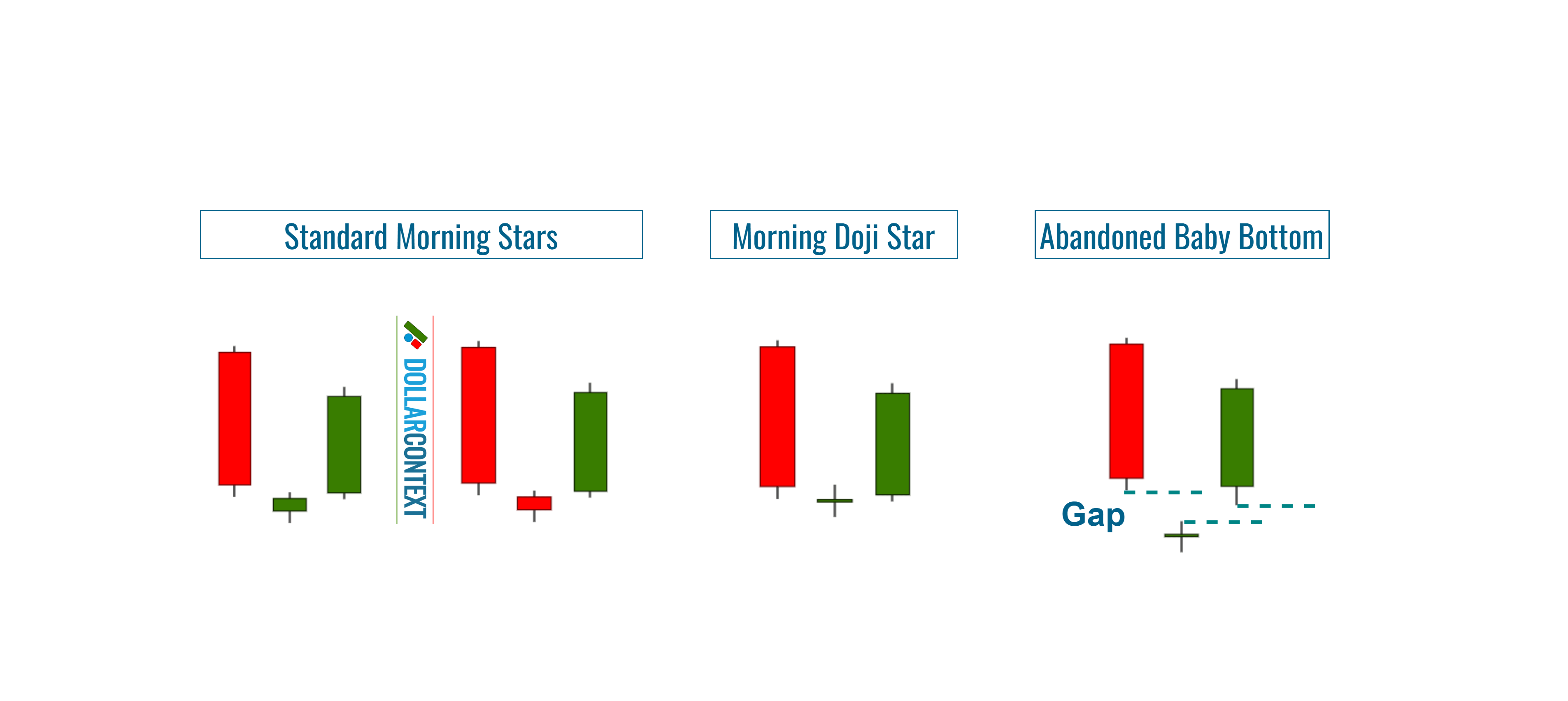

Morning Doji Star Pattern:

Morning Doji star aik taizi ka ulta namona hai jo ghair mulki currency ki kharidari aur farokht mein kami ke rujhan ke khatmay par bantaa hai. is model mein teen mom batian shaamil first mom batii aik taweel mandi ki mom batii hai jis ke baad Doji mom batii aati hai, jis ki khasusiyat is ke chhootey jism ki madad se hoti hai jo be yakeeni ya salahiyat ke ulat ki nishandahi karti hai, aur 1 / 3 mom batii aik taweel taiz mom batii hai. Morning Doji star pehlay se hi neechay ki taraf rujhan aur mumkina taizi ki harkat ki salahiyat ke ulat jane ki nishandahi karta hai.

Technical Analysis Morning Doji Star Pattern:

Morning Doji star patteren ko takneeki tashkhees mein herat angaiz tor par samjha jata hai kyunkay fashion ke ulat honay ki paish goi mein is ki hai. tajir aur tajzia car aksar is namoonay par poori tawajah dete hain kyunkay yeh market ke jazbaat mein mandi se taizi ki taraf tabdeeli ki nishandahi karta hai. namoonay ke andar Doji mom batii ki mojoodgi ahmiyat faraham karti hai kyunkay yeh mukhalif simt mein salahiyat ke break out se pehlay istehkaam ya be yakeeni ki muddat ko zahir karti hai. nateejay ke tor par, bohat se sarmaya car Morning Doji star ko lambi pozishnon mein ya fori pozishnon ke qareeb daakhil honay ke isharay ke tor par istemaal karte hain, jis se yeh zar e mubadla ki tijarti technical mein intikhab karne ka aik qeemti zareya ban jata hai.

Trading With Morning Doji Star Pattern:

Tajir apni ghair mulki currency ki tijarat ke Morning Doji star patteren ka istemaal karte waqt mukhtalif hikmat amlyon ko barooay car laa satke hain. aik aam tareeqa yeh hai ke namoonay ki tashkeel ke baad qeemat ki naqal o harkat ko dekh kar ulat ki tasdeeq ke liye nazar rakhi jaye. is mein andaaz mein 1 / 3 mom batii ki oonchai ko uboor karne ki sharah ki tawaqqa karna ya taizi se ulat jane mein madad ke liye deegar takneeki isharay talaash karna shaamil ho sakta hai. mazeed bar-aan, tajir Morning Doji star ko barray tijarti tareeqa car ke hissay ke tor par istemaal kar satke hain, aur usay mukhtalif takneeki tshkhisi alaat ke sath jor satke hain jin mein shifting average, are s aayi, ya am ae si d shaamil hain taakay kamyaab tijarat ke imkaan ko badhaya ja sakay.

Entry and Exit point on Morning Doji star Pattern:

Morning Doji star ke namoonay ki tijarat karte waqt rasai aur bahar jane ke points ka taayun karna ahem hai. tajir baqaidagi se aik taweel taqreeb mein jane ke liye zahir hotay hain jab Doji mom batii ke baad anay wali taiz mom batii Doji mom batii ke oopar band ho jati hai. yeh taizi ke ulat jane ki tasdeeq karta hai aur tabadlay mein jane ki alamat ke tor par nazar aasakta hai. jahan tak bahar niklny ke awamil ka talluq hai, sarmaya car Doji mom batii ke nichale hissay ke neechay farist all las order tarteeb dainay par bhi ghhor kar satke hain taakay salahiyat ke nuqsanaat se bacha ja sakay agar ulat palat amal mein nahi aata hai. mazeed bar-aan, madad aur muzahmat ki hudood ya Fibonacci Retracement darjay ki bunyaad par pehlay se tay shuda hadaf ki satah par munafe lena mutabadil se ziyada se ziyada fawaid haasil karne mein madad kar sakta hai.

Limitations and consideration of Morning Doji Star Pattern:

Agarchay Morning Doji star namona takneeki tashkhees mein aik taaqatwar aala hai, lekin yeh is ki rukawaton aur khatraat ke baghair nahi hai. yaad karne ka aik khatrah jaali intabahat hain, jahan namona taizi se ulat jane mein nakaam rehta hai aur is ke nateejay mein mandi ki harkat jari rehti hai. is mauqa ko kam karne ke liye, khredar izafi tasdeeq ke ishaaron ka istemaal kar satke hain ya kamyabi ki tabdeeli ke imkaan ko badhaane ke liye namoonay ko mukhtalif takneeki ishaaron ke sath marboot kar satke hain. mazeed bar-aan, kisi bhi tijarti namoonay ki terhan, Morning Doji star hamesha faul proof nahi hota hai aur salahiyat ke nuqsanaat se bachney ke liye usay munasib rissk control taknik ke sath mil kar istemaal karna parta hai. taajiron ke liye yeh bohat zaroori hai ke woh apni khareed o farokht ki hikmat e amli mein Morning Doji star ko shaamil karte waqt un rukawaton aur khatraat se aagah rahen.

Morning Doji star aik taizi ka ulta namona hai jo ghair mulki currency ki kharidari aur farokht mein kami ke rujhan ke khatmay par bantaa hai. is model mein teen mom batian shaamil first mom batii aik taweel mandi ki mom batii hai jis ke baad Doji mom batii aati hai, jis ki khasusiyat is ke chhootey jism ki madad se hoti hai jo be yakeeni ya salahiyat ke ulat ki nishandahi karti hai, aur 1 / 3 mom batii aik taweel taiz mom batii hai. Morning Doji star pehlay se hi neechay ki taraf rujhan aur mumkina taizi ki harkat ki salahiyat ke ulat jane ki nishandahi karta hai.

Technical Analysis Morning Doji Star Pattern:

Morning Doji star patteren ko takneeki tashkhees mein herat angaiz tor par samjha jata hai kyunkay fashion ke ulat honay ki paish goi mein is ki hai. tajir aur tajzia car aksar is namoonay par poori tawajah dete hain kyunkay yeh market ke jazbaat mein mandi se taizi ki taraf tabdeeli ki nishandahi karta hai. namoonay ke andar Doji mom batii ki mojoodgi ahmiyat faraham karti hai kyunkay yeh mukhalif simt mein salahiyat ke break out se pehlay istehkaam ya be yakeeni ki muddat ko zahir karti hai. nateejay ke tor par, bohat se sarmaya car Morning Doji star ko lambi pozishnon mein ya fori pozishnon ke qareeb daakhil honay ke isharay ke tor par istemaal karte hain, jis se yeh zar e mubadla ki tijarti technical mein intikhab karne ka aik qeemti zareya ban jata hai.

Trading With Morning Doji Star Pattern:

Tajir apni ghair mulki currency ki tijarat ke Morning Doji star patteren ka istemaal karte waqt mukhtalif hikmat amlyon ko barooay car laa satke hain. aik aam tareeqa yeh hai ke namoonay ki tashkeel ke baad qeemat ki naqal o harkat ko dekh kar ulat ki tasdeeq ke liye nazar rakhi jaye. is mein andaaz mein 1 / 3 mom batii ki oonchai ko uboor karne ki sharah ki tawaqqa karna ya taizi se ulat jane mein madad ke liye deegar takneeki isharay talaash karna shaamil ho sakta hai. mazeed bar-aan, tajir Morning Doji star ko barray tijarti tareeqa car ke hissay ke tor par istemaal kar satke hain, aur usay mukhtalif takneeki tshkhisi alaat ke sath jor satke hain jin mein shifting average, are s aayi, ya am ae si d shaamil hain taakay kamyaab tijarat ke imkaan ko badhaya ja sakay.

Entry and Exit point on Morning Doji star Pattern:

Morning Doji star ke namoonay ki tijarat karte waqt rasai aur bahar jane ke points ka taayun karna ahem hai. tajir baqaidagi se aik taweel taqreeb mein jane ke liye zahir hotay hain jab Doji mom batii ke baad anay wali taiz mom batii Doji mom batii ke oopar band ho jati hai. yeh taizi ke ulat jane ki tasdeeq karta hai aur tabadlay mein jane ki alamat ke tor par nazar aasakta hai. jahan tak bahar niklny ke awamil ka talluq hai, sarmaya car Doji mom batii ke nichale hissay ke neechay farist all las order tarteeb dainay par bhi ghhor kar satke hain taakay salahiyat ke nuqsanaat se bacha ja sakay agar ulat palat amal mein nahi aata hai. mazeed bar-aan, madad aur muzahmat ki hudood ya Fibonacci Retracement darjay ki bunyaad par pehlay se tay shuda hadaf ki satah par munafe lena mutabadil se ziyada se ziyada fawaid haasil karne mein madad kar sakta hai.

Limitations and consideration of Morning Doji Star Pattern:

Agarchay Morning Doji star namona takneeki tashkhees mein aik taaqatwar aala hai, lekin yeh is ki rukawaton aur khatraat ke baghair nahi hai. yaad karne ka aik khatrah jaali intabahat hain, jahan namona taizi se ulat jane mein nakaam rehta hai aur is ke nateejay mein mandi ki harkat jari rehti hai. is mauqa ko kam karne ke liye, khredar izafi tasdeeq ke ishaaron ka istemaal kar satke hain ya kamyabi ki tabdeeli ke imkaan ko badhaane ke liye namoonay ko mukhtalif takneeki ishaaron ke sath marboot kar satke hain. mazeed bar-aan, kisi bhi tijarti namoonay ki terhan, Morning Doji star hamesha faul proof nahi hota hai aur salahiyat ke nuqsanaat se bachney ke liye usay munasib rissk control taknik ke sath mil kar istemaal karna parta hai. taajiron ke liye yeh bohat zaroori hai ke woh apni khareed o farokht ki hikmat e amli mein Morning Doji star ko shaamil karte waqt un rukawaton aur khatraat se aagah rahen.

تبصرہ

Расширенный режим Обычный режим