What's the Rectangle chart pattern

Rectangle Chart Pattern (Chakor Chaart Naqsha)

Rectangle Chart Pattern (Chakor Chaart Naqsha)

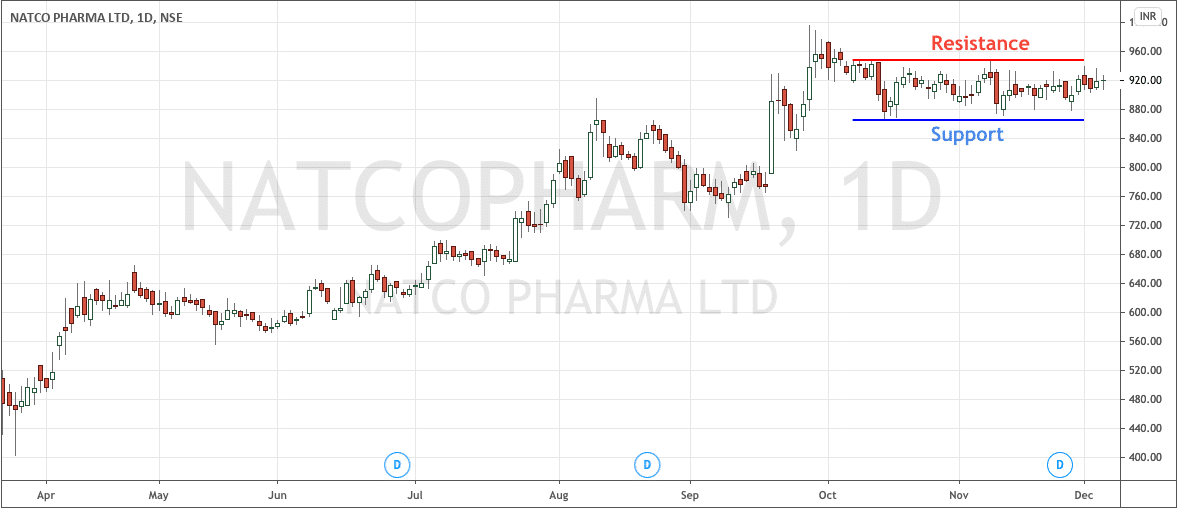

- Mufasil Wazehat: Chakor chart pattern ek sideways trading range ko darust karta hai jahan price mein mazeed izafa ya kami nahi hoti. Yeh pattern typically bullish ya bearish trend ke doran paida hota hai jab price ek mukhtalif stage mein stagnant hoti hai.

- Shuruaati Nishan: Is pattern ki shuruaat mein, volume usually kam hoti hai aur price mein chand pataun ka chakor (rectangle) ban jata hai. Yeh dikhne mein ek flat aur stable trading range ko darust karta hai.

- Mukhtasir Nishan: Chakor chart pattern mein, price bars barabar lambay hote hain aur rectangle ki shakal ikhtiyaar karte hain. Yeh dikhne mein sideways movement ko darust karta hai jahan buyers aur sellers ke darmiyan equilibrium hota hai.

- Tasdiq: Jab price trading range se bahar nikalne ka intezar karta hai, volume ki tezi se iqrar hoti hai. Breakout ke baad, volume mein izafa hota hai jo price direction ki tasdiq karta hai. Agar breakout bullish hai, to volume ki tezi se izafa hota hai jo uptrend ko tasdiq karta hai. Agar breakout bearish hai, to volume ki tezi se izafa hota hai jo downtrend ko tasdiq karta hai.

- Trading Strategy: Chakor chart pattern ke breakout par traders ki strategy hoti hai ke woh price ke movement ki direction ko dekhte hue positions lein. Agar breakout bullish hai, to traders long positions le sakte hain. Agar breakout bearish hai, to traders short positions le sakte hain. Stop-loss aur take-profit levels ko bhi dhyan mein rakha jata hai.

- Muddaton Ka Maamla: Chakor chart pattern ke formation mein muddaton ka maamla hota hai, jisey samajhna traders ke liye zaroori hota hai. Kabhi kabhi trading range kafi lambi muddat tak bani rehti hai aur breakout ka intezar karna traders ko sabr ke sath rehne ki zaroorat hoti hai.

تبصرہ

Расширенный режим Обычный режим