What is Easy to Movement Indicator:

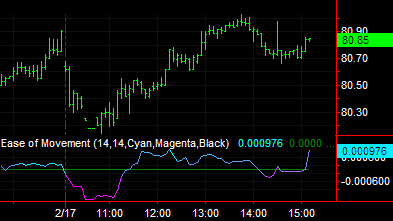

Easy to Movement ( EMV ) isharay aik takneeki tajzia aala hai jo sharah harkat aur miqdaar ke darmiyan talluq ki pemaiesh karta hai. EMV isharay ka hisaab aik makhsoos muddat ke liye zaroorat se ziyada aur kaafi ke akhrajaat ki ost le kar kya jata hai, aur phir usay had ke lehaaz se taqseem kya jata hai. emv ke ajzaa yeh hain : emv = ( ( aala kam ) / 2 ) - ( ( tarjeehi aala tarjeehi kam ) / 2 ) / hajam. is ke nateejay mein anay wali laagat ko aam tor par 14 dinon ke waqfon ki aik wasee aqsam par exponential transfer average ( e am ae ) ka istemaal karte hue hamwar kya jata hai. yeh hisaab taajiron ko market ke andar salahiyat ke rujhanaat ya ulat ko daryaft karne ke liye qeemat aur had ke darmiyan talluq ki tasdeeq karne ke qabil banata hai.

Interpretation of Easy to Movement Indicator:

Easy to Movement ka isharay sarmaya karon ko miqdaar ke muqablay mein qeematon ki naqal o harkat ki taaqat aur rastay ke baray mein baseerat faraham karta hai. barhti hui EMV se pata chalta hai ke market nisbatan aasani ke sath onche taraf barh rahi hai, jo taizi se bijli ki nishandahi karti hai. is ke bar aks, girtay hue EMV se pata chalta hai ke sharah ke aamaal ko muzahmat ya rukawaton ka saamna karna par raha hai, jo salahiyat bardasht ke dabao ki nishandahi karta hai. tajir salahiyat ke rujhan ke ulat ko muntakhib karne ke liye charge aur EMV ke darmiyan farq bhi talaash kar satke hain. misaal ke tor par, agar EMV ke girnay ke bawajood qeematein barh rahi hain, to yeh kamzor fashion aur salahiyat ke ulat jane ka ishara karne ke qabil hai.

Trading With Easy to Movement Indicator:

Tajir bakhabar faislay karne ke liye mtnoa khareed o farokht ki hikmat amlyon mein EMV isharay ka istemaal kar satke hain. aik aam nuqta nazar yeh hai ke EMV cross overs ko sign line ke sath talaash kya jaye, jaisa ke aam cross overs ko muntaqil karna hai. jab EMV signal line ke oopar se guzarta hai, to yeh kharidari ke nishaan ki nishandahi kar sakta hai, jis se taizi ki raftaar ka pata chalta hai. is ke bar aks, jab EMV signal line ke neechay se guzarta hai, to yeh farokht ki alamat ho sakti hai, jo salahiyat ke mandi ke dabao ki nishandahi karti hai. mazeed bar-aan, tajir EMV ko deegar takneeki isharay ke sath mil kar khaslato ki tasdeeq ya jaali intabahat ko saaf karne ke liye istemaal kar satke hain .

Limitations of Easy to Movement Indicator:

Agarchay Easy to Movement ka isharay takneeki tajzia ke liye aik qeemti zareya ho sakta hai, lekin yeh is ki hudood ke baghair nahi hai. ziyada tar takneeki alamaat ki terhan, EMV peechay hatna aik masla hai aur baar baar jaali isharay peda kar sakta hai, khaas tor par na hamwar ya side way baazaaron ke kisi maqam par. taajiron ko EMV par mukammal tor par inhisaar karne se mohtaat rehne ki zaroorat hai aur tasdeeq ke liye mukhtalif isharay ke sath is ke istemaal ko nah bhulen. mazeed bar-aan, EMV herat angaiz tor par khatarnaak baazaaron mein bhi kaam nahi kar sakta hai jahan qeematon ki naqal o harkat be tarteeb aur ghair mutawaqqa hoti hai.

Combining Easy to Movement Indicator with Other Indicators:

Easy to Movement ke isharay ki taseer ko behtar bananay ke liye, khredar usay deegar takneeki isharay ke sath marboot kar ke aik mukammal tijarti tareeqa bana satke hain. misaal ke tor par, chalti ost ke sath EMV ki jori, rishta daar tawanai index ( are s aayi ) ya am ae si d izafi tasdeeq ke isharay faraham kar satke hain aur jaali alarm ko saaf kar satke hain. mutadid alamaat ko shaamil karkay, khredar aik mazboot trading device tayyar kar satke hain jo zaroorat se ziyada mawaqay ki tijarat ko talaash karne aur khatraat ko kam karne mein madad karta hai. krdaron ki kharidari aur farokht ke andaaz aur mutabadil ke liye ziyada se ziyada mozoon tareeqa talaash karne ke liye mukhtali ke sath tajurbah karna zaroori hai .

Easy to Movement ( EMV ) isharay aik takneeki tajzia aala hai jo sharah harkat aur miqdaar ke darmiyan talluq ki pemaiesh karta hai. EMV isharay ka hisaab aik makhsoos muddat ke liye zaroorat se ziyada aur kaafi ke akhrajaat ki ost le kar kya jata hai, aur phir usay had ke lehaaz se taqseem kya jata hai. emv ke ajzaa yeh hain : emv = ( ( aala kam ) / 2 ) - ( ( tarjeehi aala tarjeehi kam ) / 2 ) / hajam. is ke nateejay mein anay wali laagat ko aam tor par 14 dinon ke waqfon ki aik wasee aqsam par exponential transfer average ( e am ae ) ka istemaal karte hue hamwar kya jata hai. yeh hisaab taajiron ko market ke andar salahiyat ke rujhanaat ya ulat ko daryaft karne ke liye qeemat aur had ke darmiyan talluq ki tasdeeq karne ke qabil banata hai.

Interpretation of Easy to Movement Indicator:

Easy to Movement ka isharay sarmaya karon ko miqdaar ke muqablay mein qeematon ki naqal o harkat ki taaqat aur rastay ke baray mein baseerat faraham karta hai. barhti hui EMV se pata chalta hai ke market nisbatan aasani ke sath onche taraf barh rahi hai, jo taizi se bijli ki nishandahi karti hai. is ke bar aks, girtay hue EMV se pata chalta hai ke sharah ke aamaal ko muzahmat ya rukawaton ka saamna karna par raha hai, jo salahiyat bardasht ke dabao ki nishandahi karta hai. tajir salahiyat ke rujhan ke ulat ko muntakhib karne ke liye charge aur EMV ke darmiyan farq bhi talaash kar satke hain. misaal ke tor par, agar EMV ke girnay ke bawajood qeematein barh rahi hain, to yeh kamzor fashion aur salahiyat ke ulat jane ka ishara karne ke qabil hai.

Trading With Easy to Movement Indicator:

Tajir bakhabar faislay karne ke liye mtnoa khareed o farokht ki hikmat amlyon mein EMV isharay ka istemaal kar satke hain. aik aam nuqta nazar yeh hai ke EMV cross overs ko sign line ke sath talaash kya jaye, jaisa ke aam cross overs ko muntaqil karna hai. jab EMV signal line ke oopar se guzarta hai, to yeh kharidari ke nishaan ki nishandahi kar sakta hai, jis se taizi ki raftaar ka pata chalta hai. is ke bar aks, jab EMV signal line ke neechay se guzarta hai, to yeh farokht ki alamat ho sakti hai, jo salahiyat ke mandi ke dabao ki nishandahi karti hai. mazeed bar-aan, tajir EMV ko deegar takneeki isharay ke sath mil kar khaslato ki tasdeeq ya jaali intabahat ko saaf karne ke liye istemaal kar satke hain .

Limitations of Easy to Movement Indicator:

Agarchay Easy to Movement ka isharay takneeki tajzia ke liye aik qeemti zareya ho sakta hai, lekin yeh is ki hudood ke baghair nahi hai. ziyada tar takneeki alamaat ki terhan, EMV peechay hatna aik masla hai aur baar baar jaali isharay peda kar sakta hai, khaas tor par na hamwar ya side way baazaaron ke kisi maqam par. taajiron ko EMV par mukammal tor par inhisaar karne se mohtaat rehne ki zaroorat hai aur tasdeeq ke liye mukhtalif isharay ke sath is ke istemaal ko nah bhulen. mazeed bar-aan, EMV herat angaiz tor par khatarnaak baazaaron mein bhi kaam nahi kar sakta hai jahan qeematon ki naqal o harkat be tarteeb aur ghair mutawaqqa hoti hai.

Combining Easy to Movement Indicator with Other Indicators:

Easy to Movement ke isharay ki taseer ko behtar bananay ke liye, khredar usay deegar takneeki isharay ke sath marboot kar ke aik mukammal tijarti tareeqa bana satke hain. misaal ke tor par, chalti ost ke sath EMV ki jori, rishta daar tawanai index ( are s aayi ) ya am ae si d izafi tasdeeq ke isharay faraham kar satke hain aur jaali alarm ko saaf kar satke hain. mutadid alamaat ko shaamil karkay, khredar aik mazboot trading device tayyar kar satke hain jo zaroorat se ziyada mawaqay ki tijarat ko talaash karne aur khatraat ko kam karne mein madad karta hai. krdaron ki kharidari aur farokht ke andaaz aur mutabadil ke liye ziyada se ziyada mozoon tareeqa talaash karne ke liye mukhtali ke sath tajurbah karna zaroori hai .

تبصرہ

Расширенный режим Обычный режим