Details.

Forex (Foreign Exchange) mein trading techniques ka istemal karke traders apni trading performance ko improve kar sakte hain. Yahan hum kuch popular trading techniques ke baare mein baat karenge:

Technical Analysis.

Technical analysis mein traders price charts aur technical indicators ka istemal karte hain, jaise ki moving averages, Bollinger bands, RSI, MACD, aur Fibonacci retracements.

Technical analysis ka istemal karke traders price trends aur market direction ko predict kar sakte hain.

Fundamental Analysis.

Fundamental analysis mein traders economic data aur news ka istemal karte hain, jaise ki GDP, interest rates, inflation, aur political events. Fundamental analysis ka istemal karke traders market trends aur currency values ke changes ko understand kar sakte hain.

Price Action Trading.

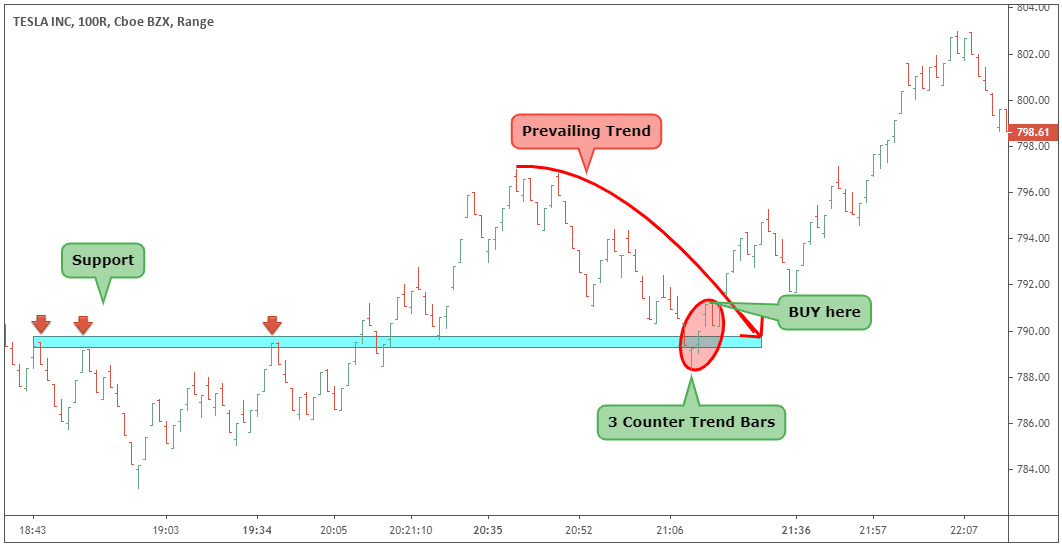

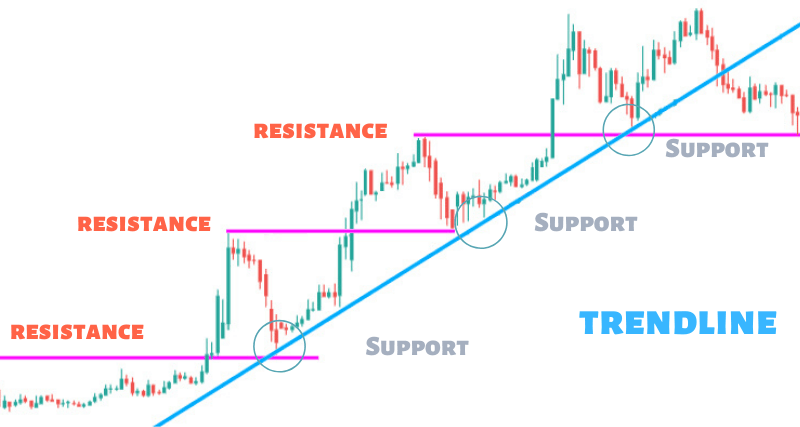

Price action trading mein traders price charts ka istemal karte hain aur price movements ko analyze karte hain.

Price action trading mein traders price patterns, trend lines, aur support/resistance levels ka istemal karte hain.

Trading Strategies.

Trading strategies mein traders apni trades ko plan karte hain aur trading rules banate hain. Trading strategies mein traders apne risk tolerance, entry/exit points, aur position sizing ko define karte hain.

Algorithmic Trading.

Algorithmic trading mein traders computer programs ka istemal karte hain, jinhe apne trading strategies ke according set kiya jata hai. Algorithmic trading mein traders apne trades ko automate kar sakte hain aur human error ko kam kar sakte hain.

In sabhi techniques ka istemal karke traders apni trading skills ko improve kar sakte hain aur forex market mein successful trades kar sakte hain techniques ka use krna acha sabit hota hay is say trend ka malom hota hay or is k ilava experience may bhi izafa hota hay.

Forex (Foreign Exchange) mein trading techniques ka istemal karke traders apni trading performance ko improve kar sakte hain. Yahan hum kuch popular trading techniques ke baare mein baat karenge:

Technical Analysis.

Technical analysis mein traders price charts aur technical indicators ka istemal karte hain, jaise ki moving averages, Bollinger bands, RSI, MACD, aur Fibonacci retracements.

Technical analysis ka istemal karke traders price trends aur market direction ko predict kar sakte hain.

Fundamental Analysis.

Fundamental analysis mein traders economic data aur news ka istemal karte hain, jaise ki GDP, interest rates, inflation, aur political events. Fundamental analysis ka istemal karke traders market trends aur currency values ke changes ko understand kar sakte hain.

Price Action Trading.

Price action trading mein traders price charts ka istemal karte hain aur price movements ko analyze karte hain.

Price action trading mein traders price patterns, trend lines, aur support/resistance levels ka istemal karte hain.

Trading Strategies.

Trading strategies mein traders apni trades ko plan karte hain aur trading rules banate hain. Trading strategies mein traders apne risk tolerance, entry/exit points, aur position sizing ko define karte hain.

Algorithmic Trading.

Algorithmic trading mein traders computer programs ka istemal karte hain, jinhe apne trading strategies ke according set kiya jata hai. Algorithmic trading mein traders apne trades ko automate kar sakte hain aur human error ko kam kar sakte hain.

In sabhi techniques ka istemal karke traders apni trading skills ko improve kar sakte hain aur forex market mein successful trades kar sakte hain techniques ka use krna acha sabit hota hay is say trend ka malom hota hay or is k ilava experience may bhi izafa hota hay.

تبصرہ

Расширенный режим Обычный режим