High Tight Flag Pattern:

1. Introduction (Tanzim):

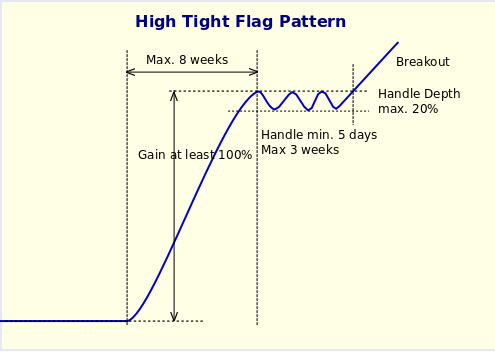

High Tight Flag Pattern ek bullish continuation pattern hai jo uptrend ke doran form hota hai. Yeh pattern indicate karta hai ke market ka trend strong hai aur further upside movement expected hai.

2. Formation (Takhleeq):

High Tight Flag Pattern ek tight consolidation phase ke baad form hota hai. Ismein price ek vertical uptrend ke doran zyada move nahi karta, balki ek tight range mein trade karta hai. Is tight range ko ek flag ki tarah dekha jata hai.

3. Bullish Signal (Dhaleez):

High Tight Flag Pattern ek bullish signal hai. Iska formation indicate karta hai ke market mein buying pressure strong hai aur uptrend continue hone ki possibility hai.

4. Confirmation (Tasdiq):

High Tight Flag Pattern ke signals ko confirm karne ke liye, traders doosre technical indicators ya price action signals ko dekhte hain. Confirm hone ke baad hi traders apne positions ko adjust karte hain.

5. Entry aur Exit Points (Dakhil aur Baahar Nikalne ke Nukaat):

High Tight Flag Pattern ko istemal karke, traders market mein entry aur exit points ko determine karte hain. Agar bullish continuation signal milta hai, to traders uptrend ke doran long positions enter kar sakte hain.

6. Risk aur Reward (Khatra aur Inaam):

High Tight Flag Pattern ke signals ko istemal karte hue, traders apne positions ke liye risk aur reward ko consider karte hain. Stop-loss aur profit targets ko set karke, wo apne trades ko manage karte hain.

7. Market Observation aur Practice (Market Ki Nigaarish aur Mashq):

High Tight Flag Pattern ko effectively istemal karne ke liye, traders ko regular market observation aur practice ki zarurat hoti hai. Iske saath hi, patience aur discipline bhi maintain karna zaruri hai taki sahi waqt par sahi trading decisions liye ja sakein.

1. Introduction (Tanzim):

High Tight Flag Pattern ek bullish continuation pattern hai jo uptrend ke doran form hota hai. Yeh pattern indicate karta hai ke market ka trend strong hai aur further upside movement expected hai.

2. Formation (Takhleeq):

High Tight Flag Pattern ek tight consolidation phase ke baad form hota hai. Ismein price ek vertical uptrend ke doran zyada move nahi karta, balki ek tight range mein trade karta hai. Is tight range ko ek flag ki tarah dekha jata hai.

3. Bullish Signal (Dhaleez):

High Tight Flag Pattern ek bullish signal hai. Iska formation indicate karta hai ke market mein buying pressure strong hai aur uptrend continue hone ki possibility hai.

4. Confirmation (Tasdiq):

High Tight Flag Pattern ke signals ko confirm karne ke liye, traders doosre technical indicators ya price action signals ko dekhte hain. Confirm hone ke baad hi traders apne positions ko adjust karte hain.

5. Entry aur Exit Points (Dakhil aur Baahar Nikalne ke Nukaat):

High Tight Flag Pattern ko istemal karke, traders market mein entry aur exit points ko determine karte hain. Agar bullish continuation signal milta hai, to traders uptrend ke doran long positions enter kar sakte hain.

6. Risk aur Reward (Khatra aur Inaam):

High Tight Flag Pattern ke signals ko istemal karte hue, traders apne positions ke liye risk aur reward ko consider karte hain. Stop-loss aur profit targets ko set karke, wo apne trades ko manage karte hain.

7. Market Observation aur Practice (Market Ki Nigaarish aur Mashq):

High Tight Flag Pattern ko effectively istemal karne ke liye, traders ko regular market observation aur practice ki zarurat hoti hai. Iske saath hi, patience aur discipline bhi maintain karna zaruri hai taki sahi waqt par sahi trading decisions liye ja sakein.

تبصرہ

Расширенный режим Обычный режим