak wohi raha hai jo opening price tha.

2. Hanging Man Pattern Ka Istemal:

Hanging Man pattern ka istemal karne ke liye traders ko kuch ahem points ka khayal rakhna chahiye:- Trend Ka Pata Lagayein: Hanging Man pattern ka sahi interpretation ke liye traders ko pehle yeh dekhna zaroori hai ke market mein kis tarah ka trend hai. Hanging Man pattern uptrend ke baad aane wala reversal pattern hai.

- Confirmation Ke Liye Doosre Indicators Ka Istemal Karein: Hanging Man pattern ko confirm karne ke liye traders ko doosre technical indicators, jese ke RSI (Relative Strength Index) ya MACD (Moving Average Convergence Divergence), ka bhi istemal karna chahiye.

- Multiple Time Frames Check Karein: Hanging Man pattern ko confirm karne ke liye traders ko doosre time frames par bhi is pattern ki tafseelat dekhni chahiye. Kuch traders ek higher time frame par dekhte hain taake unhe sahi malumat mile.

3. Hanging Man Ka Matlab:

Hanging Man pattern ka appearance ek potential trend reversal ko indicate karta hai. Jab yeh pattern uptrend ke baad aata hai, to iska matlab hai ke buyers initially control mein hote hain, lekin phir price mein uncertainty ya phir selling pressure aati hai.- Upper Shadow (Wick): Hanging Man pattern ka upper shadow (wick) lamba hota hai, jo show karta hai ke price ne candlestick ke opening price se upar gaya tha, lekin phir market session ke end tak wapas aagaya.

- Chhota Body (Real Body): Hanging Man ka body chhota hota hai, jo indicate karta hai ke opening price aur closing price ke darmiyan kam farq hai. Yeh chhota body market mein indecision ya confusion ko dikhata hai.

- Lower Shadow (Wick): Hanging Man pattern mein lower shadow (wick) chhota hota hai ya bilkul nahi hota, jo show karta hai ke price session ke end tak wohi raha hai jo opening price tha. Yeh bearish pressure ko indicate karta hai.

4. Trading Strategies Using Hanging Man:

Hanging Man pattern ko istemal karke traders kuch trading strategies bana sakte hain:- Reversal Trading: Hanging Man pattern uptrend ke baad aane wala reversal pattern hai, isliye traders ise dekh kar selling positions le sakte hain. Agar Hanging Man pattern ko sahi tarah se confirm kiya jata hai, toh yeh ek potential downtrend ka sign ho sakta hai.

- Confirmation with Other Indicators: Hanging Man pattern ko confirm karne ke liye traders doosre technical indicators ka bhi istemal karte hain. Agar RSI ya MACD jese indicators bhi bearish signals de rahe hain, toh yeh Hanging Man pattern ko aur bhi powerful bana sakta hai.

- Stop Loss Aur Take Profit Levels Set Karein: Trading positions lete waqt, traders ko hamesha stop loss aur take profit levels set karna chahiye. Yeh levels Hanging Man pattern ke confirmation aur market conditions ke mutabiq tay kiye ja sakte hain.

5. Hanging Man Pattern Ke Faide:- Trend Reversal Ko Pehchan: Hanging Man pattern ka sahi istemal karke traders uptrend ke baad hone wale reversals ko pehchan sakte hain, jo unhe early entry point deta hai.

- Clear Entry Aur Exit Points: Is pattern ka clear structure hone ke wajah se, traders ko entry aur exit points ka saaf pata chal jata hai. Yeh clear levels provide karta hai jahan se positions le sakte hain.

- Risk Management: Hanging Man pattern ka istemal karke traders apni risk management ko improve kar sakte hain. Saheeh stop loss levels set karke, loss ko minimize karne mein madad milti hai.

6. Hanging Man Pattern Ke Khatre:- False Signals: Jese ke kisi bhi technical indicator ya pattern ke sath hota hai, Hanging Man pattern bhi false signals de sakta hai. Isliye, hamesha doosre confirmatory factors ka bhi khayal rakhna zaroori hai.

- Market Volatility: Agar market mein zyada volatility hai, to Hanging Man pattern ke tafsile signals ka nuqsan ho sakta hai. Market conditions ko samajhne ke liye hamesha market analysis karna chahiye.

7. Hanging Man Pattern Aur Psychological Aspects:

Hanging Man pattern ke alawa, is tajaweezat aur patterns ka bhi khayal rakhna zaroori hai ke market mein traders ke amal o feal ka asar hota hai. Hanging Man pattern ke appearance ke

-

#13 Collapse

Hanging main candlesticks pattern in forex

The "Hanging Man" candlestick pattern is a single candlestick pattern that can be significant in the context of technical analysis in Forex trading. This pattern is a potential reversal signal and is identified by its specific characteristics. Here's a brief explanation in Roman Urdu:

Heading: "Hanging Man Candlestick Pattern in Forex"

Tafseelat: Hanging Man candlestick pattern ek akele candlestick pattern hai jo Forex trading mein technical analysis ke asoolon mein ahem ho sakta hai. Ye pattern ek mawafiq badalne ki isharaat mein istemaal hota hai. Yeh pattern apni khaas sifat se pehchana jata hai.

Khaas Pechan: Hanging Man candlestick pattern ka pehchanne ka tareeqa yeh hai ke iski closing price neeche hoti hai aur woh price market ke neeche chali jaati hai. Iska body chhota hota hai aur ek lambi shadow ya wick hoti hai jo neeche ki taraf extend hoti hai. Is pattern ka naam isiliye "Hanging Man" hai kyun ke yeh candle market mein girte waqt ek insaan ke jaise dikhai deta hai.

Matloob Reversal Signal: Hanging Man candlestick pattern market mein bullish trend ke baad aane wale potential reversal ko darust kar sakta hai. Agar yeh pattern uptrend ke baad aata hai toh yeh dikhata hai ke buyers control se bahar ja rahe hain aur sellers ko control mil raha hai. Iska matloob yeh hai ke future mein bearish movement ki sambhavna hai.

Istemal ka Tareeqa: Traders ko Hanging Man pattern ka istemal karke samajhna chahiye ke kya yeh ek asal reversal signal hai ya phir bas temporary market fluctuations hain. Is pattern ko dusri technical indicators aur price action ke saath mila kar istemal karna behtar hota hai.

Dhyan Rahein: Hanging Man candlestick pattern ke istemal mein hamesha risk management ka dhyan rakhein. Kisi bhi trading decision se pehle market conditions ko aur dusre relevant factors ko bhi madde nazar rakhein.

Is Roman Urdu mein di gayi information ko istemal karke, traders Hanging Man candlestick pattern ko samajh kar apne trading strategies ko improve kar sakte hain.

-

#14 Collapse

**Hanging Man Candlestick Pattern Forex Mein Kya Hai?**

Hanging Man candlestick pattern ek mashhoor reversal signal hota hai jo zyada tar uptrend ke end par nazar aata hai. Yeh pattern market mein bearish reversal ki taraf ishara karta hai, yaani jab price upar ja rahi ho aur phir neeche girne ki tasveer paish karta hai. Forex trading mein, Hanging Man ka aana is baat ki nishani ho sakti hai ke bulls (buyers) thak gaye hain aur bears (sellers) market ko control karna shuru kar rahe hain.

Is pattern ka naam iske shape ki wajah se rakha gaya hai, jo bilkul latakte hue aadmi jaisa dikhta hai. Is pattern mein ek chhoti body aur lambi neeche wali shadow hoti hai, jo is baat ko darshati hai ke market mein pressure neechay ki taraf hai lekin price ne wapas upar close ki hai.

**Hanging Man Candlestick Pattern Ka Structure**

1. **Small Body:** Hanging Man candlestick mein chhoti body hoti hai, jo khuli aur band hui price ke darmiyan kam difference ko dikhati hai. Yeh small body upper side par hoti hai candlestick ke.

2. **Long Lower Shadow:** Is pattern ki khasiyat lambi neeche wali shadow hai, jo yeh dikhati hai ke trading session ke dauran price ne kaafi neeche tak jaane ki koshish ki, lekin wapas upar close hui. Yeh lower shadow body ke size se kam az kam double hoti hai.

3. **No Upper Shadow (Ya Bohat Chhoti Upper Shadow):** Hanging Man candlestick mein upper shadow ya to hoti hi nahi, aur agar hoti hai to bohat chhoti hoti hai. Yeh baat is baat ki taraf ishara karti hai ke session mein buyers ne price ko upar le jaane ki koshish nahi ki.

**Hanging Man Pattern Ko Pehchan'na**

Hanging Man candlestick pattern ko pehchan'na forex trading mein zaroori hota hai, kyunki yeh ek warning signal hota hai ke uptrend ab khatam hone wala hai. Magar, sirf ek Hanging Man candlestick dekh kar trade nahi karni chahiye. Iske sath doosray confirmation signals ka intezaar karna zaroori hai, jaise ke:

- **Volume Analysis:** Agar Hanging Man pattern ke saath high volume dekha jaye, to yeh is baat ki confirmation de sakta hai ke market ab neeche ki taraf jaane wali hai.

- **Next Candlestick:** Jab Hanging Man candlestick ke baad ek bearish candlestick (jisme price neeche close ho) nazar aaye, to yeh ek strong confirmation hota hai ke market reversal ke liye tayar hai.

**Hanging Man Pattern Ka Faida**

Hanging Man pattern ka sabse bara faida yeh hai ke yeh aapko market ke direction mein change ka early warning signal deta hai. Agar aap uptrend mein trading kar rahe hain aur aapko Hanging Man pattern nazar aaye, to yeh waqt ho sakta hai apne profits ko secure karne ka ya apni positions ko adjust karne ka.

**Hanging Man Pattern Ki Limitations**

Halaanke yeh pattern forex market mein ek kaar amad reversal signal ho sakta hai, lekin kabhi kabhi yeh false signals bhi de sakta hai. Isliye, traders ko is pattern ko doosray technical indicators ke sath combine karke dekhna chahiye. Sirf ek Hanging Man candlestick dekh kar apna trade plan nahi banana chahiye, balki market ke overall conditions aur confirmation signals ka intezaar karna chahiye.

Aakhir mein, Hanging Man candlestick pattern forex trading mein bearish reversal ko signal karta hai, lekin iske sath doosray tools ko istemal karke trade karna zyada faidamand ho sakta hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 Collapse

Hanging Man Candlestick Pattern in Forex Trading

Forex trading mein technical analysis ke zariye kai aise candlestick patterns hain jo price movement ko samajhne mein madad karte hain. Unme se ek "Hanging Man" pattern hai. Ye pattern ek warning signal hota hai ke market ke trend mein badlav aasakta hai. Hanging Man ko sahi tareeqe se samajhna aur istemal karna forex traders ke liye bohat zaroori hai, isliye hum is article mein detail mein is pattern ko discuss kareinge.

1. Hanging Man Pattern Kya Hai?

Hanging Man candlestick pattern ek bearish reversal pattern hai jo normally ek uptrend ke dauran banta hai. Iska matlab ye hota hai ke jab market mein qeemat barh rahi hoti hai to is pattern ke aane se yeh sign milta hai ke trend ab ulatne wala hai, aur qeemat gir sakti hai.

2. Hanging Man Candlestick Ki Pehchan

Is pattern ko pehchanne ke liye candlestick ka structure dekhna zaroori hai. Hanging Man candlestick ki body choti hoti hai aur iska lower shadow bohat lamba hota hai. Iska upper shadow ya to bilkul nahi hota ya phir bohat chhota hota hai.

3. Pattern Ka Muhim Role

Hanging Man ka ek ahem role yeh hota hai ke yeh buyer aur seller ke darmiyan shift ko highlight karta hai. Jab qeemat barh rahi hoti hai aur Hanging Man banta hai, to iska matlab yeh hota hai ke seller ne control haasil kar liya hai aur buyer kamzor ho rahe hain.

4. Uptrend Mein Hanging Man Ki Ahmiyat

Hanging Man pattern ko sirf ek uptrend mein dekhna meaningful hota hai. Agar yeh ek downtrend mein banta hai, to iska naam "Hammer" hota hai. Uptrend ke dauran agar yeh pattern samne aaye, to iska matlab yeh hota hai ke market girne ke liye tayaar hai.

5. Confirmation Ki Zaroorat

Sirf Hanging Man pattern ko dekh kar faisla nahi kiya ja sakta. Is pattern ke baad ek confirmation ki zaroorat hoti hai, jisme aglay din ya aglay candlestick ki closing price Hanging Man ki body ke neeche ho. Yeh confirm karta hai ke market ab bearish ho rahi hai.

6. Price Action Aur Hanging Man

Hanging Man pattern price action ko samajhne ka ek tareeqa hai. Is pattern ka banna yeh dikhata hai ke us waqt market mein seller ne lower prices pe dominant hone ki koshish ki thi, lekin market ne wapis recover kar liya. Magar yeh recovery weak hoti hai, jo future bearishness ka ishara deti hai.

7. Hanging Man Aur Market Sentiment

Hanging Man market ke sentiment ko badalne ka signal deta hai. Jab yeh pattern banta hai to iska matlab hota hai ke market ka bullish sentiment ab kamzor par raha hai aur log sell karna shuru kar rahe hain.

8. Hanging Man Pattern Ki Limitations

Yeh zaroori hai ke trader is pattern ko dusre indicators ke saath mila kar dekhein. Hanging Man ka banna hamesha trend reversal ko indicate nahi karta. Kabhi kabhi yeh pattern false signals bhi de sakta hai, isliye isko dusre technical tools ke saath combine karna zaroori hai.

9. Trading Strategy Mein Istemaal

Agar aap Hanging Man pattern ka sahi istemal karna chahte hain to isko apni trading strategy mein include karein. Aap yeh pattern dekhte hi sell ka soch sakte hain lekin pehle confirmation ka intezaar karna behtareen hoga.

10. Risk Management Ke Liye Hanging Man

Hanging Man ka sahi tareeqe se istemal risk management ke liye bhi kiya ja sakta hai. Jab yeh pattern ban jaye aur market girne ka signal milne lage, to trader apni positions ko adjust kar sakte hain aur losses se bachne ke liye exit kar sakte hain.

11. Timeframe Ka Asar

Forex trading mein different timeframes par Hanging Man pattern ka mutala karna zaroori hai. Higher timeframes jaise daily ya weekly charts par yeh pattern zyada reliable hota hai, jabke lower timeframes par iska impact kum ho sakta hai.

12. Trendline Aur Hanging Man Ka Milaap

Agar aap Hanging Man ko trendlines ke saath mila kar use karein, to aap zyada strong trading signals haasil kar sakte hain. Agar yeh pattern ek strong trendline ke kareeb banta hai to iska matlab yeh hota hai ke reversal ki chances badh jate hain.

13. Support Aur Resistance Level

Support aur resistance levels ke kareeb Hanging Man pattern dekhna bhi bohat meaningful hota hai. Agar yeh pattern resistance level ke kareeb banta hai, to iska matlab hota hai ke market mein ab reversal ka waqt aane wala hai.

14. Conclusion

Hanging Man candlestick pattern forex trading mein ek ahem bearish reversal indicator hai jo traders ko market ke trend mein badlav ka signal deta hai. Lekin is pattern ko sahi tareeqe se samajhne ke liye, confirmation aur dusre technical indicators ke saath use karna zaroori hai. Agar sahi time par is pattern ko samjha jaye, to yeh traders ko market ke girne se pehle warn kar sakta hai, jis se woh apni positions adjust kar ke profit ya loss ko manage kar sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 08:57 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим