Bull Flag Pattern: Ek Jaiza

1. Taaruf

Bull flag pattern ek technical analysis ka tool hai jo traders ko market ke upward movement ko samajhne mein madad karta hai. Ye pattern aksar bullish market conditions mein dekha jata hai aur iska istemal stock aur forex trading mein kiya jata hai.

2. Bull Flag Kya Hai?

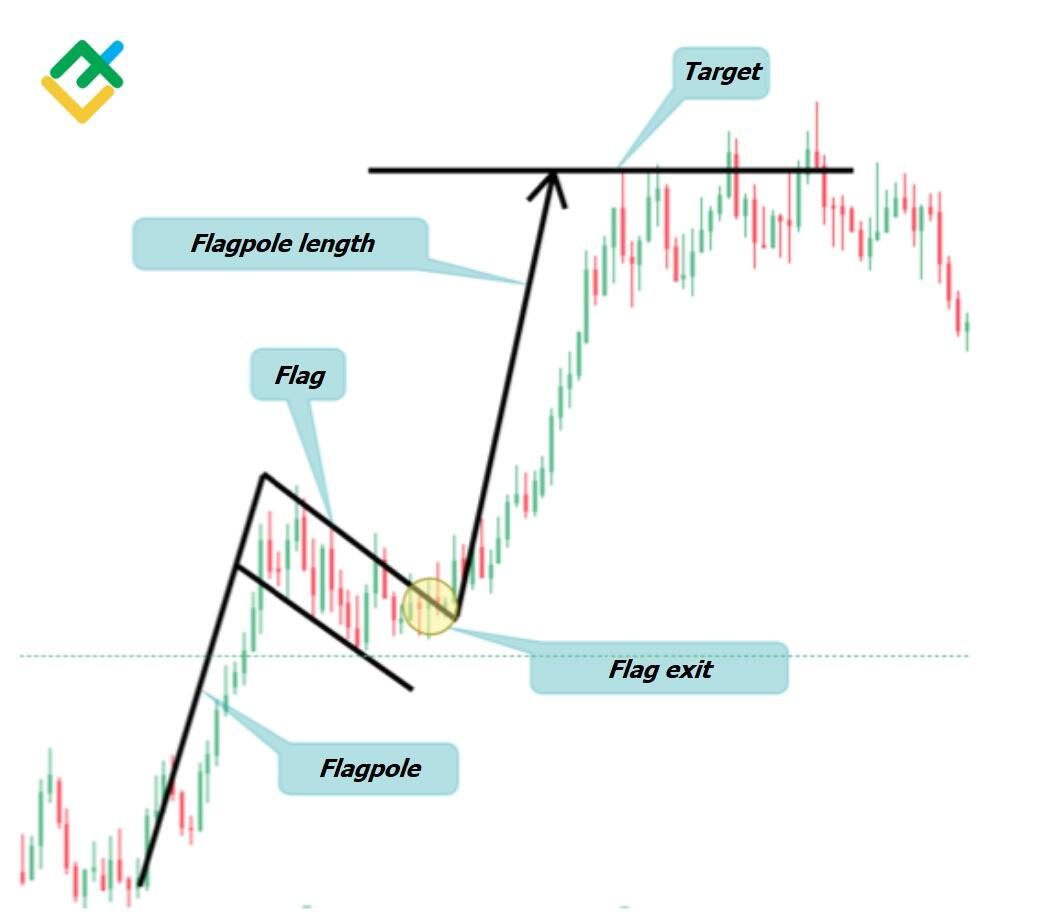

Bull flag pattern do mukhya hissoon par mushtamil hota hai: ek strong upward movement (flagpole) aur us ke baad consolidation ka aik dauraan (flag). Is pattern ka matlab hai ke market ki bullish momentum abhi bhi zinda hai, lekin thoda waqt ke liye stability ki zaroorat hai.

3. Flagpole Aur Flag

Flagpole wo strong price movement hai jo pattern ke shuruat mein hota hai. Ye aksar ek sudden rise ke sath hota hai, jahan price kaafi upar jati hai. Uske baad, consolidation ka period aata hai, jo flag kehlata hai. Ye generally aik downward slope ya horizontal range mein hota hai.

4. Pattern Ka Nakshe

Is pattern ka naksha banana aasaan hai. Aapko ek steep upward movement dekhni hogi, jiske baad price ka consolidation phase hoga. Ye consolidation phase thoda waqt le sakta hai aur iska length kuch dinon se lekar kuch hafton tak ho sakta hai.

5. Bull Flag Pattern Ki Pehchaan

Bull flag pattern ko pehchanna mushkil nahi hai. Iski pehchaan ke liye aapko pehle flagpole ki talash karni hogi, phir uske baad consolidation ka period dekhna hoga. Ye consolidation price ke upar aur niche hone ke dauran hota hai.

6. Trading Signal

Bull flag pattern ka trading signal aksar breakout ke waqt milta hai. Jab price flag ke upper boundary ko todti hai, to ye bullish signal hota hai. Is waqt traders aksar entry lene ka faisla karte hain.

7. Stop-Loss Ki Strategy

Bull flag pattern ko trade karte waqt stop-loss set karna bohot zaroori hai. Aam tor par, stop-loss ko flag ke neeche rakha jata hai, jisse agar price ulat jaye to aap ka loss minimize ho sake.

8. Target Price

Target price nikaalne ke liye aap flagpole ki length ko measure karke use flag ke breakout point par add kar sakte hain. Ye method aapko ek estimated target price provide karega, jahan aap apne profits book kar sakte hain.

9. Timeframe Ka Ahmiyat

Bull flag pattern kisi bhi timeframe par ban sakta hai, lekin daily aur hourly charts par ye zyada effective hota hai. Longer timeframes par ye pattern zyada reliable signals de sakta hai.

10. Volume Ka Role

Volume bhi is pattern ki pehchaan mein ahmiyat rakhta hai. Jab flagpole banta hai, to volume zyada hona chahiye, aur jab flag ka breakout hota hai, to volume mein bhi izafa hona chahiye. Ye indicators bullish trend ki taeed karte hain.

11. Market Conditions

Market conditions bhi bull flag pattern ke kaam karne par asar daalti hain. Agar overall market bullish hai, to bull flag pattern zyada effective hota hai. Isliye, market sentiment ko samajhna bhi zaroori hai.

12. Common Mistakes

Traders aksar kuch ghaltiyan karte hain jab bull flag pattern ko trade karte hain. Sabse badi ghalti hoti hai breakout ko ignore karna ya stop-loss na lagana. Is wajah se bohot saare traders ko nuksan hota hai.

13. Practical Examples

Agar aap kisi stock ya currency pair ka analysis karte hain aur wahan bull flag pattern nazar aata hai, to aap is signal ka faida utha sakte hain. Misal ke tor par, agar stock XYZ ne 20% ki rise dekhi hai, phir consolidation period ke doran flag ban gaya hai, to ye aapke liye trade karne ka mauqa ho sakta hai.

14. Conclusion

Bull flag pattern trading ka aik behtareen tool hai jo traders ko market ke bullish movements ko samajhne mein madad karta hai. Is pattern ko samajhne aur effectively use karne se aap apne trading strategies ko behtar bana sakte hain. Hamesha yaad rahe ke market ki volatility aur risk management par nazar rakhna zaroori hai. Trading mein success ke liye practice aur patience ki zaroorat hoti hai.

1. Taaruf

Bull flag pattern ek technical analysis ka tool hai jo traders ko market ke upward movement ko samajhne mein madad karta hai. Ye pattern aksar bullish market conditions mein dekha jata hai aur iska istemal stock aur forex trading mein kiya jata hai.

2. Bull Flag Kya Hai?

Bull flag pattern do mukhya hissoon par mushtamil hota hai: ek strong upward movement (flagpole) aur us ke baad consolidation ka aik dauraan (flag). Is pattern ka matlab hai ke market ki bullish momentum abhi bhi zinda hai, lekin thoda waqt ke liye stability ki zaroorat hai.

3. Flagpole Aur Flag

Flagpole wo strong price movement hai jo pattern ke shuruat mein hota hai. Ye aksar ek sudden rise ke sath hota hai, jahan price kaafi upar jati hai. Uske baad, consolidation ka period aata hai, jo flag kehlata hai. Ye generally aik downward slope ya horizontal range mein hota hai.

4. Pattern Ka Nakshe

Is pattern ka naksha banana aasaan hai. Aapko ek steep upward movement dekhni hogi, jiske baad price ka consolidation phase hoga. Ye consolidation phase thoda waqt le sakta hai aur iska length kuch dinon se lekar kuch hafton tak ho sakta hai.

5. Bull Flag Pattern Ki Pehchaan

Bull flag pattern ko pehchanna mushkil nahi hai. Iski pehchaan ke liye aapko pehle flagpole ki talash karni hogi, phir uske baad consolidation ka period dekhna hoga. Ye consolidation price ke upar aur niche hone ke dauran hota hai.

6. Trading Signal

Bull flag pattern ka trading signal aksar breakout ke waqt milta hai. Jab price flag ke upper boundary ko todti hai, to ye bullish signal hota hai. Is waqt traders aksar entry lene ka faisla karte hain.

7. Stop-Loss Ki Strategy

Bull flag pattern ko trade karte waqt stop-loss set karna bohot zaroori hai. Aam tor par, stop-loss ko flag ke neeche rakha jata hai, jisse agar price ulat jaye to aap ka loss minimize ho sake.

8. Target Price

Target price nikaalne ke liye aap flagpole ki length ko measure karke use flag ke breakout point par add kar sakte hain. Ye method aapko ek estimated target price provide karega, jahan aap apne profits book kar sakte hain.

9. Timeframe Ka Ahmiyat

Bull flag pattern kisi bhi timeframe par ban sakta hai, lekin daily aur hourly charts par ye zyada effective hota hai. Longer timeframes par ye pattern zyada reliable signals de sakta hai.

10. Volume Ka Role

Volume bhi is pattern ki pehchaan mein ahmiyat rakhta hai. Jab flagpole banta hai, to volume zyada hona chahiye, aur jab flag ka breakout hota hai, to volume mein bhi izafa hona chahiye. Ye indicators bullish trend ki taeed karte hain.

11. Market Conditions

Market conditions bhi bull flag pattern ke kaam karne par asar daalti hain. Agar overall market bullish hai, to bull flag pattern zyada effective hota hai. Isliye, market sentiment ko samajhna bhi zaroori hai.

12. Common Mistakes

Traders aksar kuch ghaltiyan karte hain jab bull flag pattern ko trade karte hain. Sabse badi ghalti hoti hai breakout ko ignore karna ya stop-loss na lagana. Is wajah se bohot saare traders ko nuksan hota hai.

13. Practical Examples

Agar aap kisi stock ya currency pair ka analysis karte hain aur wahan bull flag pattern nazar aata hai, to aap is signal ka faida utha sakte hain. Misal ke tor par, agar stock XYZ ne 20% ki rise dekhi hai, phir consolidation period ke doran flag ban gaya hai, to ye aapke liye trade karne ka mauqa ho sakta hai.

14. Conclusion

Bull flag pattern trading ka aik behtareen tool hai jo traders ko market ke bullish movements ko samajhne mein madad karta hai. Is pattern ko samajhne aur effectively use karne se aap apne trading strategies ko behtar bana sakte hain. Hamesha yaad rahe ke market ki volatility aur risk management par nazar rakhna zaroori hai. Trading mein success ke liye practice aur patience ki zaroorat hoti hai.

تبصرہ

Расширенный режим Обычный режим