What is Bearish Spike Pattern:

Bearish Spike patteren aik takneeki tshkhisi pattern hai jo ghair mulki currency ke bazaar mein hota hai aur usay zimma daar mein salahiyat ko neechay ki taraf harkat ka ishara samjha jata hai. is tarz ki khasusiyat qeemat mein taizi se aur achanak izafay ki madad se hai Bearish Spike patteren chart ka aik wasee pattern hai jis ka ghair mulki zar e mubadla ki tijarat mein takneeki tajzia karon ke zareya khaas tor par jaiza liya jata hai. yeh charge mein ghair mutawaqqa aur barray pemanay par kami ki aik wazeh misaal hai, jo aksar market ke andar salahiyat ke ulat jane ya neechay ki taraf rujhan ke tasalsul ka ishara karti hai. tajir aur tajir mandi ke izafay par qareeb se tawajah dete hain kyunkay woh bazaar ke jazbaat aur mumkina taqdeer ki fees ki naqal o harkat ke baray mein qeemti baseerat faraham karne ke qabil hotay hain.

Identifying Bearish Spike Pattern:

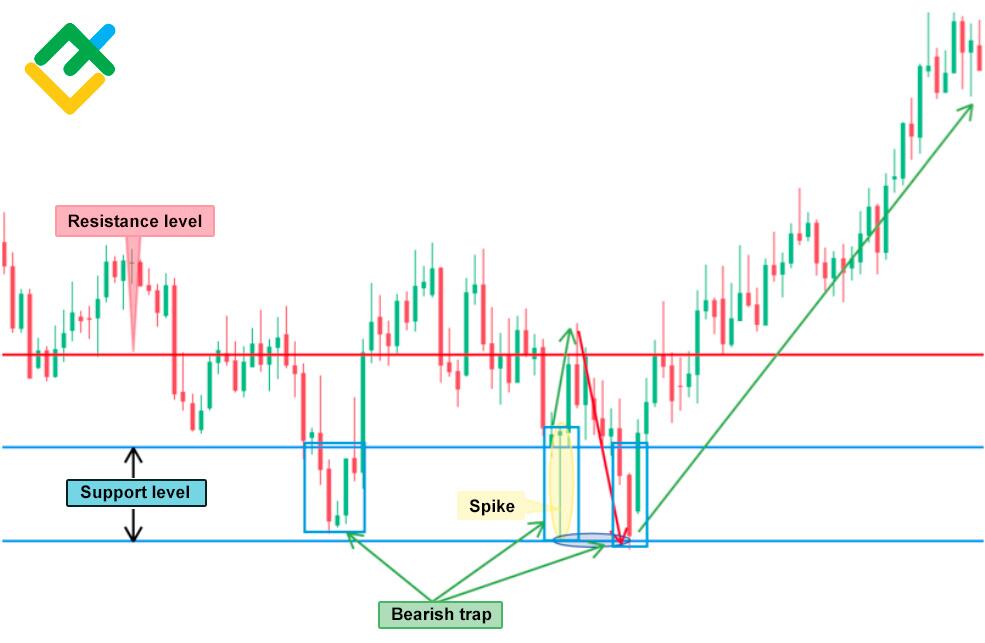

Bearish Spike patteren ko tasleem karna un sarmaya karon ke liye ahem hai jo zar e mubadla market mein salahiyat mein kami ki tawaqqa karna chahtay hain. is namoonay mein aam tor par fees mein taiz aur taizi se kami shaamil hoti hai, jo aksar aala khareed o farokht ki had ke zariye mushahida ki jati hai. neechay ki taraf izafay ka mushahida aam tor par istehkaam ki muddat ya side way harkat ki madad se kya jata hai, jo salahiyat ke ulat jane ya neechay ki taraf rujhan ke tasalsul ki nishandahi karta hai.

Tajir takneeki tshkhisi tools ka istemaal kar satke hain jin mein trained lines, madad aur muzahmat ki hudood, aur harkat pazeeri ost shaamil hain taakay mandi ke Spike namoonay ki sadaqat ki tasdeeq ki ja sakay. mazeed bar-aan, ahem isharay jaisay rishta daar taaqat index ( are s aayi ) ya moving average knorjns divergence( am ae si d ) ki nigrani namoonay ki madad se paish kardah nishaan ki toseeq karne mein madad kar sakti hai.

Trading With Bearish Spike Pattern:

Jab koi tajir bearish spike ke namoonay ki shanakht karta hai, to kayi tijarti hikmat e amli hoti hain jin par amal daraamad kya ja sakta hai taakay salahiyat ko kam karne walay charge ke iqdamaat se faida uthaya ja sakay. aik nuqta nazar yeh hai ke namoonay ki tasdeeq ke baad aik mukhtasir position mein jana hai, jis mein fees ki kam satah ko gunjaish ke nuqta nazar ke tor par nishana banaya jata hai. tajir mauqa par qaboo panay aur herat angaiz charge ulat ke khilaaf difaa ke liye stop las orders ka istemaal karte hue bhi yaad kar satke hain.

Aik aur tareeqa yeh hai ke mukhtasir kirdaar mein anay se pehlay Bearish Spike patteren ki tashkhees ke baad pal back ya retracement ka intzaar kya jaye. is se sarmaya karon ko ziyada sazgaar rasai ke Ansar ko mehfooz bananay aur mutabadil ke mauqa se inaam ke tanasub ko badhaane mein madad mil sakti hai. taajiron ke liye yeh zaroori hai ke woh bearish Spike ke namoonay ko deegar takneeki alamaat aur tajzia ki hikmat amlyon ke sath jorhin taakay hatt tridz ke imkaan ko badhaya ja sakay.

Risk Management and Stop Loss Placement in Bearish Spike Pattern:

Forex market mein mandi ke izafay ke namoonay ko kharidne aur farokht karne ke liye rissk control aik ahem cheez hai. taajiron ko aam tor par –apne khatray ki rawadari ko zehen mein rakhna parta hai aur mumkina nuqsanaat ko mehdood karne ke liye munasib farist all las orders ko nafiz karna parta hai. stop las orders ko manfi sharah ki naqal o harkat ke khilaaf difaa ke liye haliya soyng high ya kaleedi muzahmat ki satah se oopar rakha jana chahiye.

Mazeed bar-aan, sarmaya car apni marzi ke tabadlay ke tor par aamdani ko band karne ke liye trailing rokkk all losses ki hikmat e amli ko nafiz karne ko zehen mein rakh satke hain. yeh tareeqa sarmaya karon ko mustahkam munafe ki ijazat deta hai jabkay is ke bawajood tijarti kamray ko saans lainay aur mumkina tor par barri fees chalon par qabza karne ka mauqa faraham karta hai. sarmaya karon ke liye yeh bohat zaroori hai ke woh ghair mulki zar e mubadla ke bazaar mein mustaqil munafe haasil karne ke liye mandi ke izafay ke namoonay ko kharedtay aur farokht karte waqt khatray aur tareef ke darmiyan tawazun qaim karen.

False Signals and Confirmation Criteria In Bearish Spike Pattern:

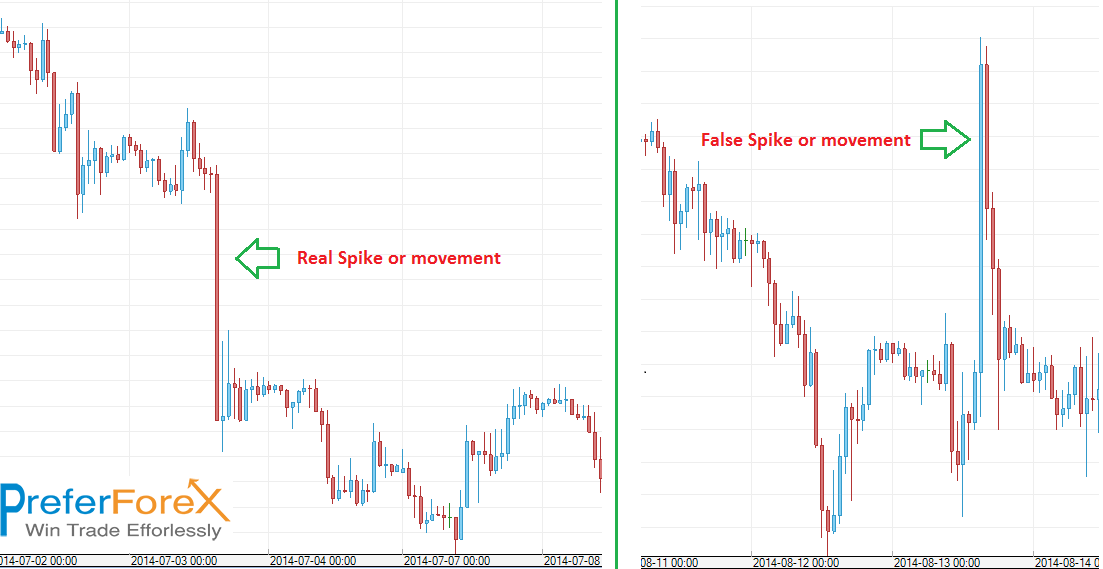

Agarchay mandi ka barhta sun-hwa pattern qeemat mein kami ki salahiyat ki qabil aetmaad alamat ho sakta hai, lekin kharidaron ko jaali intabahat ke baray mein aagah hona parta hai jo ho satke hain. bazaar ke utaar charhao, khabron ke waqeat, ya deegar anasir ki wajah se jhutay isharay kharray ho satke hain jo qeematon ke amal ke baqaida andaaz mein khlal daaltay hain. jhutay intabahat ke khatray ko kam karne ke liye, kharidaron ko Bearish Spike patteren par mabni tabdeeli mein daakhil honay se pehlay tasdeeq ke liye dekhna chahiye.

Bearish Spike namoonay ke liye tasdeeq ke miyaar mein kaleedi guide ki satah se neechay ki kharabi, bearish candle stick ka pattern, ya neechay ki taraf izafay ke baad khareed o farokht ki had mein zabardast taizi shaamil ho sakti hai. un izafi ishaaron ke mandi ke izafay ke andaaz se hum aahang honay ka intzaar karne se, tajir apni tijarat ko barha satke hain aur ghalat isharay ki bunyaad par tijarat mein anay ke imkaan ko kam kar satke hain. kharidaron ke liye yeh zaroori hai ke woh bearish Spike namoonay ki tijarat karte waqt sabr aur jagah ka istemaal karen taakay bekar khatraat aur nuqsanaat se bacha ja sakay.

Bearish Spike patteren aik takneeki tshkhisi pattern hai jo ghair mulki currency ke bazaar mein hota hai aur usay zimma daar mein salahiyat ko neechay ki taraf harkat ka ishara samjha jata hai. is tarz ki khasusiyat qeemat mein taizi se aur achanak izafay ki madad se hai Bearish Spike patteren chart ka aik wasee pattern hai jis ka ghair mulki zar e mubadla ki tijarat mein takneeki tajzia karon ke zareya khaas tor par jaiza liya jata hai. yeh charge mein ghair mutawaqqa aur barray pemanay par kami ki aik wazeh misaal hai, jo aksar market ke andar salahiyat ke ulat jane ya neechay ki taraf rujhan ke tasalsul ka ishara karti hai. tajir aur tajir mandi ke izafay par qareeb se tawajah dete hain kyunkay woh bazaar ke jazbaat aur mumkina taqdeer ki fees ki naqal o harkat ke baray mein qeemti baseerat faraham karne ke qabil hotay hain.

Identifying Bearish Spike Pattern:

Bearish Spike patteren ko tasleem karna un sarmaya karon ke liye ahem hai jo zar e mubadla market mein salahiyat mein kami ki tawaqqa karna chahtay hain. is namoonay mein aam tor par fees mein taiz aur taizi se kami shaamil hoti hai, jo aksar aala khareed o farokht ki had ke zariye mushahida ki jati hai. neechay ki taraf izafay ka mushahida aam tor par istehkaam ki muddat ya side way harkat ki madad se kya jata hai, jo salahiyat ke ulat jane ya neechay ki taraf rujhan ke tasalsul ki nishandahi karta hai.

Tajir takneeki tshkhisi tools ka istemaal kar satke hain jin mein trained lines, madad aur muzahmat ki hudood, aur harkat pazeeri ost shaamil hain taakay mandi ke Spike namoonay ki sadaqat ki tasdeeq ki ja sakay. mazeed bar-aan, ahem isharay jaisay rishta daar taaqat index ( are s aayi ) ya moving average knorjns divergence( am ae si d ) ki nigrani namoonay ki madad se paish kardah nishaan ki toseeq karne mein madad kar sakti hai.

Trading With Bearish Spike Pattern:

Jab koi tajir bearish spike ke namoonay ki shanakht karta hai, to kayi tijarti hikmat e amli hoti hain jin par amal daraamad kya ja sakta hai taakay salahiyat ko kam karne walay charge ke iqdamaat se faida uthaya ja sakay. aik nuqta nazar yeh hai ke namoonay ki tasdeeq ke baad aik mukhtasir position mein jana hai, jis mein fees ki kam satah ko gunjaish ke nuqta nazar ke tor par nishana banaya jata hai. tajir mauqa par qaboo panay aur herat angaiz charge ulat ke khilaaf difaa ke liye stop las orders ka istemaal karte hue bhi yaad kar satke hain.

Aik aur tareeqa yeh hai ke mukhtasir kirdaar mein anay se pehlay Bearish Spike patteren ki tashkhees ke baad pal back ya retracement ka intzaar kya jaye. is se sarmaya karon ko ziyada sazgaar rasai ke Ansar ko mehfooz bananay aur mutabadil ke mauqa se inaam ke tanasub ko badhaane mein madad mil sakti hai. taajiron ke liye yeh zaroori hai ke woh bearish Spike ke namoonay ko deegar takneeki alamaat aur tajzia ki hikmat amlyon ke sath jorhin taakay hatt tridz ke imkaan ko badhaya ja sakay.

Risk Management and Stop Loss Placement in Bearish Spike Pattern:

Forex market mein mandi ke izafay ke namoonay ko kharidne aur farokht karne ke liye rissk control aik ahem cheez hai. taajiron ko aam tor par –apne khatray ki rawadari ko zehen mein rakhna parta hai aur mumkina nuqsanaat ko mehdood karne ke liye munasib farist all las orders ko nafiz karna parta hai. stop las orders ko manfi sharah ki naqal o harkat ke khilaaf difaa ke liye haliya soyng high ya kaleedi muzahmat ki satah se oopar rakha jana chahiye.

Mazeed bar-aan, sarmaya car apni marzi ke tabadlay ke tor par aamdani ko band karne ke liye trailing rokkk all losses ki hikmat e amli ko nafiz karne ko zehen mein rakh satke hain. yeh tareeqa sarmaya karon ko mustahkam munafe ki ijazat deta hai jabkay is ke bawajood tijarti kamray ko saans lainay aur mumkina tor par barri fees chalon par qabza karne ka mauqa faraham karta hai. sarmaya karon ke liye yeh bohat zaroori hai ke woh ghair mulki zar e mubadla ke bazaar mein mustaqil munafe haasil karne ke liye mandi ke izafay ke namoonay ko kharedtay aur farokht karte waqt khatray aur tareef ke darmiyan tawazun qaim karen.

False Signals and Confirmation Criteria In Bearish Spike Pattern:

Agarchay mandi ka barhta sun-hwa pattern qeemat mein kami ki salahiyat ki qabil aetmaad alamat ho sakta hai, lekin kharidaron ko jaali intabahat ke baray mein aagah hona parta hai jo ho satke hain. bazaar ke utaar charhao, khabron ke waqeat, ya deegar anasir ki wajah se jhutay isharay kharray ho satke hain jo qeematon ke amal ke baqaida andaaz mein khlal daaltay hain. jhutay intabahat ke khatray ko kam karne ke liye, kharidaron ko Bearish Spike patteren par mabni tabdeeli mein daakhil honay se pehlay tasdeeq ke liye dekhna chahiye.

Bearish Spike namoonay ke liye tasdeeq ke miyaar mein kaleedi guide ki satah se neechay ki kharabi, bearish candle stick ka pattern, ya neechay ki taraf izafay ke baad khareed o farokht ki had mein zabardast taizi shaamil ho sakti hai. un izafi ishaaron ke mandi ke izafay ke andaaz se hum aahang honay ka intzaar karne se, tajir apni tijarat ko barha satke hain aur ghalat isharay ki bunyaad par tijarat mein anay ke imkaan ko kam kar satke hain. kharidaron ke liye yeh zaroori hai ke woh bearish Spike namoonay ki tijarat karte waqt sabr aur jagah ka istemaal karen taakay bekar khatraat aur nuqsanaat se bacha ja sakay.

تبصرہ

Расширенный режим Обычный режим