Chapter 1: Forex Trading Ko Samajhna

Forex Trading Kya Hai?

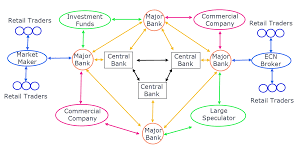

Forex trading currencies ki khareed o farokht ke amal ko kehta hai jahan exchange rates ke tagayur se munafa hasil karna hota hai. Stock market ke mukhable mein, jahan investors companies ke shares khareedte hain aur farokht karte hain, forex trading currencies ke pairs ke ird gird ghoomti hai.

Forex Trading Kaise Kaam Karti Hai?

Forex trading over the counter (OTC) hoti hai, yani ke yeh seedha parties ke darmiyan hoti hai, aam tor par electronic trading platforms ke zariye. Traders currency pairs ke mustaqbil ke harkat par tawaqo rakhte hain, umeed hai ke exchange rates ke tabadlay se munafa hasil karenge.

Chapter 2: Forex Trading Ke Bunyadi Usool

Currency Pairs

Forex trading mein hamesha currencies pairs mein ki jati hai. Pair ka pehla currency base currency kehlata hai, jab ke doosra currency quote currency hota hai. For example, pair EUR/USD mein, euro base currency hota hai aur US dollar quote currency hota hai.

Bid aur Ask Price

Bid price woh price hai jis par market currency pair khareedne ko taiyar hoti hai, jab ke ask price woh price hai jis par market currency pair farokht karne ko taiyar hoti hai. Bid aur ask price ke darmiyan ka farq spread kehlaya jata hai.

Chapter 3: Forex Trading Mein Shuruaat Karna

Broker Chunaav

Regulashan

Regulation bohot ahem hai jab aap ek forex broker ko chunte hain. Regulatory bodies jaise ke Financial Conduct Authority (FCA) UK mein, Australian Securities and Investments Commission (ASIC) ya Commodity Futures Trading Commission (CFTC) US mein, brokers ko mazboot standards ka paalan karne ke liye dekhti hain, clients ke funds ki hifazat karti hain aur market integrity ko barqarar rakhti hain.

Trading Platform

Trading platform aapka pehla tool hota hai forex market tak pohnchne ka. Yeh samajhne wala, mustaqil aur advanced features faraham karne wala hona chahiye taa ke analysis aur execution ki suvidha ho. MetaTrader 4 (MT4) aur MetaTrader 5 (MT5) mashhoor platforms hain jo ke apni user-friendly interfaces, customizeable charts aur technical indicators aur expert advisors (EAs) ke wasee range ke liye jaane jaate hain.

Spreads aur Commissions

Spreads currencies pair ki bid aur ask price ke darmiyan farq ko represent karte hain aur brokers ke liye mukhya aamdani ka zariya hote hain. Jab ke kuch brokers fixed spreads faraham karte hain, doosre variable spreads faraham karte hain jo ke high market volatility ke doran wide ho sakte hain. Iske ilawa, broker dawara charge kiye jane wale commission fees ko bhi ghor karein, jo ke account type aur trading volume par mukhtalif ho sakti hain.

Leverage

Leverage traders ko chhoti raqam ke saath bade positions ko control karne ki ijaazat deta hai. Jab ke leverage munafa ko barhata hai, lekin nuqsanat ko bhi barhata hai, is liye risk management ahem hai. Mukhtalif brokers mukhtalif leverage levels faraham karte hain, jahan kuch leverage ko 500:1 tak bhi pohanchate hain. Shuruaati log leverage ka istemal karne se pehle ihtiyaat bartain aur poori tarah samajh lain.

Customer Service

Achi customer service masbat jawab dahi karne aur sawalon ka hal jaldi dene ke liye bohot zaroori hai. Broker ki customer support ko mukhtalif channels jaise ke live chat, email ya phone ke zariye sampark karke dekhein aur unki responsiveness aur madadgarana ko ghor karein. Un brokers ko talaash karein jo 24/7 customer support faraham karte hain, khaaskar agar aap ghair standard ghanto mein trading karte hain wajah time zone ke farq ke wajah se.

Trading Account Kholna

Account Types

Brokers aam tor par mukhtalif account types faraham karte hain taake mukhtalif trading needs aur preferences ko pura kiya ja sake. Aam account types mein standard accounts, micro accounts, Islamic accounts aur demo accounts shamil hain.

Account Funding

Jab aap ek broker chun lete hain aur account type select karte hain, to agla kadam aapke trading account ko fund karna hota hai. Brokers mukhtalif deposit methods faraham karte hain, jinmein bank transfers, credit/debit cards aur electronic payment processors jaise PayPal aur Skrill shamil hain.

Account Verification

Zyadatar brokers account verification ki zaroorat anti-money laundering (AML) aur know your customer (KYC) regulations ko pura karne ke liye zaroori hai. Verification aam tor par identification documents jaise passport ya driver's license aur address proof jaise utility bill ya bank statement submit karne ke zariye hoti hai.

Chapter 4: Bunyadi Tijarat

Economic Indicators

Bunyadi tijarat economic indicators ka jaeza lena shamil hai taake currency movements ke future ke liye peshgoi kia ja sake. Ahem indicators mein GDP growth, inflation, interest rates, employment data aur trade balances shamil hain.

Central Bank Policies

Central banks forex markets mein apni monetary policy decisions ke zariye bohot ahem role ada karte hain. Interest rate announcements aur central bank officials ke statements par tawajjo den.

Chapter 5: Technical Analysis

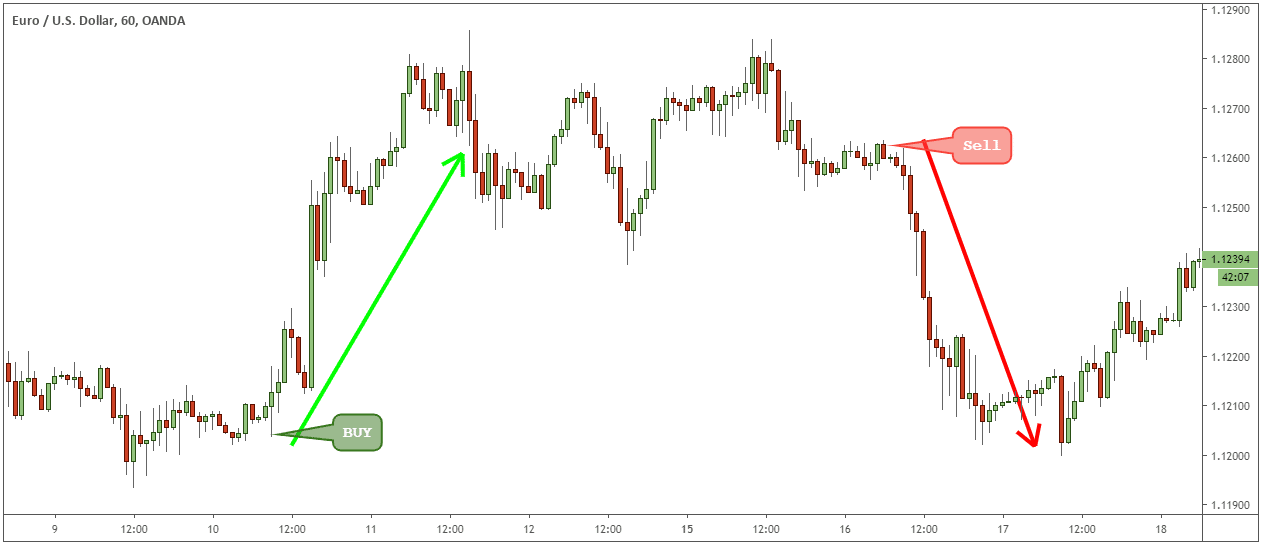

Candlestick Patterns

Candlestick patterns traders ko price trends mein potential reversals ya continuations ka pehchanne mein madad karte hain. Aam patterns mein doji, hammer, engulfing aur spinning top shamil hain.

Support aur Resistance

Support aur resistance levels price chart par wo jagah hain jahan price ko kisi khaas direction mein chalne mein rukawat hoti hai. In levels ko trades ke potential entry aur exit points ka pehchanne ke liye istemal karein.

Chapter 6: Risk Management

Position Sizing

Fixed Lot Size

Fixed lot size mein har trade ke liye pehle se mutayyin kardah number of lots ya units ka trade karna hota hai, bina account size ya risk ke dar ko dekhe.

Percentage-Based Position Sizing

Percentage-based position sizing har trade ke liye trading capital ka fix percentage allocate karta hai. Aam risk levels 1% se lekar 3% tak hote hain, trader ke risk appetite aur account size par munhasir.

Volatility-Based Position Sizing

Volatility-based position sizing currency pair ki volatility ke base par position size ko adjust karta hai. Zyada volatility wale pairs bade price fluctuations ko accommodate karne ke liye chhote position sizes ki zaroorat ho sakti hai aur ulta.

Stop-Loss Orders

Stop-Loss Orders Ke Types

Stop-loss levels ko technical analysis, support aur resistance levels aur volatility considerations ke base par set karna chahiye.

Trailing Stop-Loss Strategies

Trailing stop-loss orders trades ko trader ki marzi ke mutabiq run karne mein madadgar hote hain.

Risk-Reward Ratio

Risk-Reward Ratio Ki Ahmiyat

Risk-reward ratio ek trade ki potential reward ko liye gaye risk ke mukable mein tay karta hai, aam tor par ratio ke zariye (masalan, 1:2).

Risk-Reward Ratio Ko Calculate Karna

Risk-reward ratio ko calculate karne ke liye, potential reward (target profit) ko risk ke amount (entry se stop-loss level tak ki distance) se divide karein.

Monte Carlo Simulation

Monte Carlo Simulation Ki Maqsad

Monte Carlo simulation ek statistical technique hai jo trading strategy ke mukhtalif nateejay ko random sampling ke base par model banane ke liye istemal hoti hai.

Chapter 7: Trading Plan Tayyar Karna

Maqasid Tay Karna

Apni trading decisions ko guide karne ke liye clear aur realistic maqasid tay karein aur forex market mein apne maqasid ko define karein.

Trading Strategy Banane

Aisi trading strategy banayein jo aapke maqasid, risk tolerance aur trading style ke saath milti ho, including entry aur exit criteria, risk management rules aur trade management techniques.

Chapter 8: Trading Ki Psychology

Emotion Management

Apni trading plan ki har halat mein emotional discipline banaye rakhein.

Sabr aur Discipline

Apne trading approach mein sabr aur discipline banaye rakhein, high-probability trading setups ke liye intezaar karte hue aur apne trading plan ko behtareen discipline ke saath follow karte hue.

Chapter 9: Demo Trading

Demo Account Ke Saath Practice Trading

Demo Trading Ke Fawaid

Demo trading shuruaati logon ko trading strategies ko practice karne, trading platform ko samajhne aur asal paisa risk kiye baghair confidence hasil karne ka behtareen mauqa deta hai.

Demo Trading Ke Nuksaan

Jab ke demo trading valuable practice aur learning opportunities faraham karta hai, lekin live trading ke mukable mein kuch limitations bhi hoti hain.

Demo Trading Ki Ahmiyat

Hunar Taraqqi

Demo trading shuruaati traders ko asal paisa trading ke bina essential trading skills, jaise ke technical analysis, risk management, aur emotional discipline, develop karne mein madad karta hai.

Strategy Ko Taraf Pohanchana

Demo trading traders ko real-time market conditions mein different trading strategies, indicators, aur timeframes test karne ki ijaazat deta hai bina capital ko risk kiye.

Platform Ko Samajhna

Trading platform ke sath wakif hona successful trading ke liye ahem hai. Demo trading shuruaati traders ko apne broker dawara faraham kiye gaye trading platform ke features aur functionality ko explore karne ki ijaazat deta hai.

Confidence Banaana

Demo trading ka ek bada fayda trading abilities mein confidence banane mein madad karta hai.

Chapter 10: Live Trading

Live Trading Ki Taraf Pohanchna

Jab aap demo trading mein confidence hasil kar lete hain, to ek chhote trading account ke saath live trading mein transition ka taake banayein aur asal market conditions mein apni trading strategy ko implement karein.

Continuous Learning aur Improvement

Mustaqil Taur Par Seekhne Ki Ahmiyat

Forex trading ek dynamic aur hamesha tabdeel hoti hui field hai, aur mustaqil taur par seekhna kamiyabi ke liye ahem hai.

Market Developments Par Ma'amlaat

Economic events, geopolitical developments, aur central bank announcements ke bare mein waqayat se mutalliq maloomat hasil karna zaroori hai.

Trading Experiences Se Seekhna

Apne trading experiences ka tajziya karna aur guzishta trades ko analyze karna apne strengths, weaknesses aur areas for improvement ko pehchanne ke liye zaroori hai.

Mustaqil Strategy Taraf Pohanchana

Forex trading strategies waqt ke sath tabdeel hote rehte hain taake changing market conditions aur naye insights aur observations ko shamil karein.

Taleem Aur Mentorship Talash Karna

Forex trading mein kamiyabi ke liye taleem ahem hai. Apne trading education par invest karein kitabein padhkar, webinars attend karke, aur experienced traders dawara sikhaye gaye online courses mein enroll karke.

Conclusion

Forex trading shuruaati logon ke liye munafa bakhsh moqaat faraham karta hai, lekin yeh dedication, education, aur discipline ki zaroorat hoti hai. Forex trading ke bunyadi tajurbe ko samajhne, ek mazboot trading plan tayar karna, aur risk management ko practice karne se kamyabi milti hai.

Forex Trading Kya Hai?

Forex trading currencies ki khareed o farokht ke amal ko kehta hai jahan exchange rates ke tagayur se munafa hasil karna hota hai. Stock market ke mukhable mein, jahan investors companies ke shares khareedte hain aur farokht karte hain, forex trading currencies ke pairs ke ird gird ghoomti hai.

Forex Trading Kaise Kaam Karti Hai?

Forex trading over the counter (OTC) hoti hai, yani ke yeh seedha parties ke darmiyan hoti hai, aam tor par electronic trading platforms ke zariye. Traders currency pairs ke mustaqbil ke harkat par tawaqo rakhte hain, umeed hai ke exchange rates ke tabadlay se munafa hasil karenge.

Chapter 2: Forex Trading Ke Bunyadi Usool

Currency Pairs

Forex trading mein hamesha currencies pairs mein ki jati hai. Pair ka pehla currency base currency kehlata hai, jab ke doosra currency quote currency hota hai. For example, pair EUR/USD mein, euro base currency hota hai aur US dollar quote currency hota hai.

Bid aur Ask Price

Bid price woh price hai jis par market currency pair khareedne ko taiyar hoti hai, jab ke ask price woh price hai jis par market currency pair farokht karne ko taiyar hoti hai. Bid aur ask price ke darmiyan ka farq spread kehlaya jata hai.

Chapter 3: Forex Trading Mein Shuruaat Karna

Broker Chunaav

Regulashan

Regulation bohot ahem hai jab aap ek forex broker ko chunte hain. Regulatory bodies jaise ke Financial Conduct Authority (FCA) UK mein, Australian Securities and Investments Commission (ASIC) ya Commodity Futures Trading Commission (CFTC) US mein, brokers ko mazboot standards ka paalan karne ke liye dekhti hain, clients ke funds ki hifazat karti hain aur market integrity ko barqarar rakhti hain.

Trading Platform

Trading platform aapka pehla tool hota hai forex market tak pohnchne ka. Yeh samajhne wala, mustaqil aur advanced features faraham karne wala hona chahiye taa ke analysis aur execution ki suvidha ho. MetaTrader 4 (MT4) aur MetaTrader 5 (MT5) mashhoor platforms hain jo ke apni user-friendly interfaces, customizeable charts aur technical indicators aur expert advisors (EAs) ke wasee range ke liye jaane jaate hain.

Spreads aur Commissions

Spreads currencies pair ki bid aur ask price ke darmiyan farq ko represent karte hain aur brokers ke liye mukhya aamdani ka zariya hote hain. Jab ke kuch brokers fixed spreads faraham karte hain, doosre variable spreads faraham karte hain jo ke high market volatility ke doran wide ho sakte hain. Iske ilawa, broker dawara charge kiye jane wale commission fees ko bhi ghor karein, jo ke account type aur trading volume par mukhtalif ho sakti hain.

Leverage

Leverage traders ko chhoti raqam ke saath bade positions ko control karne ki ijaazat deta hai. Jab ke leverage munafa ko barhata hai, lekin nuqsanat ko bhi barhata hai, is liye risk management ahem hai. Mukhtalif brokers mukhtalif leverage levels faraham karte hain, jahan kuch leverage ko 500:1 tak bhi pohanchate hain. Shuruaati log leverage ka istemal karne se pehle ihtiyaat bartain aur poori tarah samajh lain.

Customer Service

Achi customer service masbat jawab dahi karne aur sawalon ka hal jaldi dene ke liye bohot zaroori hai. Broker ki customer support ko mukhtalif channels jaise ke live chat, email ya phone ke zariye sampark karke dekhein aur unki responsiveness aur madadgarana ko ghor karein. Un brokers ko talaash karein jo 24/7 customer support faraham karte hain, khaaskar agar aap ghair standard ghanto mein trading karte hain wajah time zone ke farq ke wajah se.

Trading Account Kholna

Account Types

Brokers aam tor par mukhtalif account types faraham karte hain taake mukhtalif trading needs aur preferences ko pura kiya ja sake. Aam account types mein standard accounts, micro accounts, Islamic accounts aur demo accounts shamil hain.

Account Funding

Jab aap ek broker chun lete hain aur account type select karte hain, to agla kadam aapke trading account ko fund karna hota hai. Brokers mukhtalif deposit methods faraham karte hain, jinmein bank transfers, credit/debit cards aur electronic payment processors jaise PayPal aur Skrill shamil hain.

Account Verification

Zyadatar brokers account verification ki zaroorat anti-money laundering (AML) aur know your customer (KYC) regulations ko pura karne ke liye zaroori hai. Verification aam tor par identification documents jaise passport ya driver's license aur address proof jaise utility bill ya bank statement submit karne ke zariye hoti hai.

Chapter 4: Bunyadi Tijarat

Economic Indicators

Bunyadi tijarat economic indicators ka jaeza lena shamil hai taake currency movements ke future ke liye peshgoi kia ja sake. Ahem indicators mein GDP growth, inflation, interest rates, employment data aur trade balances shamil hain.

Central Bank Policies

Central banks forex markets mein apni monetary policy decisions ke zariye bohot ahem role ada karte hain. Interest rate announcements aur central bank officials ke statements par tawajjo den.

Chapter 5: Technical Analysis

Candlestick Patterns

Candlestick patterns traders ko price trends mein potential reversals ya continuations ka pehchanne mein madad karte hain. Aam patterns mein doji, hammer, engulfing aur spinning top shamil hain.

Support aur Resistance

Support aur resistance levels price chart par wo jagah hain jahan price ko kisi khaas direction mein chalne mein rukawat hoti hai. In levels ko trades ke potential entry aur exit points ka pehchanne ke liye istemal karein.

Chapter 6: Risk Management

Position Sizing

Fixed Lot Size

Fixed lot size mein har trade ke liye pehle se mutayyin kardah number of lots ya units ka trade karna hota hai, bina account size ya risk ke dar ko dekhe.

Percentage-Based Position Sizing

Percentage-based position sizing har trade ke liye trading capital ka fix percentage allocate karta hai. Aam risk levels 1% se lekar 3% tak hote hain, trader ke risk appetite aur account size par munhasir.

Volatility-Based Position Sizing

Volatility-based position sizing currency pair ki volatility ke base par position size ko adjust karta hai. Zyada volatility wale pairs bade price fluctuations ko accommodate karne ke liye chhote position sizes ki zaroorat ho sakti hai aur ulta.

Stop-Loss Orders

Stop-Loss Orders Ke Types

- Fixed Stop-Loss

- Trailing Stop-Loss

- Time-Based Stop-Loss

Stop-loss levels ko technical analysis, support aur resistance levels aur volatility considerations ke base par set karna chahiye.

Trailing Stop-Loss Strategies

Trailing stop-loss orders trades ko trader ki marzi ke mutabiq run karne mein madadgar hote hain.

Risk-Reward Ratio

Risk-Reward Ratio Ki Ahmiyat

Risk-reward ratio ek trade ki potential reward ko liye gaye risk ke mukable mein tay karta hai, aam tor par ratio ke zariye (masalan, 1:2).

Risk-Reward Ratio Ko Calculate Karna

Risk-reward ratio ko calculate karne ke liye, potential reward (target profit) ko risk ke amount (entry se stop-loss level tak ki distance) se divide karein.

Monte Carlo Simulation

Monte Carlo Simulation Ki Maqsad

Monte Carlo simulation ek statistical technique hai jo trading strategy ke mukhtalif nateejay ko random sampling ke base par model banane ke liye istemal hoti hai.

Chapter 7: Trading Plan Tayyar Karna

Maqasid Tay Karna

Apni trading decisions ko guide karne ke liye clear aur realistic maqasid tay karein aur forex market mein apne maqasid ko define karein.

Trading Strategy Banane

Aisi trading strategy banayein jo aapke maqasid, risk tolerance aur trading style ke saath milti ho, including entry aur exit criteria, risk management rules aur trade management techniques.

Chapter 8: Trading Ki Psychology

Emotion Management

Apni trading plan ki har halat mein emotional discipline banaye rakhein.

Sabr aur Discipline

Apne trading approach mein sabr aur discipline banaye rakhein, high-probability trading setups ke liye intezaar karte hue aur apne trading plan ko behtareen discipline ke saath follow karte hue.

Chapter 9: Demo Trading

Demo Account Ke Saath Practice Trading

Demo Trading Ke Fawaid

Demo trading shuruaati logon ko trading strategies ko practice karne, trading platform ko samajhne aur asal paisa risk kiye baghair confidence hasil karne ka behtareen mauqa deta hai.

Demo Trading Ke Nuksaan

Jab ke demo trading valuable practice aur learning opportunities faraham karta hai, lekin live trading ke mukable mein kuch limitations bhi hoti hain.

Demo Trading Ki Ahmiyat

Hunar Taraqqi

Demo trading shuruaati traders ko asal paisa trading ke bina essential trading skills, jaise ke technical analysis, risk management, aur emotional discipline, develop karne mein madad karta hai.

Strategy Ko Taraf Pohanchana

Demo trading traders ko real-time market conditions mein different trading strategies, indicators, aur timeframes test karne ki ijaazat deta hai bina capital ko risk kiye.

Platform Ko Samajhna

Trading platform ke sath wakif hona successful trading ke liye ahem hai. Demo trading shuruaati traders ko apne broker dawara faraham kiye gaye trading platform ke features aur functionality ko explore karne ki ijaazat deta hai.

Confidence Banaana

Demo trading ka ek bada fayda trading abilities mein confidence banane mein madad karta hai.

Chapter 10: Live Trading

Live Trading Ki Taraf Pohanchna

Jab aap demo trading mein confidence hasil kar lete hain, to ek chhote trading account ke saath live trading mein transition ka taake banayein aur asal market conditions mein apni trading strategy ko implement karein.

Continuous Learning aur Improvement

Mustaqil Taur Par Seekhne Ki Ahmiyat

Forex trading ek dynamic aur hamesha tabdeel hoti hui field hai, aur mustaqil taur par seekhna kamiyabi ke liye ahem hai.

Market Developments Par Ma'amlaat

Economic events, geopolitical developments, aur central bank announcements ke bare mein waqayat se mutalliq maloomat hasil karna zaroori hai.

Trading Experiences Se Seekhna

Apne trading experiences ka tajziya karna aur guzishta trades ko analyze karna apne strengths, weaknesses aur areas for improvement ko pehchanne ke liye zaroori hai.

Mustaqil Strategy Taraf Pohanchana

Forex trading strategies waqt ke sath tabdeel hote rehte hain taake changing market conditions aur naye insights aur observations ko shamil karein.

Taleem Aur Mentorship Talash Karna

Forex trading mein kamiyabi ke liye taleem ahem hai. Apne trading education par invest karein kitabein padhkar, webinars attend karke, aur experienced traders dawara sikhaye gaye online courses mein enroll karke.

Conclusion

Forex trading shuruaati logon ke liye munafa bakhsh moqaat faraham karta hai, lekin yeh dedication, education, aur discipline ki zaroorat hoti hai. Forex trading ke bunyadi tajurbe ko samajhne, ek mazboot trading plan tayar karna, aur risk management ko practice karne se kamyabi milti hai.

تبصرہ

Расширенный режим Обычный режим