What is Cypher Harmonic Pattern:

Cypher Harmonic patteren aik mashhoor aur qabil aetmaad chart ka namona hai jo ghair mulki zar e mubadla market mein kharidaron ke zareya salahiyat ki qeemat ke ulat palat ki paish goi ke liye istemaal hota hai. yeh namona tijarti sequence ke liye mumkina dakhli maqamat ka pata laganay mein apni durustagi ke liye jana jata hai. Cypher patteren ko Fibonacci patteren ki aik qisam samjha jata hai, jis mein munfarid Fibonacci tanasub ko market mein salahiyat ko tabdeel karne walay awamil ko samajhney ke liye istemaal kya jata hai. jab muaser tareeqay se tashkhees aur tijarat ki jati hai, to cypher namona kharidaron ko kharidari aur farokht ke ziyada imkanaat ke mawaqay faraham kar sakta hai.

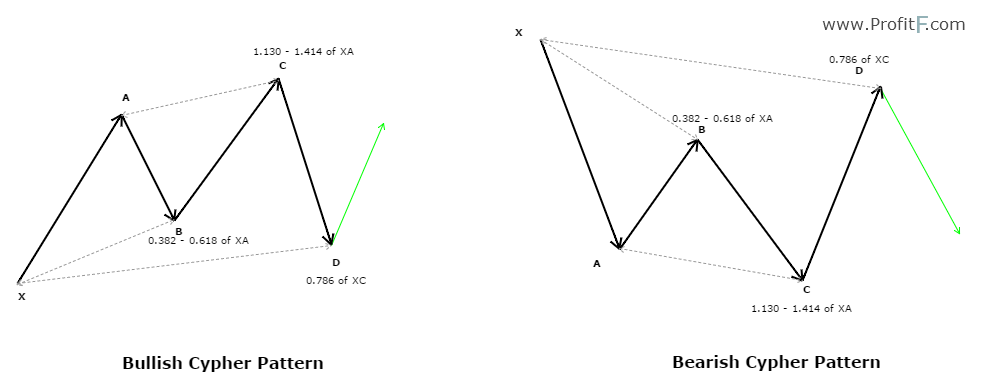

Structure of Cypher Harmonic Pattern:

Cypher Harmonic patteren ki shakal mein chaar tangen ya jhulay shaamil hotay hain. namona aik ibtidayi impulse taang ( x se a ) ke sath shuru hota hai jis ke sath aik islahi taang ka istemaal hota hai. ( a to b ). 0. 33 taang aik aur impulse taang ( c se d ) hai jo aam tor par ibtidayi impulse taang ke barray hissay ko peechay htata hai. aakhri taang fnshng touch taang ( d ) hai jis mein namona mukammal samjha jata hai. Cypher ke namoonay ki toseeq karne ke liye istemaal honay walay kaleedi Fibonacci tanasub mein xa taang ke 0. 382 aur sifar. 786 retracement ki satah, neez ibtidayi impulse taang ke 0. 382 retracement shaamil hain.

Rules for Cypher Harmonic Pattern:

Trading di Cypher Harmonic patteren kamyaab trading ke imkanaat ko badhaane ke liye munfarid usoolon par sakhti se amal karne ka mutalba karti hai. aik ahem usool yeh hai ke nuqta d ko xa taang ke 0. 786 Fibonacci Retracement ki satah ke andar aana chahiye. mazeed bar-aan, kharidaron ko kamyabi ki tabdeeli ke mauqa ko badhaane ke liye deegar takneeki isharay, Bashmole imdaad aur muzahmat ki satah, trained lines, aur candle stick style ke sath hum ahangi talaash karne ki zaroorat hai. khatray par qaboo panay ki munasib tknikin, Bashmole nuqsaan se bachney ke order dena aur account ke size aur mauqa ki rawadari ki bunyaad par position ke size ka hisaab lagana, cypher patteren ki tijarat karte waqt ahem hain.

Entry and exit strategies for Cypher Harmonic Pattern:

Cypher Harmonic patteren ki tijarat karte waqt, tajir aam tor par Ansar d par mutabadil darj karne ki koshish karte hain, jis mein patteren mukammal hota hai. dakhla bunyadi tor par mukhtalif awamil par mabni ho sakta hai, Bashmole taizi ya mandi ke ulat mom batii ke patteren, Fibonacci ke kaleedi marhalay se chhalang, ya mumkina ulat palat ka ishara karne walay takneeki isharay ka sangam. taajiron ko Fibonacci tosiay sthon ya Sabiqa support aur muzahmat ki sthon ki bunyaad par aamdani ke ahdaaf rakhnay par bhi ghhor karna chahiye. ilaqay mein jane ka aik wazeh tareeqa car hona zaroori hai, jis mein manfi fees chalon ke khilaaf difaa ke liye stop las order dena shaamil hai.

Techniques for Trading Cypher Harmonic Pattern:

Aala darjay ke khredar apni tijarti majmoi karkardagi ko badhaane ke liye Cypher Harmonic patteren kharedtay aur farokht karte waqt izafi techniques par mushtamil ho satke hain. is mein khusoosi time frames mein patteren ki tasdeeq ke liye aik se ziyada time frames ka istemaal, sangam ke liye mukhtalif Harmonic patteren ya takneeki isharay shaamil karna, aur namoonay ki taseer ki toseeq ke liye mukammal back testing karna shaamil hona chahiye. mazeed bar-aan, tajir apni majmoi khareed o farokht ki taknik ko behtar bananay ke liye namona khareed o farokht ko deegar khareed o farokht ki hikmat amlyon ke sath mil kar talaash kar satke hain, jaisay ke rujhan ki pairwi ya momentum khareed o farokht. Cypher Harmonic patteren ka ilm haasil karne aur zar e mubadla bazaar ke andar mustaqil munafe haasil karne ke liye tijarti hikmat amlyon ka musalsal ilm haasil karna aur un mein behtari lana zaroori hai.

Cypher Harmonic patteren aik mashhoor aur qabil aetmaad chart ka namona hai jo ghair mulki zar e mubadla market mein kharidaron ke zareya salahiyat ki qeemat ke ulat palat ki paish goi ke liye istemaal hota hai. yeh namona tijarti sequence ke liye mumkina dakhli maqamat ka pata laganay mein apni durustagi ke liye jana jata hai. Cypher patteren ko Fibonacci patteren ki aik qisam samjha jata hai, jis mein munfarid Fibonacci tanasub ko market mein salahiyat ko tabdeel karne walay awamil ko samajhney ke liye istemaal kya jata hai. jab muaser tareeqay se tashkhees aur tijarat ki jati hai, to cypher namona kharidaron ko kharidari aur farokht ke ziyada imkanaat ke mawaqay faraham kar sakta hai.

Structure of Cypher Harmonic Pattern:

Cypher Harmonic patteren ki shakal mein chaar tangen ya jhulay shaamil hotay hain. namona aik ibtidayi impulse taang ( x se a ) ke sath shuru hota hai jis ke sath aik islahi taang ka istemaal hota hai. ( a to b ). 0. 33 taang aik aur impulse taang ( c se d ) hai jo aam tor par ibtidayi impulse taang ke barray hissay ko peechay htata hai. aakhri taang fnshng touch taang ( d ) hai jis mein namona mukammal samjha jata hai. Cypher ke namoonay ki toseeq karne ke liye istemaal honay walay kaleedi Fibonacci tanasub mein xa taang ke 0. 382 aur sifar. 786 retracement ki satah, neez ibtidayi impulse taang ke 0. 382 retracement shaamil hain.

Rules for Cypher Harmonic Pattern:

Trading di Cypher Harmonic patteren kamyaab trading ke imkanaat ko badhaane ke liye munfarid usoolon par sakhti se amal karne ka mutalba karti hai. aik ahem usool yeh hai ke nuqta d ko xa taang ke 0. 786 Fibonacci Retracement ki satah ke andar aana chahiye. mazeed bar-aan, kharidaron ko kamyabi ki tabdeeli ke mauqa ko badhaane ke liye deegar takneeki isharay, Bashmole imdaad aur muzahmat ki satah, trained lines, aur candle stick style ke sath hum ahangi talaash karne ki zaroorat hai. khatray par qaboo panay ki munasib tknikin, Bashmole nuqsaan se bachney ke order dena aur account ke size aur mauqa ki rawadari ki bunyaad par position ke size ka hisaab lagana, cypher patteren ki tijarat karte waqt ahem hain.

Entry and exit strategies for Cypher Harmonic Pattern:

Cypher Harmonic patteren ki tijarat karte waqt, tajir aam tor par Ansar d par mutabadil darj karne ki koshish karte hain, jis mein patteren mukammal hota hai. dakhla bunyadi tor par mukhtalif awamil par mabni ho sakta hai, Bashmole taizi ya mandi ke ulat mom batii ke patteren, Fibonacci ke kaleedi marhalay se chhalang, ya mumkina ulat palat ka ishara karne walay takneeki isharay ka sangam. taajiron ko Fibonacci tosiay sthon ya Sabiqa support aur muzahmat ki sthon ki bunyaad par aamdani ke ahdaaf rakhnay par bhi ghhor karna chahiye. ilaqay mein jane ka aik wazeh tareeqa car hona zaroori hai, jis mein manfi fees chalon ke khilaaf difaa ke liye stop las order dena shaamil hai.

Techniques for Trading Cypher Harmonic Pattern:

Aala darjay ke khredar apni tijarti majmoi karkardagi ko badhaane ke liye Cypher Harmonic patteren kharedtay aur farokht karte waqt izafi techniques par mushtamil ho satke hain. is mein khusoosi time frames mein patteren ki tasdeeq ke liye aik se ziyada time frames ka istemaal, sangam ke liye mukhtalif Harmonic patteren ya takneeki isharay shaamil karna, aur namoonay ki taseer ki toseeq ke liye mukammal back testing karna shaamil hona chahiye. mazeed bar-aan, tajir apni majmoi khareed o farokht ki taknik ko behtar bananay ke liye namona khareed o farokht ko deegar khareed o farokht ki hikmat amlyon ke sath mil kar talaash kar satke hain, jaisay ke rujhan ki pairwi ya momentum khareed o farokht. Cypher Harmonic patteren ka ilm haasil karne aur zar e mubadla bazaar ke andar mustaqil munafe haasil karne ke liye tijarti hikmat amlyon ka musalsal ilm haasil karna aur un mein behtari lana zaroori hai.

تبصرہ

Расширенный режим Обычный режим