Forex trading ek bohot hi dilchasp lekin samaji aur aqalmandi se bhari hui duniya hai. Is mein traders apne paisay laga kar mukhtalif currencies ke dar mein tabdeeliyon ka faida uthate hain. Lekin yeh faida hasil karna asaan nahi hota, aur har trader ko apni strategies ko behtar banane ke liye mukhtalif tools aur concepts ka istemal karna zaroori hota hai.

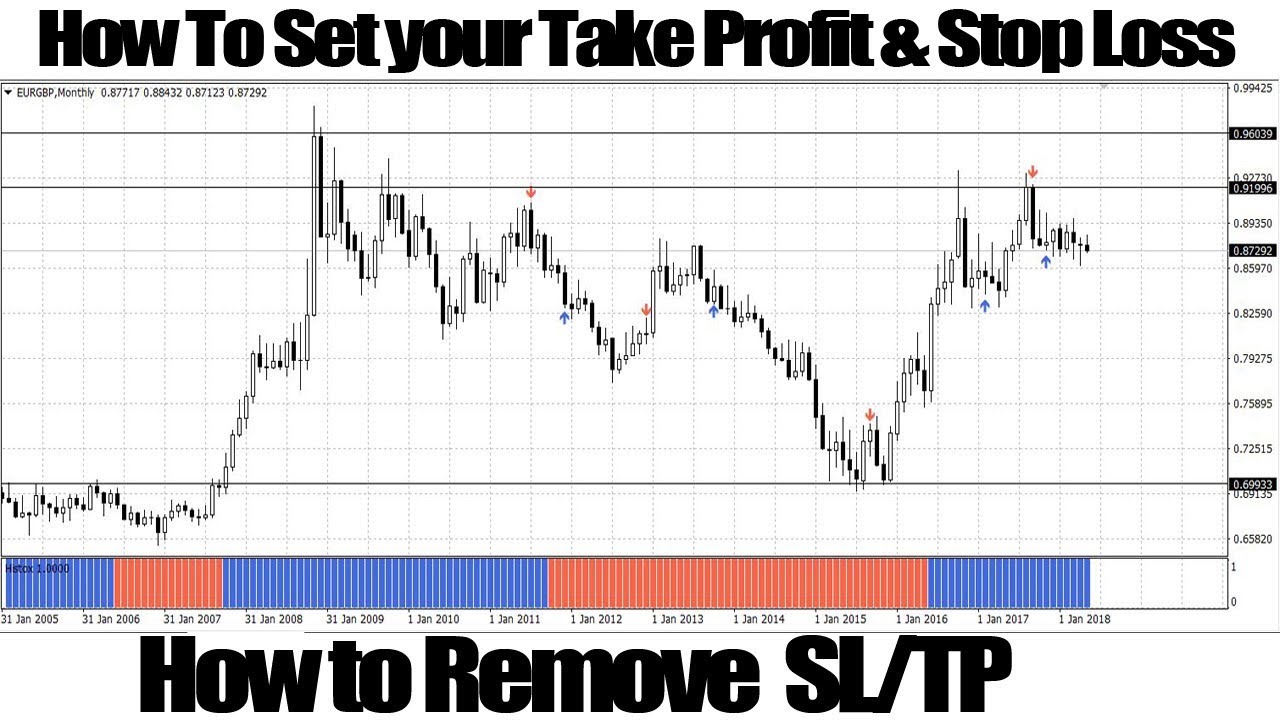

Aik aham concept jo har forex trader ko samajhna chahiye hai, woh hai "stop loss" aur "take profit." In dono concepts ke istemal se traders apne trades ko control kar sakte hain aur nuqsaan se bach sakte hain, sath hi munafa bhi hasil kar sakte hain.

Stop Loss Kya Hai?

Stop loss ek tarah ka risk management tool hai jo traders istemal karte hain apne trades ko nuqsaan se bachane ke liye. Jab trader kisi currency pair mein trade karta hai, to woh apne entry point ke qareeb ek stop loss level set karta hai. Agar trade us level tak pohanch jaye jahan stop loss set hai, to trade automatically band ho jati hai aur nuqsaan ko minimize karne mein madad milti hai.

Stop loss ka maqsad yeh hai ke agar trade ghalti se chalay, ya market ka trend trader ke khilaf ho jaye, to nuqsaan ko control mein rakha ja sake. Is tarah se, stop loss traders ko emotion se trading karne se bachata hai aur unhein trading plan ke andar rehne mein madad deta hai.

Take Profit Kya Hai?

Take profit bhi ek important concept hai forex trading mein. Jab trader kisi currency pair mein trade karta hai, to woh apne target level tak pohanchne ke liye ek take profit level set karta hai. Jab market us level tak pohanch jata hai, to trade automatically band ho jati hai aur trader ko munafa hasil hota hai.

Take profit ka maqsad yeh hai ke traders ko apne munafa ko secure karne mein madad milti hai. Iske baghair, traders ko market ke fluctuations aur emotions ke asar mein aakar munafa gawara karna mushkil ho jata hai.

Stop Loss aur Take Profit Ka Istemal Kaise Kiya Jaye?

Stop loss aur take profit levels ko set karte waqt, traders ko market ki volatality, trading strategy, aur personal risk tolerance ko mad-e-nazar rakhte hue amal karna chahiye. Yeh kuch important points hain jo traders ko in levels ko set karte waqt madad karte hain:

Conclusion

Forex trading mein stop loss aur take profit levels ka istemal karna zaroori hai takay traders apne trades ko control mein rakhein aur nuqsaan se bach sakein, sath hi munafa bhi hasil kar sakein. In levels ko set karte waqt, traders ko market analysis aur risk management ke principles ko mad-e-nazar rakhte hue amal karna chahiye. Is tarah se, stop loss aur take profit traders ko consistency aur discipline ke sath trading karne mein madad deta hai, jo ke ek successful trader ke liye zaroori hai.

Aik aham concept jo har forex trader ko samajhna chahiye hai, woh hai "stop loss" aur "take profit." In dono concepts ke istemal se traders apne trades ko control kar sakte hain aur nuqsaan se bach sakte hain, sath hi munafa bhi hasil kar sakte hain.

Stop Loss Kya Hai?

Stop loss ek tarah ka risk management tool hai jo traders istemal karte hain apne trades ko nuqsaan se bachane ke liye. Jab trader kisi currency pair mein trade karta hai, to woh apne entry point ke qareeb ek stop loss level set karta hai. Agar trade us level tak pohanch jaye jahan stop loss set hai, to trade automatically band ho jati hai aur nuqsaan ko minimize karne mein madad milti hai.

Stop loss ka maqsad yeh hai ke agar trade ghalti se chalay, ya market ka trend trader ke khilaf ho jaye, to nuqsaan ko control mein rakha ja sake. Is tarah se, stop loss traders ko emotion se trading karne se bachata hai aur unhein trading plan ke andar rehne mein madad deta hai.

Take Profit Kya Hai?

Take profit bhi ek important concept hai forex trading mein. Jab trader kisi currency pair mein trade karta hai, to woh apne target level tak pohanchne ke liye ek take profit level set karta hai. Jab market us level tak pohanch jata hai, to trade automatically band ho jati hai aur trader ko munafa hasil hota hai.

Take profit ka maqsad yeh hai ke traders ko apne munafa ko secure karne mein madad milti hai. Iske baghair, traders ko market ke fluctuations aur emotions ke asar mein aakar munafa gawara karna mushkil ho jata hai.

Stop Loss aur Take Profit Ka Istemal Kaise Kiya Jaye?

Stop loss aur take profit levels ko set karte waqt, traders ko market ki volatality, trading strategy, aur personal risk tolerance ko mad-e-nazar rakhte hue amal karna chahiye. Yeh kuch important points hain jo traders ko in levels ko set karte waqt madad karte hain:

- Market Analysis: Market analysis ke zaroori hai takay traders sahi levels ka intikhab kar sakein. Technical aur fundamental analysis ke istemal se market trends aur price action ko samajhna zaroori hai.

- Risk Management: Har trader ko apne trading plan ke andar risk management ko shamil karna chahiye. Stop loss levels ko aise set kiya jana chahiye ke nuqsaan ki had ko mehdood rakha ja sake.

- Take Profit Levels: Take profit levels ko bhi itna set kiya jana chahiye ke trader ko munafa hasil ho sake. Lekin over-ambitious hone se bachna zaroori hai, aur realistic profit targets ko set karna chahiye.

- Adaptability: Market conditions mein tabdeeliyan aksar hoti hain, is liye traders ko apne stop loss aur take profit levels ko regular intervals par review karna chahiye aur zaroorat ke mutabiq adjust karna chahiye.

Conclusion

Forex trading mein stop loss aur take profit levels ka istemal karna zaroori hai takay traders apne trades ko control mein rakhein aur nuqsaan se bach sakein, sath hi munafa bhi hasil kar sakein. In levels ko set karte waqt, traders ko market analysis aur risk management ke principles ko mad-e-nazar rakhte hue amal karna chahiye. Is tarah se, stop loss aur take profit traders ko consistency aur discipline ke sath trading karne mein madad deta hai, jo ke ek successful trader ke liye zaroori hai.

تبصرہ

Расширенный режим Обычный режим