trading ek aise shobha hai jo duniya bhar mein logon ko apni taraf khinchta hai. Yeh ek azeem mauqa hai jahan aap apne paisay ko istemal kar ke mukhtalif currencies ke darmiyan tabdeel kar sakte hain aur munafa haasil kar sakte hain. Forex market ki dynamic nature ki wajah se, yeh ek shobha hai jo hamesha badalte rehti hai aur ismein kamiyabi haasil karne ke liye tajurba aur strategy ki zarurat hoti hai.

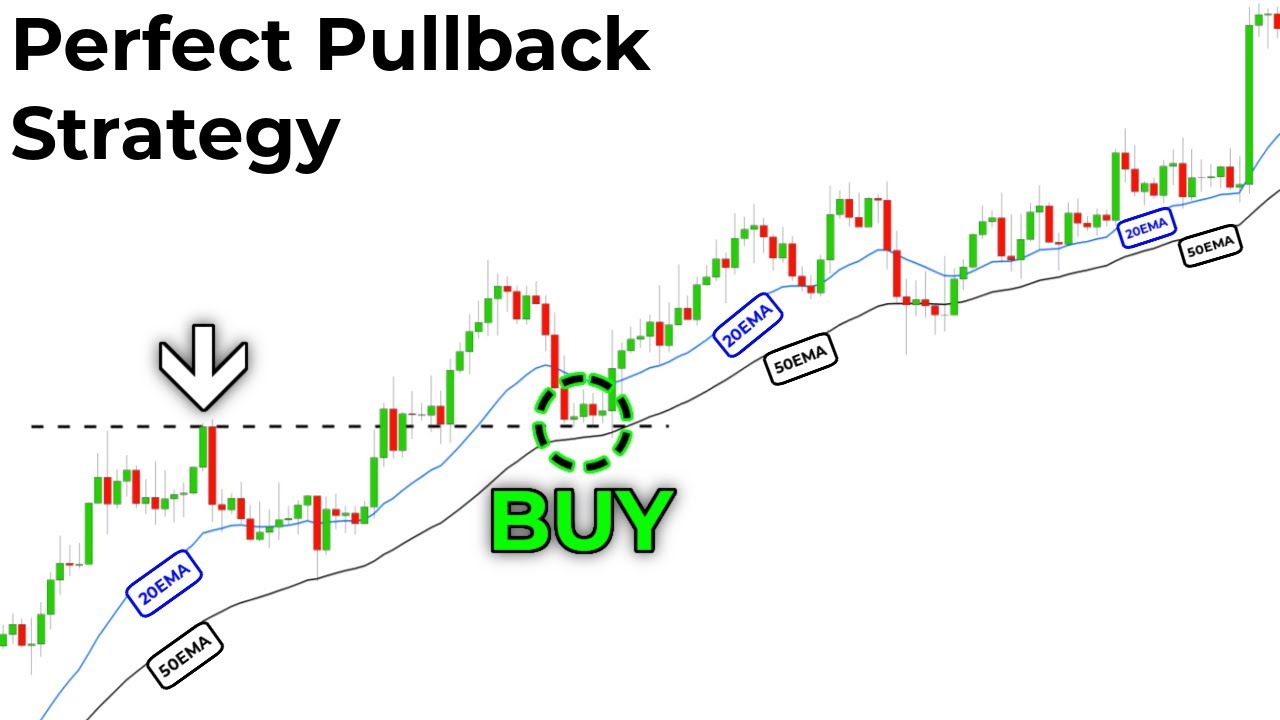

Forex trading mein mukhtalif tareeqay istemal kiye jaate hain, jin mein se ek popular tareeqa "pullback strategy" hai. Is article mein, hum is strategy ko tafseel se tajziya karenge aur samjhenge ke yeh kis tarah kaam karta hai aur kis tarah se isay istemal kiya ja sakta hai.

Pullback Strategy Kya Hai?

Pullback strategy ek trading technique hai jo trend-based trading par mabni hai. Is strategy mein, trader trend ke mukhalif direction mein thori dair ke liye movement ko dekhta hai, jo ke ek temporary reversal hoti hai, phir woh trend ke direction mein wapas entry leta hai.

Yeh strategy traders ko trend ke saath trading karne ka mauqa deta hai jab woh market ke momentum ko samajhne mein kamiyab nahi hote. Iske alawa, yeh strategy risk ko minimize karne mein bhi madadgar hoti hai, kyun ke traders sirf trend ke mukhalif direction mein entry lete hain jab temporary reversal dekha jata hai.

Pullback Strategy ke Fawaid

Pullback strategy ka istemal karne ke kuch fawaid hain jo isay traders ke liye attractive banate hain:

Pullback Strategy ke Tareeqay

Pullback strategy ko implement karne ke liye, traders ko kuch asoolon ka khayal rakhna zaroori hai. Yeh kuch aham tareeqay hain jo traders ko is strategy ko sahi tareeqay se istemal karne mein madad dete hain:

Pullback Strategy ka Amal

Pullback strategy ka amal aksar mukhtalif steps par mabni hota hai. Yeh kuch aam steps hain jo traders pullback strategy ko amal mein laate hain:

Pullback Strategy ke Challenges

Pullback strategy ka istemal karte waqt, kuch challenges bhi ho sakte hain jo traders ko samajhna zaroori hai:

Forex trading mein mukhtalif tareeqay istemal kiye jaate hain, jin mein se ek popular tareeqa "pullback strategy" hai. Is article mein, hum is strategy ko tafseel se tajziya karenge aur samjhenge ke yeh kis tarah kaam karta hai aur kis tarah se isay istemal kiya ja sakta hai.

Pullback Strategy Kya Hai?

Pullback strategy ek trading technique hai jo trend-based trading par mabni hai. Is strategy mein, trader trend ke mukhalif direction mein thori dair ke liye movement ko dekhta hai, jo ke ek temporary reversal hoti hai, phir woh trend ke direction mein wapas entry leta hai.

Yeh strategy traders ko trend ke saath trading karne ka mauqa deta hai jab woh market ke momentum ko samajhne mein kamiyab nahi hote. Iske alawa, yeh strategy risk ko minimize karne mein bhi madadgar hoti hai, kyun ke traders sirf trend ke mukhalif direction mein entry lete hain jab temporary reversal dekha jata hai.

Pullback Strategy ke Fawaid

Pullback strategy ka istemal karne ke kuch fawaid hain jo isay traders ke liye attractive banate hain:

- Trend ke Sath Trading: Pullback strategy traders ko trend ke sath trading karne ka mauqa deti hai, jo ke zyada tar traders ke liye munasib hota hai kyunki trend mein trading karna aksar zyada munafa bakhsh hota hai.

- Risk Management: Is strategy mein, traders apne stop loss orders ko tight rakh sakte hain, jo ke risk ko minimize karne mein madadgar hota hai.

- Entry Points: Pullback strategy traders ko munasib entry points faraham karti hai jab temporary reversal hoti hai, jo ke unhe munafa haasil karne ka zyada faida pohunchata hai.

- Flexibility: Yeh strategy versatile hoti hai aur alag-alag timeframes par istemal ki ja sakti hai, jo ke traders ko market ki changing conditions ke mutabiq adjust karne mein madad deti hai.

Pullback Strategy ke Tareeqay

Pullback strategy ko implement karne ke liye, traders ko kuch asoolon ka khayal rakhna zaroori hai. Yeh kuch aham tareeqay hain jo traders ko is strategy ko sahi tareeqay se istemal karne mein madad dete hain:

- Trend Identification: Sab se pehle, traders ko trend ko identify karna zaroori hai. Trend ki direction ko samajhne ke liye, traders technical indicators jaise ke moving averages aur trend lines ka istemal karte hain.

- Pullback Ki Talaash: Trend identify karne ke baad, traders ko pullback ya temporary reversal ka pata lagana hota hai. Iske liye, traders price action aur oscillators jaise ke RSI (Relative Strength Index) ka istemal karte hain.

- Entry Point Ka Intekhab: Pullback ko identify karne ke baad, traders ko munasib entry point ka intekhab karna hota hai. Yeh entry point market ke momentum aur trend ke mutabiq tajwez kiya jata hai.

- Risk Management: Har trading strategy mein risk management ka ahem kirdar hota hai. Pullback strategy mein bhi, traders ko apne stop loss orders ko properly set karna chahiye taake nuqsaan ko minimize kiya ja sake.

Pullback Strategy ka Amal

Pullback strategy ka amal aksar mukhtalif steps par mabni hota hai. Yeh kuch aam steps hain jo traders pullback strategy ko amal mein laate hain:

- Trend Ki Tafteesh: Sab se pehle, traders trend ko identify karte hain, jo ke aksar technical indicators aur price action analysis ki madad se ki jati hai.

- Pullback Ka Intekhab: Phir traders pullback ka intekhab karte hain, jo ke temporary reversal hoti hai. Isko identify karne ke liye, traders price action aur oscillators ka istemal karte hain.

- Entry Point Ka Intekhab: Pullback ko identify karne ke baad, traders ko munasib entry point ka intekhab karna hota hai. Yeh entry point market ke momentum aur trend ke mutabiq tajwez kiya jata hai.

- Stop Loss aur Target Levels Ka Tiyar Karna: Har trading strategy mein risk management ka ahem kirdar hota hai. Pullback strategy mein bhi, traders ko apne stop loss aur target levels ko tiyar karna zaroori hai taake nuqsaan ko minimize kiya ja sake aur munafa haasil kiya ja sake.

Pullback Strategy ke Challenges

Pullback strategy ka istemal karte waqt, kuch challenges bhi ho sakte hain jo traders ko samajhna zaroori hai:

- False Signals: Pullback strategy mein, false signals ya ghalat entry points ka samna karna aksar hota hai, jo ke traders ko nuqsaan mein daal sakta hai.

- Timing: Pullback ka sahi waqt ka intekhab karna zaroori hai, jo ke traders ke liye mushkil ho sakta hai. Galat timing pullback strategy ko nakam bana sakti hai.

- Risk Management: Agar traders apne stop loss aur target levels ko sahi tareeqay se set nahi karte, toh yeh unke liye nuqsaan deh ho sakta hai.

- Market Volatility: Market ki tabdeeliyon aur volatility ke darmiyan, pullback strategy kaam karne mein mushkilat peda ho sakti

تبصرہ

Расширенный режим Обычный режим