What is Price Range Channel in forex trading.

Assalam o Alaikum Dear friends and Fellows Price Range Channel ek technical analysis tool hy jo marketplace ke rate actions ko represent karta hy.aor usky head ky inverse facet py underneath facet jo immediately line bnti hy us ko on neck line kaha jata hy aor yeh zaroori nhi hy ky flat he ho wo thori tehri bhi hoti hy pattern Me banti hy aur simply wo Apna hole recover karny ke liye Thodi Si inversion development kar sakti hy to is condition Me ap ne Koi Bhi incorrect chance Nahin lena.Support aur resistance ke darmiyan ek design small hy jisy neck line kaha jata hy ye head and shoulder draw krty honyy undersized hwi hit marketplace me pattern neck line sy oper Chala jata hy to us me inversion possibilities nhi hoty ye constantly oper he jata hy.Forex replacing outline ho skti hy apko candle graph ko recognize krna ana chahiye candle diagram me marketplace ki subsequent improvement ko show kar rahi hoti hy is liye apko chahie ki ap in ko appropriately analyze Karen Taki ap market ko asani ke sath samajhne ki condition Me a jaen punch tak ap ine ko acchi Tarah Nahin samajh lete ap kabhi bhi acchi exchanging nahin kar sakte isliye neck area ki significance Se Koi Banda Inkar nahin kar saktas channel me do fashion lines hoti hein: ek upper trend line (resistance) aur ek decrease trend line (aid). Price range channel ka istemal kar ke traders marketplace me hony wale trends aur charge stages ko samajhte hein.

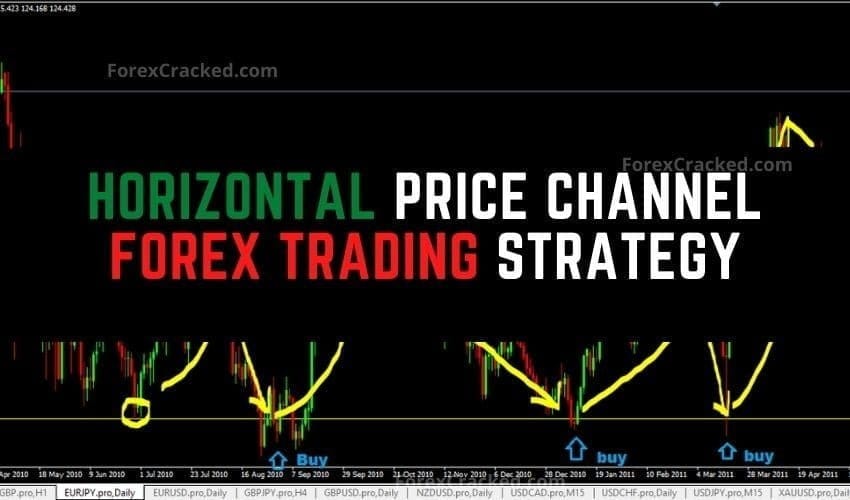

Price Range Channel Strategy.

Dear Friends Neck line sample line ke sath he hote hy.The neck area aik h level hota ha backing or opposition ka jo ap head and shoulders design consistent with dekh sakbty han jo sellers use krty han to decide key regions to position orders. Hit value transcends the neck area ja rhi hoti han or usk horrible us mama inversion pattern ni hota us mama proceeds rehta ha usy in neck line kaha jata ha.Neckline layout Ek bahut greetings easy instance hota hy jisme simply ap ko do candle ke horrible pata chal jata hy ki yah neck region design banne jad and shoulder layout bnta nazar ay aor usky head ky inverse side py under aspect jo directly line bnti hy us ko on neck line kaha jata hy aor yeh zaroori nhi hy ky flat he ho wo thori teri bhi ho skti hy apko candle graph ko realize krna hy.Agar marketplace Upar ko development kar rahi hy aur us ke horrible ap dekhty hein ki candles neck location bana deti Hein To is ka matlab yah hota hy ki Is ke horrible marketplace Apna sample proceed with Rakhy gi aur Mazeed Upar hi ki taraf improvement Kary gi.

Trading strategy with price range channel.

:max_bytes(150000):strip_icc():format(webp)/PriceChannel2-f2b5fb4fc7d44b4294d5af1d00022da3.png)

تبصرہ

Расширенный режим Обычный режим