WHAT IS SWING TRADING

Friends market mein trading strategies use ki jati hein jo traders ko trading mein help kerti hein. Swing trading aik bahut hi best trading strategy hai yah trading strategiesshort term trading ke liye use ki jaati hay. Market mein short-term trader ess group ko new trade place kerny ke liye select karte hayn. Jis sey unn ko bhout positive results milty hein. Market mein traders swing trading ke sath price chart or technical indicator ka istemal karke apni trading ko successful trading banaa sakte hain, aur market mein acha profit bi earn ker sakty hein.

QUALITIES OF SWING TRADING

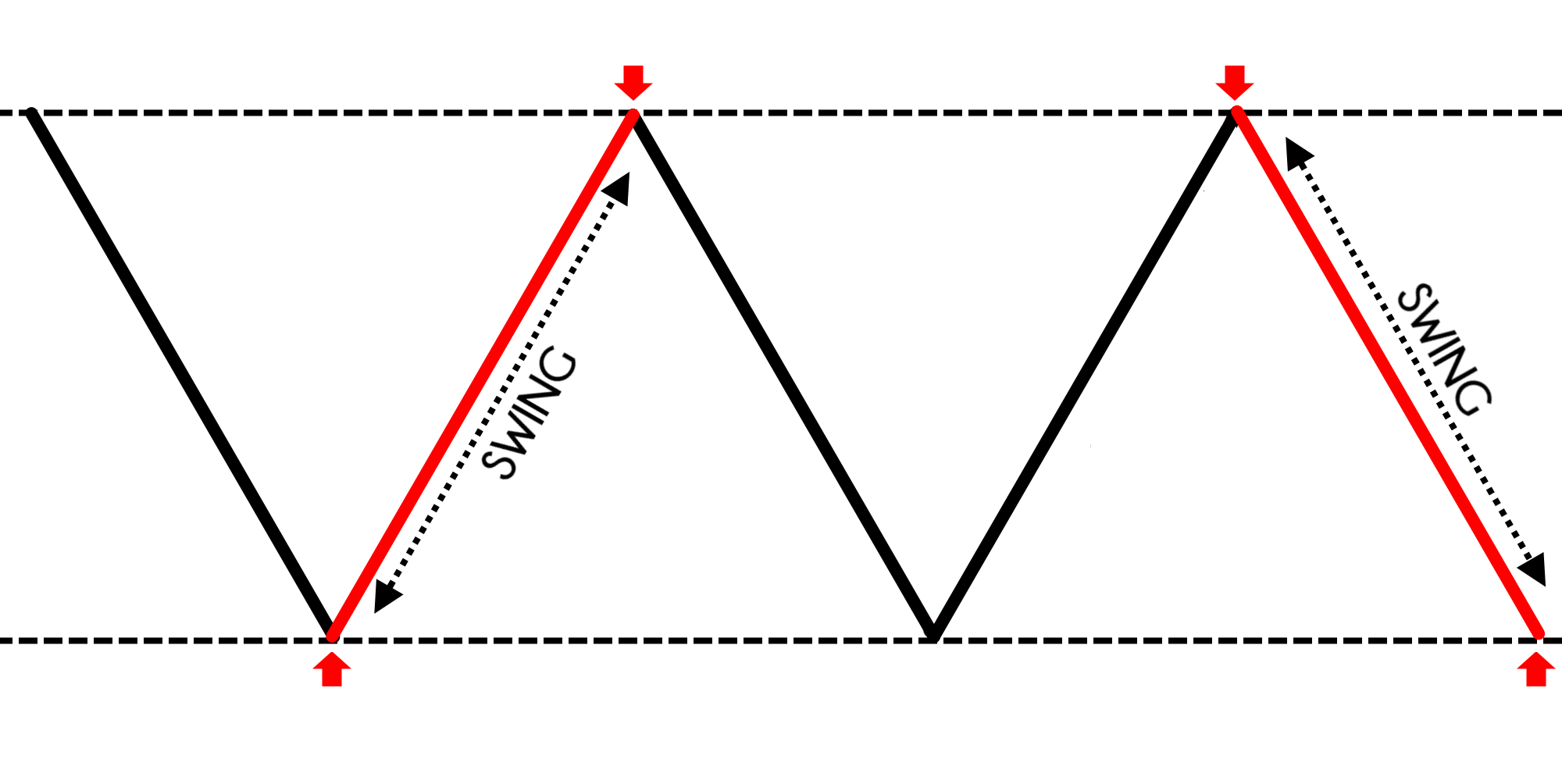

Dear fellows market mein swing traders stock ki price mein increase aur decrease dono sey faida uthany ki koshish karty hein. Positions ko aam tor par aik se six days ke darmiyan rakha jata hay. Market jab bhi kisi supply ya demand ki pressure ki waja se bohut hi ziada top ya down position per move ker jati hay tou zarori nahi hota hay kay market uosss same position pe continue hi chalti hay, bulke maximum market wahan se wapis reverse ho jati hay aur kuch reverse trend pe chalne k bad wapis wo apni position pe chal parti hay. Swing trading strategy me market me hum day trading aur scalping se mukhtalif kaam karte hen is me short term ki trading bhi ho sakti hay aur long term ki trading bhi ho sakti hay.lekin agar market mein suddenly demand ya supply ziada ho jaye tu ess sey market aksar breakout karke aik long candle stick create kerti hy, jo kay aik particular time kay leye bohut high position pe chali jati hay, aur oss kay baad market ki price wapis down ward start hoti hay. Aesy mein market mein swing trading formation form hoti hay,jo traders ko market mein entry ky leye kafi help deti hy.

TRADING PARAMETERS

Dear traders jab bhi market ki hum highest ya lowest position pe trade open karte hein tou ess sey benefits melte hein, aur market ki aksar highest point se reversal hi hoti hay. Ess waja sey jab hum short term trading karne ka irada rakhte hein tou oss kay leye zarori hay kay hum trading market mein price ki highest aur lowest points ko lazmi observe kerein. Market ki swing high aur swing low position ke method sy acche advantage hasil kar sakte hain. Breakout trading strategy open karne ke liye traders ko market ky momentum trend ko confirm karna hota hay aur market ki breakout range ko study kar lena chahie aur inke sath traders ko support aur resistence level ka istemal karte hue market mein price action strategy ke related complete study karna chehye.jb market lowest point par ponch jae to trader ko buy ko trade ko open karna chahe or jb market highest point par ponch jae to trader ko sell ki trade ko open karna chahe. Jo trader low point par mazeed sell ki trade ko open karty hay aor market kay high point reach kerny par mazeed buy ki trade ko open kat letyn hain to unko profit hasil karny mein bhout problem ho jati hay, aor aesy mein trader ka account wash bi ho sakta hy. Ess leye trend complete hony ky baad available information ko mind mein rakh ker aur pattern ki knowledge ky according hi trade place kerni chehye.ta kay trading ki basic achievement ho saky.

Friends market mein trading strategies use ki jati hein jo traders ko trading mein help kerti hein. Swing trading aik bahut hi best trading strategy hai yah trading strategiesshort term trading ke liye use ki jaati hay. Market mein short-term trader ess group ko new trade place kerny ke liye select karte hayn. Jis sey unn ko bhout positive results milty hein. Market mein traders swing trading ke sath price chart or technical indicator ka istemal karke apni trading ko successful trading banaa sakte hain, aur market mein acha profit bi earn ker sakty hein.

QUALITIES OF SWING TRADING

Dear fellows market mein swing traders stock ki price mein increase aur decrease dono sey faida uthany ki koshish karty hein. Positions ko aam tor par aik se six days ke darmiyan rakha jata hay. Market jab bhi kisi supply ya demand ki pressure ki waja se bohut hi ziada top ya down position per move ker jati hay tou zarori nahi hota hay kay market uosss same position pe continue hi chalti hay, bulke maximum market wahan se wapis reverse ho jati hay aur kuch reverse trend pe chalne k bad wapis wo apni position pe chal parti hay. Swing trading strategy me market me hum day trading aur scalping se mukhtalif kaam karte hen is me short term ki trading bhi ho sakti hay aur long term ki trading bhi ho sakti hay.lekin agar market mein suddenly demand ya supply ziada ho jaye tu ess sey market aksar breakout karke aik long candle stick create kerti hy, jo kay aik particular time kay leye bohut high position pe chali jati hay, aur oss kay baad market ki price wapis down ward start hoti hay. Aesy mein market mein swing trading formation form hoti hay,jo traders ko market mein entry ky leye kafi help deti hy.

TRADING PARAMETERS

Dear traders jab bhi market ki hum highest ya lowest position pe trade open karte hein tou ess sey benefits melte hein, aur market ki aksar highest point se reversal hi hoti hay. Ess waja sey jab hum short term trading karne ka irada rakhte hein tou oss kay leye zarori hay kay hum trading market mein price ki highest aur lowest points ko lazmi observe kerein. Market ki swing high aur swing low position ke method sy acche advantage hasil kar sakte hain. Breakout trading strategy open karne ke liye traders ko market ky momentum trend ko confirm karna hota hay aur market ki breakout range ko study kar lena chahie aur inke sath traders ko support aur resistence level ka istemal karte hue market mein price action strategy ke related complete study karna chehye.jb market lowest point par ponch jae to trader ko buy ko trade ko open karna chahe or jb market highest point par ponch jae to trader ko sell ki trade ko open karna chahe. Jo trader low point par mazeed sell ki trade ko open karty hay aor market kay high point reach kerny par mazeed buy ki trade ko open kat letyn hain to unko profit hasil karny mein bhout problem ho jati hay, aor aesy mein trader ka account wash bi ho sakta hy. Ess leye trend complete hony ky baad available information ko mind mein rakh ker aur pattern ki knowledge ky according hi trade place kerni chehye.ta kay trading ki basic achievement ho saky.

تبصرہ

Расширенный режим Обычный режим