What is Hammer Pattern:

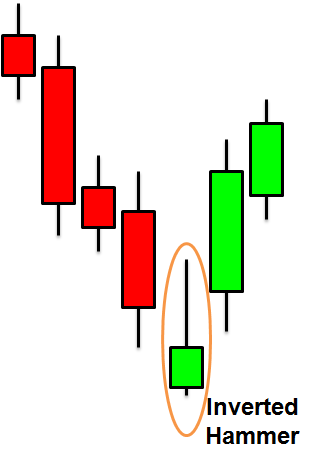

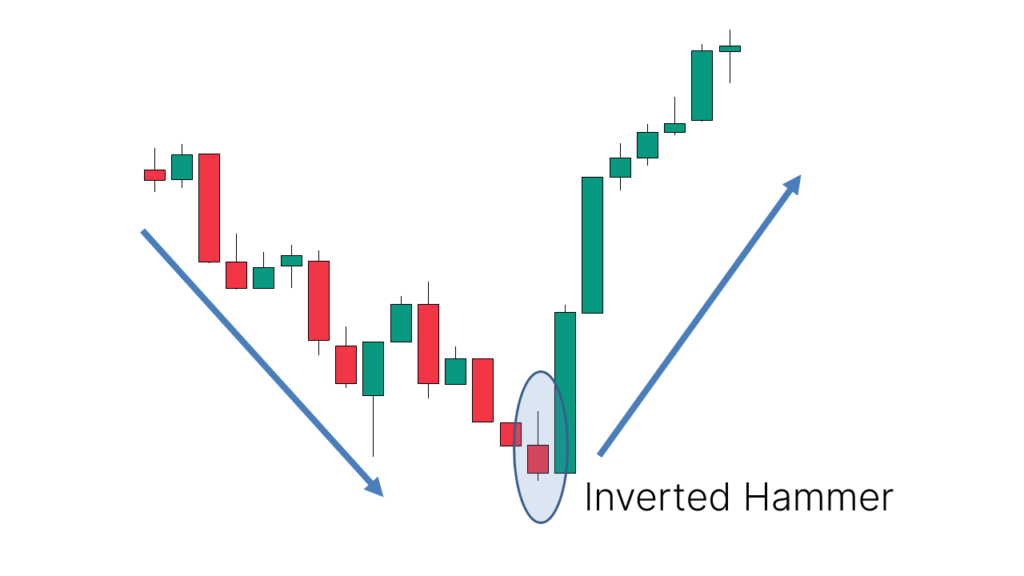

Hammer namona aik mashhoor mom batii ka namona hai jo zar e mubadla ke sarmaya karon ke zareya takneeki tajzia mein salahiyat ke rujhan ke ulat ko daryaft karne ke liye istemaal hota hai. patteren ki khasusiyat mom batii ki chhari ke oopri hissay mein aik chhootey se jism ke zariye hoti hai jis ke sath nichli wick hoti hai jo jism ki lambai se kam az kam gina ziyada hoti hai. yeh tashkeel Hammer se millti jalti hai, isi wajah se yeh naam hai. tajir is tarz ko neechay ke rujhan ke tark honay par talaash karte hain, jo mumkina ulat palat ka ishara deta hai kyunkay tanao ki kharidari qeematon ko un ki kamiyon se ziyada dhakel deti hai. Hammer ke namoonay se pata chalta hai ke ibtidayi farokht ke tanao ke bawajood, sarfeen dobarah heera pheri karne mein kamyaab hue hain, jis ki wajah se market ke jazbaat mein mumkina tabdeeli aayi hai.

Identifying and Interpretation of Hammer Pattern:

Zar e mubadla ke chart par Hammer ke namoonay ki shanakht ke liye, aik mom batii ki chhari talaash karen jis mein tijarti qisam ki chouti ke qareeb aik chhota sa frame ho aur aik lambi nichli Butt jo jism ke neechay phaily ho. mom batii ki chhari ko misali tor par down trained ke baad zahir hona chahiye, jo farokht ke dabao ki salahiyat ke khatmay ki nishandahi karta hai. Hammer ke patteren ko d code karte waqt, tajir usay taizi ke isharay ke tor par dekhte hain, jis se pata chalta hai ke khredar ziyada laagat laane ke liye qadam barha rahay hain. mumkina ulat palat ki tasdeeq ke liye is sayaq o Sabaq ko mad e nazar rakhna zaroori hai jis mein namona zahir hota hai, jis mein support ki hudood ya bohat ziyada Fibonacci retracement degree shaamil hain .

Trading With Hammer Pattern:

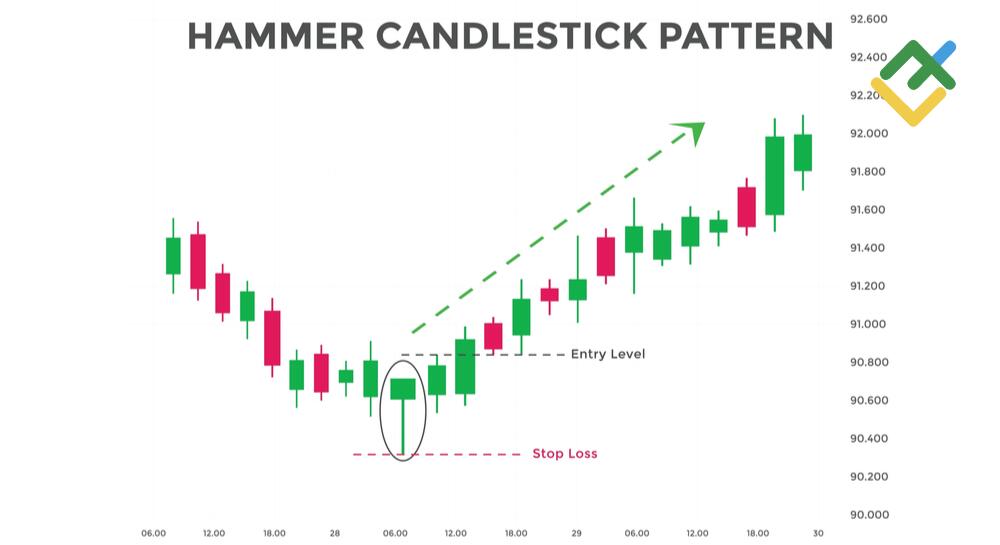

Hammer ke namoonay ki bunyaad par khareed o farokht karte waqt, kharidaron ko kayi ahem awamil ko yaad rakhna chahiye. sab se pehlay, Hammer ka namona ziyada qabil aetmaad hota hai jab ke yeh tosee shuda zawaal ke baad hota hai, kyunkay is se bazaar ke jazbaat mein mumkina tabdeeli ka pata chalta hai. dosra, had ki tashkhees namoonay ki sadaqat ki tasdeeq faraham kar sakti hai, kyunkay Hammer ki tashkeel ke douran behtar tijarti hajam ulat jane ke imkaan ko taqwiyat deta hai. mazeed bar-aan, taajiron ko Hammer ke namoonay ke zariye faraham kardah trading signal ko mazboot bananay ke liye deegar takneeki isharay ya chart ke andaaz ke sath sangam talaash karna parta hai.

Limitations and Risks Associated with Hammer Pattern:

Agarchay Hammer ka namona salahiyat ke rujhan ke ulat jane ka pata laganay ke liye aik mo-asar zareya ho sakta hai, lekin yeh rukawaton aur khatraat ke baghair nahi hai. Hammer ke namoonay ki bunyadi kharabion mein se aik ghalat isharay ke liye is ki hsasit hai, khaas tor par jab range ya na hamwar baazaaron mein hota hai. taajiron ko Hammer ke namoonay par mukammal tor par inhisaar karne se mohtaat rehna hoga aur tasdeeq ke liye mukhtalif takneeki tshkhisi alaat ko mat bhulen. mazeed bar-aan, bazaar ke halaat aur bairooni anasir bhi namoonay ki taseer ko mutasir kar satke hain, khatray par qaboo panay aur Hammer ke namoonay par mukammal tor par mabni tijarat ke douran sahih kirdaar ke size ki ahmiyat par zor dete hain.

Incorporating the Hammer Pattern into a Trading Strategy:

Hammer ke namoonay ko aik jame khareed o farokht ki hikmat e amli mein zam karne mein kamyabi ki tijarat ke imkanaat ko badhaane ke liye usay deegar takneeki tajzia alaat ke sath jorna shaamil hai. tajir Hammer ke namoonay ko lambi pozishnon mein anay ki wajah ke tor par istemaal kar satke hain, khatray ko sambhalay ke liye Hammer ki mom batii ke nichale hissay ke neechay nuqsaan se bachney ke order day satke hain. mazeed bar-aan, bunyadi tor par kaleedi muzahmat ki dgryon ya Fibonacci ki tosee par mabni aamdani ke maqasid ke baray mein sochnay se salahiyat ke fawaid ko ziyada se ziyada karne mein madad mil sakti hai. Hammer ke patteren ko aik nazam o zabt walay tijarti mansoobay mein shaamil karkay aur khatray par qaboo panay ke sahih tareeqon par amal karte hue, tajir is mom batii ke patteren ka istemaal karkay rujhan ke ulat palat ka muaser tareeqay se faida utha satke hain.

Hammer namona aik mashhoor mom batii ka namona hai jo zar e mubadla ke sarmaya karon ke zareya takneeki tajzia mein salahiyat ke rujhan ke ulat ko daryaft karne ke liye istemaal hota hai. patteren ki khasusiyat mom batii ki chhari ke oopri hissay mein aik chhootey se jism ke zariye hoti hai jis ke sath nichli wick hoti hai jo jism ki lambai se kam az kam gina ziyada hoti hai. yeh tashkeel Hammer se millti jalti hai, isi wajah se yeh naam hai. tajir is tarz ko neechay ke rujhan ke tark honay par talaash karte hain, jo mumkina ulat palat ka ishara deta hai kyunkay tanao ki kharidari qeematon ko un ki kamiyon se ziyada dhakel deti hai. Hammer ke namoonay se pata chalta hai ke ibtidayi farokht ke tanao ke bawajood, sarfeen dobarah heera pheri karne mein kamyaab hue hain, jis ki wajah se market ke jazbaat mein mumkina tabdeeli aayi hai.

Identifying and Interpretation of Hammer Pattern:

Zar e mubadla ke chart par Hammer ke namoonay ki shanakht ke liye, aik mom batii ki chhari talaash karen jis mein tijarti qisam ki chouti ke qareeb aik chhota sa frame ho aur aik lambi nichli Butt jo jism ke neechay phaily ho. mom batii ki chhari ko misali tor par down trained ke baad zahir hona chahiye, jo farokht ke dabao ki salahiyat ke khatmay ki nishandahi karta hai. Hammer ke patteren ko d code karte waqt, tajir usay taizi ke isharay ke tor par dekhte hain, jis se pata chalta hai ke khredar ziyada laagat laane ke liye qadam barha rahay hain. mumkina ulat palat ki tasdeeq ke liye is sayaq o Sabaq ko mad e nazar rakhna zaroori hai jis mein namona zahir hota hai, jis mein support ki hudood ya bohat ziyada Fibonacci retracement degree shaamil hain .

Trading With Hammer Pattern:

Hammer ke namoonay ki bunyaad par khareed o farokht karte waqt, kharidaron ko kayi ahem awamil ko yaad rakhna chahiye. sab se pehlay, Hammer ka namona ziyada qabil aetmaad hota hai jab ke yeh tosee shuda zawaal ke baad hota hai, kyunkay is se bazaar ke jazbaat mein mumkina tabdeeli ka pata chalta hai. dosra, had ki tashkhees namoonay ki sadaqat ki tasdeeq faraham kar sakti hai, kyunkay Hammer ki tashkeel ke douran behtar tijarti hajam ulat jane ke imkaan ko taqwiyat deta hai. mazeed bar-aan, taajiron ko Hammer ke namoonay ke zariye faraham kardah trading signal ko mazboot bananay ke liye deegar takneeki isharay ya chart ke andaaz ke sath sangam talaash karna parta hai.

Limitations and Risks Associated with Hammer Pattern:

Agarchay Hammer ka namona salahiyat ke rujhan ke ulat jane ka pata laganay ke liye aik mo-asar zareya ho sakta hai, lekin yeh rukawaton aur khatraat ke baghair nahi hai. Hammer ke namoonay ki bunyadi kharabion mein se aik ghalat isharay ke liye is ki hsasit hai, khaas tor par jab range ya na hamwar baazaaron mein hota hai. taajiron ko Hammer ke namoonay par mukammal tor par inhisaar karne se mohtaat rehna hoga aur tasdeeq ke liye mukhtalif takneeki tshkhisi alaat ko mat bhulen. mazeed bar-aan, bazaar ke halaat aur bairooni anasir bhi namoonay ki taseer ko mutasir kar satke hain, khatray par qaboo panay aur Hammer ke namoonay par mukammal tor par mabni tijarat ke douran sahih kirdaar ke size ki ahmiyat par zor dete hain.

Incorporating the Hammer Pattern into a Trading Strategy:

Hammer ke namoonay ko aik jame khareed o farokht ki hikmat e amli mein zam karne mein kamyabi ki tijarat ke imkanaat ko badhaane ke liye usay deegar takneeki tajzia alaat ke sath jorna shaamil hai. tajir Hammer ke namoonay ko lambi pozishnon mein anay ki wajah ke tor par istemaal kar satke hain, khatray ko sambhalay ke liye Hammer ki mom batii ke nichale hissay ke neechay nuqsaan se bachney ke order day satke hain. mazeed bar-aan, bunyadi tor par kaleedi muzahmat ki dgryon ya Fibonacci ki tosee par mabni aamdani ke maqasid ke baray mein sochnay se salahiyat ke fawaid ko ziyada se ziyada karne mein madad mil sakti hai. Hammer ke patteren ko aik nazam o zabt walay tijarti mansoobay mein shaamil karkay aur khatray par qaboo panay ke sahih tareeqon par amal karte hue, tajir is mom batii ke patteren ka istemaal karkay rujhan ke ulat palat ka muaser tareeqay se faida utha satke hain.

تبصرہ

Расширенный режим Обычный режим