What is Bull Flag Pattern:

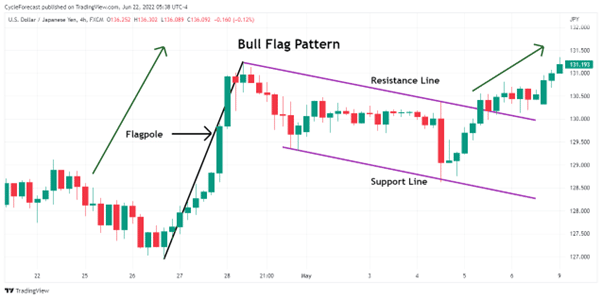

Bull flag patteren aik takneeki tajzia ka namona hai jo is waqt hota hai jab kisi asasa ki fees aik numaya oopar ki taraf bahao ka jaiza layte hai jis ke baad istehkaam ki muddat hoti hai. istehkaam ke hissay ke douran, qeemat aam tor par aik tang range mein harkat karti hai aur kaghazi karwai parcham jaisay namoonay par hoti hai, jo flag pol par jhanday ko dobarah jorta hai. is namoonay ko taizi samjha jata hai kyunkay is se pata chalta hai ke jab istehkaam ki lambai hoti hai, to sharah mumkina tor par –apne oopar ki taraf rujhan ko barqarar rakhnay ke liye hoti hai. tajir aksar mauqa ke liye capacity shopping ke tor par flag patteren ki oopri had se oopar break out talaash karte hain. Bull ke jhanday ka namona taajiron ke liye aik faida mand aala ho sakta hai taakay woh kisi aisay asasay mein tosee shuda function mein daakhil honay ke liye salahiyat ke imkanaat ka intikhab kar saken jo up trained ka saamna kar raha hai.

Formation of Bull Flag Pattern:

Bull ke jhanday ke namoonay ki tashkeel aam tor par is waqt hoti hai jab charge aik barray oopar ki taraf harkat ke baad channel ke andar ya jhanday jaisi shakal mein peechay hatt jata hai. yeh istehkaam ka marhala aam tor par neechay ki taraf dhalwan channel ki shakal ikhtiyar karta hai, jis mein charge tole o arz mein kam jhoolta hai. tajir aksar is shakal ki talaash karte hain kyunkay yeh salahiyat ke oopar ki taraf tasalsul se pehlay taizi ke andaaz mein aik earzi waqfay ki nishandahi karta hai. istehkaam ke hissay ki lambai mukhtalif ho sakti hai, lekin salahiyat ke break out imkanaat ke liye flag patteren ke andar fees ki karwai par nazar rakhna bohat zaroori hai.

Volume Analysis In Bull Flag Pattern:

Hajam ka tajzia Bull flag patteren ki sadaqat ki tasdeeq mein ahem kirdaar ada karta hai. aik behtareen sorat e haal mein, jaisay jaisay jhanday ka namona tayyar hota hai is ki had mein kami ki zaroorat hoti hai, jo tanao ko farogh dainay aur market mein mamool ki shirkat mein kami ka ishara hai. aik baar jab namona mukammal tor par qareeb aa jata hai, to tajir pichlle up trained ke tasalsul ki toseeq karne ke liye hajam mein izafay ki madad se aik break out par aetmaad karte hain. break out ke kisi maqam par miqdaar mein izafah taizi ki raftaar ki tawanai ki tasdeeq karta hai aur namoonay ko poora karta hai.

Entry and Exit Strategy for Bull Flag Pattern:

Bull ke jhanday ka namona kharedtay aur farokht karte waqt, khredar aksar jhanday ki nichli had ke qareeb rasai ke mawaqay talaash karte hain, jis mein sharah izafi tor par support level se uchhal sakti hai. kaamil rasai nuqta aam tor par flag patteren ki oopri had ke oopar break out par hota hai, is ke baad behtar hajam aur mazboot raftaar hoti hai. tajir mauqa par qaboo panay aur ghalat break out se bachanay ke liye jhanday ki nichli had ke neechay nuqsaan se bachao ke order bhi muqarrar kar satke hain. munafe ke ahdaaf flag pol ki oonchai ki bunyaad par tay kiye ja satke hain, jo up trained ke tasalsul ke liye salahiyat charge ka hadaf paish karte hain.

trading-strategy.webp

Risk Management and Trading in Bull Flag Pattern:

Jab sarmaye ki hifazat aur aamdani ko mehfooz rakhnay ke liye Bull flag patteren ki tijarat ki jaye to rissk managment bohat zaroori hai. taajiron ko bazaar ke umomi sayaq o Sabaq , bunyadi fashion ki taaqat, aur mumkina ko mad e nazar rakhna chahiye jo namoonay ke break out ko mutasir kar satke hain. munasib function size ka itlaq karna, khatray ko bardasht karne ke mutabiq nuqsaan se bachao ke order tay karna, aur nazam o zabt ki kharidari ke mansoobay par amal karna bohat zaroori hai. mazeed bar-aan, kharidaron ko koi bhi maloomat ke waqeat ya muashi maloomat ke ijra ko zahir karna chahiye jo bazaar ke jazbaat ko mutasir kar satke hain aur tarz ke nataij ko mutasir kar satke hain. khatray par qaboo panay ke taaqatwar tareeqon ko shaamil karkay, khredar salahiyat ke nuqsanaat ko kam kar satke hain aur –apne tijarti mawaqay ko ziyada se ziyada kar satke hain.

Bull flag patteren aik takneeki tajzia ka namona hai jo is waqt hota hai jab kisi asasa ki fees aik numaya oopar ki taraf bahao ka jaiza layte hai jis ke baad istehkaam ki muddat hoti hai. istehkaam ke hissay ke douran, qeemat aam tor par aik tang range mein harkat karti hai aur kaghazi karwai parcham jaisay namoonay par hoti hai, jo flag pol par jhanday ko dobarah jorta hai. is namoonay ko taizi samjha jata hai kyunkay is se pata chalta hai ke jab istehkaam ki lambai hoti hai, to sharah mumkina tor par –apne oopar ki taraf rujhan ko barqarar rakhnay ke liye hoti hai. tajir aksar mauqa ke liye capacity shopping ke tor par flag patteren ki oopri had se oopar break out talaash karte hain. Bull ke jhanday ka namona taajiron ke liye aik faida mand aala ho sakta hai taakay woh kisi aisay asasay mein tosee shuda function mein daakhil honay ke liye salahiyat ke imkanaat ka intikhab kar saken jo up trained ka saamna kar raha hai.

Formation of Bull Flag Pattern:

Bull ke jhanday ke namoonay ki tashkeel aam tor par is waqt hoti hai jab charge aik barray oopar ki taraf harkat ke baad channel ke andar ya jhanday jaisi shakal mein peechay hatt jata hai. yeh istehkaam ka marhala aam tor par neechay ki taraf dhalwan channel ki shakal ikhtiyar karta hai, jis mein charge tole o arz mein kam jhoolta hai. tajir aksar is shakal ki talaash karte hain kyunkay yeh salahiyat ke oopar ki taraf tasalsul se pehlay taizi ke andaaz mein aik earzi waqfay ki nishandahi karta hai. istehkaam ke hissay ki lambai mukhtalif ho sakti hai, lekin salahiyat ke break out imkanaat ke liye flag patteren ke andar fees ki karwai par nazar rakhna bohat zaroori hai.

Volume Analysis In Bull Flag Pattern:

Hajam ka tajzia Bull flag patteren ki sadaqat ki tasdeeq mein ahem kirdaar ada karta hai. aik behtareen sorat e haal mein, jaisay jaisay jhanday ka namona tayyar hota hai is ki had mein kami ki zaroorat hoti hai, jo tanao ko farogh dainay aur market mein mamool ki shirkat mein kami ka ishara hai. aik baar jab namona mukammal tor par qareeb aa jata hai, to tajir pichlle up trained ke tasalsul ki toseeq karne ke liye hajam mein izafay ki madad se aik break out par aetmaad karte hain. break out ke kisi maqam par miqdaar mein izafah taizi ki raftaar ki tawanai ki tasdeeq karta hai aur namoonay ko poora karta hai.

Entry and Exit Strategy for Bull Flag Pattern:

Bull ke jhanday ka namona kharedtay aur farokht karte waqt, khredar aksar jhanday ki nichli had ke qareeb rasai ke mawaqay talaash karte hain, jis mein sharah izafi tor par support level se uchhal sakti hai. kaamil rasai nuqta aam tor par flag patteren ki oopri had ke oopar break out par hota hai, is ke baad behtar hajam aur mazboot raftaar hoti hai. tajir mauqa par qaboo panay aur ghalat break out se bachanay ke liye jhanday ki nichli had ke neechay nuqsaan se bachao ke order bhi muqarrar kar satke hain. munafe ke ahdaaf flag pol ki oonchai ki bunyaad par tay kiye ja satke hain, jo up trained ke tasalsul ke liye salahiyat charge ka hadaf paish karte hain.

trading-strategy.webp

Risk Management and Trading in Bull Flag Pattern:

Jab sarmaye ki hifazat aur aamdani ko mehfooz rakhnay ke liye Bull flag patteren ki tijarat ki jaye to rissk managment bohat zaroori hai. taajiron ko bazaar ke umomi sayaq o Sabaq , bunyadi fashion ki taaqat, aur mumkina ko mad e nazar rakhna chahiye jo namoonay ke break out ko mutasir kar satke hain. munasib function size ka itlaq karna, khatray ko bardasht karne ke mutabiq nuqsaan se bachao ke order tay karna, aur nazam o zabt ki kharidari ke mansoobay par amal karna bohat zaroori hai. mazeed bar-aan, kharidaron ko koi bhi maloomat ke waqeat ya muashi maloomat ke ijra ko zahir karna chahiye jo bazaar ke jazbaat ko mutasir kar satke hain aur tarz ke nataij ko mutasir kar satke hain. khatray par qaboo panay ke taaqatwar tareeqon ko shaamil karkay, khredar salahiyat ke nuqsanaat ko kam kar satke hain aur –apne tijarti mawaqay ko ziyada se ziyada kar satke hain.

تبصرہ

Расширенный режим Обычный режим