"Aroon Indicator: Ek Technical Analysis Tool"

Aroon Indicator forex aur stock market mein ek ahem technical analysis tool hai jo price trends aur trend changes ko identify karne mein istemal hota hai. Yeh indicator ek range-bound oscillator hai jo price ke highs aur lows ko analyze karta hai.

Aroon Indicator Kya Hai?

Aroon Indicator, Tushar Chande ne develop kiya, ek trend-following indicator hai jo market trends aur trend reversals ko detect karta hai. Iska istemal karke traders market ke momentum ko samajh sakte hain aur potential entry aur exit points ko identify kar sakte hain.

Aroon Indicator Ke Tareeqa:

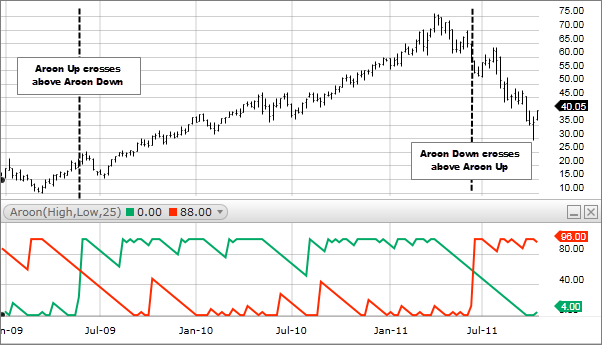

- Aroon-Up aur Aroon-Down Lines: Aroon Indicator do lines se bana hota hai: Aroon-Up aur Aroon-Down. Aroon-Up line high prices ke maximum levels ko measure karta hai, jabki Aroon-Down line low prices ke minimum levels ko measure karta hai.

- Calculation: Aroon-Up aur Aroon-Down lines ka calculation ek specific period ke highs aur lows ko dekhte hue hota hai. Isse calculate kiya gaya value percentage form mein hota hai.

- Aroon Oscillator: Aroon-Up se Aroon-Down ka farq ko Aroon Oscillator kehte hain. Positive values bullish trend ko indicate karte hain jabki negative values bearish trend ko represent karte hain.

- Signal Lines: Some traders use signal lines with Aroon Indicator, which are moving averages of Aroon-Up and Aroon-Down lines. Crossovers of these signal lines may indicate potential trend changes.

Aroon Indicator Ke Fayde:

- Trend Identification: Aroon Indicator traders ko trend direction aur trend strength ka pata lagane mein madad deta hai.

- Entry Aur Exit Points: Is indicator ke istemal se traders ko potential entry aur exit points ka tareeqa samajhne mein madad milti hai.

- Trend Reversals Ka Pata: Aroon Indicator trend reversals ko detect karne mein madad deta hai, jo traders ko market ke movements ke baray mein agah karta hai.

:max_bytes(150000):strip_icc()/chart_dip_recovery_shutterstock_454129360-5bfc305746e0fb00517ccd45.jpg)

تبصرہ

Расширенный режим Обычный режим