@@@Forex Mein Red Candlestick Pattern@@@

Forex market mein "red candlestick pattern" ka matlab hota hai ki ek candlestick chart mein ek red candlestick form hua hai, jismein closing price opening price se niche hai. Yeh pattern market mein bearish sentiment ko darust karta hai aur traders ko kisi mukhtalif trend ki shuruaat hone ki soochit karta hai.

@@@Forex Mein Red Candlestick Pattern Ke Fawaed@@@

Red candlestick pattern ke faidey niche diye gaye hain:

Forex market mein "red candlestick pattern" ka matlab hota hai ki ek candlestick chart mein ek red candlestick form hua hai, jismein closing price opening price se niche hai. Yeh pattern market mein bearish sentiment ko darust karta hai aur traders ko kisi mukhtalif trend ki shuruaat hone ki soochit karta hai.

@@@Forex Mein Red Candlestick Pattern Ke Fawaed@@@

Red candlestick pattern ke faidey niche diye gaye hain:

- Bearish Signal: Red candlestick pattern bearish market sentiment ko darust karta hai. Yeh indicate karta hai ki sellers control mein hain aur price ka neeche jaane ka zyada chance hai. Traders ko sell positions enter karne ya existing positions ko hold karne ke liye motivate karta hai.

- Trend Reversal Indication: Jab red candlestick pattern kisi uptrend ke baad dikhta hai, toh yeh trend reversal ki possibility ko darust karta hai. Yeh ek indication ho sakta hai ki uptrend khatam ho raha hai aur market downward movement mein jaane wala hai. Isse traders ko trend change ke liye prepare hone ka mauka milta hai.

- Entry and Exit Points: Red candlestick pattern traders ko entry aur exit points determine karne mein madad karta hai. Jab red candlestick pattern dikhta hai, traders ko short positions enter karne ka mouka milta hai. Isi tarah, jab yeh pattern kisi trade mein dikhta hai, toh traders ko apne existing positions ko exit karne ka signal milta hai.

- Risk Management: Red candlestick pattern ka istemal risk management mein bhi kiya ja sakta hai. Agar ek trader uptrend mein hai aur red candlestick pattern dikh raha hai, toh woh apne stop-loss orders ko adjust kar sakta hai ya phir position ko exit kar sakta hai taaki loss ko minimize kiya ja sake.

- Resistance Levels Ka Tasdiq: Red candlestick patterns market mein resistance levels ko tasdiq kar sakti hain. Jab red candlestick kisi resistance level ke qareeb banegi, toh yeh yeh ishara deta hai ke us level par bechnay wala dabao itna ziada hai ke keemat ko neeche le ja sakta hai. Ye tasdiq traders ko trend ke mukhtalif phaslon ka faisla karne mein madad deti hai.

- Technical Tahlil Ka Aik Aham Aala: Red candlestick patterns technical tahlil mein ek ahem aala hain. In patterns ke peeche chhupi psychology ko samajh kar, traders market sentiment ka andaaza laga sakte hain aur future ke keemat ke harkaton ke baare mein behtar peshangoiyan kar sakte hain. Ye red candlestick patterns ko doosre technical indicators ke saath mila kar istemal karna traders ki tahlil ko mazboot karta hai.

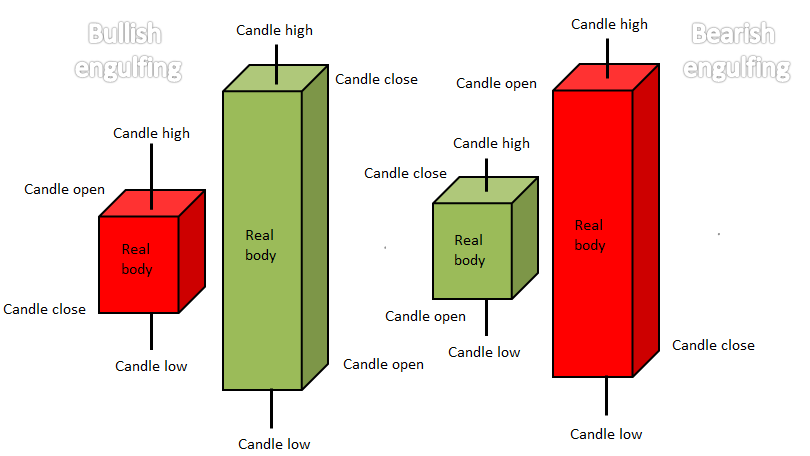

- Pattern Shinaakht: Red candlestick patterns ka pehchanana traders ko trading ke moqay jaldi pehchanne mein madad karta hai. Chahe woh aam bearish engulfing pattern ho ya phir dark cloud cover jaise zyada mushkil formation, inn patterns ko jaldi pehchan lena traders ko market mein fawaid mand moqay faraham kar sakta hai.

تبصرہ

Расширенный режим Обычный режим