What is Crab Harmonic Pattern:

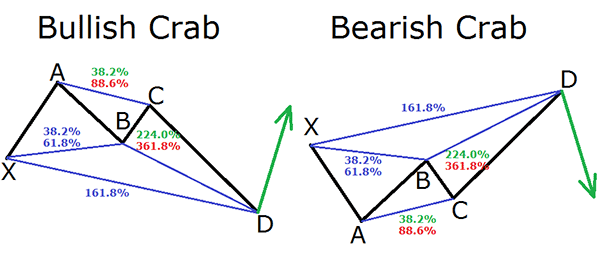

Crab Harmonic patteren aik ulta namona hai jo ghair mulki currency ke bazaar mein mazboot up trained ya down trained ke baad bantaa hai. usay is ki makhsoos saakht ke zariye pehchana jata hai, jis mein paanch allag allag nakat-x, a, b, c, aur d shaamil hain. nuqta x namoonay ke ibtidayi nuqta ki numaindagi karta hai, jis ka mushahida nuqta a par bahao ka istemaal karte hue kya jata hai, jo ibtidayi charge ke ulat jane ki nishandahi karta hai. a se, namona Ansar b par wapas aata hai, jo aam tor par xa ke 0. 618 Fibonacci Retracement degree par hota hai. agla, charge nuqta c par chala jata hai, jis mein namona ab ke 0. 382 se sifar 886 Fibonacci marahil ke darmiyan peechay hatt jata hai. aakhir mein, namona nuqta d par mukammal hota hai, xa ke 1.618 fibonacci tosee par rakha jata hai. Crab Harmonic patteren charge ki simt mein salahiyat ke ulat jane ka mahswara deta hai, jo market ke jazbaat mein tabdeeli ka ishara karta hai.

Fibonacci Relationship with Crab Harmonic Pattern:

Fibonacci tanasub zar e mubadla ki tijarat mein Crab ke Harmonic patteren ka pata laganay aur is ki toseeq karne mein ahem kirdaar ada karte hain. namoonay mein kaleedi Fibonacci taluqaat nuqta b par xa ke sifar. 618 Retracement marhalay aur Ansar d par xa ki 1.618 tosee ki degree par mushtamil hai. yeh Fibonacci darjay kharidaron ko mumkina rasai aur bahar jane ke points paish karte hain, jis se patteren ki sadaqat ki tasdeeq karne mein madad millti hai. mazeed bar-aan, Ansar si par ae bi ke peechay hatnay ke marahil Crab ke namoonay ki Harmonic shakal ki mazeed himayat karte hain. tajir baqaidagi se Fibonacci Retracement aur ka istemaal fees ke tkhminon ka faisla karne aur Crab ke Harmonic patteren ko kharidne aur farokht karte waqt munafe ke maqasid tay karne ke liye karte hain.

Entry and Exit Strategies in Crab Harmonic Pattern:

Crab ke Harmonic patteren ki tijarat karte waqt, tajir point d par bazaar mein daakhil honay ke mawaqay talaash karte hain, jo patteren ka takmeel Ansar hai. yeh degree aam tor par aik mazboot imdaad ya muzahmat ke shobay ke tor par kaam karti hai, jo fees ke rastay mein tabdeeli ke zaroorat se ziyada imkaan ki nishandahi karti hai. tajir taizi walay Crab ke namoonay mein Ansar d par lambi pozishnin aur mandi walay Crab ke namoonay mein mukhtasir pozishnin daal satke hain. khatray par qaboo panay ke liye, nuqsaan se bachao ke order aam tor par nichale ( taweel pozishnon ke liye ) ya point d ke aala ( mukhtasir pozishnon ke liye ) se oopar rakhay jatay hain. munafe ke ahdaaf Fibonacci Retracement ya deegar takneeki ishaaron ke istemaal se muqarrar kiye ja satke hain taakay salahiyat ki sharah ke iqdamaat ka andaza lagaya ja sakay.

Confirmations Tools For The Crab Harmonic Pattern:

Crab ke Harmonic patteren ki ko badhaane ke liye, khredar aksar tasdeeq ke liye izafi takneeki alaat aur nishanaat istemaal karte hain. oscillators jin mein rishta daar taaqat index ( are s aayi ) ya stochastic Oscillator shaamil hain, Crab ke patteren ke zariye diye gaye ulat signal ki madad karte hue, ziyada kharidari ya ziyada farokht honay walay halaat ko muntakhib karne mein madad kar satke hain. tajir salahiyat ke ulat jane ki toseeq karne ke liye mom batii ki chhari ke stayl, fashion strin, ya support / muzahmat ki satah bhi talaash kar satke hain. aik se ziyada tasdeeq ke isharay ko yakja karne se Crab ke Harmonic patteren ka istemaal karte hue kharidari aur farokht ke ikhtiyarat ki durustagi mein izafah ho sakta hai.

Risk Management and Trade With Crab Harmonic Pattern:

Ghair mulki zar e mubadla mein Crab ke Harmonic patteren ko kharidne aur farokht karte waqt muaser mauqa par qaboo paana bohat zaroori hai. taajiron ko sahih rule size par amal karna parta hai, agar market apni position ki taraf barhti hai to salahiyat ke nuqsaan ko mehdood karne ke liye forest all las order dena parta hai. Crab ke namoonay par mabni trading ko injaam dete waqt khatray se inaam ke sazgaar tanasub ko barqarar rakhna zaroori hai, is baat ko yakeeni banatay hue ke salahiyat ki aamdani salahiyat ke nuqsanaat se kahin ziyada hai. mazeed bar-aan, taajiron ko sabr karna chahiye aur tijarat mein anay se pehlay tasdeeq ke ishaaron ka intzaar karna chahiye, qabal az waqt andrajaat ko band karna chahiye jo ghalat ishaaron ka baais ban satke hain. rissk control aur tabdeeli ke nifaz ke liye aik nazam o zabt ke nuqta nazar par amal karte hue, tajir ghair mulki zar e mubadla market ke andar Crab ke Harmonic patteren ka istemaal karkay paish kardah imkanaat ka muaser tareeqay se faida utha satke hain.

Crab Harmonic patteren aik ulta namona hai jo ghair mulki currency ke bazaar mein mazboot up trained ya down trained ke baad bantaa hai. usay is ki makhsoos saakht ke zariye pehchana jata hai, jis mein paanch allag allag nakat-x, a, b, c, aur d shaamil hain. nuqta x namoonay ke ibtidayi nuqta ki numaindagi karta hai, jis ka mushahida nuqta a par bahao ka istemaal karte hue kya jata hai, jo ibtidayi charge ke ulat jane ki nishandahi karta hai. a se, namona Ansar b par wapas aata hai, jo aam tor par xa ke 0. 618 Fibonacci Retracement degree par hota hai. agla, charge nuqta c par chala jata hai, jis mein namona ab ke 0. 382 se sifar 886 Fibonacci marahil ke darmiyan peechay hatt jata hai. aakhir mein, namona nuqta d par mukammal hota hai, xa ke 1.618 fibonacci tosee par rakha jata hai. Crab Harmonic patteren charge ki simt mein salahiyat ke ulat jane ka mahswara deta hai, jo market ke jazbaat mein tabdeeli ka ishara karta hai.

Fibonacci Relationship with Crab Harmonic Pattern:

Fibonacci tanasub zar e mubadla ki tijarat mein Crab ke Harmonic patteren ka pata laganay aur is ki toseeq karne mein ahem kirdaar ada karte hain. namoonay mein kaleedi Fibonacci taluqaat nuqta b par xa ke sifar. 618 Retracement marhalay aur Ansar d par xa ki 1.618 tosee ki degree par mushtamil hai. yeh Fibonacci darjay kharidaron ko mumkina rasai aur bahar jane ke points paish karte hain, jis se patteren ki sadaqat ki tasdeeq karne mein madad millti hai. mazeed bar-aan, Ansar si par ae bi ke peechay hatnay ke marahil Crab ke namoonay ki Harmonic shakal ki mazeed himayat karte hain. tajir baqaidagi se Fibonacci Retracement aur ka istemaal fees ke tkhminon ka faisla karne aur Crab ke Harmonic patteren ko kharidne aur farokht karte waqt munafe ke maqasid tay karne ke liye karte hain.

Entry and Exit Strategies in Crab Harmonic Pattern:

Crab ke Harmonic patteren ki tijarat karte waqt, tajir point d par bazaar mein daakhil honay ke mawaqay talaash karte hain, jo patteren ka takmeel Ansar hai. yeh degree aam tor par aik mazboot imdaad ya muzahmat ke shobay ke tor par kaam karti hai, jo fees ke rastay mein tabdeeli ke zaroorat se ziyada imkaan ki nishandahi karti hai. tajir taizi walay Crab ke namoonay mein Ansar d par lambi pozishnin aur mandi walay Crab ke namoonay mein mukhtasir pozishnin daal satke hain. khatray par qaboo panay ke liye, nuqsaan se bachao ke order aam tor par nichale ( taweel pozishnon ke liye ) ya point d ke aala ( mukhtasir pozishnon ke liye ) se oopar rakhay jatay hain. munafe ke ahdaaf Fibonacci Retracement ya deegar takneeki ishaaron ke istemaal se muqarrar kiye ja satke hain taakay salahiyat ki sharah ke iqdamaat ka andaza lagaya ja sakay.

Confirmations Tools For The Crab Harmonic Pattern:

Crab ke Harmonic patteren ki ko badhaane ke liye, khredar aksar tasdeeq ke liye izafi takneeki alaat aur nishanaat istemaal karte hain. oscillators jin mein rishta daar taaqat index ( are s aayi ) ya stochastic Oscillator shaamil hain, Crab ke patteren ke zariye diye gaye ulat signal ki madad karte hue, ziyada kharidari ya ziyada farokht honay walay halaat ko muntakhib karne mein madad kar satke hain. tajir salahiyat ke ulat jane ki toseeq karne ke liye mom batii ki chhari ke stayl, fashion strin, ya support / muzahmat ki satah bhi talaash kar satke hain. aik se ziyada tasdeeq ke isharay ko yakja karne se Crab ke Harmonic patteren ka istemaal karte hue kharidari aur farokht ke ikhtiyarat ki durustagi mein izafah ho sakta hai.

Risk Management and Trade With Crab Harmonic Pattern:

Ghair mulki zar e mubadla mein Crab ke Harmonic patteren ko kharidne aur farokht karte waqt muaser mauqa par qaboo paana bohat zaroori hai. taajiron ko sahih rule size par amal karna parta hai, agar market apni position ki taraf barhti hai to salahiyat ke nuqsaan ko mehdood karne ke liye forest all las order dena parta hai. Crab ke namoonay par mabni trading ko injaam dete waqt khatray se inaam ke sazgaar tanasub ko barqarar rakhna zaroori hai, is baat ko yakeeni banatay hue ke salahiyat ki aamdani salahiyat ke nuqsanaat se kahin ziyada hai. mazeed bar-aan, taajiron ko sabr karna chahiye aur tijarat mein anay se pehlay tasdeeq ke ishaaron ka intzaar karna chahiye, qabal az waqt andrajaat ko band karna chahiye jo ghalat ishaaron ka baais ban satke hain. rissk control aur tabdeeli ke nifaz ke liye aik nazam o zabt ke nuqta nazar par amal karte hue, tajir ghair mulki zar e mubadla market ke andar Crab ke Harmonic patteren ka istemaal karkay paish kardah imkanaat ka muaser tareeqay se faida utha satke hain.

تبصرہ

Расширенный режим Обычный режим