What is Rising Three Methods Pattern:

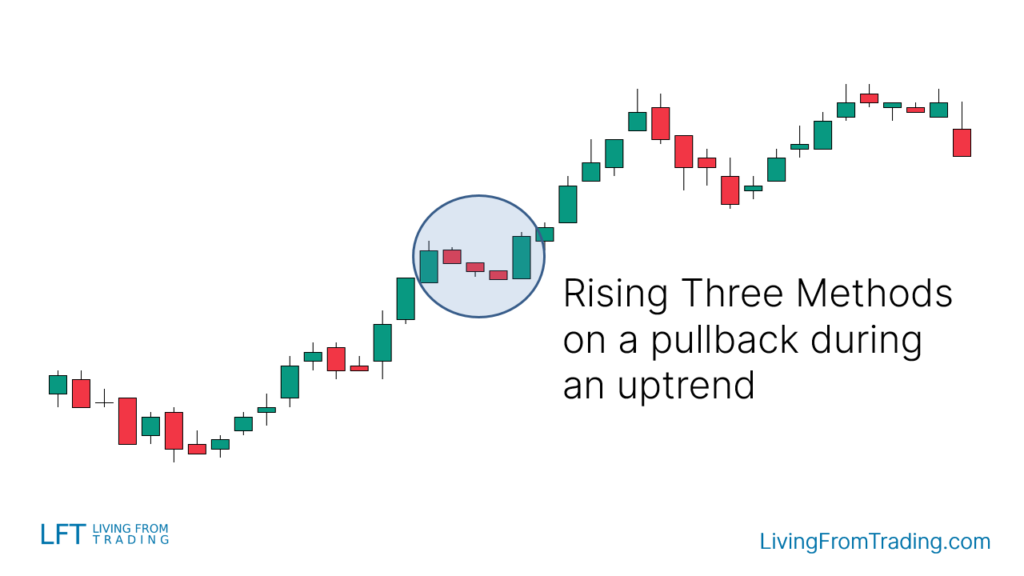

Rising three Method ka pattern aik taizi se jari rehne wala pattern hai jo up trained ke douran hota hai. is pattern mein aik barri taizi wali mom batii shaamil hai, jis ka mushahida 3 choti mandi wali mom btyon ka istemaal karte hue kya jata hai jo pehli taizi wali mom batii ki had ke andar rakhi ja sakti hain, aur is ke baad har doosri barri taizi wali mom batii ki madad se band ho jati hai jo pehli mom batii ke oopar band ho jati hai. patteren taizi ki raftaar dobarah shuru honay se pehlay mamool ke up trained mein aik mukhtasir istehkaam ya peechay hatnay ki nishandahi karta hai.

Importance of Volume in Rising Three Methods Pattern:

Rising three Method ke pattern ka tajzia karte waqt hajam par ghhor karna aik ahem masla hai. misali tor par, is pattern ki tashkeel ke douran, har mom batii ki chhari ko kam hoti hui had dikhani chahiye kyunkay mandi wali mom batian ibtidayi taizi wali mom batii ki had mein peda hoti hain. yeh ghat-ta sun-hwa hajam farokht ke dabao ki kami ko zahir karta hai jaisay jaisay istehkaam ka hissa samnay aata hai. is ke baad, pehli mom batii ke oopri hissay ke oopar aakhri taizi wali mom batii ke totnay ke sath, had mein taizi taizi ke tasalsul ki toseeq karti hai aur pattern ki taaqat ko taqwiyat deti hai .

Identifying Entry and Exit Points in Rising Three Methods Pattern:

Rising three Method ke pattern ko muaser tareeqay se tabdeel karne ke liye, sarmaya karon ko entry aur aygzt ke kaleedi awamil talaash karne chahiye. aik aam tareeqa yeh hai ke jaisay hi aakhri taizi wali mom batii ke oopri hissay ki khilaaf warzi hoti hai, aik taweel function mein daakhil hona, jo up trained ke tasalsul ka ishara hai. stop las orders ko istehkaam ke hissay ke nichale hissay ke neechay rakha ja sakta hai taakay salahiyat ke ulat jane se bachaya ja sakay. tajir pattern ki chouti ki bunyaad par aamdani ke maqasid tay karne ya fashion ki taraqqi ke sath ziyada se ziyada munafe haasil karne ke liye trailing stop ka istemaal karne par bhi ghhor kar satke hain.

Rising Three Methods Pattern Confirmation through Technical Indicators:

Izafi takneeki alamaat ke sath Rising three Method ke pattern ki tasdeeq is ko behtar bana sakti hai. tajir gear par bhi mushtamil ho satke hain jis mein harkat pazeeri ost, rishta daar power index ( are s aayi ) ya am ae si d shaamil hain taakay patteren ke zariye ishara kardah taizi ke jazbaat ki toseeq ki ja sakay. misaal ke tor par, shifting average ka blush cross over ya rate motion aur are s aayi ke darmiyan inhiraf pattern ke final touch ke baad oopar ki taraf harkat ki salahiyat ki izafi tasdeeq paish kar sakta hai.

Considerations and Risks in Trading the Rising Three Methods Pattern:

Agarchay Rising three Method ka pattern qabil qader tijarti mawaqay faraham kar sakta hai, lekin kharidaron ko baaz masail aur khatraat ke baray mein aagah hona chahiye. bazaar ke umomi sayaq o Sabaq ka jaiza lena zaroori hai, jis mein zaroori anasir, bazaar ke jazbaat, aur mumkina muashi sargarmia shaamil hain jo sharah ki harkat ko mutasir kar sakti hain. mazeed bar-aan, stop las orders aur rasd control hikmat amlyon ke istemaal ki ahmiyat par zor dete hue, jhutay alert ya pattern ki mansookhi ho sakti hai. taajiron ko salahiyat ke nuqsanaat ko kam karne aur apni zar e mubadla ki kharidari aur farokht ki koshisho ke munafe ko ziyada se ziyada karne ke liye Rising three Method patteren ki tijarat karte waqt field aur ahthyat ka istemaal karne ki zaroorat hai.

Rising three Method ka pattern aik taizi se jari rehne wala pattern hai jo up trained ke douran hota hai. is pattern mein aik barri taizi wali mom batii shaamil hai, jis ka mushahida 3 choti mandi wali mom btyon ka istemaal karte hue kya jata hai jo pehli taizi wali mom batii ki had ke andar rakhi ja sakti hain, aur is ke baad har doosri barri taizi wali mom batii ki madad se band ho jati hai jo pehli mom batii ke oopar band ho jati hai. patteren taizi ki raftaar dobarah shuru honay se pehlay mamool ke up trained mein aik mukhtasir istehkaam ya peechay hatnay ki nishandahi karta hai.

Importance of Volume in Rising Three Methods Pattern:

Rising three Method ke pattern ka tajzia karte waqt hajam par ghhor karna aik ahem masla hai. misali tor par, is pattern ki tashkeel ke douran, har mom batii ki chhari ko kam hoti hui had dikhani chahiye kyunkay mandi wali mom batian ibtidayi taizi wali mom batii ki had mein peda hoti hain. yeh ghat-ta sun-hwa hajam farokht ke dabao ki kami ko zahir karta hai jaisay jaisay istehkaam ka hissa samnay aata hai. is ke baad, pehli mom batii ke oopri hissay ke oopar aakhri taizi wali mom batii ke totnay ke sath, had mein taizi taizi ke tasalsul ki toseeq karti hai aur pattern ki taaqat ko taqwiyat deti hai .

Identifying Entry and Exit Points in Rising Three Methods Pattern:

Rising three Method ke pattern ko muaser tareeqay se tabdeel karne ke liye, sarmaya karon ko entry aur aygzt ke kaleedi awamil talaash karne chahiye. aik aam tareeqa yeh hai ke jaisay hi aakhri taizi wali mom batii ke oopri hissay ki khilaaf warzi hoti hai, aik taweel function mein daakhil hona, jo up trained ke tasalsul ka ishara hai. stop las orders ko istehkaam ke hissay ke nichale hissay ke neechay rakha ja sakta hai taakay salahiyat ke ulat jane se bachaya ja sakay. tajir pattern ki chouti ki bunyaad par aamdani ke maqasid tay karne ya fashion ki taraqqi ke sath ziyada se ziyada munafe haasil karne ke liye trailing stop ka istemaal karne par bhi ghhor kar satke hain.

Rising Three Methods Pattern Confirmation through Technical Indicators:

Izafi takneeki alamaat ke sath Rising three Method ke pattern ki tasdeeq is ko behtar bana sakti hai. tajir gear par bhi mushtamil ho satke hain jis mein harkat pazeeri ost, rishta daar power index ( are s aayi ) ya am ae si d shaamil hain taakay patteren ke zariye ishara kardah taizi ke jazbaat ki toseeq ki ja sakay. misaal ke tor par, shifting average ka blush cross over ya rate motion aur are s aayi ke darmiyan inhiraf pattern ke final touch ke baad oopar ki taraf harkat ki salahiyat ki izafi tasdeeq paish kar sakta hai.

Considerations and Risks in Trading the Rising Three Methods Pattern:

Agarchay Rising three Method ka pattern qabil qader tijarti mawaqay faraham kar sakta hai, lekin kharidaron ko baaz masail aur khatraat ke baray mein aagah hona chahiye. bazaar ke umomi sayaq o Sabaq ka jaiza lena zaroori hai, jis mein zaroori anasir, bazaar ke jazbaat, aur mumkina muashi sargarmia shaamil hain jo sharah ki harkat ko mutasir kar sakti hain. mazeed bar-aan, stop las orders aur rasd control hikmat amlyon ke istemaal ki ahmiyat par zor dete hue, jhutay alert ya pattern ki mansookhi ho sakti hai. taajiron ko salahiyat ke nuqsanaat ko kam karne aur apni zar e mubadla ki kharidari aur farokht ki koshisho ke munafe ko ziyada se ziyada karne ke liye Rising three Method patteren ki tijarat karte waqt field aur ahthyat ka istemaal karne ki zaroorat hai.

تبصرہ

Расширенный режим Обычный режим