What is ABCD Harmonic Pattern:

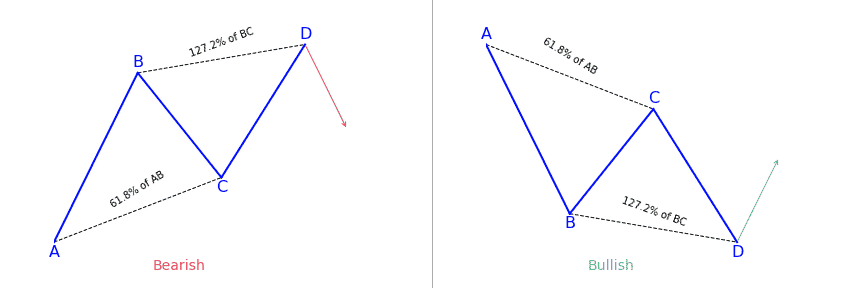

ABCD Harmonic patteren sab se ziyada aam aur qabil aetmaad Harmonic patteren mein se aik hai jo zar e mubadla ke sarmaya karon ke zareya market mein salahiyat ki sharah ki naqal o harkat ki tawaqqa kar rahay hain. yeh namona chaar musalsal qeemat points ke zariye tashkeel diya jata hai : aik ibtidayi charge boom ( a se b ) aik retracement ( b se c ) kisi bhi dosray charge boom ( c se d ) aur is ke baad, point d se aik retracement . tajir is namoonay ka istemaal salahiyat ke ulat ilaqon ya un ilaqon ko samajhney ke liye karte hain jahan charge bhi simt tabdeel kar sakta hai. ABCD ka namona har up trained aur down trained mein peda ho sakta hai, jo taajiron ko kaleedi marahil mein tijarat mein daakhil honay ya bahar jane ke mawaqay faraham karta hai.

Structure of ABCD Harmonic Pattern:

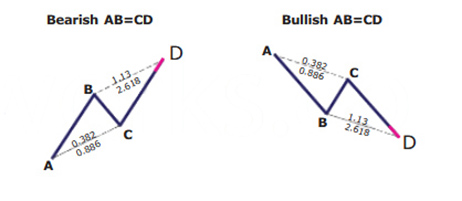

ABCD Harmonic patteren market mein salahiyat ko tabdeel karne walay awamil ka taayun karne ke liye makhsoos Fibonacci tanasub ki pairwi karta hai. tajir namoonay ke andar darj zail tanasub talaash karte hain : ab ibtidayi qeemat ki harkat ka 0. 382 ya sifar. 618 ka retracement hona chahiye, bc ko ab ke sifar. 382 ya 0. 886 ka retracement hona chahiye, aur cd ko 1. 272 ya 1.618 bc ki tosee ki zaroorat hai. yeh Fibonacci tanasub sarmaya karon ko patteren ki sadaqat ki tasdeeq karne aur un ki tijarat ke liye mumkina indraaj ya bahar jane ke awamil ko samajhney mein madad karte hain.

Trading with ABCD Harmonic Pattern:

ABCD Harmonic patteren ki tijarat karte waqt, sarmaya car aam tor par kamyaab tijarat ke mawaqay ko badhaane ke liye deegar takneeki alamaat ya tools ke sath sangam ki talaash karte hain. is mein patteren ke isharay ki tasdeeq ke liye guide aur muzahmat ke marahil, transfer average, ya oscillators ka istemaal bhi shaamil ho sakta hai. tajir up trained mein factor d par lambi pozishnin daal satke hain ya down trained mein mukhtasir pozishnin daal satke hain, stop las orders ko taweel trading ke liye factor d ke neechay aur khatray par qaboo panay ke liye fori trading ke liye factor d se oopar rakha jata hai.

Potential Pitfalls of ABCD Harmonic Pattern:

Agarchay ABCD Harmonic patteren sharah ke aamaal ki paish goi ke liye aik qabil aetmaad aala hai, lekin sarmaya karon ko is namoonay ke istemaal ke douran salahiyat ke nuqsanaat se waaqif hona parta hai. aik aam nuqsaan charge ka d factor ko overshoot karne ka rujhan hai, jis ki wajah se ghalat isharay ya nakaam tijarat hoti hai. is khatray ko kam karne ke liye, tajir tijarat mein daakhil honay se pehlay mazeed tasdeeq ka intzaar kar satke hain, jis mein mom batii ka namona ya raftaar ke isharay mein inhiraf shaamil hai.

Examples and Case studies of ABCD Harmonic Pattern:

Asal bazaar ke halaat mein ABCD Harmonic patteren kaisay kaam karta hai is ko behtar tor par samajhney ke liye, khredar un misalon aur case astdiz par aik nazar daal satke hain jo is namoonay ke istemaal se kamyaab tijarat ki numayesh karte hain. tareekhi qeemat ke adad o shumaar ko parh kar aur ABCD namoonay ke mayarat ko istemaal karte hue, khredar aala imkanaat walay tijarti imkanaat ko talaash karne aur forex market mein apni aamdani ko ziyada se ziyada karne ki apni salahiyat ko behtar bana satke hain. ABCD patteren mein qeematon ki naqal o harkat ke ravayye ka mutalea karne se sarmaya karon ko mustaqbil ki trading ke liye apni rasai aur bahar niklny ki trading ko behtar bananay mein bhi madad mil sakti hai.

ABCD Harmonic patteren sab se ziyada aam aur qabil aetmaad Harmonic patteren mein se aik hai jo zar e mubadla ke sarmaya karon ke zareya market mein salahiyat ki sharah ki naqal o harkat ki tawaqqa kar rahay hain. yeh namona chaar musalsal qeemat points ke zariye tashkeel diya jata hai : aik ibtidayi charge boom ( a se b ) aik retracement ( b se c ) kisi bhi dosray charge boom ( c se d ) aur is ke baad, point d se aik retracement . tajir is namoonay ka istemaal salahiyat ke ulat ilaqon ya un ilaqon ko samajhney ke liye karte hain jahan charge bhi simt tabdeel kar sakta hai. ABCD ka namona har up trained aur down trained mein peda ho sakta hai, jo taajiron ko kaleedi marahil mein tijarat mein daakhil honay ya bahar jane ke mawaqay faraham karta hai.

Structure of ABCD Harmonic Pattern:

ABCD Harmonic patteren market mein salahiyat ko tabdeel karne walay awamil ka taayun karne ke liye makhsoos Fibonacci tanasub ki pairwi karta hai. tajir namoonay ke andar darj zail tanasub talaash karte hain : ab ibtidayi qeemat ki harkat ka 0. 382 ya sifar. 618 ka retracement hona chahiye, bc ko ab ke sifar. 382 ya 0. 886 ka retracement hona chahiye, aur cd ko 1. 272 ya 1.618 bc ki tosee ki zaroorat hai. yeh Fibonacci tanasub sarmaya karon ko patteren ki sadaqat ki tasdeeq karne aur un ki tijarat ke liye mumkina indraaj ya bahar jane ke awamil ko samajhney mein madad karte hain.

Trading with ABCD Harmonic Pattern:

ABCD Harmonic patteren ki tijarat karte waqt, sarmaya car aam tor par kamyaab tijarat ke mawaqay ko badhaane ke liye deegar takneeki alamaat ya tools ke sath sangam ki talaash karte hain. is mein patteren ke isharay ki tasdeeq ke liye guide aur muzahmat ke marahil, transfer average, ya oscillators ka istemaal bhi shaamil ho sakta hai. tajir up trained mein factor d par lambi pozishnin daal satke hain ya down trained mein mukhtasir pozishnin daal satke hain, stop las orders ko taweel trading ke liye factor d ke neechay aur khatray par qaboo panay ke liye fori trading ke liye factor d se oopar rakha jata hai.

Potential Pitfalls of ABCD Harmonic Pattern:

Agarchay ABCD Harmonic patteren sharah ke aamaal ki paish goi ke liye aik qabil aetmaad aala hai, lekin sarmaya karon ko is namoonay ke istemaal ke douran salahiyat ke nuqsanaat se waaqif hona parta hai. aik aam nuqsaan charge ka d factor ko overshoot karne ka rujhan hai, jis ki wajah se ghalat isharay ya nakaam tijarat hoti hai. is khatray ko kam karne ke liye, tajir tijarat mein daakhil honay se pehlay mazeed tasdeeq ka intzaar kar satke hain, jis mein mom batii ka namona ya raftaar ke isharay mein inhiraf shaamil hai.

Examples and Case studies of ABCD Harmonic Pattern:

Asal bazaar ke halaat mein ABCD Harmonic patteren kaisay kaam karta hai is ko behtar tor par samajhney ke liye, khredar un misalon aur case astdiz par aik nazar daal satke hain jo is namoonay ke istemaal se kamyaab tijarat ki numayesh karte hain. tareekhi qeemat ke adad o shumaar ko parh kar aur ABCD namoonay ke mayarat ko istemaal karte hue, khredar aala imkanaat walay tijarti imkanaat ko talaash karne aur forex market mein apni aamdani ko ziyada se ziyada karne ki apni salahiyat ko behtar bana satke hain. ABCD patteren mein qeematon ki naqal o harkat ke ravayye ka mutalea karne se sarmaya karon ko mustaqbil ki trading ke liye apni rasai aur bahar niklny ki trading ko behtar bananay mein bhi madad mil sakti hai.

تبصرہ

Расширенный режим Обычный режим