Klinger Volume Oscillator Aur Trading Sequence

Volume aur price action traders ke liye, Klinger Volume Oscillator (KVO) ek ahem tool hai jo market ke trend aur momentum ko samajhne mein madad karta hai. Yeh ek popular technical indicator hai jo volume aur price ke darmiyan ke taluqat ko analyze karta hai. Is article mein, hum Klinger Volume Oscillator aur uske saath trading sequence ke baare mein gehraai se baat karenge.

Klinger Volume Oscillator: Ek Nazar

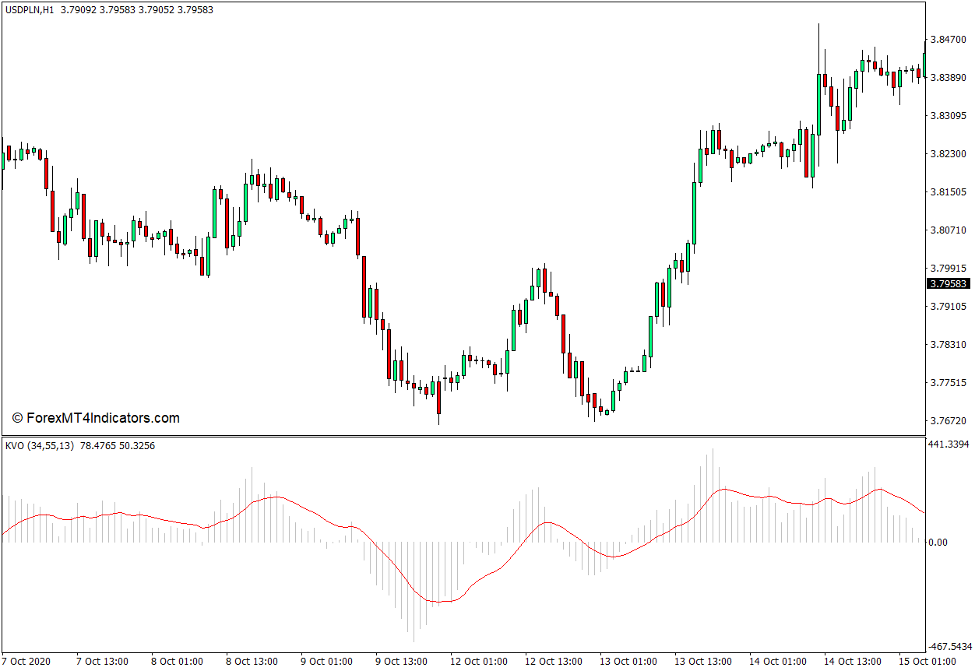

Klinger Volume Oscillator (KVO) Richard Klinger ke dwara develop kiya gaya tha aur yeh volume aur price ke darmiyan ke taluqat ko measure karta hai. Iska basic concept yeh hai ke jab price aur volume ke darmiyan strong correlation hoti hai, woh ek strong trend ko darust karti hai.

KVO ke calculation ke liye, do moving averages ka istemal hota hai: Signal Line aur Volume Force. Signal line moving average 34-period ki hoti hai jabke Volume Force moving average 55-period ki hoti hai. In dono lines ke darmiyan ke difference ko oscillator ke tor par represent kiya jata hai.

Jab Signal Line Volume Force ko cross karti hai, yeh ek bullish ya bearish signal generate karta hai, jo traders ko trend ka pata lagane mein madad karta hai.

Klinger Volume Oscillator Ke Fayde:

Klinger Volume Oscillator Ka Istemal Trading Mein:

1. Trend Confirmation:

Trend confirmation ke liye, traders KVO ka istemal karte hain. Jab Signal Line Volume Force ko cross karta hai aur bullish territory mein jaata hai, yeh ek uptrend ka indication deta hai. Vaise hi, jab yeh bearish territory mein jaata hai, yeh ek downtrend ka sign hai.

2. Divergence Ka Istemal:

Divergence KVO ka ek powerful signal hai. Jab price action aur KVO mein alag-alag directions ke movement dekha jata hai, yeh ek reversal ka sign ho sakta hai. Bullish divergence mein price action nichi ja rahi hoti hai jabke KVO upar ja raha hota hai, jo ek bullish reversal ka indication hai. Vaise hi, bearish divergence mein price action upar ja rahi hoti hai jabke KVO niche ja raha hota hai, jo ek bearish reversal ka indication hai.

3. Volume Confirmation:

Trades ko confirm karne ke liye, traders KVO ke signals ko volume ke saath confirm karte hain. Agar price action ke sath volume bhi badh raha hai jab KVO ek trend ke saath move kar raha hai, toh yeh ek strong confirmation hai ke trend mein strong participation hai.

Trading Sequence:

Klinger Volume Oscillator ke saath trading sequence ko samajhna traders ke liye zaroori hai. Yeh sequence traders ko ek systematic approach provide karta hai trading ke liye:

Step 1: Trend Identification:

Pehla qadam trend ko identify karna hai. Iske liye, traders KVO ka istemal karte hain aur dekhte hain ke Signal Line Volume Force ko kis tarah cross kar raha hai.

Step 2: Divergence Search:

Divergence ko dhundna agla qadam hai. Bullish ya bearish divergence ke signals ko search karna important hai, kyunki yeh reversal points ko indicate karte hain.

Step 3: Volume Confirmation:

Phir, volume confirmation ka tajziya karna hai. Price action ke saath volume ke taluqat ko samajhna zaroori hai taake trades ko confirm kiya ja sake.

Step 4: Entry Aur Exit Points:

Entry aur exit points ko determine karna final step hai. KVO ke signals aur confirmations ke adhaar par traders apne positions ko enter aur exit karte hain.

Conclusion:

Klinger Volume Oscillator (KVO) ek powerful technical indicator hai jo traders ko market ke trends aur momentum ke bare mein behtar understanding provide karta hai. Iske saath trading sequence ka istemal karke, traders apne trading strategies ko refine kar sakte hain aur consistent profits earn kar sakte hain. Lekin, jaise har technical indicator ki tarah, KVO bhi ek tool hai jo dusre indicators aur price action ke saath istemal hona chahiye. Iske saath me proper risk management aur discipline bhi zaroori hai taake trading mein safalta hasil ki ja sake.

Volume aur price action traders ke liye, Klinger Volume Oscillator (KVO) ek ahem tool hai jo market ke trend aur momentum ko samajhne mein madad karta hai. Yeh ek popular technical indicator hai jo volume aur price ke darmiyan ke taluqat ko analyze karta hai. Is article mein, hum Klinger Volume Oscillator aur uske saath trading sequence ke baare mein gehraai se baat karenge.

Klinger Volume Oscillator: Ek Nazar

Klinger Volume Oscillator (KVO) Richard Klinger ke dwara develop kiya gaya tha aur yeh volume aur price ke darmiyan ke taluqat ko measure karta hai. Iska basic concept yeh hai ke jab price aur volume ke darmiyan strong correlation hoti hai, woh ek strong trend ko darust karti hai.

KVO ke calculation ke liye, do moving averages ka istemal hota hai: Signal Line aur Volume Force. Signal line moving average 34-period ki hoti hai jabke Volume Force moving average 55-period ki hoti hai. In dono lines ke darmiyan ke difference ko oscillator ke tor par represent kiya jata hai.

Jab Signal Line Volume Force ko cross karti hai, yeh ek bullish ya bearish signal generate karta hai, jo traders ko trend ka pata lagane mein madad karta hai.

Klinger Volume Oscillator Ke Fayde:

- Trend Identification: KVO ke istemal se traders trend ko samajh sakte hain aur market ke direction ko predict kar sakte hain.

- Volume Confirmation: Volume aur price action ke darmiyan ke taluqat ko samajhne mein madad karta hai, jisse trades ki validity ko confirm kiya ja sakta hai.

- Entry Aur Exit Points: KVO ke signals traders ko entry aur exit points provide karte hain, jisse unka trading strategy improve hota hai.

Klinger Volume Oscillator Ka Istemal Trading Mein:

1. Trend Confirmation:

Trend confirmation ke liye, traders KVO ka istemal karte hain. Jab Signal Line Volume Force ko cross karta hai aur bullish territory mein jaata hai, yeh ek uptrend ka indication deta hai. Vaise hi, jab yeh bearish territory mein jaata hai, yeh ek downtrend ka sign hai.

2. Divergence Ka Istemal:

Divergence KVO ka ek powerful signal hai. Jab price action aur KVO mein alag-alag directions ke movement dekha jata hai, yeh ek reversal ka sign ho sakta hai. Bullish divergence mein price action nichi ja rahi hoti hai jabke KVO upar ja raha hota hai, jo ek bullish reversal ka indication hai. Vaise hi, bearish divergence mein price action upar ja rahi hoti hai jabke KVO niche ja raha hota hai, jo ek bearish reversal ka indication hai.

3. Volume Confirmation:

Trades ko confirm karne ke liye, traders KVO ke signals ko volume ke saath confirm karte hain. Agar price action ke sath volume bhi badh raha hai jab KVO ek trend ke saath move kar raha hai, toh yeh ek strong confirmation hai ke trend mein strong participation hai.

Trading Sequence:

Klinger Volume Oscillator ke saath trading sequence ko samajhna traders ke liye zaroori hai. Yeh sequence traders ko ek systematic approach provide karta hai trading ke liye:

Step 1: Trend Identification:

Pehla qadam trend ko identify karna hai. Iske liye, traders KVO ka istemal karte hain aur dekhte hain ke Signal Line Volume Force ko kis tarah cross kar raha hai.

Step 2: Divergence Search:

Divergence ko dhundna agla qadam hai. Bullish ya bearish divergence ke signals ko search karna important hai, kyunki yeh reversal points ko indicate karte hain.

Step 3: Volume Confirmation:

Phir, volume confirmation ka tajziya karna hai. Price action ke saath volume ke taluqat ko samajhna zaroori hai taake trades ko confirm kiya ja sake.

Step 4: Entry Aur Exit Points:

Entry aur exit points ko determine karna final step hai. KVO ke signals aur confirmations ke adhaar par traders apne positions ko enter aur exit karte hain.

Conclusion:

Klinger Volume Oscillator (KVO) ek powerful technical indicator hai jo traders ko market ke trends aur momentum ke bare mein behtar understanding provide karta hai. Iske saath trading sequence ka istemal karke, traders apne trading strategies ko refine kar sakte hain aur consistent profits earn kar sakte hain. Lekin, jaise har technical indicator ki tarah, KVO bhi ek tool hai jo dusre indicators aur price action ke saath istemal hona chahiye. Iske saath me proper risk management aur discipline bhi zaroori hai taake trading mein safalta hasil ki ja sake.

تبصرہ

Расширенный режим Обычный режим