Introduction

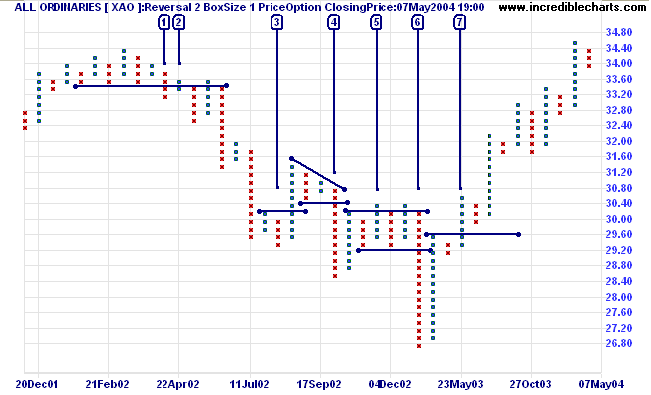

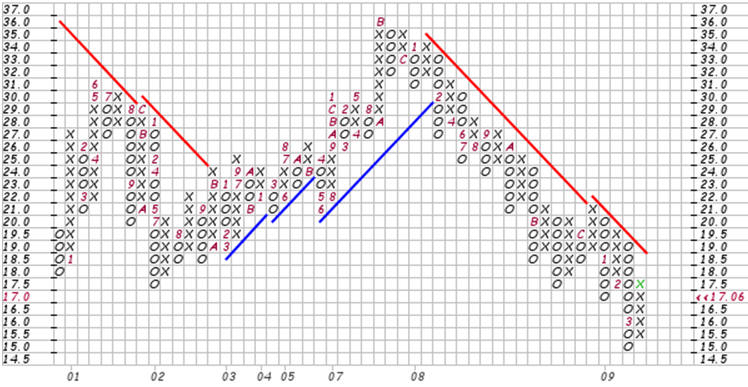

Point & Figure Chart patterns ek charting technique hai jo traders aur investors istemal karte hain taake wo price movement ko analyze kar sakein. Ye technique primarily price changes aur unke directions par focus rakhti hai.Ek mufeed technical analysis tool hain jo traders aur investors ko price movement ke patterns aur trend ka pata lagane mein madad karte hain. Ye simple aur effective technique hai jo market analysis ko samajhne mein madadgar sabit ho sakti hai.

Construction

P&F charts ko banane ke liye, sirf price changes ke hisaab se "X" aur "O" ke symbols ka istemal hota hai. Har "X" ek uptrend ko represent karta hai jabke har "O" ek downtrend ko represent karta hai. Ye chart time factor ko ignore karta hai aur sirf price movement par focus karta hai.

Chart Patterns

P&F charts mein kuch mukhtalif patterns hoti hain jo traders ko price movement ke bare mein maloomat deti hain. Kuch common patterns mein "Double Top", "Double Bottom", "Triple Top", aur "Triple Bottom" shamil hain. In patterns ki madad se traders market ke trend ko samajh sakte hain aur future price movement ka andaza lagasakte hain.

Trend Analysis

P&F charts trend analysis ke liye mufeed hote hain. Jab ek stock ya market uptrend mein hota hai, P&F chart mein "X" symbols ki series ban jati hai. Jab market downtrend mein hota hai, "O" symbols ki series banti hai. Ye trend analysis ke liye ahem hai kyunki ye traders ko trend ke direction ka pata lagane mein madad karta hai.

Support aur Resistance

P&F charts mein support aur resistance levels ko bhi dekha ja sakta hai. Support levels pe jab price girne ke baad reversal hota hai, wahan "O" se "X" ban jate hain. Resistance levels pe jab price barhti hai aur phir reverse hoti hai, wahan "X" se "O" bante hain. Ye levels traders ke liye ahem hote hain kyunki ye indicate karte hain ke kis price pe buying ya selling ka zyada interest hai.

Entry aur Exit Points

P&F charts entry aur exit points ka bhi pata lagane mein madad karte hain. Jab koi stock ya market ek specific pattern complete karta hai, jaise ki double top ya double bottom, to traders entry ya exit points decide kar sakte hain.

Risk aur Reward

P&F charts risk aur reward ko samajhne mein madadgar hote hain. Traders ko pata chalta hai ke kis level pe stop-loss lagana hai aur kis level pe profit booking karni hai, jisse unka risk aur reward ratio improve ho.

Point & Figure Chart patterns ek charting technique hai jo traders aur investors istemal karte hain taake wo price movement ko analyze kar sakein. Ye technique primarily price changes aur unke directions par focus rakhti hai.Ek mufeed technical analysis tool hain jo traders aur investors ko price movement ke patterns aur trend ka pata lagane mein madad karte hain. Ye simple aur effective technique hai jo market analysis ko samajhne mein madadgar sabit ho sakti hai.

Construction

P&F charts ko banane ke liye, sirf price changes ke hisaab se "X" aur "O" ke symbols ka istemal hota hai. Har "X" ek uptrend ko represent karta hai jabke har "O" ek downtrend ko represent karta hai. Ye chart time factor ko ignore karta hai aur sirf price movement par focus karta hai.

Chart Patterns

P&F charts mein kuch mukhtalif patterns hoti hain jo traders ko price movement ke bare mein maloomat deti hain. Kuch common patterns mein "Double Top", "Double Bottom", "Triple Top", aur "Triple Bottom" shamil hain. In patterns ki madad se traders market ke trend ko samajh sakte hain aur future price movement ka andaza lagasakte hain.

Trend Analysis

P&F charts trend analysis ke liye mufeed hote hain. Jab ek stock ya market uptrend mein hota hai, P&F chart mein "X" symbols ki series ban jati hai. Jab market downtrend mein hota hai, "O" symbols ki series banti hai. Ye trend analysis ke liye ahem hai kyunki ye traders ko trend ke direction ka pata lagane mein madad karta hai.

Support aur Resistance

P&F charts mein support aur resistance levels ko bhi dekha ja sakta hai. Support levels pe jab price girne ke baad reversal hota hai, wahan "O" se "X" ban jate hain. Resistance levels pe jab price barhti hai aur phir reverse hoti hai, wahan "X" se "O" bante hain. Ye levels traders ke liye ahem hote hain kyunki ye indicate karte hain ke kis price pe buying ya selling ka zyada interest hai.

Entry aur Exit Points

P&F charts entry aur exit points ka bhi pata lagane mein madad karte hain. Jab koi stock ya market ek specific pattern complete karta hai, jaise ki double top ya double bottom, to traders entry ya exit points decide kar sakte hain.

Risk aur Reward

P&F charts risk aur reward ko samajhne mein madadgar hote hain. Traders ko pata chalta hai ke kis level pe stop-loss lagana hai aur kis level pe profit booking karni hai, jisse unka risk aur reward ratio improve ho.

تبصرہ

Расширенный режим Обычный режим