Directional Movement Index (DMI) ek technical indicator hai jo market trends ko analyze karne mein madad karta hai. Ye indicator specifically trend strength aur direction ko measure karta hai. DMI, trend-following indicators ki family ka hissa hai aur traders ko market mein hone wale potential trend changes ke baare mein information provide karta hai.

DMI Key Points:

- Components (اہم حصے):

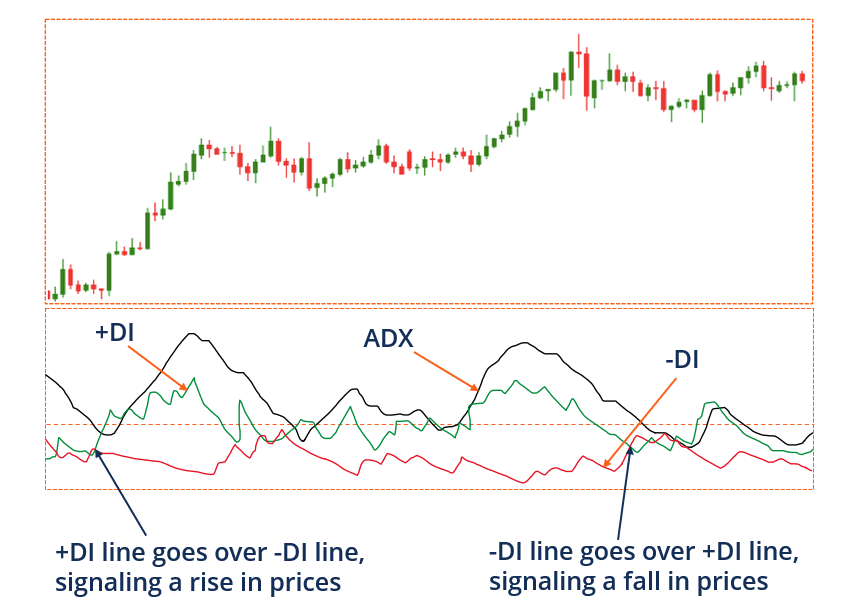

- DMI do components se mil kar bana hota hai: Positive Directional Movement Indicator (+DMI) aur Negative Directional Movement Indicator (-DMI).

- In dono indicators ki madad se trend ki direction aur uski strength ko determine kiya jata hai.

- Trend Direction (ٹرینڈ کی سمت):

- +DMI positive trends ko represent karta hai, jabki -DMI negative trends ko.

- Agar +DMI -DMI se zyada hai, to market mein uptrend hone ke chances hote hain. Wahi agar -DMI +DMI se zyada hai, to downtrend hone ke chances hote hain.

- ADX (Average Directional Index) (ای ڈی ایکس):

- ADX, DMI ke sath istemal hone wala ek aur important component hai.

- Ye indicator trend ki strength ko measure karta hai. Agar ADX ki value zyada hai, to trend strong hai, aur agar kam hai to trend weak hai.

DMI Ka Istemal (Usage):

- Trend Confirmation (ٹرینڈ کی تصدیق):

- +DMI aur -DMI ke cross overs, yaani jab +DMI -DMI ko cross karta hai, trend ke changes ko signify kar sakte hain.

- Agar +DMI ne -DMI ko upar cross kiya, to ye uptrend ki shuruat ho sakti hai, aur agar -DMI ne +DMI ko upar cross kiya, to ye downtrend ki shuruat ho sakti hai.

- ADX Ka Istemal (Use of ADX):

- ADX ki value ka istemal trend ki strength ko evaluate karne mein hota hai.

- Agar ADX zyada hai, to trend strong hai, aur agar kam hai to trend weak hai.

- Divergence Analysis (متنازعہ تجزیہ):

- DMI ke istemal se traders trend ke divergence ko identify kar sakte hain, jo future trend changes ka indicator ho sakta hai.

Conclusion (ختم): Directional Movement Index (DMI) ek powerful tool hai jo traders ko market trends ke baare mein behtareen insights deta hai. Iska istemal trend confirmation, strength measurement, aur potential reversals ke liye kiya ja sakta hai. Lekin, har ek indicator ki tarah, isko bhi dusre tools aur analysis ke saath istemal karna important hai.

تبصرہ

Расширенный режим Обычный режим