What is Bat Harmonic Pattern:

Bat harmonic patteren zar e mubadla mein aik mashhoor tijarti namona hai jo salahiyat fashion ke ulat palat ko samajhney ke liye istemaal hota hai. yeh Gartley ke namoonay ka aik version hai aur is ke munfarid mathematician tanasub ke liye socha jata hai jo salahiyat ke ulat ilaqon ki wazahat karta hai. is namoonay mein paanch awamil shaamil hai x, a, b, c, aur d-or yeh ibtidayi impulse harkat ke peechay hatnay se tashkeel paata hai. tajir namoonay ki sadaqat ki tasdeeq ke liye un awamil mein se makhsoos Fibonacci tanasub talaash karte hain.

Characteristics of Bat Harmonic Pattern:

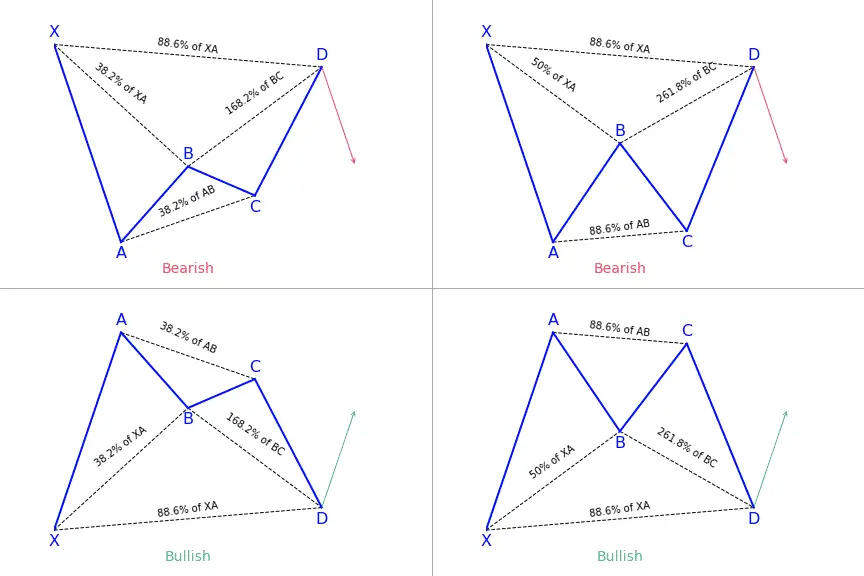

Bat harmonic patteren ki khasusiyat ain mutabiq Fibonacci tanasub hai jo market mein mumkina rasai aur bahar niklny ke maqamat ko muntakhib karne mein madad karta hai. dekhnay ke liye kaleedi tanasub mein x ae retracement, ae bi league extension, bi si retracement aur si d league extension shaamil hain. yeh tanasub kharidaron ko salahiyat ki ulat sah mahi ka faisla karne mein madad karte hain jahan sharah tijarat ke rastay ka imkaan hai. mazeed bar-aan, namoonay mein aam tor par butterfly ki aik allag shakal hoti hai, jis mein Ansar d x ae ke 88. 6? Fibonacci retracement ke qareeb hota hai.

Trading With Bat Harmonic Pattern:

Bat harmonic patteren ki tijarat karte waqt, tajir aam tor par bazaar mein jane ke liye tasdeeq ke isharay talaash karte hain. is mein namoonay ke sath saf bandi karne wali deegar takneeki alamtain shaamil ho sakti hain, jin mein momentum oscalter ya candle stick style shaamil hain. dakhlay ke awamil aam tor par Ansar d ke qareeb hotay hain, jis mein stop las ke order taaza tareen soyng high ya lo se bilkul agay hotay hain. ahdaaf aksar fibonacci tosee darjay maazi Ansar d, Bashmole 38. 2 %, 50 %, ya 61. eight % tosee par muqarrar kar rahay hain.

Importance Mistak when trading Bat Harmonic Pattern:

Bat harmonic patteren ki tijarat karte waqt aik ghair mamooli ghalti tasdeeq ke intabahat ko dekhe baghair tijarat mein aana hai. taajiron ko mutasirah shakhs honay ki zaroorat hai aur bazaar mein anay se pehlay patteren ki toseeq karne ke liye karwai ki darja bandi karne ke liye tayyar hain. aik aur ghalti yeh hai ke rasai ke maqam ke qareeb bhi stop las order dena hai, jis ki wajah se pehlay hi usay rokkk diya ja sakta hai. khatray se muaser tareeqay se nimatnay ke bawajood sanat ko saans lainay ke liye kaafi gunjaish faraham karna zaroori hai.

Combining Bat Harmonic Pattern with other technical analysis:

Bat harmonic patteren kharidne aur farokht karne ki taseer ko sajanay ke liye, khredar usay baqaidagi se mukhtalif takneeki tajzia ki technique ke sath marboot karte hain. is mein trained lines, guide aur muzahmat ki degreeian, shifting average ya hajam ki tashkhees shaamil ho sakti hai. aik se ziyada tools aur ishaaron ko shaamil karkay, sarmaya car kamyaab tijarat ke mawaqay ko barha satke hain aur ghalat ishaaron ke imkanaat ko kam kar satke hain. –apne tijarti andaaz ke liye behtareen hikmat e amli talaash karne ke liye ghair mamooli hikmat amlyon par amal karna aur un ki jaanch karna bohat zaroori hai.

image widget

Bat harmonic patteren zar e mubadla mein aik mashhoor tijarti namona hai jo salahiyat fashion ke ulat palat ko samajhney ke liye istemaal hota hai. yeh Gartley ke namoonay ka aik version hai aur is ke munfarid mathematician tanasub ke liye socha jata hai jo salahiyat ke ulat ilaqon ki wazahat karta hai. is namoonay mein paanch awamil shaamil hai x, a, b, c, aur d-or yeh ibtidayi impulse harkat ke peechay hatnay se tashkeel paata hai. tajir namoonay ki sadaqat ki tasdeeq ke liye un awamil mein se makhsoos Fibonacci tanasub talaash karte hain.

Characteristics of Bat Harmonic Pattern:

Bat harmonic patteren ki khasusiyat ain mutabiq Fibonacci tanasub hai jo market mein mumkina rasai aur bahar niklny ke maqamat ko muntakhib karne mein madad karta hai. dekhnay ke liye kaleedi tanasub mein x ae retracement, ae bi league extension, bi si retracement aur si d league extension shaamil hain. yeh tanasub kharidaron ko salahiyat ki ulat sah mahi ka faisla karne mein madad karte hain jahan sharah tijarat ke rastay ka imkaan hai. mazeed bar-aan, namoonay mein aam tor par butterfly ki aik allag shakal hoti hai, jis mein Ansar d x ae ke 88. 6? Fibonacci retracement ke qareeb hota hai.

Trading With Bat Harmonic Pattern:

Bat harmonic patteren ki tijarat karte waqt, tajir aam tor par bazaar mein jane ke liye tasdeeq ke isharay talaash karte hain. is mein namoonay ke sath saf bandi karne wali deegar takneeki alamtain shaamil ho sakti hain, jin mein momentum oscalter ya candle stick style shaamil hain. dakhlay ke awamil aam tor par Ansar d ke qareeb hotay hain, jis mein stop las ke order taaza tareen soyng high ya lo se bilkul agay hotay hain. ahdaaf aksar fibonacci tosee darjay maazi Ansar d, Bashmole 38. 2 %, 50 %, ya 61. eight % tosee par muqarrar kar rahay hain.

Importance Mistak when trading Bat Harmonic Pattern:

Bat harmonic patteren ki tijarat karte waqt aik ghair mamooli ghalti tasdeeq ke intabahat ko dekhe baghair tijarat mein aana hai. taajiron ko mutasirah shakhs honay ki zaroorat hai aur bazaar mein anay se pehlay patteren ki toseeq karne ke liye karwai ki darja bandi karne ke liye tayyar hain. aik aur ghalti yeh hai ke rasai ke maqam ke qareeb bhi stop las order dena hai, jis ki wajah se pehlay hi usay rokkk diya ja sakta hai. khatray se muaser tareeqay se nimatnay ke bawajood sanat ko saans lainay ke liye kaafi gunjaish faraham karna zaroori hai.

Combining Bat Harmonic Pattern with other technical analysis:

Bat harmonic patteren kharidne aur farokht karne ki taseer ko sajanay ke liye, khredar usay baqaidagi se mukhtalif takneeki tajzia ki technique ke sath marboot karte hain. is mein trained lines, guide aur muzahmat ki degreeian, shifting average ya hajam ki tashkhees shaamil ho sakti hai. aik se ziyada tools aur ishaaron ko shaamil karkay, sarmaya car kamyaab tijarat ke mawaqay ko barha satke hain aur ghalat ishaaron ke imkanaat ko kam kar satke hain. –apne tijarti andaaz ke liye behtareen hikmat e amli talaash karne ke liye ghair mamooli hikmat amlyon par amal karna aur un ki jaanch karna bohat zaroori hai.

image widget

تبصرہ

Расширенный режим Обычный режим