Explanation.

Forex trading, jaise ke naam se pata chalta hai, ek aisa business hai jisme ke risk aur reward dono maujood hote hain. Lekin, is business mein safal hone ke liye, aapko apne trades ke risk reward ratio ko samajhna ho ga.

Risk Reward Ratio more info.

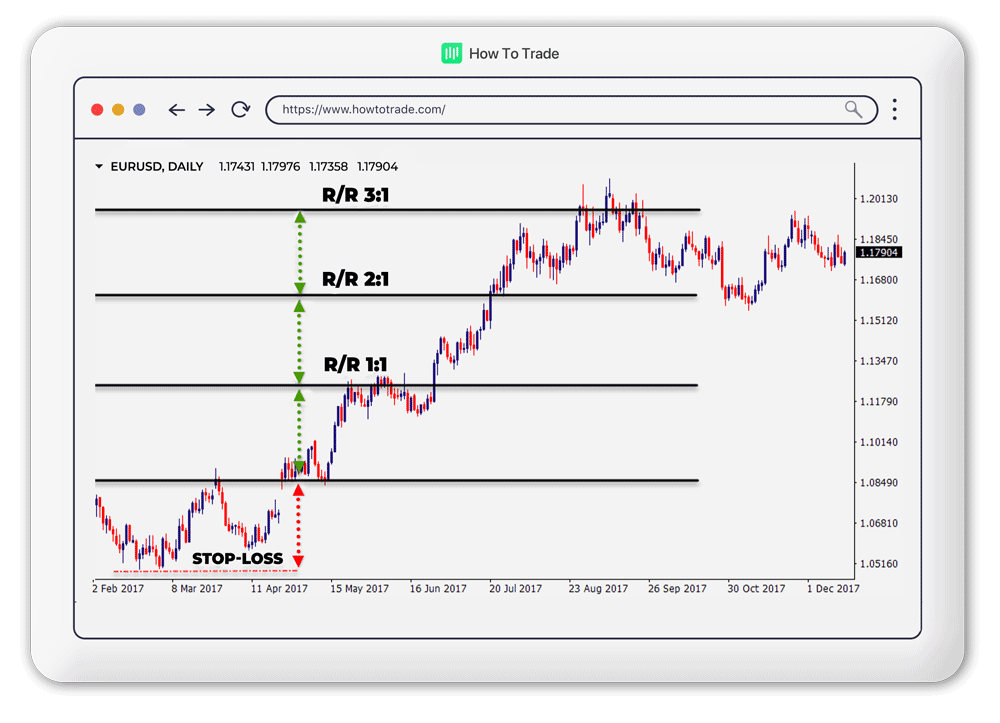

Risk reward ratio ka matlab hai ki aap apne trade mein lagaaye gaye paise ke risk aur profit ko kaise balance karte hain. Agar aap ek trade karte hain aur aapko usmein 100 paise ka profit mil raha hai toh aapko us trade mein maximum 50 paise ka risk lena chahiye. Iska matlab hai ki aapko 50 paise ka loss hone ke baad trade ko close karna chahiye.

Reward Ratio Importants.

Forex trading mein risk reward ratio ka hona bahut zaroori hai kyunki yeh aapki trading strategy ko define karta hai. Aapke trading strategy ke hisab se aap apne trades ke risk reward ratio ko set kar sakte hain. Agar aap apne trades ke risk reward ratio ko manage nahi karenge toh aapke trades ka outcome bhi unpredictable hoga.

Risk Reward Ratio Calculation.

Risk reward ratio calculate karne ke liye aapko apne stop loss aur profit target ko set karna hoga. Agar aapko ek trade ke liye 50 paise ka stop loss aur 100 paise ka profit target set karna hai toh aapka risk reward ratio 1:2 hoga.

Forex trading mein safal hone ke liye, aapko apne trades ke risk reward ratio ko samajhna bahut zaroori hai. Iske liye aapko apne trading strategy ke hisab se apne trades ke risk reward ratio ko set karna hoga. Agar aap apne trades ke risk reward ratio ko manage karte hain toh aapko forex trading mein success milne ke chances bahut zyada hote hain.

Forex trading, jaise ke naam se pata chalta hai, ek aisa business hai jisme ke risk aur reward dono maujood hote hain. Lekin, is business mein safal hone ke liye, aapko apne trades ke risk reward ratio ko samajhna ho ga.

Risk Reward Ratio more info.

Risk reward ratio ka matlab hai ki aap apne trade mein lagaaye gaye paise ke risk aur profit ko kaise balance karte hain. Agar aap ek trade karte hain aur aapko usmein 100 paise ka profit mil raha hai toh aapko us trade mein maximum 50 paise ka risk lena chahiye. Iska matlab hai ki aapko 50 paise ka loss hone ke baad trade ko close karna chahiye.

Reward Ratio Importants.

Forex trading mein risk reward ratio ka hona bahut zaroori hai kyunki yeh aapki trading strategy ko define karta hai. Aapke trading strategy ke hisab se aap apne trades ke risk reward ratio ko set kar sakte hain. Agar aap apne trades ke risk reward ratio ko manage nahi karenge toh aapke trades ka outcome bhi unpredictable hoga.

Risk Reward Ratio Calculation.

Risk reward ratio calculate karne ke liye aapko apne stop loss aur profit target ko set karna hoga. Agar aapko ek trade ke liye 50 paise ka stop loss aur 100 paise ka profit target set karna hai toh aapka risk reward ratio 1:2 hoga.

Forex trading mein safal hone ke liye, aapko apne trades ke risk reward ratio ko samajhna bahut zaroori hai. Iske liye aapko apne trading strategy ke hisab se apne trades ke risk reward ratio ko set karna hoga. Agar aap apne trades ke risk reward ratio ko manage karte hain toh aapko forex trading mein success milne ke chances bahut zyada hote hain.

تبصرہ

Расширенный режим Обычный режим