What is Dynamic Index Indicator:

Dynamic Index isharay aik takneeki tajzia aala hai jo ghair mulki currency ke bazaar mein aik makhsoos ghair mulki currency ke jore ke umomi rujhan ko muntakhib karne ke liye istemaal hota hai. yeh mukammal tor par is usool par mabni hai ke bazaar ke rujhanaat lime nahi hain aur taizi se badal satke hain. isharay mein charge chalon aur utaar charhao ko yakja kya jata hai taakay taajiron ko bazaar ki raftaar aur rastay ki izafi durust numaindagi faraham ki ja sakay. sharah aur utaar charhao ke darmiyan talluq ka mutalea karkay, Dynamic index indicator sarmaya karon ko fashion ke ulat palat aur bazaar ki tabdeelion ki tawaqqa karne ki ijazat deta hai. yeh aik lachak dar tool hai jisay mutadid time frames par istemaal kya ja sakta hai aur character trading ki technical se milnay ke liye apni marzi ke mutabiq banaya ja sakta hai.

Calculation of Dynamic Index Indicator:

Dynamic Index isharay ke hisaab mein mutadid marahil shaamil hotay hain. sab se pehlay, haqeeqi range ( tea are ) ka hisaab mojooda aala aur kaafi charges ke darmiyan mutlaq farq talaash karkay kya jata hai. agla, ost haqeeqi range ( ae tea are ) ka hisaab aik makhsoos lambai, aam tor par 14 waqfon par ost tea are eqdaar ka istemaal karkay kya jata hai. is ke baad rishta daar taaqat index ( are s aayi ) ka hisaab ae tea are eqdaar ke istemaal se lagaya jata hai. aakhir mein, Dynamic index indicator are s aayi ki eqdaar ko hamwar karne ki madad se haasil kya gaya hai. ( ema ).

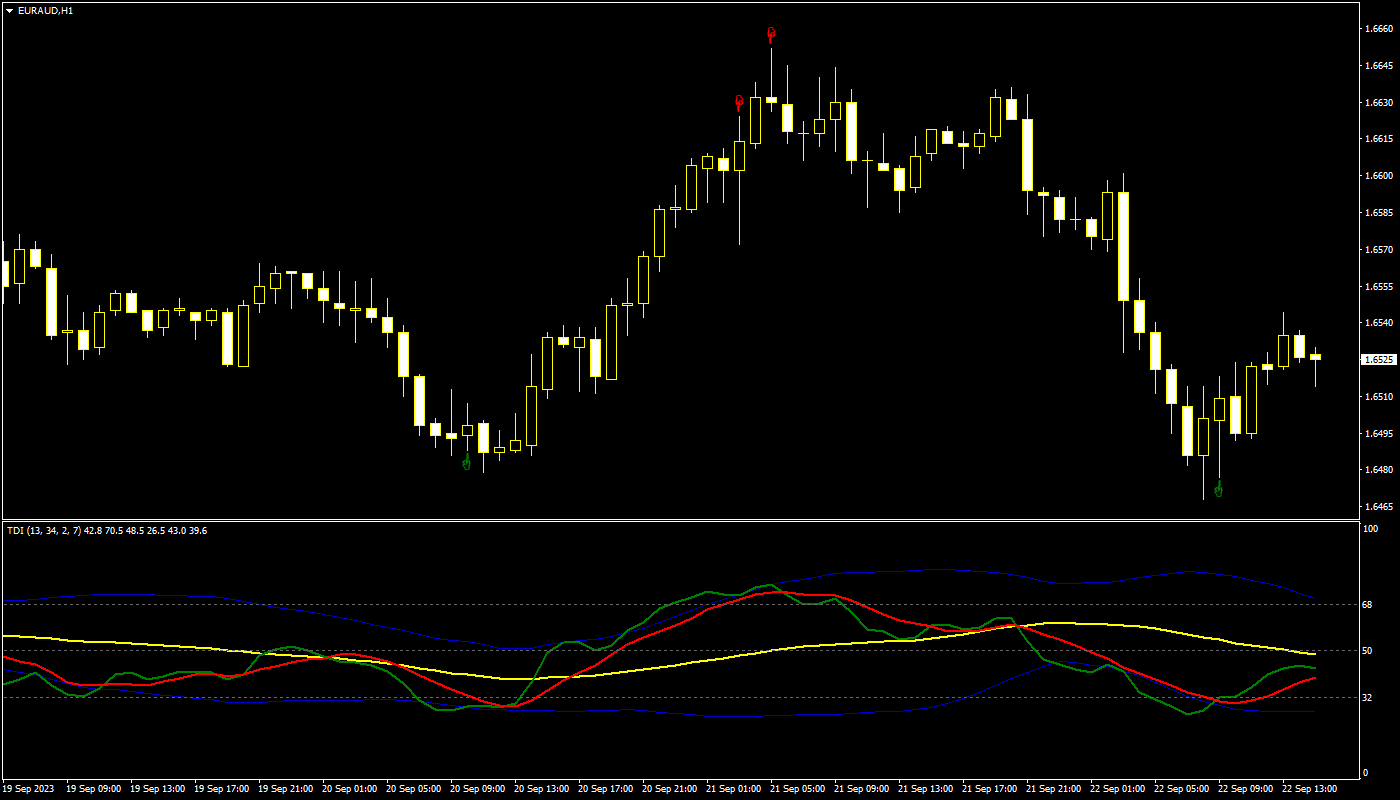

Interpretation of Dynamic Index Indicator:

Dynamic Index isharay mein aik aisi lakeer shaamil hoti hai jo bunyadi 0 line ke oopar aur neechay utaar charhao karti hai. jab isharay 0 line se oopar hota hai, to is se pata chalta hai ke bazaar oopar ki taraf rujhan kar raha hai, jabkay 0 line ke neechay ki eqdaar neechay ki taraf rujhan ka ishara karti hain. tajir sifar line ke sath isharay ke cross over par qareeb se tawajah dete hain, kyunkay yeh salahiyat fashion ke ulat jane ki nishandahi kar satke hain. mazeed bar-aan, qeematon ki naqal o harkat aur Dynamic index indicator ke darmiyan farq bazaar ki raftaar aur salahiyat ki sharah ke rastay mein aydjstmnt ke baray mein qeemti baseerat faraham kar sakta hai.

Trading Strategies using Dynamic Index Indicator:

Tajir khaslato ki tasdeeq karne aur jaali intabahat ko flutter karne ke liye baqaidagi se apni khareed o farokht ki technical mein Dynamic Index isharay ko shaamil karte hain. jab dosray takneeki isharay ke sath istemaal kya jata hai, jis mein shifting average ya trained lines shaamil hotay hain, to Dynamic index indicator kharidaron ko ziyada bakhabar kharidari aur farokht ke faislay karne mein madad kar sakta hai. kuch tajir market mein ziyada kharidari aur ziyada farokht ke halaat ko talaash karne ke liye isharay ka bhi istemaal kar satke hain, jis ki wajah se tijarat ke liye rasai ya bahar jane ke awamil ki salahiyat peda hoti hai.

Limitations of Dynamic Index Indicator:

Agarchay Dynamic index indicator rujhanaat aur market ki raftaar ki shanakht ke liye aik qeemti aala ho sakta hai, lekin yeh hamesha apni hudood ke baghair nahi hota hai. kisi bhi takneeki isharay ki terhan, Dynamic Index isharay faul proof nahi hai aur usay tajzia ki deegar aqsam ke sath mil kar istemaal kya jana chahiye. taajiron ko salahiyat ke jhutay isharay aur bazaar ke shore se aagah hona chahiye jo isharay ki durustagi ko mutasir kar satke hain. mazeed bar-aan, Dynamic index indicator ho sakta hai ke ranging ya ghair mustahkam baazaaron mein munasib tareeqay se kaam nah kere, kyunkay yeh side way harkato ki jagah khaslato ki shanakht ke liye design kya gaya hai. sarmaya karon ke liye yeh zaroori hai ke woh isharay ko apni tijarti technical mein shaamil karne se pehlay is ki taaqat aur rukawaton ko samjhain.

Dynamic Index isharay aik takneeki tajzia aala hai jo ghair mulki currency ke bazaar mein aik makhsoos ghair mulki currency ke jore ke umomi rujhan ko muntakhib karne ke liye istemaal hota hai. yeh mukammal tor par is usool par mabni hai ke bazaar ke rujhanaat lime nahi hain aur taizi se badal satke hain. isharay mein charge chalon aur utaar charhao ko yakja kya jata hai taakay taajiron ko bazaar ki raftaar aur rastay ki izafi durust numaindagi faraham ki ja sakay. sharah aur utaar charhao ke darmiyan talluq ka mutalea karkay, Dynamic index indicator sarmaya karon ko fashion ke ulat palat aur bazaar ki tabdeelion ki tawaqqa karne ki ijazat deta hai. yeh aik lachak dar tool hai jisay mutadid time frames par istemaal kya ja sakta hai aur character trading ki technical se milnay ke liye apni marzi ke mutabiq banaya ja sakta hai.

Calculation of Dynamic Index Indicator:

Dynamic Index isharay ke hisaab mein mutadid marahil shaamil hotay hain. sab se pehlay, haqeeqi range ( tea are ) ka hisaab mojooda aala aur kaafi charges ke darmiyan mutlaq farq talaash karkay kya jata hai. agla, ost haqeeqi range ( ae tea are ) ka hisaab aik makhsoos lambai, aam tor par 14 waqfon par ost tea are eqdaar ka istemaal karkay kya jata hai. is ke baad rishta daar taaqat index ( are s aayi ) ka hisaab ae tea are eqdaar ke istemaal se lagaya jata hai. aakhir mein, Dynamic index indicator are s aayi ki eqdaar ko hamwar karne ki madad se haasil kya gaya hai. ( ema ).

Interpretation of Dynamic Index Indicator:

Dynamic Index isharay mein aik aisi lakeer shaamil hoti hai jo bunyadi 0 line ke oopar aur neechay utaar charhao karti hai. jab isharay 0 line se oopar hota hai, to is se pata chalta hai ke bazaar oopar ki taraf rujhan kar raha hai, jabkay 0 line ke neechay ki eqdaar neechay ki taraf rujhan ka ishara karti hain. tajir sifar line ke sath isharay ke cross over par qareeb se tawajah dete hain, kyunkay yeh salahiyat fashion ke ulat jane ki nishandahi kar satke hain. mazeed bar-aan, qeematon ki naqal o harkat aur Dynamic index indicator ke darmiyan farq bazaar ki raftaar aur salahiyat ki sharah ke rastay mein aydjstmnt ke baray mein qeemti baseerat faraham kar sakta hai.

Trading Strategies using Dynamic Index Indicator:

Tajir khaslato ki tasdeeq karne aur jaali intabahat ko flutter karne ke liye baqaidagi se apni khareed o farokht ki technical mein Dynamic Index isharay ko shaamil karte hain. jab dosray takneeki isharay ke sath istemaal kya jata hai, jis mein shifting average ya trained lines shaamil hotay hain, to Dynamic index indicator kharidaron ko ziyada bakhabar kharidari aur farokht ke faislay karne mein madad kar sakta hai. kuch tajir market mein ziyada kharidari aur ziyada farokht ke halaat ko talaash karne ke liye isharay ka bhi istemaal kar satke hain, jis ki wajah se tijarat ke liye rasai ya bahar jane ke awamil ki salahiyat peda hoti hai.

Limitations of Dynamic Index Indicator:

Agarchay Dynamic index indicator rujhanaat aur market ki raftaar ki shanakht ke liye aik qeemti aala ho sakta hai, lekin yeh hamesha apni hudood ke baghair nahi hota hai. kisi bhi takneeki isharay ki terhan, Dynamic Index isharay faul proof nahi hai aur usay tajzia ki deegar aqsam ke sath mil kar istemaal kya jana chahiye. taajiron ko salahiyat ke jhutay isharay aur bazaar ke shore se aagah hona chahiye jo isharay ki durustagi ko mutasir kar satke hain. mazeed bar-aan, Dynamic index indicator ho sakta hai ke ranging ya ghair mustahkam baazaaron mein munasib tareeqay se kaam nah kere, kyunkay yeh side way harkato ki jagah khaslato ki shanakht ke liye design kya gaya hai. sarmaya karon ke liye yeh zaroori hai ke woh isharay ko apni tijarti technical mein shaamil karne se pehlay is ki taaqat aur rukawaton ko samjhain.

تبصرہ

Расширенный режим Обычный режим