What is Negative Volume index (NVI) indicator:

Negative Volume index ( NVI ) aik takneeki isharay hai jo tijarti had ko kam karne ki bunyaad par tahaffuz ke andaaz ki pemaiesh karta hai. NVI ke peechay tasawwur yeh hai ke bazaar ki kamzoree ya zawaal ke waqfon mein, tijarti had kam hoti jati hai kyunkay tajir security kharidne ya farokht karne mein kam dilchaspi letay hain. NVI un dinon ka istemaal karte hue rujhan ka hisaab lagaata hai jahan pichlle din ke muqablay mein Volume kam hota hai, aur is terhan index ko adjust karta hai. is isharay ka istemaal taajiron aur tajzia karon ke zareya salahiyat mein kami ke rujhanaat aur market ke jazbaat mein honay wali tabdeelion ko samajhney ke liye kya jata hai jis ki bunyaad mukammal tor par tijarat ki satah mein kami par hoti hai. deegar takneeki alamaat ke sath NVI ko parh kar, tajir is baray mein izafi bakhabar faislay kar satke hain ke tijarat mein kab daakhil hona hai ya bahar jana hai.

Calculation and Interpretation of Negative Volume index indicator:

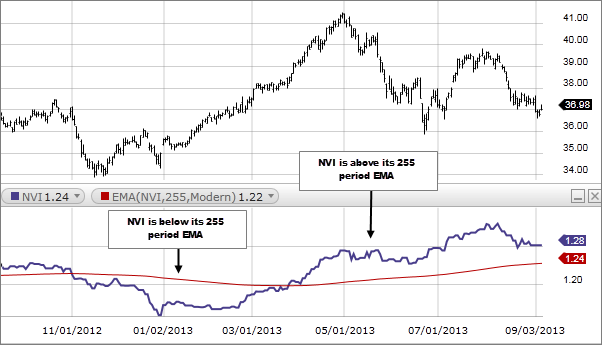

Negative Volume index ( NVI ) ka hisaab is tasawwur ki bunyaad par lagaya jata hai ke smart cash din mein market mein daakhil honay ka rujhan rakhti hai jabkay miqdaar kam hoti hai. NVI bunyadi laagat se shuru hota hai jo aam tor par 1, 000 par muqarrar hoti hai. agar kharidari aur farokht ke din ki had kal ke muqablay mein kam hai, to NVI mein koi tabdeeli nahi hogi. agar had barhti hai to NVI charge ke andar mutabadil hasas ke aik yakeeni hissay se kam ho jata hai. NVI mein yeh sust kami zahir karti hai ke hooshiyar paisa bazaar se bahar nikal raha hai. sarmaya car NVI ke fashion ko parh kar is ki tashreeh karte hain. barhti hui NVI se pata chalta hai ke market mein kam Volume aur mumkina tor par khorda taajiron ke zariye heera pheri ki khasusiyat hai, jabkay girtay hue NVI se pata chalta hai ke idaara jati khredar apni pozishnin beech rahay hain.

Advantages of Negative Volume index indicator:

Negative volume index indicator ke istemaal ke ahem fawaid mein se aik salahiyat market ke ulat palat ki shanakht karne ki salahiyat hai. jab NVI isi waqt kam ho raha ho jab stock charge barh raha ho, to yeh is baat ka ishara ho sakta hai ke bazaar mein ziyada kharidari hui hai aur jald hi islaah ka tajurbah ho sakta hai. mazeed bar-aan, NVI khorda taajiron ke bar aks idaara jati kharidaron ke ravayye ke baray mein baseerat paish kar sakta hai. had ke rujhanaat ki nigrani karkay, sarmaya car market ki naqal o harkat ko kon istemaal kar raha hai is ke baray mein behtar jaankaari haasil kar satke hain aur is terhan apni technical ko munazzam kar satke hain. mazeed bar-aan, intabahat ki tasdeeq aur tijarti faislon ki umomi durustagi ko badhaane ke liye NVI ko mukhtalif takneeki isharay ke sath istemaal kya ja sakta hai.

Limitations of Negative Volume index indicator:

Agarchay Negative Volume index isharay takneeki tashkhees ke liye aik faida mand zareya ho sakta hai, lekin is ki izafi hudood bhi hain. bunyadi kharabion mein se aik Volume ke record par is ka inhisaar hai, jisay waqtan foqtan heera pheri ya maskh kya ja sakta hai. aisay mamlaat mein jahan kam miqdaar walay stock ya ghair maya asasay pareshan hain, ho sakta hai ke NVI durust isharay faraham nah kere. mazeed bar-aan, NVI rujhan saaz baazaaron mein sab se ziyada mo-asar hai aur ghair mustahkam ya side way baazaaron mein ghalat isharay peda kar sakta hai. taajiron ko allag thalag hokar NVI ki tashreeh karne mein bhi mohtaat rehna chahiye aur deegar awamil ko mat bhulen jin mein qeemat ki karwai, bazaar ke jazbaat, aur –apne tijarti faislon ki toseeq ke liye bunyadi tashkhees shaamil hain.

Trading With Negative Volume index indicator:

Agarchay Negative Volume index indicator ibtidayi tor par stock market ke liye tayyar kya gaya tha, lekin usay ghair mulki currency ki tijarat mein bhi laago kya ja sakta hai. forex market mein, had ke adaad o shumaar hotay hain aur stock market ki terhan aasani se dastyab nahi hotay hain. tajir ghair mulki currency ke joron ke liye NVI ka hisaab laganay ke liye –apne mutaliqa brokrz se tik ki miqdaar ya khareed o farokht ki had ki maloomat ka istemaal kar satke hain. fees ki naqal o harkat ke sath NVI ki nigrani karkay, sarmaya car zar e mubadla market ke andar rujhanaat, ulat palat aur market ki harkiyaat ko daryaft kar satke hain. NVI ko aik jame khareed o farokht ke tareeqa car mein zam karne se sarmaya karon ko bakhabar intikhab karne aur ghair mulki currency ke bazaar ki utaar charhao wali noiyat ko ziyada durust tareeqay se navigate karne mein madad mil sakti hai.

Negative Volume index ( NVI ) aik takneeki isharay hai jo tijarti had ko kam karne ki bunyaad par tahaffuz ke andaaz ki pemaiesh karta hai. NVI ke peechay tasawwur yeh hai ke bazaar ki kamzoree ya zawaal ke waqfon mein, tijarti had kam hoti jati hai kyunkay tajir security kharidne ya farokht karne mein kam dilchaspi letay hain. NVI un dinon ka istemaal karte hue rujhan ka hisaab lagaata hai jahan pichlle din ke muqablay mein Volume kam hota hai, aur is terhan index ko adjust karta hai. is isharay ka istemaal taajiron aur tajzia karon ke zareya salahiyat mein kami ke rujhanaat aur market ke jazbaat mein honay wali tabdeelion ko samajhney ke liye kya jata hai jis ki bunyaad mukammal tor par tijarat ki satah mein kami par hoti hai. deegar takneeki alamaat ke sath NVI ko parh kar, tajir is baray mein izafi bakhabar faislay kar satke hain ke tijarat mein kab daakhil hona hai ya bahar jana hai.

Calculation and Interpretation of Negative Volume index indicator:

Negative Volume index ( NVI ) ka hisaab is tasawwur ki bunyaad par lagaya jata hai ke smart cash din mein market mein daakhil honay ka rujhan rakhti hai jabkay miqdaar kam hoti hai. NVI bunyadi laagat se shuru hota hai jo aam tor par 1, 000 par muqarrar hoti hai. agar kharidari aur farokht ke din ki had kal ke muqablay mein kam hai, to NVI mein koi tabdeeli nahi hogi. agar had barhti hai to NVI charge ke andar mutabadil hasas ke aik yakeeni hissay se kam ho jata hai. NVI mein yeh sust kami zahir karti hai ke hooshiyar paisa bazaar se bahar nikal raha hai. sarmaya car NVI ke fashion ko parh kar is ki tashreeh karte hain. barhti hui NVI se pata chalta hai ke market mein kam Volume aur mumkina tor par khorda taajiron ke zariye heera pheri ki khasusiyat hai, jabkay girtay hue NVI se pata chalta hai ke idaara jati khredar apni pozishnin beech rahay hain.

Advantages of Negative Volume index indicator:

Negative volume index indicator ke istemaal ke ahem fawaid mein se aik salahiyat market ke ulat palat ki shanakht karne ki salahiyat hai. jab NVI isi waqt kam ho raha ho jab stock charge barh raha ho, to yeh is baat ka ishara ho sakta hai ke bazaar mein ziyada kharidari hui hai aur jald hi islaah ka tajurbah ho sakta hai. mazeed bar-aan, NVI khorda taajiron ke bar aks idaara jati kharidaron ke ravayye ke baray mein baseerat paish kar sakta hai. had ke rujhanaat ki nigrani karkay, sarmaya car market ki naqal o harkat ko kon istemaal kar raha hai is ke baray mein behtar jaankaari haasil kar satke hain aur is terhan apni technical ko munazzam kar satke hain. mazeed bar-aan, intabahat ki tasdeeq aur tijarti faislon ki umomi durustagi ko badhaane ke liye NVI ko mukhtalif takneeki isharay ke sath istemaal kya ja sakta hai.

Limitations of Negative Volume index indicator:

Agarchay Negative Volume index isharay takneeki tashkhees ke liye aik faida mand zareya ho sakta hai, lekin is ki izafi hudood bhi hain. bunyadi kharabion mein se aik Volume ke record par is ka inhisaar hai, jisay waqtan foqtan heera pheri ya maskh kya ja sakta hai. aisay mamlaat mein jahan kam miqdaar walay stock ya ghair maya asasay pareshan hain, ho sakta hai ke NVI durust isharay faraham nah kere. mazeed bar-aan, NVI rujhan saaz baazaaron mein sab se ziyada mo-asar hai aur ghair mustahkam ya side way baazaaron mein ghalat isharay peda kar sakta hai. taajiron ko allag thalag hokar NVI ki tashreeh karne mein bhi mohtaat rehna chahiye aur deegar awamil ko mat bhulen jin mein qeemat ki karwai, bazaar ke jazbaat, aur –apne tijarti faislon ki toseeq ke liye bunyadi tashkhees shaamil hain.

Trading With Negative Volume index indicator:

Agarchay Negative Volume index indicator ibtidayi tor par stock market ke liye tayyar kya gaya tha, lekin usay ghair mulki currency ki tijarat mein bhi laago kya ja sakta hai. forex market mein, had ke adaad o shumaar hotay hain aur stock market ki terhan aasani se dastyab nahi hotay hain. tajir ghair mulki currency ke joron ke liye NVI ka hisaab laganay ke liye –apne mutaliqa brokrz se tik ki miqdaar ya khareed o farokht ki had ki maloomat ka istemaal kar satke hain. fees ki naqal o harkat ke sath NVI ki nigrani karkay, sarmaya car zar e mubadla market ke andar rujhanaat, ulat palat aur market ki harkiyaat ko daryaft kar satke hain. NVI ko aik jame khareed o farokht ke tareeqa car mein zam karne se sarmaya karon ko bakhabar intikhab karne aur ghair mulki currency ke bazaar ki utaar charhao wali noiyat ko ziyada durust tareeqay se navigate karne mein madad mil sakti hai.

تبصرہ

Расширенный режим Обычный режим