What is Butterfly Pattern:

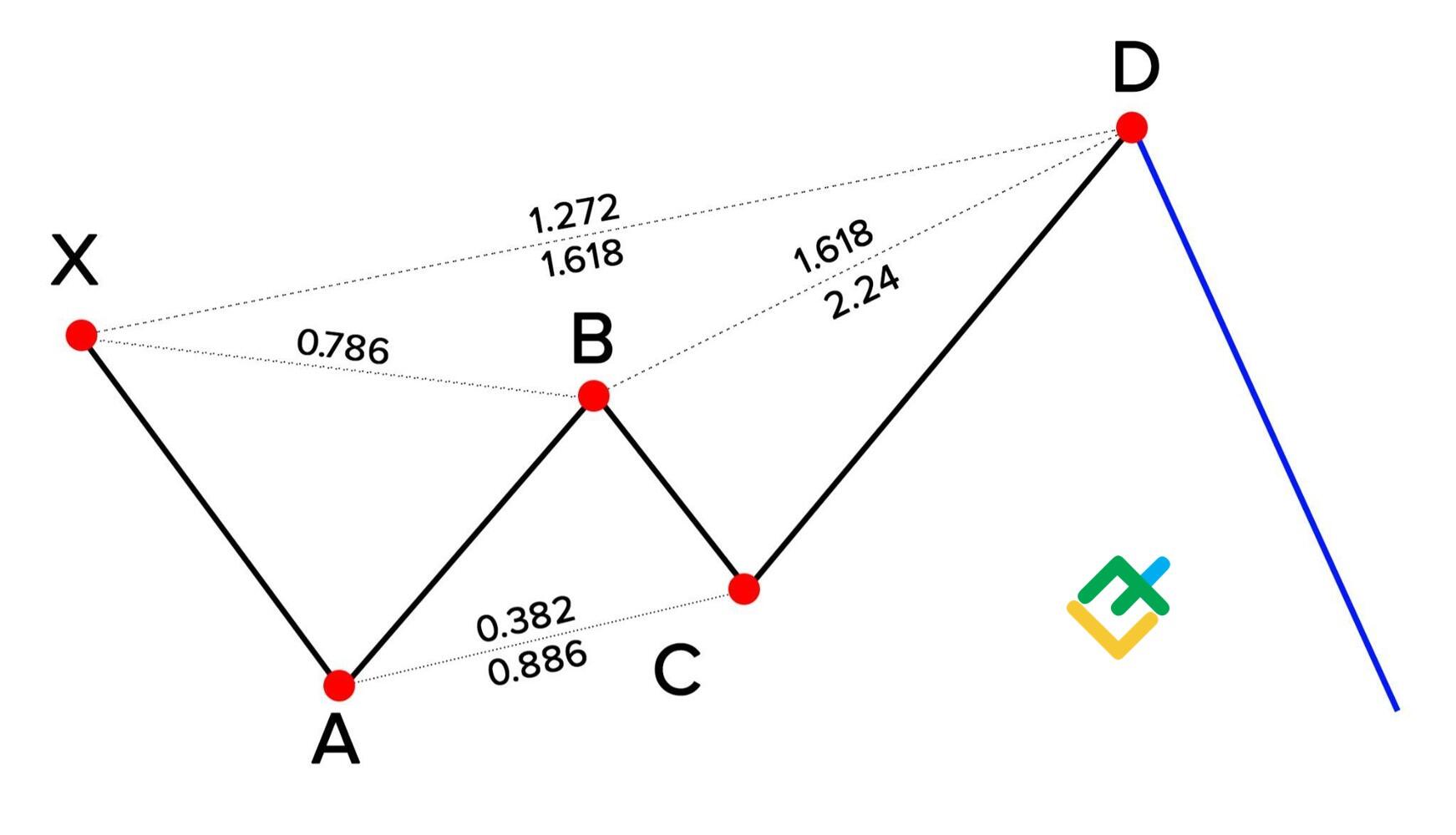

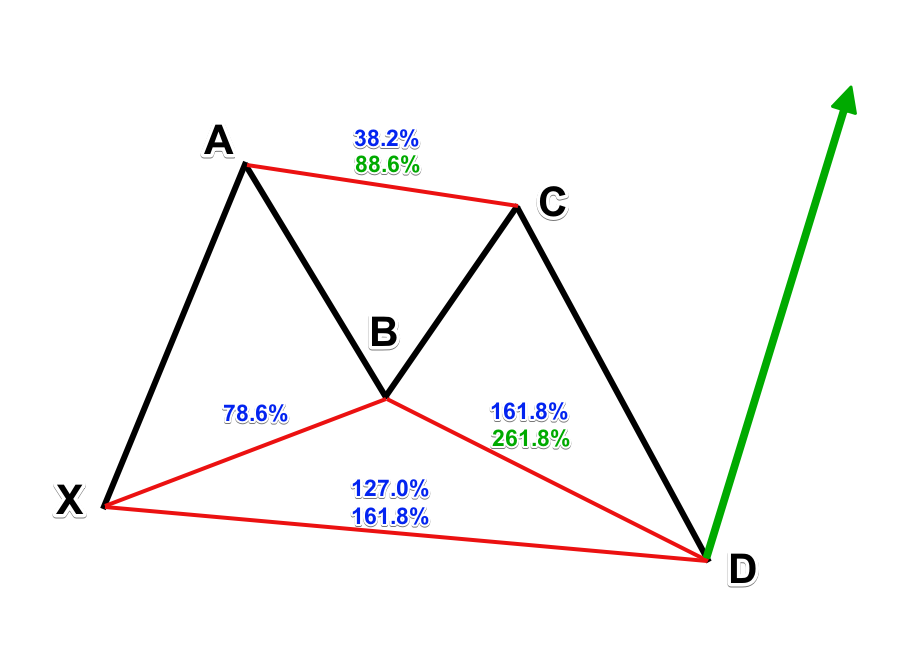

Butterfly patteren aik hum aahang namona hai jo takneeki tashkhees mein ghair mulki zar e mubadla market mein salahiyat ki fees mein tabdeeli ki tawaqqa ke liye istemaal hota hai. namona munfarid Fibonacci marahil par mushtamil hota hai jo sharah chart par makhsoos hindsi shakalain banatay hain. Butterfly ke namoonay ko aik ulta namona samjha jata hai aur is ki shakal 4 herat angaiz nakaat ke zariye ki jati hai : x, ae, bi, aur si. namona aam tor par fees chart par w ya am ki terhan nazar aata hai, jo rujhan ki simt mein salahiyat ke tabadlay ki nishandahi karta hai. x ae taang ibtidayi sharah ki harkat ki numaindagi karti hai, jis ke sath ae bi taang hoti hai jo x ae taang ke aik hissay ko peechay hatati hai. is ke baad bi si taang xa taang se agay barh jati hai, aksar 1.618 Fibonacci tosiay satah tak pahonch jati hai. aakhir mein, si d taang bc taang ke qareeb kam peechay peechay, misali tor par xa taang ke sifar. 786 ya sifar. 886 Fibonacci Retracement ki satah par khatam hota hai.

Identifying Butterfly Pattern:

Zar e mubadla ke chart par Butterfly patteren se durust tor par waaqif honay ke liye, kharidaron ko har taang ki ain khususiyaat ko note karne ki zaroorat hai. x ae taang ko aik hi rastay mein aik mazboot aur saaf bahao hona chahiye, jis se ibtidayi charge impulse bantaa hai. is ke baad ki ae bi taang x ae taang ke kaafi hissay ko peechay chortay hue usay peechay chore deti hai, baqaidagi se sifar. 382 aur 0. 786 Fibonacci marahil ke darmiyan peechay hatti hai. is ke baad bc taang xa taang se agay barh jati hai, tarjeehi tor par 1.618 Fibonacci tosiay degree tak pahonch jati hai. aakhir mein, si d taang bc taang ki taraf kam wapas loutta hai, xa taang ke sifar. 786 ya 0. 886 Fibonacci Retracement marahil par landing, namona mukammal.

Trading strategies with Butterfly Pattern:

Ghair mulki zar e mubadla ki tijarat mein Butterfly patteren ka istemaal karte waqt, khredar baqaidagi se tijarat mein daakhil honay aur bahar jane ke liye ain halaat talaash karte hain. aik aam tareeqa yeh hai ke mutabadil mein anay se pehlay poooray namoonay ki takmeel ka intzaar kya jaye. is mein aam tor par charge ki salahiyat ulat zone tak pounchanay ki tawaqqa karna shaamil hai, jis mein si d taang Fibonacci Retracement darjay ke qareeb mukammal hoti hai. tajir salahiyat ke ulat palat ki tasdeeq ke liye izafi takneeki ishaaron ka bhi istemaal kar satke hain, jaisay ke Oscillator ya moving average.

Aik aur tareeqa yeh hai ke patteren mein makhsoos maqamat par tabadlay mein daakhil hona hai. kuch sarmaya car d factor ki simt mein patteren ke tasalsul ki tawaqqa karte hue, bi si league ki taaj poshi ki shaan mein daakhil honay ka intikhab bhi kar satke hain. is nuqta nazar mein ziyada khatrah shaamil hota hai lekin agar namona muaser tareeqay se mukammal ho jaye to paishgi andrajaat aur shayad behtar munafe haasil kar sakta hai.

Risk Management and Stop loss Placement in Butterfly Pattern:

Ghair mulki currency mein Butterfly patteren kharedtay aur farokht karte waqt rissk control zaroori hai, kyunkay style musalsal tawaqqa ke mutabiq nahi chal satke hain. tajir aksar farist all las orders ka istemaal salahiyat ke nuqsaan ko mehdood karne ke liye karte hain agar tijarat un ke khilaaf ho rahi ho. stop las orders aam tor par market mein utaar charhao ka hisaab laganay ke liye power reveal area ya patteren ke takmeel point se agay rakhay jatay hain.

Butterfly ke namonon ka istemaal karte waqt, taajiron ko khatray ko muaser tareeqay se control karne ke liye position size aur faida uthany ko bhi yaad rakhnay ki zaroorat hoti hai. account ki lambai aur khatray ki rawadari ki bunyaad par munasib function size ka hisaab laga kar, tajir –apne sarmaye ka difaa kar satke hain aur barray nuqsanaat se bach satke hain agar tabdeeli paish goi ke mutabiq kaam nahi karti hai.

Combining Butterfly Pattern with Other technical Tools:

Hatt tridz ke mawaqay ko badhaane ke liye, sarmaya car Butterfly pitrnz ko deegar takneeki tajzia gear ke sath marboot kar satke hain. misaal ke tor par, Butterfly patteren ki sadaqat ki tasdeeq ke liye khredar support aur muzahmat ki sthon, trained lines, ya chart style ke sath sangam ki talaash bhi kar satke hain. mazeed bar-aan, aik se ziyada time frames ka istemaal market ke rujhan aur salahiyat ki sharah ki naqal o harkat par wasee tar rawayya faraham kar sakta hai.

Mazeed bar-aan, tajir bakhabar tijarti faislay karne ke liye takneeki tajzia ke sath bunyadi tajzia aur bazaar ke jazbaat ko bhi shaamil kar satke hain. muashi khabron ki release, geographiyai siyasi sar garmion, aur ahem maliyati idaron ke elanaat ko barqarar rakhnay se kharidaron ko bazaar ki karwaiyon ki tawaqqa karne aur apni tijarti hikmat e amli ko tabdeel karne mein madad mil sakti hai.

Butterfly patteren aik hum aahang namona hai jo takneeki tashkhees mein ghair mulki zar e mubadla market mein salahiyat ki fees mein tabdeeli ki tawaqqa ke liye istemaal hota hai. namona munfarid Fibonacci marahil par mushtamil hota hai jo sharah chart par makhsoos hindsi shakalain banatay hain. Butterfly ke namoonay ko aik ulta namona samjha jata hai aur is ki shakal 4 herat angaiz nakaat ke zariye ki jati hai : x, ae, bi, aur si. namona aam tor par fees chart par w ya am ki terhan nazar aata hai, jo rujhan ki simt mein salahiyat ke tabadlay ki nishandahi karta hai. x ae taang ibtidayi sharah ki harkat ki numaindagi karti hai, jis ke sath ae bi taang hoti hai jo x ae taang ke aik hissay ko peechay hatati hai. is ke baad bi si taang xa taang se agay barh jati hai, aksar 1.618 Fibonacci tosiay satah tak pahonch jati hai. aakhir mein, si d taang bc taang ke qareeb kam peechay peechay, misali tor par xa taang ke sifar. 786 ya sifar. 886 Fibonacci Retracement ki satah par khatam hota hai.

Identifying Butterfly Pattern:

Zar e mubadla ke chart par Butterfly patteren se durust tor par waaqif honay ke liye, kharidaron ko har taang ki ain khususiyaat ko note karne ki zaroorat hai. x ae taang ko aik hi rastay mein aik mazboot aur saaf bahao hona chahiye, jis se ibtidayi charge impulse bantaa hai. is ke baad ki ae bi taang x ae taang ke kaafi hissay ko peechay chortay hue usay peechay chore deti hai, baqaidagi se sifar. 382 aur 0. 786 Fibonacci marahil ke darmiyan peechay hatti hai. is ke baad bc taang xa taang se agay barh jati hai, tarjeehi tor par 1.618 Fibonacci tosiay degree tak pahonch jati hai. aakhir mein, si d taang bc taang ki taraf kam wapas loutta hai, xa taang ke sifar. 786 ya 0. 886 Fibonacci Retracement marahil par landing, namona mukammal.

Trading strategies with Butterfly Pattern:

Ghair mulki zar e mubadla ki tijarat mein Butterfly patteren ka istemaal karte waqt, khredar baqaidagi se tijarat mein daakhil honay aur bahar jane ke liye ain halaat talaash karte hain. aik aam tareeqa yeh hai ke mutabadil mein anay se pehlay poooray namoonay ki takmeel ka intzaar kya jaye. is mein aam tor par charge ki salahiyat ulat zone tak pounchanay ki tawaqqa karna shaamil hai, jis mein si d taang Fibonacci Retracement darjay ke qareeb mukammal hoti hai. tajir salahiyat ke ulat palat ki tasdeeq ke liye izafi takneeki ishaaron ka bhi istemaal kar satke hain, jaisay ke Oscillator ya moving average.

Aik aur tareeqa yeh hai ke patteren mein makhsoos maqamat par tabadlay mein daakhil hona hai. kuch sarmaya car d factor ki simt mein patteren ke tasalsul ki tawaqqa karte hue, bi si league ki taaj poshi ki shaan mein daakhil honay ka intikhab bhi kar satke hain. is nuqta nazar mein ziyada khatrah shaamil hota hai lekin agar namona muaser tareeqay se mukammal ho jaye to paishgi andrajaat aur shayad behtar munafe haasil kar sakta hai.

Risk Management and Stop loss Placement in Butterfly Pattern:

Ghair mulki currency mein Butterfly patteren kharedtay aur farokht karte waqt rissk control zaroori hai, kyunkay style musalsal tawaqqa ke mutabiq nahi chal satke hain. tajir aksar farist all las orders ka istemaal salahiyat ke nuqsaan ko mehdood karne ke liye karte hain agar tijarat un ke khilaaf ho rahi ho. stop las orders aam tor par market mein utaar charhao ka hisaab laganay ke liye power reveal area ya patteren ke takmeel point se agay rakhay jatay hain.

Butterfly ke namonon ka istemaal karte waqt, taajiron ko khatray ko muaser tareeqay se control karne ke liye position size aur faida uthany ko bhi yaad rakhnay ki zaroorat hoti hai. account ki lambai aur khatray ki rawadari ki bunyaad par munasib function size ka hisaab laga kar, tajir –apne sarmaye ka difaa kar satke hain aur barray nuqsanaat se bach satke hain agar tabdeeli paish goi ke mutabiq kaam nahi karti hai.

Combining Butterfly Pattern with Other technical Tools:

Hatt tridz ke mawaqay ko badhaane ke liye, sarmaya car Butterfly pitrnz ko deegar takneeki tajzia gear ke sath marboot kar satke hain. misaal ke tor par, Butterfly patteren ki sadaqat ki tasdeeq ke liye khredar support aur muzahmat ki sthon, trained lines, ya chart style ke sath sangam ki talaash bhi kar satke hain. mazeed bar-aan, aik se ziyada time frames ka istemaal market ke rujhan aur salahiyat ki sharah ki naqal o harkat par wasee tar rawayya faraham kar sakta hai.

Mazeed bar-aan, tajir bakhabar tijarti faislay karne ke liye takneeki tajzia ke sath bunyadi tajzia aur bazaar ke jazbaat ko bhi shaamil kar satke hain. muashi khabron ki release, geographiyai siyasi sar garmion, aur ahem maliyati idaron ke elanaat ko barqarar rakhnay se kharidaron ko bazaar ki karwaiyon ki tawaqqa karne aur apni tijarti hikmat e amli ko tabdeel karne mein madad mil sakti hai.

تبصرہ

Расширенный режим Обычный режим