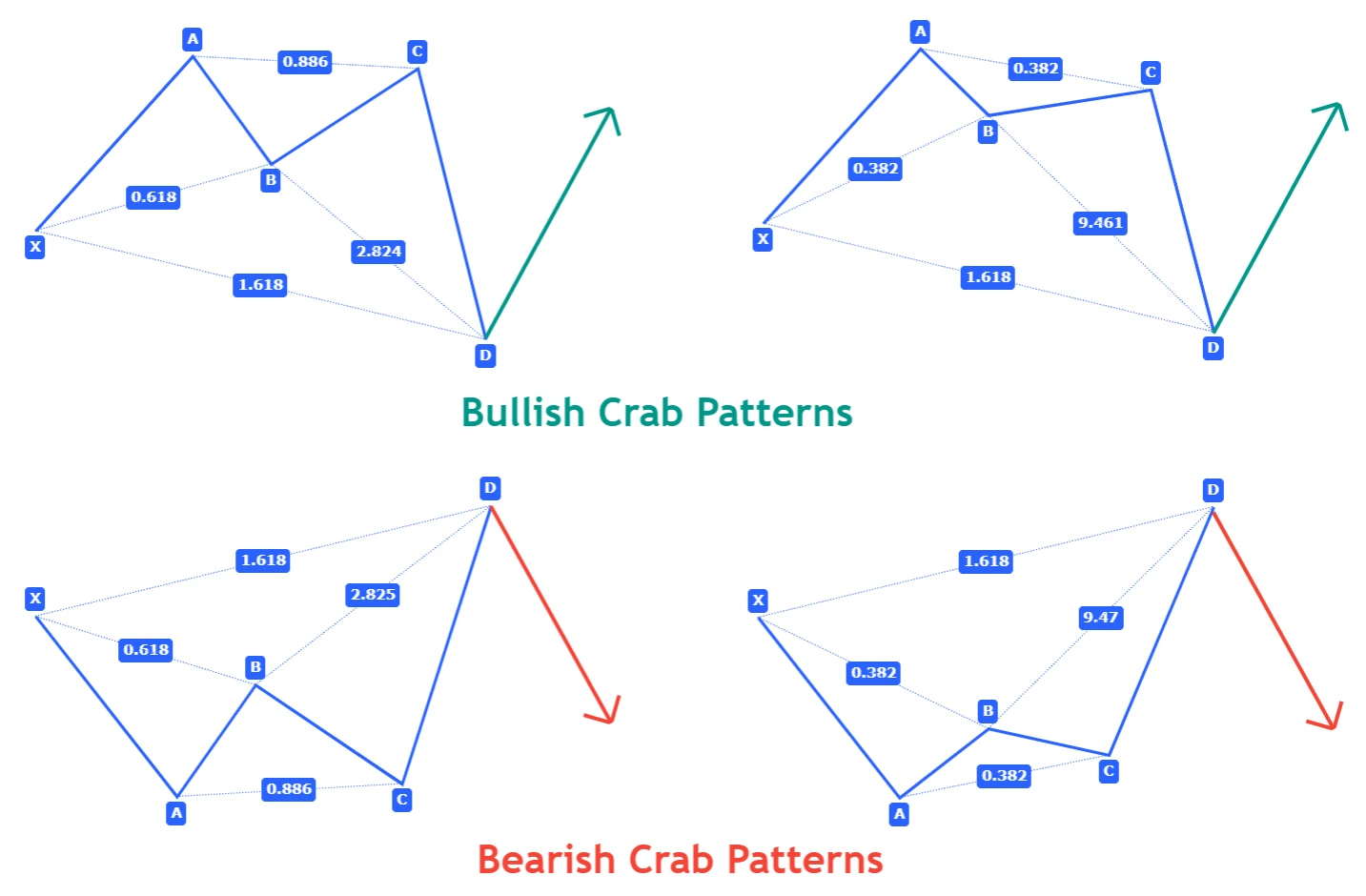

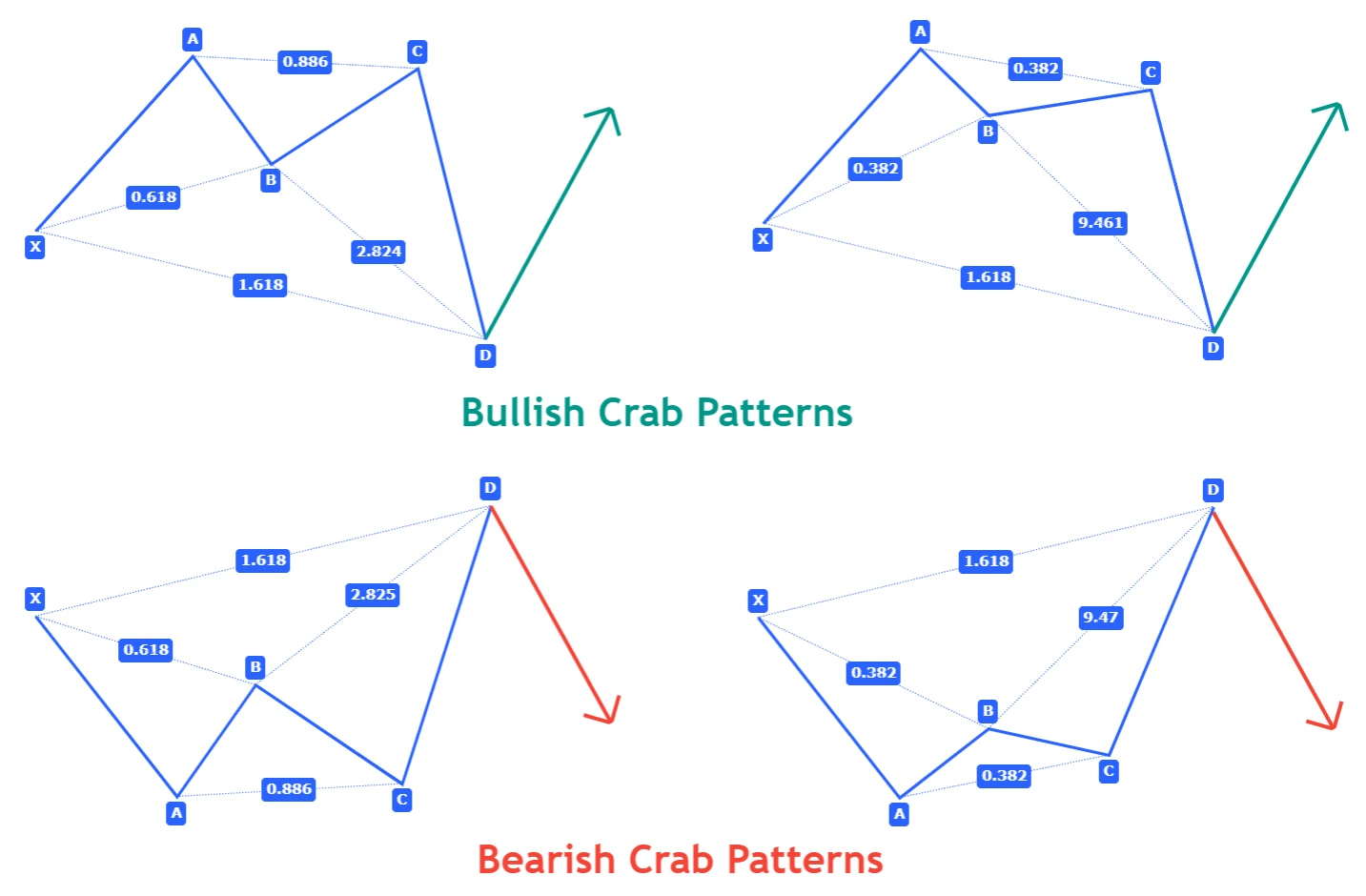

Crab Design patterns ke tareeqe ko samajhne se pehle, Crab Design exchange patterns ke asool ko samajhna zaroori hai. Ye patterns traders ke liye nishaan hote hain potential reversal points ki pehchaan karne ke liye. Ye patterns khaas price movements ko darust karti hain jo Fibonacci retracement aur extension levels ko dikhate hain.

Crab Design chaar mukhtalif points se mushakil price levels ko darust karti hai: X, A, B, aur C, har point pattern ke andar ahem price levels ko darust karta hai. Pattern aam tor par ek significant price rally ya decline ke baad banta hai aur prevailing trend mein ek potential reversal ko signal karta hai. Traders in points ke darmiyan ratios ka tajziya karte hain, aksar Fibonacci retracement aur extension levels ka istemal karte hain, pattern ki vaqaiyat ko tasdeeq karne ke liye.

chaar mukhtalif points se mushakil price levels ko darust karti hai: X, A, B, aur C, har point pattern ke andar ahem price levels ko darust karta hai. Pattern aam tor par ek significant price rally ya decline ke baad banta hai aur prevailing trend mein ek potential reversal ko signal karta hai. Traders in points ke darmiyan ratios ka tajziya karte hain, aksar Fibonacci retracement aur extension levels ka istemal karte hain, pattern ki vaqaiyat ko tasdeeq karne ke liye.

The Process of Crab Design in Forex:

Forex mein Crab Design ki tabadeli ka amalCrab Design exchange patterns ko pehchan karne aur fayde mand trades karne par mabni hota hai. Amal aam tor par yeh umeed hai:

Kuch ahem factors ka asar hota hai Crab Design exchange forex mein exchange karne ki kamyabi par:

Crab Design exchange patterns ki tabadeli ka mukhtalif implications hain forex traders ke liye:

Crab Design

chaar mukhtalif points se mushakil price levels ko darust karti hai: X, A, B, aur C, har point pattern ke andar ahem price levels ko darust karta hai. Pattern aam tor par ek significant price rally ya decline ke baad banta hai aur prevailing trend mein ek potential reversal ko signal karta hai. Traders in points ke darmiyan ratios ka tajziya karte hain, aksar Fibonacci retracement aur extension levels ka istemal karte hain, pattern ki vaqaiyat ko tasdeeq karne ke liye.

chaar mukhtalif points se mushakil price levels ko darust karti hai: X, A, B, aur C, har point pattern ke andar ahem price levels ko darust karta hai. Pattern aam tor par ek significant price rally ya decline ke baad banta hai aur prevailing trend mein ek potential reversal ko signal karta hai. Traders in points ke darmiyan ratios ka tajziya karte hain, aksar Fibonacci retracement aur extension levels ka istemal karte hain, pattern ki vaqaiyat ko tasdeeq karne ke liye.The Process of Crab Design in Forex:

Forex mein Crab Design ki tabadeli ka amalCrab Design exchange patterns ko pehchan karne aur fayde mand trades karne par mabni hota hai. Amal aam tor par yeh umeed hai:

- Pattern Recognition: Pehla qadam potential Crab Design exchange patterns ko forex market mein pehchanne ka hai. Traders technical analysis tools ka istemal karte hain, jaise chart patterns, Fibonacci retracement aur extension levels, aur doosre indicators, in patterns ko durust tarah se pehchane ke liye.

- Confirmation: Jab ek potential Crab Design exchange pattern ko pehchan lia jata hai, traders mazeed technical analysis techniques se tasdeeq karte hain. Ye bhi shamil hai Fibonacci ratios ki alignment ki tasdeeq, support aur resistance levels ki taqat ka tajziya, aur doosre mutalliq market factors ka tajziya.

- Trade Execution: Crab Design exchange pattern ki maujoodgi ko tasdeeq karne ke baad aur uski potential vaqaiyat ko tajziya karne ke baad, traders apne trades ko mutabiq execute karte hain. Is mein positions daakhil karna shaamil hai jo pattern ke dikhaye gaye potential reversal ke saath milta hai.

- Risk Management: Mazboot risk management forex trading mein ahem hai, khaaskar jab Crab Design exchange ki tabadeli ko exchange kiya jata hai. Traders apni potential nuqsanat ko mehdood karne ke liye stop-loss orders ko implement karte hain aur risk ko behtar taur par manage karne ke liye sahi position sizing techniques ka istemal karte hain.

- Monitoring and Adjustment: Jab trade execute ho jata hai, traders market ko qareeb se nazar andaz karte hain apni progress ka tajziya karne ke liye. Agar market shuruaati shiraa'iq tabdeel ho jati hai ya agar naye maloomat dastiyab hoti hain to traders apne positions ko adjust karte hain ya trades ko pehle se hi nikal lete hain.

- Review and Analysis: Jab trade mukammal ho jata hai, traders apne performance ka jayeza lete hain aur nateeja tajziya karte hain. Ye unhe apne trading approach mein mazbootiyan aur kamzoriyan pehchanne mein madad karta hai aur mustaqbil ke trades ke liye apne strategies ko saaf karte hain.

Kuch ahem factors ka asar hota hai Crab Design exchange forex mein exchange karne ki kamyabi par:

- Market Conditions: Crab Design exchange patterns ki kamyabi aam tor par maujooda market conditions par mabni hoti hai. Traders ko volatility, liquidity, aur overall market sentiment jaise factors ko mad e nazar rakna chahiye jab ye patterns ko identify aur trade kiya jata hai.

- Technical Analysis Tools: Sahi technical analysis tools ka istemal Crab Design exchange patterns ko durust tarah se pehchanne ke liye zaroori hai. Traders aik mishraq chart patterns, Fibonacci retracement aur extension levels, oscillators, aur doosre indicators ka istemal kar sakte hain taake ye patterns ki vaqaiyat ko tasdeeq kar sakein.

- Risk Management: Risk ka behtar taur par manage karna forex trading mein ahem hai, khaaskar jab Crab Design exchange patterns ko exchange kiya jata hai. Traders ko durust stop-loss levels set karne, munasib position sizing principles ko follow karne, aur apni trades ka risk-reward ratio ko apne trading maqasid ke mutabiq adjust karne ki zaroorat hoti hai.

- Patience and Discipline: Kamyabi ke liye sabr aur discipline ka hona zaroori hai. Traders ko darust Crab Design exchange patterns ke hone ka intezar karna chahiye aur unhe emotion ya market noise ke zor par amal karne se bachna chahiye.

- Continuous Learning: Forex market mustaqil tor par taqatwar hai aur hamesha tabdeel hoti rehti hai. Traders ko taqatwar rehne aur market ke naye tajurbaat, trading strategies, aur technical analysis techniques par mustaqil tor par mutaharrik rehne ki zimmedari hai takay wo apni competitive hone ka sath qayam rakh sakein.

Crab Design exchange patterns ki tabadeli ka mukhtalif implications hain forex traders ke liye:

- Enhanced Market Understanding: Crab Design exchange exchange mein shamil hona traders ki market dynamics aur price action ko samajhne mein madad karta hai. In patterns ko pehchanne aur analyze karne se, traders potential trend reversals aur market sentiment ke shifts ke baray mein insights haasil karte hain.

- Diversification of Trading Strategies: Crab Design exchange exchange ko aik trader ke arsenal mein shamil karna unke trading strategies ko tajurba karta hai. Ye traders ko mukhtalif market conditions ke mutabiq adjust hone aur trading opportunities ka faida uthane ki ijazat deta hai.

- Improved Risk Management: Crab Design exchange patterns ko trade karna traders ko behtar risk management strategies ko implement karne ki ijazat deta hai. Potential reversal points ko pehchan kar, traders ko mazeed tight stop-loss levels set karne aur apni trades ka overall risk-reward profile behtar karne ki ijazat deta hai.

- Alpha Generation: Crab Design exchange patterns ko kamyabi se trade karne se traders apne liye alpha generate kar sakte hain. Ye patterns ko durust taur par identify karne aur un par fayde se trade karne se traders excess returns generate kar sakte hain aur overall market ko peechay chor sakte hain.

تبصرہ

Расширенный режим Обычный режим