Introduction

Dosto aaj hum aik ayse strategy par bat karenge jis ke istaal se arwaqt aur savhe analysis kare trading ko mahfooz aur munafa bakhsh bana sakte hai ayye range trading ke bare main detail ke sath bat karte hain

Forex range market kya hay?

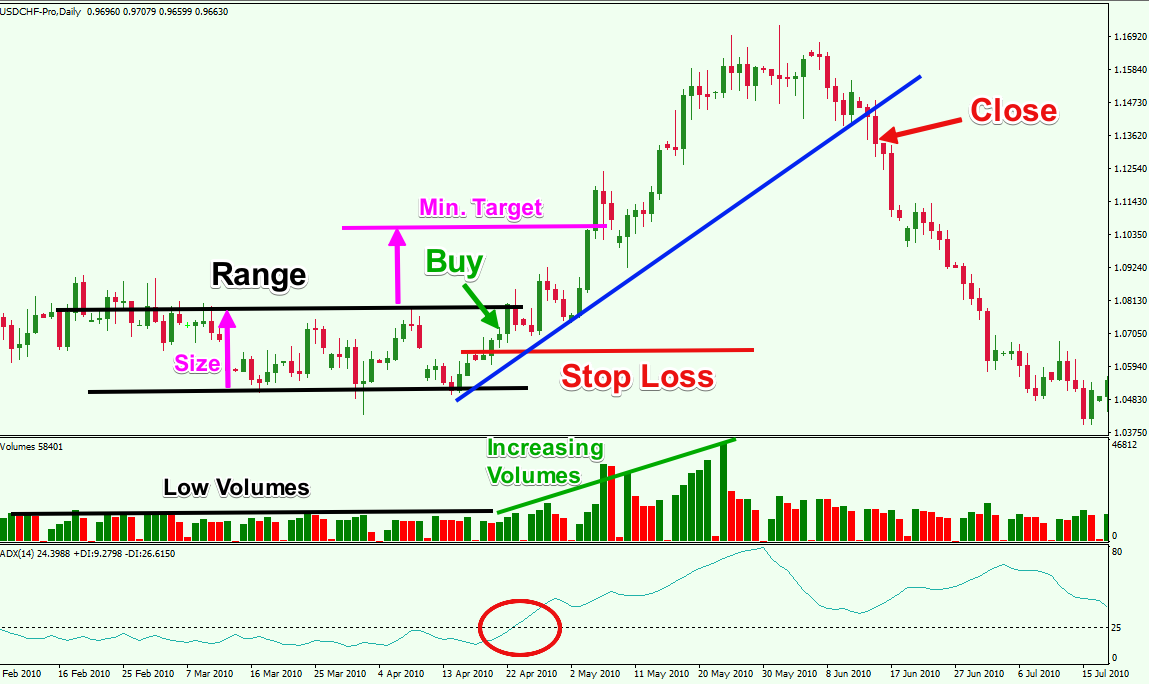

Forex range market ek aisa market hay jis mein currency pair ki qeemt ek specific high price aur low price ke darmiyan upar neeche hoti rahti hay. High price ko resistance level kaha jata hay aur low price ko support level kaha jata hay. Traders in levels ko istamal karke market mein entry aur exit orders place karte hain.

Ranging situation mein kaise

trade ke jate hain?

Ranging situation mein trade karne ke liye kuchh basic strategies ye hain:

Restrictions on trade

Ranging situation mein trade karte waqt kuchh important baatein dhyaan mein rakhni chahiye:

Conclusion

Ranging markets mein trade karna ek profitable experience ho sakta hay. Lekin is ke liye proper planning aur strategy ki zaroorat hoti hay. Traders ko risk management ki importance ko samjhna aur apni trading strategy ko test karna chahiye.

Dosto aaj hum aik ayse strategy par bat karenge jis ke istaal se arwaqt aur savhe analysis kare trading ko mahfooz aur munafa bakhsh bana sakte hai ayye range trading ke bare main detail ke sath bat karte hain

Forex range market kya hay?

Forex range market ek aisa market hay jis mein currency pair ki qeemt ek specific high price aur low price ke darmiyan upar neeche hoti rahti hay. High price ko resistance level kaha jata hay aur low price ko support level kaha jata hay. Traders in levels ko istamal karke market mein entry aur exit orders place karte hain.

Ranging situation mein kaise

trade ke jate hain?

Ranging situation mein trade karne ke liye kuchh basic strategies ye hain:

- Support aur resistance levels ka istamal karen. Jab currency pair ki qeemt resistance level ko chhuti hay to traders market se exit ho jate hain kyunke unhen umeed hoti hay ke qeemt ab niche aye gi. Jab qeemt support level ko chhuti hay to traders market mein entry ho jate hain kyunke unhen umeed hoti hay ke qeemt ab upar jaye gi.

- Bollinger Bands ka istamal karen. Bollinger Bands ek technical indicator hay jo qeemt ki volatility ko measure karta hay. Jab Bollinger Bands contract ho jaate hain to is ka matlab hay ke qeemt range bound ho chuki hay. Is situation mein traders range trading strategies ka istamal kar sakte hain.

- Channel trading ka istamal karen. Channel trading ek range trading strategy hay jismein traders currency pair ki qeemt ke movement ke liye ek channel identify karte hain. Traders channel ke upper aur lower boundaries per entry aur exit orders place karte hain.

Restrictions on trade

Ranging situation mein trade karte waqt kuchh important baatein dhyaan mein rakhni chahiye:

- Risk management ki importance ko samjhen. Ranging markets mein bhi qeemt mein sudden aur sharp movements ho sakte hain. Is liye risk management ki importance ko samjhna aur apne trades ko proper tarike se manage karna zaroori hay.

- Patience rakhen. Ranging markets mein qeemt mein slow aur steady movement hota hay. Is liye traders ko patience rakhni chahiye aur apne trades ko jaldi se close nahin karna chahiye.

- Apni trading strategy ko test karen. Koi bhi trading strategy ko live market mein use karne se pehle demo account per test karna zaroori hay. Is se aap ko apni strategy ki effectiveness ko judge karne mein madad mile gi.

Conclusion

Ranging markets mein trade karna ek profitable experience ho sakta hay. Lekin is ke liye proper planning aur strategy ki zaroorat hoti hay. Traders ko risk management ki importance ko samjhna aur apni trading strategy ko test karna chahiye.

تبصرہ

Расширенный режим Обычный режим