What is Rising and Falling three Methods Pattern:

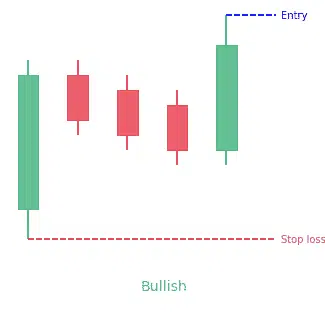

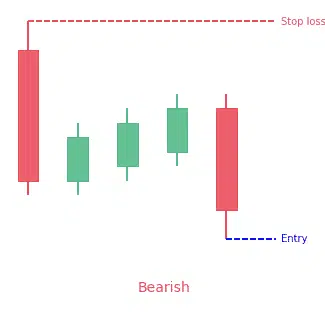

Rising three Methods aik taiz mom batii ka namona hai jis mein teen safaid mom batian shaamil hain. pehli mom batii ki chhari aik lambi safaid mom batii hoti hai, jis ke sath teen choti kaali mom batian hoti hain jo pehli mom batii ki chhari ke andar se guzarti hain. panchawan mom batii ka osciken aik safaid mom batii hai jo bunyadi mom batii ke ounchay hissay ke oopar band hoti hai. yeh namona jadeed up trained ki salahiyat ke tasalsul ki nishandahi karta hai.

Characteristics of Rising Three Methods Pattern:

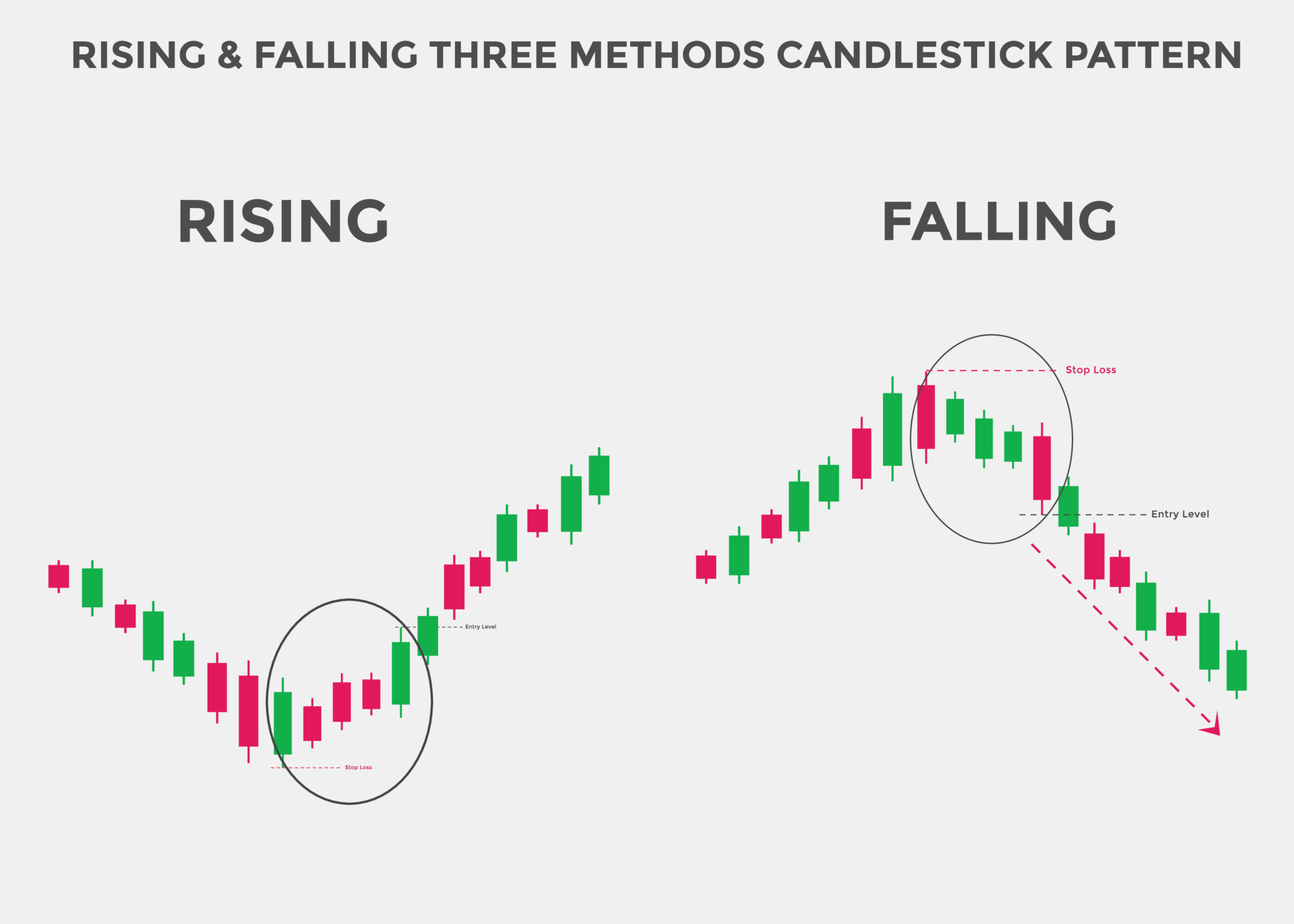

Rising three Methods patteren ko taizi ke tasalsul ka namona samjha jata hai. yeh aam tor par aik up trained ke douran hota hai jab ke mojooda fashion dobarah shuru honay se pehlay aik mukhtasir istehkaam ya pal back hota hai. namoonay mein paanch mom batian shaamil hain : pehli aik lambi taizi wali mom batii hai, jis ka mushahida lagataar teen choti mandi wali mom btyon ke zariye kya jata hai ( jo juzwi tor par pehli mom batii ki tadaad mein beh sakti hai ) aur bil akhir kisi bhi doosri lambi taizi wali mom batii ke sath khatam hoti hai jo pehli mom batii ke oopar band hoti hai. is tashkeel se pata chalta hai ke is ke bawajood bail qaboo mein hain aur oopar ki raftaar barqarar rehne ka imkaan hai.

Characteristic of Falling three Methods Pattern:

Doosri taraf, Falling three Methods patteren aik mandi ka tasalsul namona hai jo aam tor par neechay ke rujhanaat mein dekha jata hai. is mein paanch mom batian shaamil hain : pehli mom batii aik lambi mandi wali mom batii hai, jis ke sath teen choti taizi wali mom batian hoti hain jo juzwi tor par pehli mom batii ki mukhtalif aqsam mein gardish karti hain. namona aik hatmi lambi mandi wali mom batii se mukammal hota hai jo bunyadi mom batii ke nichale hissay ke neechay band ho jata hai. is silsilay se pata chalta hai ke dealers is ke bawajood ghalib hain, aur zawaal ka rujhan barqarar rehne ka imkaan hai.

Trading with Rising and Falling Three Methods Patterns:

Rising aur Falling teen tareeqon ke namonon ko muaser tareeqay se tabdeel karne ke liye, taajiron ko kaleedi hudood se aagah hona chahiye jin mein support aur muzahmat ki hudood shaamil hain, kyunkay woh style ki sadaqat ki tasdeeq mein madad kar satke hain. Rising three Methods patteren mein, tajir aakhri taizi wali mom batii pehli mom batii ke oopri hissay ke oopar band honay ke baad lambi pozishnon mein jane par bhi ghhor kar satke hain, jabkay Falling three Methods patteren mein, aakhri mandi wali mom batii ke neechay band honay ke baad mukhtasir position li ja sakti hai. pehli mom batii. izafi takneeki isharay ya alaat ka istemaal un namonon ki bunyaad par salahiyat ke tabadlay ki andrajaat ki tasdeeq ko mazeed barha sakta hai.

falling-three-methods-candle-structure-1-1701133268374.webp

Considered when Using Falling and Rising Three Methods Pattern:

Agarchay rujhan ke tasalsul ka pata laganay ke liye Rising and Falling three Methods pitrnz qeemti gear ho satke hain, sarmaya karon ko ahthyat baratnay aur tasdeeq ke liye inhen deegar takneeki tshkhisi alaat ke sath marboot karne ki zaroorat hai. bazaar ke utaar charhao, ahem khabron ki release, aur ost market ke jazbaat samait awamil ko mad e nazar rakhna zaroori hai jab ke un taro ko tijarat ke ikhtiyarat mein istemaal kya jaye. mazeed bar-aan, khatray ke intizam ki technical ko aam tor par capital ki hifazat ke liye laago kya jana chahiye agar mutawaqqa rujhan ulat nahi hota hai. un masail ko khareed o farokht ke faislon mein shaamil karkay, sarmaya car ghair mulki zar e mubadla market ke andar Rising and Falling three Methods patteren ka istemaal karte hue kamyabi ke –apne imkanaat ko barha satke hain.

Rising three Methods aik taiz mom batii ka namona hai jis mein teen safaid mom batian shaamil hain. pehli mom batii ki chhari aik lambi safaid mom batii hoti hai, jis ke sath teen choti kaali mom batian hoti hain jo pehli mom batii ki chhari ke andar se guzarti hain. panchawan mom batii ka osciken aik safaid mom batii hai jo bunyadi mom batii ke ounchay hissay ke oopar band hoti hai. yeh namona jadeed up trained ki salahiyat ke tasalsul ki nishandahi karta hai.

Characteristics of Rising Three Methods Pattern:

Rising three Methods patteren ko taizi ke tasalsul ka namona samjha jata hai. yeh aam tor par aik up trained ke douran hota hai jab ke mojooda fashion dobarah shuru honay se pehlay aik mukhtasir istehkaam ya pal back hota hai. namoonay mein paanch mom batian shaamil hain : pehli aik lambi taizi wali mom batii hai, jis ka mushahida lagataar teen choti mandi wali mom btyon ke zariye kya jata hai ( jo juzwi tor par pehli mom batii ki tadaad mein beh sakti hai ) aur bil akhir kisi bhi doosri lambi taizi wali mom batii ke sath khatam hoti hai jo pehli mom batii ke oopar band hoti hai. is tashkeel se pata chalta hai ke is ke bawajood bail qaboo mein hain aur oopar ki raftaar barqarar rehne ka imkaan hai.

Characteristic of Falling three Methods Pattern:

Doosri taraf, Falling three Methods patteren aik mandi ka tasalsul namona hai jo aam tor par neechay ke rujhanaat mein dekha jata hai. is mein paanch mom batian shaamil hain : pehli mom batii aik lambi mandi wali mom batii hai, jis ke sath teen choti taizi wali mom batian hoti hain jo juzwi tor par pehli mom batii ki mukhtalif aqsam mein gardish karti hain. namona aik hatmi lambi mandi wali mom batii se mukammal hota hai jo bunyadi mom batii ke nichale hissay ke neechay band ho jata hai. is silsilay se pata chalta hai ke dealers is ke bawajood ghalib hain, aur zawaal ka rujhan barqarar rehne ka imkaan hai.

Trading with Rising and Falling Three Methods Patterns:

Rising aur Falling teen tareeqon ke namonon ko muaser tareeqay se tabdeel karne ke liye, taajiron ko kaleedi hudood se aagah hona chahiye jin mein support aur muzahmat ki hudood shaamil hain, kyunkay woh style ki sadaqat ki tasdeeq mein madad kar satke hain. Rising three Methods patteren mein, tajir aakhri taizi wali mom batii pehli mom batii ke oopri hissay ke oopar band honay ke baad lambi pozishnon mein jane par bhi ghhor kar satke hain, jabkay Falling three Methods patteren mein, aakhri mandi wali mom batii ke neechay band honay ke baad mukhtasir position li ja sakti hai. pehli mom batii. izafi takneeki isharay ya alaat ka istemaal un namonon ki bunyaad par salahiyat ke tabadlay ki andrajaat ki tasdeeq ko mazeed barha sakta hai.

falling-three-methods-candle-structure-1-1701133268374.webp

Considered when Using Falling and Rising Three Methods Pattern:

Agarchay rujhan ke tasalsul ka pata laganay ke liye Rising and Falling three Methods pitrnz qeemti gear ho satke hain, sarmaya karon ko ahthyat baratnay aur tasdeeq ke liye inhen deegar takneeki tshkhisi alaat ke sath marboot karne ki zaroorat hai. bazaar ke utaar charhao, ahem khabron ki release, aur ost market ke jazbaat samait awamil ko mad e nazar rakhna zaroori hai jab ke un taro ko tijarat ke ikhtiyarat mein istemaal kya jaye. mazeed bar-aan, khatray ke intizam ki technical ko aam tor par capital ki hifazat ke liye laago kya jana chahiye agar mutawaqqa rujhan ulat nahi hota hai. un masail ko khareed o farokht ke faislon mein shaamil karkay, sarmaya car ghair mulki zar e mubadla market ke andar Rising and Falling three Methods patteren ka istemaal karte hue kamyabi ke –apne imkanaat ko barha satke hain.

تبصرہ

Расширенный режим Обычный режим