!!!!Forex Mein Bearish Harami Pattern!!!!

Forex mein "Bearish Harami" pattern ek pramukh Japanese candlestick pattern hai jo ek downtrend ke dauran dikhai deta hai aur aksar reversal ke sath jude hote hain.

!!!!Forex Mein Bearish Harami Pattern Ki Tashkeel!!!!

Yeh pattern do mukhya candlesticks se bana hota hai:

Bearish Harami pattern ka matlab hota hai ki market ki bearish sentiment badh rahi hai. Is pattern ko confirm karne ke liye, traders dusre candlestick ki close ke neeche entry karne ki avashyakta ko dekhte hain, jo ki pehle candlestick ki high aur low ke beech hoti hai.

!!!!Forex Mein Bearish Harami Pattern Ke Ehem Nukaat!!!!

Bearish Harami pattern ko samajhne ke liye, yeh kuch Important points hain:

Forex mein "Bearish Harami" pattern ek pramukh Japanese candlestick pattern hai jo ek downtrend ke dauran dikhai deta hai aur aksar reversal ke sath jude hote hain.

!!!!Forex Mein Bearish Harami Pattern Ki Tashkeel!!!!

Yeh pattern do mukhya candlesticks se bana hota hai:

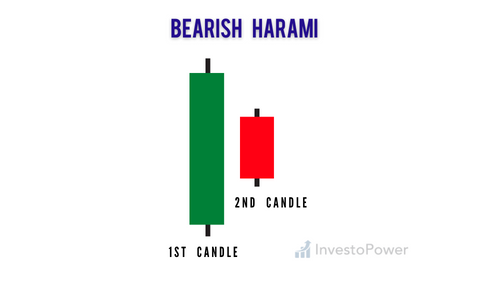

- Pehla Candlestick: Ye candlestick uptrend ke dauran dikhai deta hai aur lamba hota hai, jisse ki bullish momentum ko darshata hai.

- Dusra Candlestick: Dusra candlestick pehle candlestick ke andar shuru hota hai aur chhota hota hai. Ye candlestick typically pehle candlestick ke range ke andar hota hai, yani ki uske high aur low ke beech mein.

Bearish Harami pattern ka matlab hota hai ki market ki bearish sentiment badh rahi hai. Is pattern ko confirm karne ke liye, traders dusre candlestick ki close ke neeche entry karne ki avashyakta ko dekhte hain, jo ki pehle candlestick ki high aur low ke beech hoti hai.

!!!!Forex Mein Bearish Harami Pattern Ke Ehem Nukaat!!!!

Bearish Harami pattern ko samajhne ke liye, yeh kuch Important points hain:

- Confirmation: Bearish Harami pattern ko trading decision ke liye confirm karna mahatvapurn hota hai. Traders often wait for the next candlestick after the pattern to confirm the bearish reversal. Agar next candlestick bearish hai aur pehle candlestick ke neeche close hoti hai, to yeh pattern confirm hota hai.

- Volume: Volume analysis bhi pattern ke confirm hone mein madad karta hai. Agar Bearish Harami pattern ke samay volume badh jata hai, to yeh bearish reversal ko validate karta hai. Kam volume ke saath bearish harami pattern kam reliable hota hai.

- Stop Loss: Har trade mein stop loss lagana zaroori hai, taaki agar trade galat ho jaaye to nuksan kam ho. Bearish Harami pattern ke case mein, stop loss aksar pehle candlestick ke high ke thoda oopar rakha jata hai.

- Target: Target ko decide karne ke liye traders price action analysis ka istemal karte hain. Support levels, previous lows, aur Fibonacci retracement levels ka istemal kiya ja sakta hai target ko set karne ke liye.

- Dusre Indicators: Bearish Harami pattern ko confirm karne ke liye traders dusre technical indicators jaise ki RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), aur Stochastic Oscillator ka istemal karte hain.

تبصرہ

Расширенный режим Обычный режим