Commodity channel index Indicator :

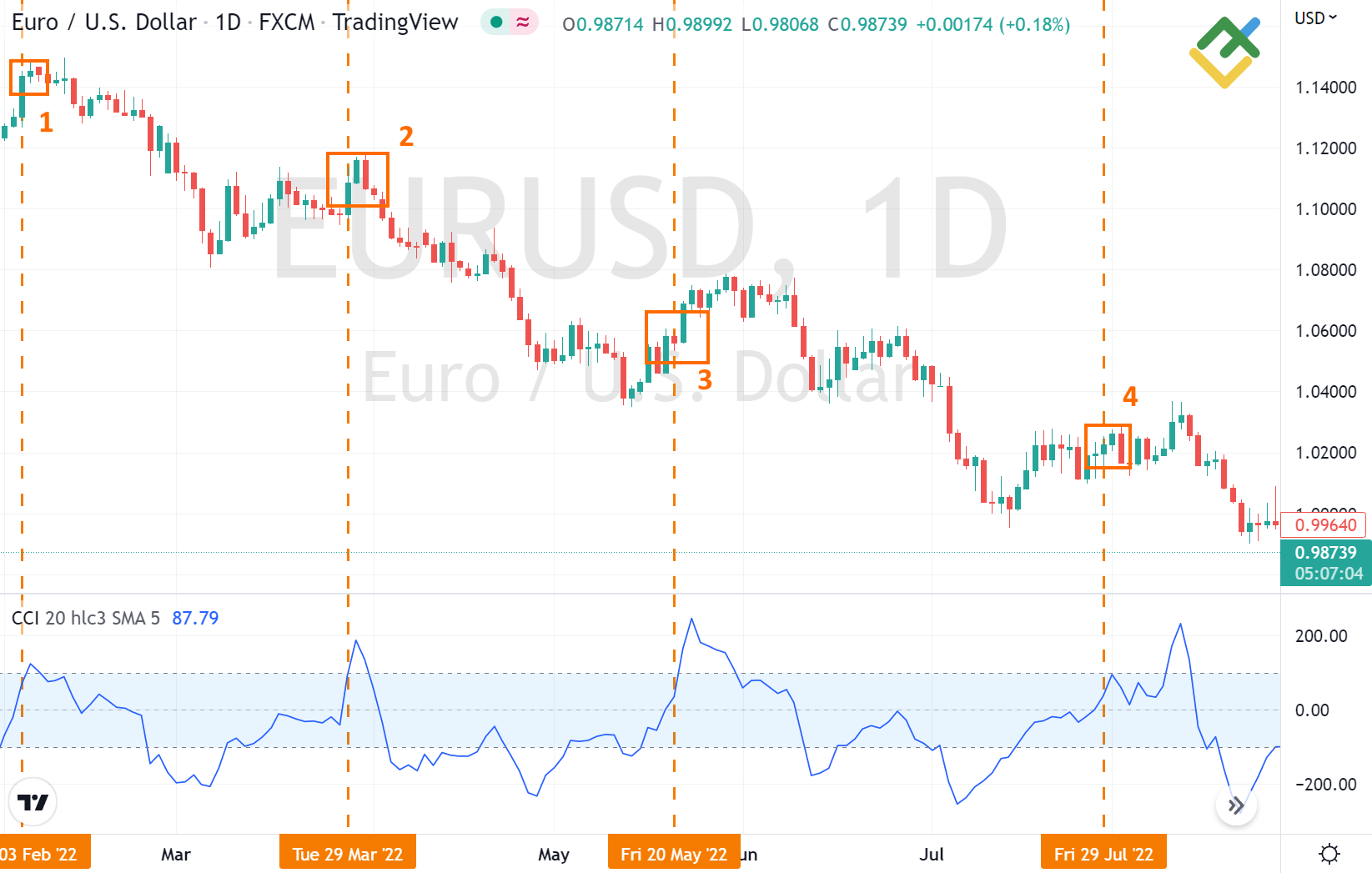

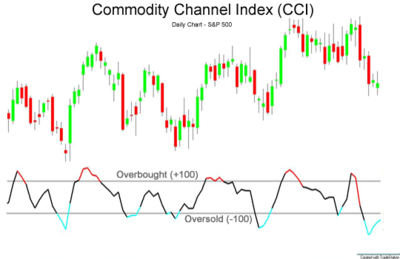

Assalam o Alaikum Dear Friends and Fellows Commodity Channel Index (CCI) indicator ek popular technical analysis tool hy. Yeh price movements ko analyze karny ke liye istemal hota hy. CCI volatility aur overbought/oversold conditions ko identify karny me madad krta hy. Positive aur negative divergence ko bhi detect karny me helpful hota hy. CCI indicator -100 aur +100 ke beech oscillate krta hy. Jab CCI +100 se upar jata hy, toh overbought condition indicate krta hy aur jab -100 se neechy jata hy, toh oversold condition indicate krta hy. Traders CCI indicator ka istemal kar ke trading signals generate kar sakty hein.

Overbought And Oversold Conditions

Dear Fellows CCI +100 se zyada ho to ye market ko overbought indicate krta hy, jab ke CCI -100 se kam ho to ye market ko oversold indicate krta hy. Overbought condition me trend reversal ka chance hota hy aur oversold condition me trend change hone ka chance hota hy.

Trading Signals

CCI ko trading signals ke liye istemal kiya ja sakta hy: Buy Signals: Jab CCI -100 se upar se neechy aata hy aur phir upar direction me move krta hy. Sell Signals: Jab CCI +100 se neechy aata hy aur phir neechy direction me move krta hy.

Divergence-Risk Management

CCI ki madad se trader market me divergence detect kar sakty hein, jo trend reversal ki nishani ho sakti hy. CCI ko risk management me istemal kar ke trader apni stop-loss aur take-profit levels ko set kar sakty hein.

CCI indicator Formula :

CCI indicator ka formula yeh hy: CCI = (Typical Price - 20-period SMA of Typical Price) / (0.015 * Mean Deviation) Yaha "Typical Price" current candle ka average price hota hy, "SMA" simple moving average hy, aur "Mean Deviation" standard deviation ke average ko represent krta hy. Is formula ka istemal kar ke CCI indicator ka value calculate kiya jata hy.

Assalam o Alaikum Dear Friends and Fellows Commodity Channel Index (CCI) indicator ek popular technical analysis tool hy. Yeh price movements ko analyze karny ke liye istemal hota hy. CCI volatility aur overbought/oversold conditions ko identify karny me madad krta hy. Positive aur negative divergence ko bhi detect karny me helpful hota hy. CCI indicator -100 aur +100 ke beech oscillate krta hy. Jab CCI +100 se upar jata hy, toh overbought condition indicate krta hy aur jab -100 se neechy jata hy, toh oversold condition indicate krta hy. Traders CCI indicator ka istemal kar ke trading signals generate kar sakty hein.

Overbought And Oversold Conditions

Dear Fellows CCI +100 se zyada ho to ye market ko overbought indicate krta hy, jab ke CCI -100 se kam ho to ye market ko oversold indicate krta hy. Overbought condition me trend reversal ka chance hota hy aur oversold condition me trend change hone ka chance hota hy.

Trading Signals

CCI ko trading signals ke liye istemal kiya ja sakta hy: Buy Signals: Jab CCI -100 se upar se neechy aata hy aur phir upar direction me move krta hy. Sell Signals: Jab CCI +100 se neechy aata hy aur phir neechy direction me move krta hy.

Divergence-Risk Management

CCI ki madad se trader market me divergence detect kar sakty hein, jo trend reversal ki nishani ho sakti hy. CCI ko risk management me istemal kar ke trader apni stop-loss aur take-profit levels ko set kar sakty hein.

CCI indicator Formula :

CCI indicator ka formula yeh hy: CCI = (Typical Price - 20-period SMA of Typical Price) / (0.015 * Mean Deviation) Yaha "Typical Price" current candle ka average price hota hy, "SMA" simple moving average hy, aur "Mean Deviation" standard deviation ke average ko represent krta hy. Is formula ka istemal kar ke CCI indicator ka value calculate kiya jata hy.

:max_bytes(150000):strip_icc():format(webp)/dotdash_INV-final-Commodity-Channel-Index-CCI-June-2021-01-45a136bc81d746acbc178b6f4afc07c2.jpg)

تبصرہ

Расширенный режим Обычный режим