What is Three Black Crows Pattern:

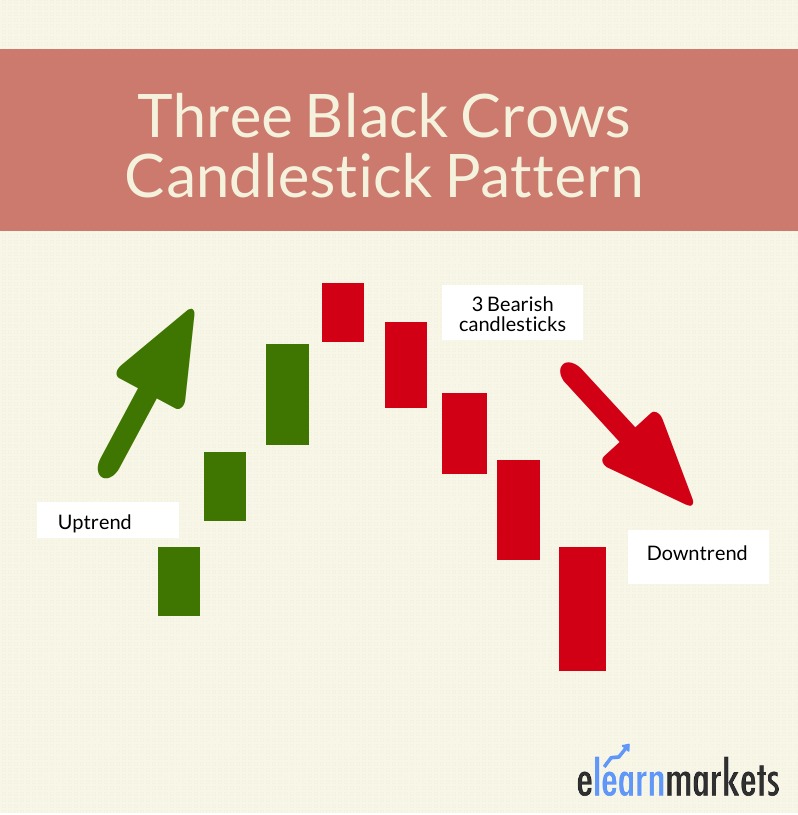

Three Black Crows ka namona aik mandi ka ulta namona hai jo mukhtasir ya ghair mojood saaye ke sath lagataar Three lambi siyah ( neechay ki taraf ) mom btyon par mushtamil hota hai. yeh namona aam tor par taizi ke rujhan ke ekhtataam par hota hai aur market ke jazbaat mein taizi se mandi ki taraf salahiyat ki tabdeeli ki nishandahi karta hai. Three kalay kawoon ko salahiyat ke rujhan ke ulat jane ka aik mazboot ishara samjha jata hai, kyunkay woh barhatay hue farogh dainay walay tanao aur kharidari ki dilchaspi ki Adam mojoodgi ki akkaasi karte hain. tajir aksar –apne mandi ke taasub ki tasdeeq ke liye is namoonay ki talaash karte hain aur is ke nateejay mein apni rasai aur ikhraj ke awamil ki mansoobah bandi karte hain.

Characteristics of Three Black Crows Pattern:

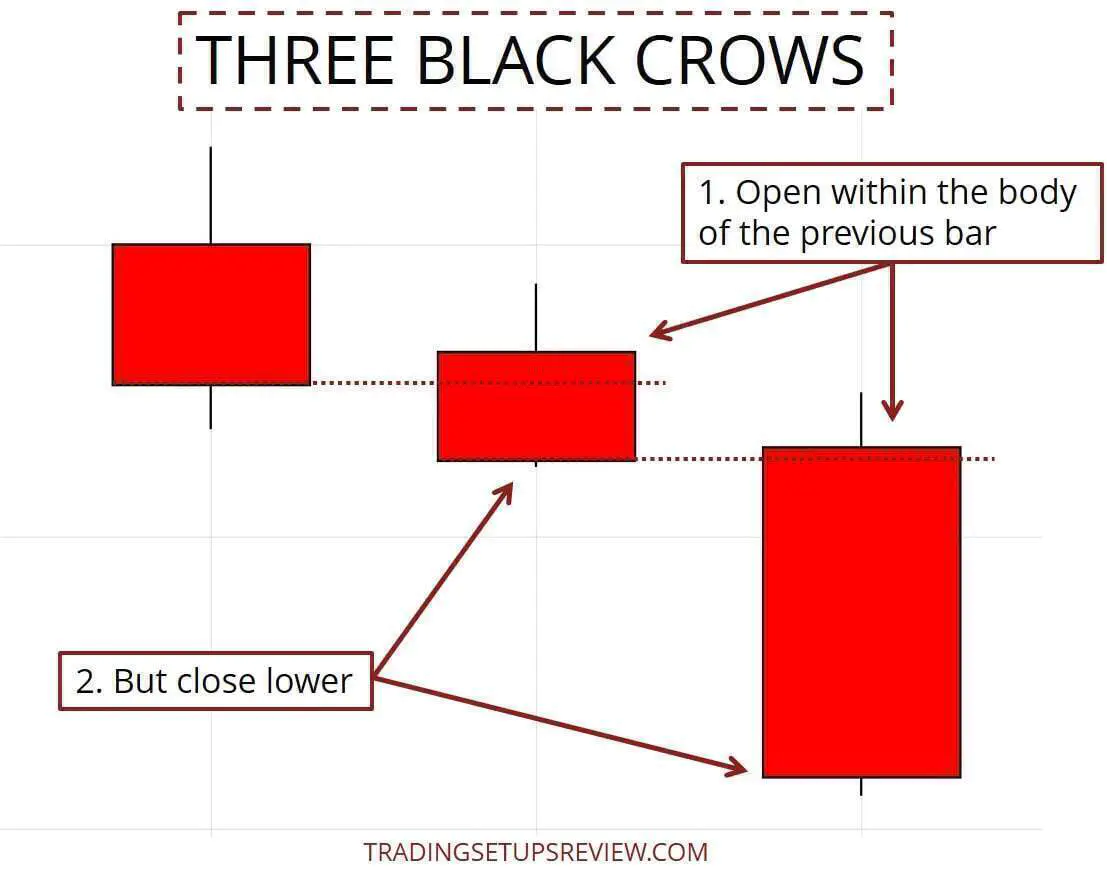

Three Black Crows patteren se waaqif honay ke liye, taajiron ko lagataar 3 lambi kaali mom batian talaash karni chahiye jo un ki kamiyon ke qareeb hon, jin ke oopri saaye kam hon ya nah hon. har candle stick ko pichli candle stick ke frame ke andar khilna chahiye aur nichale hissay ko band karna chahiye, jis se neechay ki taraf bherne ka amal peda hota hai. mom btyon ki lashain kaafi lambi honi chahiye, jo mazboot farokht ke dabao aur bazaar mein bears ki ghalib mojoodgi ki nishandahi karti hain. mazeed bar-aan, namona ziyada qabil aetmaad hota hai jab yeh taweel up trained ke baad hota hai, Bashmole mandi ke ulat signal ke tor par is ki ahmiyat.

Trading With Three Black Crows Pattern:

Jab sarmaya car Three Black Crows ke namoonay ko talaash karte hain, to koi bhi tijarti faisla karne se pehlay tasdeeq ka intzaar karna bohat zaroori hai. tasdeeq chothi bearish mom batii ki chhari, kaleedi guide marhalay ke neechay malba, ya Three Black Crows ke sath ban'nay walay bearish chart patteren ki shakal mein askati hai. aik baar namona dukhaay jane ke baad, tajir fori position mein aana ya kisi bhi lambi position ko hatmi shakal dena yaad rakh satke hain jis ki inhen mutawaqqa mandi ke bahao se faida uthany ki zaroorat par sakti hai. stop las orders ko mauqa par qaboo panay ke liye haliya soyng high se oopar rakha ja sakta hai, yahan tak ke aamdani ke maqasid ko mukammal tor par takneeki tehqeeq ya guide ki sthon ki bunyaad par muqarrar kya ja sakta hai.

Potential Pitfall and False Signal in Three Black Crows Pattern:

Agarchay Three Black Crows ka namona aik mo-asar ulat signal hai, lekin kharidaron ko salahiyat ke nuqsanaat aur ghalat ishaaron se mohtaat rehna chahiye. market ke umomi sayaq o Sabaq ko yaad rakhna bohat zaroori hai, jis mein namoonay ki sadaqat ki tasdeeq ke liye pichli tarz ki taaqat, hajam ki tashkhees, aur mukhtalif takneeki alamaat shaamil hain. jhutay isharay is waqt ho satke hain jab namona kisi range market place mein ya kam tijarti hajam ke waqfon ke douran tashkeel paata hai, jis ki wajah se saaf fashion ulat ke barkhilaf na hamwar sharah harkat hoti hai. taajiron ko aam tor par ghalat isharay mein phansnay se bachney ke liye izafi tasdeeq ke isharay aur mauqa par qaboo panay ki hikmat e amli istemaal karni chahiye.

Risk Management and Trading in Three Black Crows Pattern:

Three Black Crows patteren ya kisi aur takneeki patteren ko khareed o farokht karte waqt rissk managment zaroori hai. taajiron ke paas hamesha khatray se nimatnay ka aik achi terhan se tay shuda tareeqa car hona zaroori hai, jis mein tijarat un ke khilaaf honay ki soorat mein salahiyat ke nuqsanaat ko mehdood karne ke liye nuqsaan se bachney ke order dena shaamil hai. Three Black Crows patteren ki bunyaad par khareed o farokht karte waqt, sharah ki naqal o harkat ko ahthyat se screen karna aur munafe ko lock karne ke liye stop las orders ke peechay rehne ko zehen mein rakhna bohat zaroori hai kyunkay tijarat maqbool rastay mein chalti hai. mazeed bar-aan, takneeki hudood, munafe ke ahdaaf, ya deegar alamaat ke intabahat ki bunyaad par aik wazeh tijarti safar ka tareeqa car rakhnay se taajiron ko –apne tijarti nataij ko behtar bananay aur bazaar ke utaar charhao walay halaat mein jazbati faisla saazi ko kam karne mein madad mil sakti hai.

Three Black Crows ka namona aik mandi ka ulta namona hai jo mukhtasir ya ghair mojood saaye ke sath lagataar Three lambi siyah ( neechay ki taraf ) mom btyon par mushtamil hota hai. yeh namona aam tor par taizi ke rujhan ke ekhtataam par hota hai aur market ke jazbaat mein taizi se mandi ki taraf salahiyat ki tabdeeli ki nishandahi karta hai. Three kalay kawoon ko salahiyat ke rujhan ke ulat jane ka aik mazboot ishara samjha jata hai, kyunkay woh barhatay hue farogh dainay walay tanao aur kharidari ki dilchaspi ki Adam mojoodgi ki akkaasi karte hain. tajir aksar –apne mandi ke taasub ki tasdeeq ke liye is namoonay ki talaash karte hain aur is ke nateejay mein apni rasai aur ikhraj ke awamil ki mansoobah bandi karte hain.

Characteristics of Three Black Crows Pattern:

Three Black Crows patteren se waaqif honay ke liye, taajiron ko lagataar 3 lambi kaali mom batian talaash karni chahiye jo un ki kamiyon ke qareeb hon, jin ke oopri saaye kam hon ya nah hon. har candle stick ko pichli candle stick ke frame ke andar khilna chahiye aur nichale hissay ko band karna chahiye, jis se neechay ki taraf bherne ka amal peda hota hai. mom btyon ki lashain kaafi lambi honi chahiye, jo mazboot farokht ke dabao aur bazaar mein bears ki ghalib mojoodgi ki nishandahi karti hain. mazeed bar-aan, namona ziyada qabil aetmaad hota hai jab yeh taweel up trained ke baad hota hai, Bashmole mandi ke ulat signal ke tor par is ki ahmiyat.

Trading With Three Black Crows Pattern:

Jab sarmaya car Three Black Crows ke namoonay ko talaash karte hain, to koi bhi tijarti faisla karne se pehlay tasdeeq ka intzaar karna bohat zaroori hai. tasdeeq chothi bearish mom batii ki chhari, kaleedi guide marhalay ke neechay malba, ya Three Black Crows ke sath ban'nay walay bearish chart patteren ki shakal mein askati hai. aik baar namona dukhaay jane ke baad, tajir fori position mein aana ya kisi bhi lambi position ko hatmi shakal dena yaad rakh satke hain jis ki inhen mutawaqqa mandi ke bahao se faida uthany ki zaroorat par sakti hai. stop las orders ko mauqa par qaboo panay ke liye haliya soyng high se oopar rakha ja sakta hai, yahan tak ke aamdani ke maqasid ko mukammal tor par takneeki tehqeeq ya guide ki sthon ki bunyaad par muqarrar kya ja sakta hai.

Potential Pitfall and False Signal in Three Black Crows Pattern:

Agarchay Three Black Crows ka namona aik mo-asar ulat signal hai, lekin kharidaron ko salahiyat ke nuqsanaat aur ghalat ishaaron se mohtaat rehna chahiye. market ke umomi sayaq o Sabaq ko yaad rakhna bohat zaroori hai, jis mein namoonay ki sadaqat ki tasdeeq ke liye pichli tarz ki taaqat, hajam ki tashkhees, aur mukhtalif takneeki alamaat shaamil hain. jhutay isharay is waqt ho satke hain jab namona kisi range market place mein ya kam tijarti hajam ke waqfon ke douran tashkeel paata hai, jis ki wajah se saaf fashion ulat ke barkhilaf na hamwar sharah harkat hoti hai. taajiron ko aam tor par ghalat isharay mein phansnay se bachney ke liye izafi tasdeeq ke isharay aur mauqa par qaboo panay ki hikmat e amli istemaal karni chahiye.

Risk Management and Trading in Three Black Crows Pattern:

Three Black Crows patteren ya kisi aur takneeki patteren ko khareed o farokht karte waqt rissk managment zaroori hai. taajiron ke paas hamesha khatray se nimatnay ka aik achi terhan se tay shuda tareeqa car hona zaroori hai, jis mein tijarat un ke khilaaf honay ki soorat mein salahiyat ke nuqsanaat ko mehdood karne ke liye nuqsaan se bachney ke order dena shaamil hai. Three Black Crows patteren ki bunyaad par khareed o farokht karte waqt, sharah ki naqal o harkat ko ahthyat se screen karna aur munafe ko lock karne ke liye stop las orders ke peechay rehne ko zehen mein rakhna bohat zaroori hai kyunkay tijarat maqbool rastay mein chalti hai. mazeed bar-aan, takneeki hudood, munafe ke ahdaaf, ya deegar alamaat ke intabahat ki bunyaad par aik wazeh tijarti safar ka tareeqa car rakhnay se taajiron ko –apne tijarti nataij ko behtar bananay aur bazaar ke utaar charhao walay halaat mein jazbati faisla saazi ko kam karne mein madad mil sakti hai.

تبصرہ

Расширенный режим Обычный режим