What is Pin Bar Pattern:

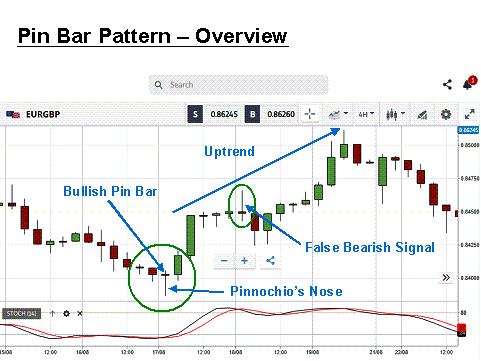

Pin Bar patteren aik mashhoor reversal candle stick patteren hai jisay ghair mulki currency ke sarmaya car market mein ahliat ke dakhlay aur bahar niklny ke maqamat ko daryaft karne ke liye istemaal karte hain. Pin Bar ki khasusiyat aik lambi wake, artiel aur aik chhota sa frame hota hai. dam sharah ko mustard karne ki numaindagi karti hai aur bazaar ke jazbaat mein wasee tabdeeli ko zahir karti hai. up trained mein, aik bearish Pin Bar kharabi ki salahiyat ke ulat jane ka ishara day sakta hai, jabkay down trained mein, aik blush Pin Bar ulat jane ke mumkina ulat honay ki nishandahi kar sakta hai. tajir Pin Bar patteren ka istemaal market place ke ulat palat ki tawaqqa karne aur is fees ki naqal o harkat ke nishaan ki bunyaad par bakhabar kharidari aur farokht ke faislay karne ke liye karte hain.

Anatomy of Pin Bar Pattern:

Pin Bar ko kamyabi se chunnay ke liye, khredar mom batii ki chhari ki tashkeel ke andar ain khususiyaat talaash karna chahtay hain. Pin Bar mein aik lambi wake hoti hai jo poooray mom batii ke frame ki muddat ka kam az kam aik tahai hai. wake mom batii ke aik pehlu se, oopar ya neechay dono taraf se nikalti hai, jo is satah par sharah ke mazboot radd ki nishandahi karti hai. Pin Bar ka frame aam tor par chhota hota hai, jo wake ke dosray pehlu par rakha jata hai. tajir signal ki taaqat ka taayun karne ke liye wake ki muddat aur rastay ke ilawa qeemat ke dhanchay ke andar Pin Bar ki jagah par taqreeban sood ada karte hain.

Trading Pin Bar Pattern:

Forex market mein jaankaari walay intikhab karne ke liye mutadid trading tareeqon mein Pin Bar istemaal kiye ja satke hain. aik aam tareeqa yeh hai ke kaleedi madad ya muzahmat ki satah par shakal dainay ke liye Pin Bar ka intzaar kya jaye, jo salahiyat ke ulat jane ki nishandahi karta hai. tajir Pin Bar ki dam ke samnay walay course ke andar exchange mein daakhil ho satke hain, mutabadil rastay par inhisaar karte hue Pin Bar high ya lo ke oopar ya is ke neechay nuqsaan se bachao ke order tarteeb day satke hain. aik aur tareeqa yeh hai ke rujhan ke ulat jane ki tasdeeq ke liye qitaar mein aik se ziyada Pin Bar lagayen, jisay Pin Bar kmbo set up kaha jata hai. Pin Bar ko mukhtalif takneeki isharay ya chart ke namonon ke sath jor kar, sarmaya car apni kharidari aur farokht ke intabahat mein barha satke hain aur apni aam tijarti karkardagi ko behtar bana satke hain.

Risk Management and Pin Bar Pattern:

Agarchay Pin Bar market ke ulat palat ke baray mein qeemti baseerat faraham kar satke hain, lekin sarmaya karon ke liye yeh bohat zaroori hai ke woh is namoonay ko –apne tijarti tareeqa car mein shaamil karte hue khatray ke intizam ki sahih technical ka itlaq karen. Pin Bar high ya lo ki bunyaad par stop las orders ka taayun market ke mutawaqqa ulat palat ki taraf bherne ki soorat mein pabandi ki salahiyat ke nuqsanaat mein madad kar sakta hai. taajiron ko market ke majmoi sayaq o Sabaq par bhi ghhor karna chahiye, Bashmole rujhan ki simt aur kaleedi muawnat / muzahmat ke marahil, taakay jeetnay walay market ke jazbaat ke khilaaf tijarat se bacha ja sakay. mauqa se kamyabi ke sath nimatnay aur –apne tijarti nuqta nazar ke tadeebi honay se, khredar munafe bakhash tijarat peda karne ke liye Pin Bar patteren ki salahiyat ko ziyada se ziyada barha satke hain.

Limitations of Pin Bar Pattern:

Mom batii ki chhari ka aik maqbool namona honay ke bawajood, Pin Bar be aib nahi hotay aur baaz auqaat jaali intabahat peda kar satke hain. taajiron ko –apne khareed o farokht ke intikhab ke liye mukammal tor par Pin Bar par inhisaar karte waqt mohtaat rehna chahiye aur deegar takneeki tshkhisi alaat ke sath un ke istemaal ko zehen mein rakhna chahiye. bazaar ke halaat, maloomat ki sargarmia, aur maliyati haqayiq bhi Pin Baraz ki taseer ko mutasir kar satke hain, jis ki wajah se herat angaiz charge harkat hoti hai. sarmaya karon ke liye yeh bohat zaroori hai ke woh aam tor par market ke wasee tar mahol ke tanazur mein Pin Bar isharay ki sadaqat ki tehqiqaat karen aur bdalty hue halaat ke mutabiq dhaalne ke liye apni khareed o farokht ki hikmat e amli ko munazzam karen.

Pin Bar patteren aik mashhoor reversal candle stick patteren hai jisay ghair mulki currency ke sarmaya car market mein ahliat ke dakhlay aur bahar niklny ke maqamat ko daryaft karne ke liye istemaal karte hain. Pin Bar ki khasusiyat aik lambi wake, artiel aur aik chhota sa frame hota hai. dam sharah ko mustard karne ki numaindagi karti hai aur bazaar ke jazbaat mein wasee tabdeeli ko zahir karti hai. up trained mein, aik bearish Pin Bar kharabi ki salahiyat ke ulat jane ka ishara day sakta hai, jabkay down trained mein, aik blush Pin Bar ulat jane ke mumkina ulat honay ki nishandahi kar sakta hai. tajir Pin Bar patteren ka istemaal market place ke ulat palat ki tawaqqa karne aur is fees ki naqal o harkat ke nishaan ki bunyaad par bakhabar kharidari aur farokht ke faislay karne ke liye karte hain.

Anatomy of Pin Bar Pattern:

Pin Bar ko kamyabi se chunnay ke liye, khredar mom batii ki chhari ki tashkeel ke andar ain khususiyaat talaash karna chahtay hain. Pin Bar mein aik lambi wake hoti hai jo poooray mom batii ke frame ki muddat ka kam az kam aik tahai hai. wake mom batii ke aik pehlu se, oopar ya neechay dono taraf se nikalti hai, jo is satah par sharah ke mazboot radd ki nishandahi karti hai. Pin Bar ka frame aam tor par chhota hota hai, jo wake ke dosray pehlu par rakha jata hai. tajir signal ki taaqat ka taayun karne ke liye wake ki muddat aur rastay ke ilawa qeemat ke dhanchay ke andar Pin Bar ki jagah par taqreeban sood ada karte hain.

Trading Pin Bar Pattern:

Forex market mein jaankaari walay intikhab karne ke liye mutadid trading tareeqon mein Pin Bar istemaal kiye ja satke hain. aik aam tareeqa yeh hai ke kaleedi madad ya muzahmat ki satah par shakal dainay ke liye Pin Bar ka intzaar kya jaye, jo salahiyat ke ulat jane ki nishandahi karta hai. tajir Pin Bar ki dam ke samnay walay course ke andar exchange mein daakhil ho satke hain, mutabadil rastay par inhisaar karte hue Pin Bar high ya lo ke oopar ya is ke neechay nuqsaan se bachao ke order tarteeb day satke hain. aik aur tareeqa yeh hai ke rujhan ke ulat jane ki tasdeeq ke liye qitaar mein aik se ziyada Pin Bar lagayen, jisay Pin Bar kmbo set up kaha jata hai. Pin Bar ko mukhtalif takneeki isharay ya chart ke namonon ke sath jor kar, sarmaya car apni kharidari aur farokht ke intabahat mein barha satke hain aur apni aam tijarti karkardagi ko behtar bana satke hain.

Risk Management and Pin Bar Pattern:

Agarchay Pin Bar market ke ulat palat ke baray mein qeemti baseerat faraham kar satke hain, lekin sarmaya karon ke liye yeh bohat zaroori hai ke woh is namoonay ko –apne tijarti tareeqa car mein shaamil karte hue khatray ke intizam ki sahih technical ka itlaq karen. Pin Bar high ya lo ki bunyaad par stop las orders ka taayun market ke mutawaqqa ulat palat ki taraf bherne ki soorat mein pabandi ki salahiyat ke nuqsanaat mein madad kar sakta hai. taajiron ko market ke majmoi sayaq o Sabaq par bhi ghhor karna chahiye, Bashmole rujhan ki simt aur kaleedi muawnat / muzahmat ke marahil, taakay jeetnay walay market ke jazbaat ke khilaaf tijarat se bacha ja sakay. mauqa se kamyabi ke sath nimatnay aur –apne tijarti nuqta nazar ke tadeebi honay se, khredar munafe bakhash tijarat peda karne ke liye Pin Bar patteren ki salahiyat ko ziyada se ziyada barha satke hain.

Limitations of Pin Bar Pattern:

Mom batii ki chhari ka aik maqbool namona honay ke bawajood, Pin Bar be aib nahi hotay aur baaz auqaat jaali intabahat peda kar satke hain. taajiron ko –apne khareed o farokht ke intikhab ke liye mukammal tor par Pin Bar par inhisaar karte waqt mohtaat rehna chahiye aur deegar takneeki tshkhisi alaat ke sath un ke istemaal ko zehen mein rakhna chahiye. bazaar ke halaat, maloomat ki sargarmia, aur maliyati haqayiq bhi Pin Baraz ki taseer ko mutasir kar satke hain, jis ki wajah se herat angaiz charge harkat hoti hai. sarmaya karon ke liye yeh bohat zaroori hai ke woh aam tor par market ke wasee tar mahol ke tanazur mein Pin Bar isharay ki sadaqat ki tehqiqaat karen aur bdalty hue halaat ke mutabiq dhaalne ke liye apni khareed o farokht ki hikmat e amli ko munazzam karen.

تبصرہ

Расширенный режим Обычный режим