Pull Back Enrty In Forex Trading

Pull Back Entry Introduction.

Assalam o Alaikum Dear forex friends and fellows community market me trading ky leye order place kerny sey pehly traders ko ess method me pull back point ko identify kerna hota hy.tab hee es method of trading me sucess mil sakti hy.pulback market ke price drop ko Kahate Hein pulback time trader ko new trade ko open karny ke liye new point ko find karna chahie Agar ham trade open karte hein aur acche point ko find Karte Hein To Ham market Me easily acha profit Hasil kar sakty hein.market Me price pul pack bahut important role play karti hy Forex trading ki market Me pullback market ke drop ko kaha jata hy market Me Kam Karny Wale trader Ko pullback ke bare me complete knowledge Hona chahie Agar Uske pass pullback ka complete knowledge hoga to vah market Me acche tarike se trade open kar paye ga,jis tarde me faidy kay cahnces increase ho jaty hay.

Important steps of Pull Back Enrty:-

Pull Back Ki Tashkeel:

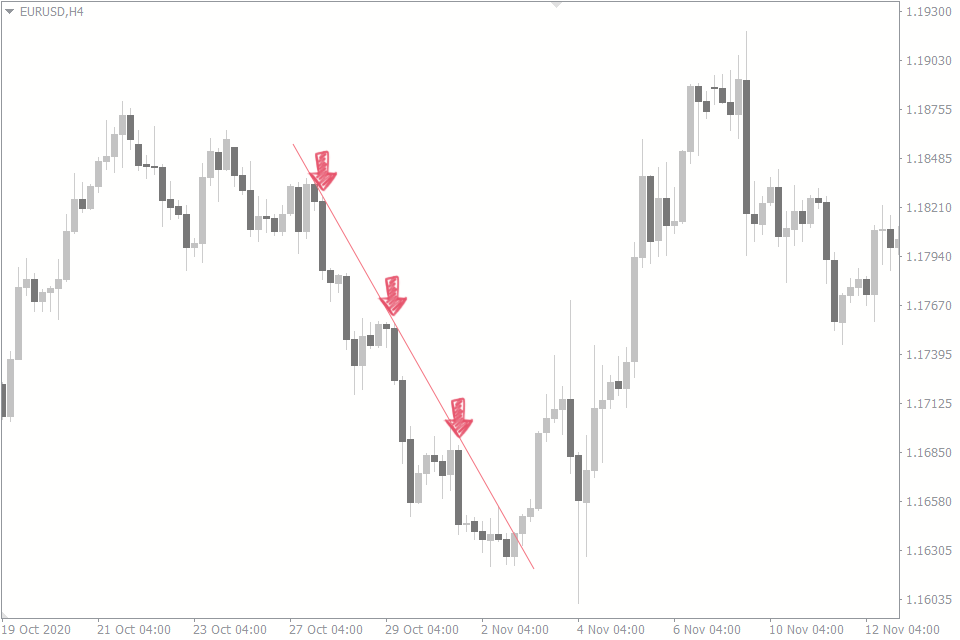

Friends Pehly to samjhein ke "pull back" market me trend reversal ke any se pehly hota hy. Yani ke jab ek trend ban raha hota hy (upward ya downward), to pull back ek choti si correction hoti hy, jahan par market wapas apne trend ke opposite direction me thoda sa move karti hy.

Detais of Highs Aur Lows:

Dear fellows Trading charts par highs aur lows ko dekhein. Highs market me woh points hoty hein jab price ek upward move ke dauran sabse zyada pohanchti hy. Lows woh points hoty hein jab price ek downward move ke dauran sab se kam hoti hy.

Identification of Trend:

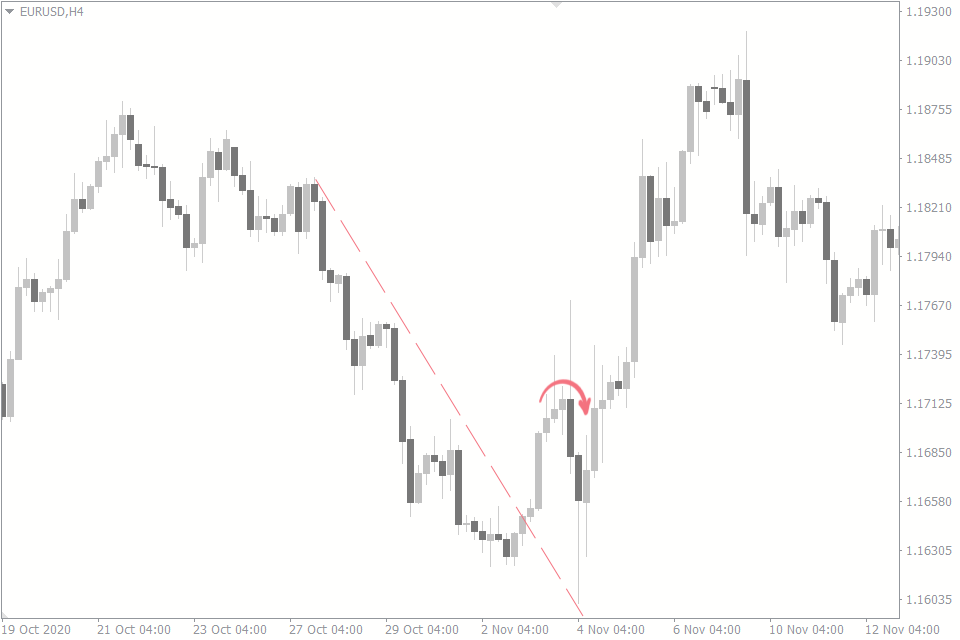

Pull back entry ke liye apko pehly trend ko pehchan na hoga. Agar market upward trend me hy, to pull back entry ka matn hy ke ap downward pull back ke chances dekh rahe hein aur agar market downward trend me hy, to ap upward pull back ke chances dekh rahe hein.

Entry Point

se dekhein. Yeh woh point hota hy jab market pull back ke bad phir se trend direction me ja sakta hy. Entry point ko identify karny ke liye technical indicators aur price patterns ka istemal kiya ja sakta hy.

Set the Stop Loss And Take Profit:

Entry point ko identify karny ke bad, apko stop loss aur target levels set karny hon ge. Stop loss apko protect karega agar trade against direction move ho. Target level woh level hota hy jahan par ap profit book karna chahte hein.

Execute the Trade:

Jab ap entry point, stop loss, aur target levels set kar lein, to trade execute karen. Isme ap apne broker ke platform par order place karenge.

Risk Management:

Hamesha risk management ka khayal rakhein. Sirf woh amount invest Karen jise ap afford kar sakty hein khona. Pull back entry strategy trading me ek important tool ho sakti hy, lekin dhyan rahe ke market me risk hota hy aur har trade me profit ya loss ho sakta hy. Isliye, hamesha trading plan bana kar aur risk management ke sath trading karen.

تبصرہ

Расширенный режим Обычный режим