What is On Nick Patten:

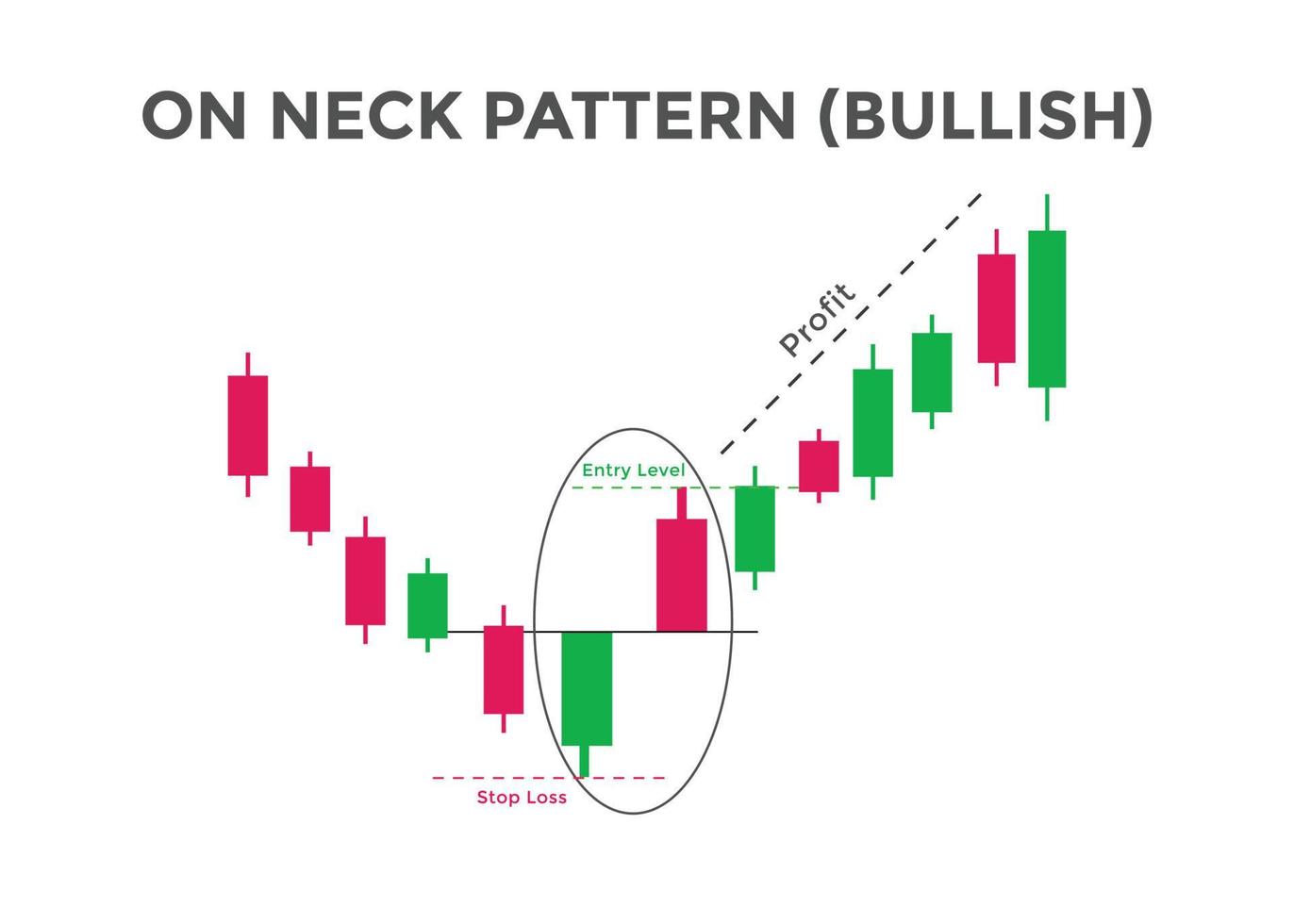

On Nick Pattern aik qisam ka takneeki tshkhisi Pattern hai jo aam tor par ghair mulki currency ke bazaar mein istemaal hota hai. is namoonay ko tasalsul ke namoonay par ghhor kya jata hai, is wajah se ke yeh aam tor par fashion ke markaz mein hota hai, jo mojooda fashion ke tasalsul ko ulat jane ki tarjeeh ka ishara karta hai. On Nick patteren mom btyon par mushtamil hota hai -banyadi mom batian aik lambi mom batian hoti hain, jin ka mushahida doosri mom btyon se hota hai jo pichli mom btyon ke qareeb ya baa-mushkil neechay khulti hain aur phir pichli mom btyon ke neechay band ho jati hain. yeh tashkeel aik mandi ke tasalsul ke namoonay se mushabihat rakhti hai, jis se pata chalta hai ke farogh dainay wala dabao barqarar rehne ka imkaan hai.

Identifying ON Neck Pattern:

Ghair mulki currency ke chart par On Nick ka Pattern lainay ke liye, sarmaya karon ko aik choti mom batii ka istemaal karte hue mushahida ki jane wali aik mom batii ki talaash karni padtee hai jo pichli mom batii ke qareeb ya is se thori neechay khulti hai aur pehli mom batii ke neechay band hoti hai. is namoonay ka kaleedi kaam doosri mom batii ka kam hona hai, jo is baat ki nishandahi karta hai ke reechh ab bhi qaboo mein hain. tajir aksar On Nick namoonay ki mojoodgi ki tasdeeq ke liye takneeki tajzia ka samaan istemaal karte hain jis mein mom batii ki chhari ke andaaz, madad aur muzahmat ki degreeian, aur trained lines shaamil hain.

Importance of On Nick Pattern:

On Nick ka Pattern wasee hai kyunkay yeh kharidaron ko mojooda down trained mein shaamil honay ke liye salahiyat tak rasai faraham karta hai. jab On Nick ka Pattern hota hai, to is se pata chalta hai ke farokht ka tanao barqarar rehne ka imkaan hai, jis se yeh taajiron ke liye mandi ka ishara bantaa hai. taham, is namoonay par mukammal tor par mabni tabdeeli mein anay se pehlay tasdeeq ka intzaar karna zaroori hai. tajir tijarti faislay karne se pehlay On Nick namoonay ke zariye faraham kardah signal ki toseeq karne ke liye izafi takneeki alamaat ya namoonay bhi talaash kar satke hain.

Trading With On Neck Pattern:

Ghair mulki zar e mubadla market mein On Nick patteren ki tijarat karte waqt, khredar aksar patteren ki tasdeeq ke baad fori position mein daakhil hotay hain. woh khatray mein heera pheri karne aur tabdeeli un ki taraf jane ki soorat mein –apne sarmaye ko bachanay ke liye doosri mom batii ki chhari ke oopar stop las order bhi muqarrar kar satke hain. munafe ke ahdaaf bunyadi tor par support tyres ya Fibonacci Retracement tyres ki bunyaad par muqarrar kiye ja satke hain taakay mumkina ilaqon ka intikhab kya ja sakay jahan sharah bhi mukhalif ho sakti hai. mazeed bar-aan, sarmaya car –apne tijarti tareeqa car ko behtar bananay aur kamyaab tijarat ke imkanaat ko badhaane ke liye mukhtalif takneeki tshkhisi alaat ko shaamil karna bhi yaad rakh satke hain.

Limitations of On Neck Pattern:

Agarchay On Nick ka Pattern ghair mulki currency ke sarmaya karon ke liye aik qeemti aala ho sakta hai, lekin is ki hudood ko samjhna bohat zaroori hai. kisi bhi takneeki tashkhees ke namoonay ki terhan, On Nick Pattern faul proof nahi hai aur baaz auqaat jaali isharay peda kar sakta hai. taajiron ko mohtaat rehna chahiye aur tabadlay mein anay se pehlay namoonay ki toseeq karne ke liye izafi tasdeeq ke ozaar istemaal karne chahiye. mazeed bar-aan, bazaar ke halaat aur bairooni anasir On Nick namoonay ko mutasir kar satke hain, lehaza is namoonay ko samajhney ke waqt wasee tar bazaar ke sayaq o Sabaq ko nah bhoolna bohat zaroori hai. On Nick patteren ki pabandion ki maloomat aur khatray par qaboo panay ki technical ko shaamil karkay, khredar is patteren ko –apne tijarti nuqta nazar ke aik hissay ke tor par kamyabi ke sath istemaal kar satke hain.

On Nick Pattern aik qisam ka takneeki tshkhisi Pattern hai jo aam tor par ghair mulki currency ke bazaar mein istemaal hota hai. is namoonay ko tasalsul ke namoonay par ghhor kya jata hai, is wajah se ke yeh aam tor par fashion ke markaz mein hota hai, jo mojooda fashion ke tasalsul ko ulat jane ki tarjeeh ka ishara karta hai. On Nick patteren mom btyon par mushtamil hota hai -banyadi mom batian aik lambi mom batian hoti hain, jin ka mushahida doosri mom btyon se hota hai jo pichli mom btyon ke qareeb ya baa-mushkil neechay khulti hain aur phir pichli mom btyon ke neechay band ho jati hain. yeh tashkeel aik mandi ke tasalsul ke namoonay se mushabihat rakhti hai, jis se pata chalta hai ke farogh dainay wala dabao barqarar rehne ka imkaan hai.

Identifying ON Neck Pattern:

Ghair mulki currency ke chart par On Nick ka Pattern lainay ke liye, sarmaya karon ko aik choti mom batii ka istemaal karte hue mushahida ki jane wali aik mom batii ki talaash karni padtee hai jo pichli mom batii ke qareeb ya is se thori neechay khulti hai aur pehli mom batii ke neechay band hoti hai. is namoonay ka kaleedi kaam doosri mom batii ka kam hona hai, jo is baat ki nishandahi karta hai ke reechh ab bhi qaboo mein hain. tajir aksar On Nick namoonay ki mojoodgi ki tasdeeq ke liye takneeki tajzia ka samaan istemaal karte hain jis mein mom batii ki chhari ke andaaz, madad aur muzahmat ki degreeian, aur trained lines shaamil hain.

Importance of On Nick Pattern:

On Nick ka Pattern wasee hai kyunkay yeh kharidaron ko mojooda down trained mein shaamil honay ke liye salahiyat tak rasai faraham karta hai. jab On Nick ka Pattern hota hai, to is se pata chalta hai ke farokht ka tanao barqarar rehne ka imkaan hai, jis se yeh taajiron ke liye mandi ka ishara bantaa hai. taham, is namoonay par mukammal tor par mabni tabdeeli mein anay se pehlay tasdeeq ka intzaar karna zaroori hai. tajir tijarti faislay karne se pehlay On Nick namoonay ke zariye faraham kardah signal ki toseeq karne ke liye izafi takneeki alamaat ya namoonay bhi talaash kar satke hain.

Trading With On Neck Pattern:

Ghair mulki zar e mubadla market mein On Nick patteren ki tijarat karte waqt, khredar aksar patteren ki tasdeeq ke baad fori position mein daakhil hotay hain. woh khatray mein heera pheri karne aur tabdeeli un ki taraf jane ki soorat mein –apne sarmaye ko bachanay ke liye doosri mom batii ki chhari ke oopar stop las order bhi muqarrar kar satke hain. munafe ke ahdaaf bunyadi tor par support tyres ya Fibonacci Retracement tyres ki bunyaad par muqarrar kiye ja satke hain taakay mumkina ilaqon ka intikhab kya ja sakay jahan sharah bhi mukhalif ho sakti hai. mazeed bar-aan, sarmaya car –apne tijarti tareeqa car ko behtar bananay aur kamyaab tijarat ke imkanaat ko badhaane ke liye mukhtalif takneeki tshkhisi alaat ko shaamil karna bhi yaad rakh satke hain.

Limitations of On Neck Pattern:

Agarchay On Nick ka Pattern ghair mulki currency ke sarmaya karon ke liye aik qeemti aala ho sakta hai, lekin is ki hudood ko samjhna bohat zaroori hai. kisi bhi takneeki tashkhees ke namoonay ki terhan, On Nick Pattern faul proof nahi hai aur baaz auqaat jaali isharay peda kar sakta hai. taajiron ko mohtaat rehna chahiye aur tabadlay mein anay se pehlay namoonay ki toseeq karne ke liye izafi tasdeeq ke ozaar istemaal karne chahiye. mazeed bar-aan, bazaar ke halaat aur bairooni anasir On Nick namoonay ko mutasir kar satke hain, lehaza is namoonay ko samajhney ke waqt wasee tar bazaar ke sayaq o Sabaq ko nah bhoolna bohat zaroori hai. On Nick patteren ki pabandion ki maloomat aur khatray par qaboo panay ki technical ko shaamil karkay, khredar is patteren ko –apne tijarti nuqta nazar ke aik hissay ke tor par kamyabi ke sath istemaal kar satke hain.

تبصرہ

Расширенный режим Обычный режим