Candlesticks.

Forex trading mein candles ka kirdar bohat ahem hota hai. Yeh ek bahut ahem tool hai jo traders ko market ki trend ko samajhne mein madad karta hai. Candles ka istemal chart analysis ke liye bohat zaroori hai, jis se traders ko trading decisions lena asan ho jata hai.

Candlesticks Uses.

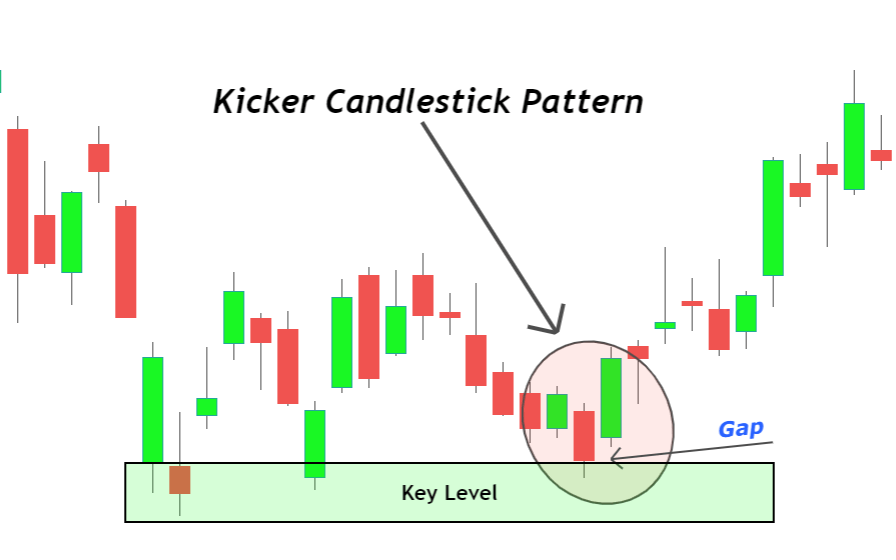

Candles ka istemal trend analysis mein hota hai. Jab traders ko market ke movement ka pata chal jata hai to woh candles ka istemal kar ke uski predictions ko improve kar sakte hain. Candles chart par ek sahi samay ko darshate hain aur traders ko market ki movements ko samajhne mein madad karte hain.

Candles ka istemal karne ke liye traders ko market ki movements ko dekhna chahiye. Jab candles ka colour change hota hai to traders ko market trend ka pata chal jata hai. Agar candles upar ki taraf ja rahe hain to yeh bullish trend hai, aur agar candles neeche ki taraf ja rahe hain to yeh bearish trend hai.

How to trade with Candles.

Candles ka istemal trading mein karne ke liye traders ko market ki movements ko samajhna chahiye. Jab market ki trend samajh mein aa jati hai to traders candles ka istemal kar ke buy ya sell kar sakte hain. Candles chart par ek sahi samay ko darshate hain aur traders ko market ki movements ko samajhne mein madad karte hain.

Important information.

Candles ka istemal forex trading mein bohat zaroori hai. Yeh ek bahut ahem tool hai jo traders ko market ki trend ko samajhne mein madad karta hai.

Candles ka istemal karne se traders ko trading decisions lena asan ho jata hai.

Forex trading mein candles ka kirdar bohat ahem hota hai. Yeh ek bahut ahem tool hai jo traders ko market ki trend ko samajhne mein madad karta hai. Candles ka istemal chart analysis ke liye bohat zaroori hai, jis se traders ko trading decisions lena asan ho jata hai.

Candlesticks Uses.

Candles ka istemal trend analysis mein hota hai. Jab traders ko market ke movement ka pata chal jata hai to woh candles ka istemal kar ke uski predictions ko improve kar sakte hain. Candles chart par ek sahi samay ko darshate hain aur traders ko market ki movements ko samajhne mein madad karte hain.

Candles ka istemal karne ke liye traders ko market ki movements ko dekhna chahiye. Jab candles ka colour change hota hai to traders ko market trend ka pata chal jata hai. Agar candles upar ki taraf ja rahe hain to yeh bullish trend hai, aur agar candles neeche ki taraf ja rahe hain to yeh bearish trend hai.

How to trade with Candles.

Candles ka istemal trading mein karne ke liye traders ko market ki movements ko samajhna chahiye. Jab market ki trend samajh mein aa jati hai to traders candles ka istemal kar ke buy ya sell kar sakte hain. Candles chart par ek sahi samay ko darshate hain aur traders ko market ki movements ko samajhne mein madad karte hain.

Important information.

Candles ka istemal forex trading mein bohat zaroori hai. Yeh ek bahut ahem tool hai jo traders ko market ki trend ko samajhne mein madad karta hai.

Candles ka istemal karne se traders ko trading decisions lena asan ho jata hai.

تبصرہ

Расширенный режим Обычный режим