Introduction

Dosto aaj hum aik forex main use hone wale pattern jis ko tweezer top aur tweezer bottom pattern kaha jata hay jo forex main aik strong pattern mana jata hay jis ke banne ke bad akasar trend change hota hay magar aik bat ka dhayan rakhna lazmi hay ke forex main trend ke hawale se kuch bhe hatmi nahe hay forex main risk hamasha rahta hay

Tweezer Top Pattern and

Tweezer Bottom Pattern

Forex mein Tweezer Top Aur Tweezer Bottom candlesticks pattern do reversal patterns hain jo ek trend ke khatm hone aur dusre trend ke shuruaat hone ka ishara dete hain.

Tweezer Top Pattern

Tweezer Top pattern do candlesticks se milkar banta hai jo ek uptrend ke khatm hone per dikhai deta hai. Is pattern mein:

Tweezer Top pattern yah ishara deta hai ki uptrend khatm hone wala hai aur bearish trend shuru hone wala hai.

Tweezer Bottom Pattern

Tweezer Bottom pattern do candlesticks se milkar banta hai jo ek downtrend ke khatm hone per dikhai deta hai. Is pattern mein:

Tweezer Bottom pattern yah ishara deta hai ki downtrend khatm hone wala hai aur bullish trend shuru hone wala hai.

Tweezer Top Aur Tweezer Bottom

Pattern ka Istemal Kaise Karen

Tweezer Top Aur Tweezer Bottom pattern ka istemal forex mein trading ke liye kiya ja sakta hai. In pattern ka istemal karne ke kuchh tarike hain:

Dosto aaj hum aik forex main use hone wale pattern jis ko tweezer top aur tweezer bottom pattern kaha jata hay jo forex main aik strong pattern mana jata hay jis ke banne ke bad akasar trend change hota hay magar aik bat ka dhayan rakhna lazmi hay ke forex main trend ke hawale se kuch bhe hatmi nahe hay forex main risk hamasha rahta hay

Tweezer Top Pattern and

Tweezer Bottom Pattern

Forex mein Tweezer Top Aur Tweezer Bottom candlesticks pattern do reversal patterns hain jo ek trend ke khatm hone aur dusre trend ke shuruaat hone ka ishara dete hain.

Tweezer Top Pattern

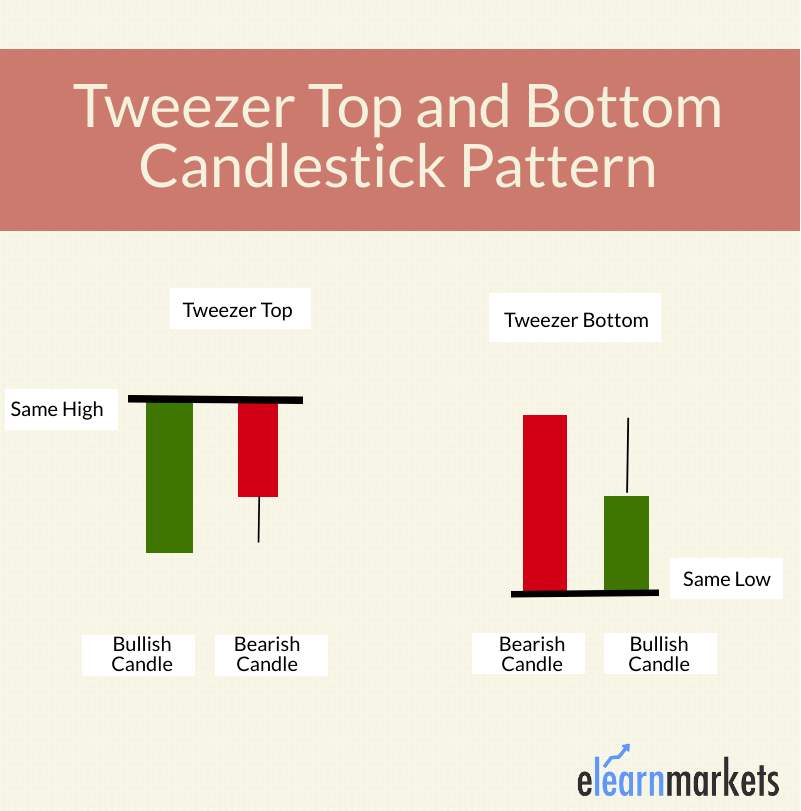

Tweezer Top pattern do candlesticks se milkar banta hai jo ek uptrend ke khatm hone per dikhai deta hai. Is pattern mein:

- Pehli candlestick ek bullish candlestick hoti hai, jiska matlab hai ki iska closing price iske opening price se zyada hota hai.

- Dusri candlestick ek bearish candlestick hoti hai, jiska matlab hai ki iska closing price iske opening price se kam hota hai.

- Donon candlesticks ki high price ek hi tarah ki hoti hai.

Tweezer Top pattern yah ishara deta hai ki uptrend khatm hone wala hai aur bearish trend shuru hone wala hai.

Tweezer Bottom Pattern

Tweezer Bottom pattern do candlesticks se milkar banta hai jo ek downtrend ke khatm hone per dikhai deta hai. Is pattern mein:

- Pehli candlestick ek bearish candlestick hoti hai, jiska matlab hai ki iska closing price iske opening price se kam hota hai.

- Dusri candlestick ek bullish candlestick hoti hai, jiska matlab hai ki iska closing price iske opening price se zyada hota hai.

- Donon candlesticks ki low price ek hi tarah ki hoti hai.

Tweezer Bottom pattern yah ishara deta hai ki downtrend khatm hone wala hai aur bullish trend shuru hone wala hai.

Tweezer Top Aur Tweezer Bottom

Pattern ka Istemal Kaise Karen

Tweezer Top Aur Tweezer Bottom pattern ka istemal forex mein trading ke liye kiya ja sakta hai. In pattern ka istemal karne ke kuchh tarike hain:

- Trend Reversal Ki Pahchan Karne Ke Liye: Tweezer Top Aur Tweezer Bottom pattern ek trend ke reversal ki pahchan karne ke liye istemal kiye ja sakte hain. Jab aap kisi uptrend ya downtrend mein ek Tweezer Top ya Tweezer Bottom pattern dekhte hain, to yah is baat ka ishara ho sakta hai ki trend khatm hone wala hai aur dusra trend shuru hone wala hai.

- Entry Point Ki Pahchan Karne Ke Liye: Tweezer Top Aur Tweezer Bottom pattern ka istemal ek naye trend mein entry karne ke liye kiya ja sakta hai. Jab aap kisi trend reversal ke baad ek Tweezer Top ya Tweezer Bottom pattern dekhte hain, to yah is baat ka ishara ho sakta hai ki aap naye trend mein entry kar sakte hain.

- Stop Loss Order Lagane Ke Liye: Tweezer Top Aur Tweezer Bottom pattern ka istemal stop loss order lagane ke liye kiya ja sakta hai. Jab aap kisi trade mein entry karte hain, to aap apne stop loss order ko ek Tweezer Top ya Tweezer Bottom pattern ke niche laga sakte hain. Agar trend aapke against mein jata hai, to aapka stop loss order aapko loss se bachane mein madad karega.

تبصرہ

Расширенный режим Обычный режим