What is Elliot Waves in Forex:

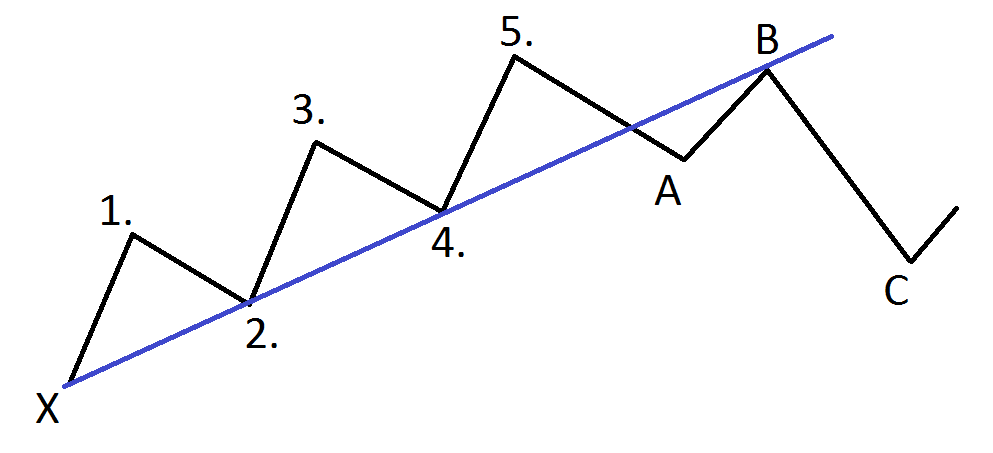

Elliot waves takneeki tashkhees ki aik shakal hai jisay zar e mubadla ke khredar bazaar ki naqal o harkat ki tawaqqa karne ke liye istemaal karte hain. yeh is nazriya par mabni hai ke bazaar ki qeematein baar baar anay walay namonon ya Wave mein behti hain. laharen paanch Wave se bani hoti teen impulse laharen ( 1, 3, 5 ) aur do islahi laharen. ( 2, four ). yeh laharen aik poooray chakkar ki tashkeel karti hain, aur un ke andaaz ko jan-nay se kharidaron ko salahiyat ke indraaj ko muntakhib karne aur market ke andar awamil ko bahar nikaalte mein madad mil sakti hai. Elliot Wave theory 1930 ki dahai mein ralf nelson Elliot ke zareya tayyar ki gayi thi aur is ne dekha hai ke sarmaya karon ne mukhtalif maliyati mandiyon, jaisay zar e mubadla market mein aamdani ke iqdamaat ki tehqeeq aur paish goi ke liye wasee pemanay par istemaal kya hai.

Five Wave Pattern of Elliot Waves:

Elliot Wave usool bazaar ki naqal o harkat mein aik makhsoos namona ki pairwi karta hai. pehli lehar ( lehar 1 ) fashion ke rastay mein ibtidayi harkat hai. usay aam tor par zabardast khabron ya sar garmion ke istemaal se taqwiyat millti hai jo kharidaron mein umeed peda karti hain. doosri lehar ( lehar 2 ) aik islahi lehar hai jo lehar 1 ke aik hissay ko peechay hatati hai. usay aksar un taajiron ke zariye kharidari ke imkaan ke tor par dekha jata hai jo ibtidayi bahao se mahroom rahay.

Wave teen aam tor par cycle ki sab se mazboot aur taweel tareen lehar hoti hai. yeh aik impulse Wave hai jo Wave 1 ke zariye nasb kardah andaaz ko barhati hai. lehar 4 aik islahi lehar hai jo lehar teen ke hissay ko peechay hatati hai taham ab lehar 1 ke sath overloopnahi hoti hai. yeh hatmi impulse Wave, Wave 5 se pehlay ka aik cansolidation section hai. lehar paanch rujhan ke douran aakhri bahao hai aur qiyaas aarai par mabni kharidari ke zariye karfrma hai. yeh marhala aksar kharidaron ke darmiyan josh o kharosh ke zariye nishaan zad hota hai.

Key Rules and Guidelines in Elliot Waves:

Ghair mulki zar e mubadla ki tijarat mein Elliot waves ka itlaq karte waqt khredar kayi ahem usoolon aur rehnuma usoolon ki tameel karte hain. zaroori khayalat mein se aik yeh hai ke lehar 2 lehar 1 ke so feesad se ziyada peechay nahi hatt sakti, aur lehar 4 lehar 1 ke sath overloop nahi ho sakti. lehar 3 aam tor par cycle ki sab se lambi aur sab se taaqatwar lehar hai, jo baqaidagi se lehar 1 ki chouti se agay barhti hai.

Tajir munfarid Wave mein salahiyat ki madad aur muzahmat ke marahil ko samajhney ke liye Fibonacci Retracement marahil ka bhi istemaal karte hain. misaal ke tor par, lehar teen aksar –apne oopar ki taraf rujhan ko dobarah shuru karne se pehlay lehar 1 ke 1.618 Fibonacci darjay par lout jati hai. un usoolon aur nakaat ko samajhney se sarmaya karon ko zar e mubadla bazaar ke andar Elliot Wave ko sahih tareeqay se label karne aur un ki tashreeh karne mein madad mil sakti hai.

Applying Elliot Waves in Forex Trading:

Wave ka itlaq trading traders Elliot waves ka istemaal salahiyat ki rasai ko samajhney aur forex market mein awamil ko bahar nikaalte ke liye karte hain. Wave ke namonon ka tajzia karkay, khredar mustaqbil ke charge ke iqdamaat ka andaza laga satke hain aur is wajah se apni tijarti technical ko adjust kar satke hain. jab paanch Wave ka chakkar mukammal ho jata hai, to khredar mukhalif rastay mein teen Wave ki islaah ki tawaqqa kar satke hain.

Elliot Wave ko aksar deegar takneeki isharay ke sath istemaal kya jata hai, jo tijarti intabahat ki tasdeeq ke liye transfer average, are s aayi, aur am ae si d par mushtamil hotay hain. tajir aamdani ke ahdaaf aur nuqsaan ke marahil ko roknay ke liye Wave counts ka bhi istemaal kar satke hain. Elliot waves ko mukhtalif takneeki tshkhisi tools ke sath jor kar, sarmaya car zar e mubadla bazaar mein ziyada se ziyada jaankaari walay tijarti intikhab kar satke hain.

Challenges and Limitations of Elliot Waves:

Agarchay Elliot waves bazaar ke rujhanaat ko parhnay ke liye aik taaqatwar zareya ho sakti hain, lekin un ke software se wabasta challenges aur rakawaten hain. usool talabb karne walay halaat mein se aik yeh hai ke lehar ki ginti spection ho sakti hai, jo taajiron ke darmiyan ghair mamooli tshrihat ke liye ahem hai. yeh spection lehar ki labiling aur passion goi mein tazadat peda kar sakti hai.

Mazeed bar-aan, Elliot waves ab bazaar ki sar garmion ke liye makhsoos waqt faraham nahi karti hain, jis ki wajah se sahih rasai aur bahar jane ke awamil ki nishandahi karna mushkil ho jata hai. tajir paicheeda lehar ke andaaz par bhi aa satke hain jin ki tashreeh karna mushkil ho sakta hai, khaas tor par mutazalzal ya mukhtalif baazaaron mein. un rukawaton ke bawajood, bohat se sarmaya car Elliot waves ko –apne ost khareed o farokht ke nuqta nazar ke hissay ke tor par istemaal karne mein fees talaash karte hain, inhen ghair mulki zar e mubadla market ke andar –apne faisla saazi ke andaaz ko behtar bananay ke liye mukhtalif takneeki tajzia tools ke sath jorhte hain.

Elliot waves takneeki tashkhees ki aik shakal hai jisay zar e mubadla ke khredar bazaar ki naqal o harkat ki tawaqqa karne ke liye istemaal karte hain. yeh is nazriya par mabni hai ke bazaar ki qeematein baar baar anay walay namonon ya Wave mein behti hain. laharen paanch Wave se bani hoti teen impulse laharen ( 1, 3, 5 ) aur do islahi laharen. ( 2, four ). yeh laharen aik poooray chakkar ki tashkeel karti hain, aur un ke andaaz ko jan-nay se kharidaron ko salahiyat ke indraaj ko muntakhib karne aur market ke andar awamil ko bahar nikaalte mein madad mil sakti hai. Elliot Wave theory 1930 ki dahai mein ralf nelson Elliot ke zareya tayyar ki gayi thi aur is ne dekha hai ke sarmaya karon ne mukhtalif maliyati mandiyon, jaisay zar e mubadla market mein aamdani ke iqdamaat ki tehqeeq aur paish goi ke liye wasee pemanay par istemaal kya hai.

Five Wave Pattern of Elliot Waves:

Elliot Wave usool bazaar ki naqal o harkat mein aik makhsoos namona ki pairwi karta hai. pehli lehar ( lehar 1 ) fashion ke rastay mein ibtidayi harkat hai. usay aam tor par zabardast khabron ya sar garmion ke istemaal se taqwiyat millti hai jo kharidaron mein umeed peda karti hain. doosri lehar ( lehar 2 ) aik islahi lehar hai jo lehar 1 ke aik hissay ko peechay hatati hai. usay aksar un taajiron ke zariye kharidari ke imkaan ke tor par dekha jata hai jo ibtidayi bahao se mahroom rahay.

Wave teen aam tor par cycle ki sab se mazboot aur taweel tareen lehar hoti hai. yeh aik impulse Wave hai jo Wave 1 ke zariye nasb kardah andaaz ko barhati hai. lehar 4 aik islahi lehar hai jo lehar teen ke hissay ko peechay hatati hai taham ab lehar 1 ke sath overloopnahi hoti hai. yeh hatmi impulse Wave, Wave 5 se pehlay ka aik cansolidation section hai. lehar paanch rujhan ke douran aakhri bahao hai aur qiyaas aarai par mabni kharidari ke zariye karfrma hai. yeh marhala aksar kharidaron ke darmiyan josh o kharosh ke zariye nishaan zad hota hai.

Key Rules and Guidelines in Elliot Waves:

Ghair mulki zar e mubadla ki tijarat mein Elliot waves ka itlaq karte waqt khredar kayi ahem usoolon aur rehnuma usoolon ki tameel karte hain. zaroori khayalat mein se aik yeh hai ke lehar 2 lehar 1 ke so feesad se ziyada peechay nahi hatt sakti, aur lehar 4 lehar 1 ke sath overloop nahi ho sakti. lehar 3 aam tor par cycle ki sab se lambi aur sab se taaqatwar lehar hai, jo baqaidagi se lehar 1 ki chouti se agay barhti hai.

Tajir munfarid Wave mein salahiyat ki madad aur muzahmat ke marahil ko samajhney ke liye Fibonacci Retracement marahil ka bhi istemaal karte hain. misaal ke tor par, lehar teen aksar –apne oopar ki taraf rujhan ko dobarah shuru karne se pehlay lehar 1 ke 1.618 Fibonacci darjay par lout jati hai. un usoolon aur nakaat ko samajhney se sarmaya karon ko zar e mubadla bazaar ke andar Elliot Wave ko sahih tareeqay se label karne aur un ki tashreeh karne mein madad mil sakti hai.

Applying Elliot Waves in Forex Trading:

Wave ka itlaq trading traders Elliot waves ka istemaal salahiyat ki rasai ko samajhney aur forex market mein awamil ko bahar nikaalte ke liye karte hain. Wave ke namonon ka tajzia karkay, khredar mustaqbil ke charge ke iqdamaat ka andaza laga satke hain aur is wajah se apni tijarti technical ko adjust kar satke hain. jab paanch Wave ka chakkar mukammal ho jata hai, to khredar mukhalif rastay mein teen Wave ki islaah ki tawaqqa kar satke hain.

Elliot Wave ko aksar deegar takneeki isharay ke sath istemaal kya jata hai, jo tijarti intabahat ki tasdeeq ke liye transfer average, are s aayi, aur am ae si d par mushtamil hotay hain. tajir aamdani ke ahdaaf aur nuqsaan ke marahil ko roknay ke liye Wave counts ka bhi istemaal kar satke hain. Elliot waves ko mukhtalif takneeki tshkhisi tools ke sath jor kar, sarmaya car zar e mubadla bazaar mein ziyada se ziyada jaankaari walay tijarti intikhab kar satke hain.

Challenges and Limitations of Elliot Waves:

Agarchay Elliot waves bazaar ke rujhanaat ko parhnay ke liye aik taaqatwar zareya ho sakti hain, lekin un ke software se wabasta challenges aur rakawaten hain. usool talabb karne walay halaat mein se aik yeh hai ke lehar ki ginti spection ho sakti hai, jo taajiron ke darmiyan ghair mamooli tshrihat ke liye ahem hai. yeh spection lehar ki labiling aur passion goi mein tazadat peda kar sakti hai.

Mazeed bar-aan, Elliot waves ab bazaar ki sar garmion ke liye makhsoos waqt faraham nahi karti hain, jis ki wajah se sahih rasai aur bahar jane ke awamil ki nishandahi karna mushkil ho jata hai. tajir paicheeda lehar ke andaaz par bhi aa satke hain jin ki tashreeh karna mushkil ho sakta hai, khaas tor par mutazalzal ya mukhtalif baazaaron mein. un rukawaton ke bawajood, bohat se sarmaya car Elliot waves ko –apne ost khareed o farokht ke nuqta nazar ke hissay ke tor par istemaal karne mein fees talaash karte hain, inhen ghair mulki zar e mubadla market ke andar –apne faisla saazi ke andaaz ko behtar bananay ke liye mukhtalif takneeki tajzia tools ke sath jorhte hain.

تبصرہ

Расширенный режим Обычный режим