Forex price action wazeh market dynamics ka sabse asal rup hai, jo currency exchange ke daire mein arz aur talab ka rawan aur giranah roop hai. Ye indicators aur oscillators ki complexities se ooper uth kar, charts par prices ka asal harkat par amal karta hai. Esan ka matlab hai, market ki jazbat ka parda utaarna, patterns ko ujaagar karna, aur maqbool trading decisions ko shaye karna. Ye guftago market ki qaraariyat, ahmiyat aur strategies ke baray mein gehre jaa rahi hai.

The Foundation of Price Action

The Foundation of Price Action

Apni bunyad par, price action analysis taqreeban future price directions ke liye tareekhi price movements ka mutaala karta hai. Ye manne par mabni hai ke tamaam relevant market information price action mein reflected hoti hai, jo isay sab se bharosemand indicator banata hai. Price action mein mahir traders candlestick patterns, chart formations, aur price trends ko dekhte hain takay market ki jazbat ka andaza lagaya ja sake.

Candlestick patterns price action analysis ke bunyadi khatoot hote hain, market ki jazbat ke baray mein qeemati isharaat faraham karte hain. Patterns jaise ke engulfing, doji, aur hammer potential reversals, continuations, ya market mein ghair yakeeni ke baray mein ahem maloomat faraham karte hain. In patterns ko pehchanne aur samajhne ki maharat traders ko wakt par aur maqbool faislay karne ki taqat faraham karti hai.

Individual candlestick patterns ke ilawa, price action ke shauqeen chart formations aur patterns ko dekhte hain taakay potential trading opportunities ka pata lagaya ja sake. Chahe woh head and shoulders ho, triangles, ya flags, har pattern ke alag tareeqay hotay hain jin ka price movement par asar hota hai. In formations ko tawajju se dekh kar traders breakouts, trend reversals, aur consolidation phases ka andaza laga sakte hain.

Trend analysis price action methodology ka markazi hissa hai, jo traders ko mojooda market momentum ke saath milana sikhaata hai. Uptrends, downtrends, aur ranging markets ko pehchaanne se traders ko potential entry aur exit points ka safar milta hai. Trendlines, moving averages, aur support/resistance levels market trends ko samajhne aur trading opportunities ko exploit karne ke liye laazmi tools hote hain.

Market Structure and Support/Resistance

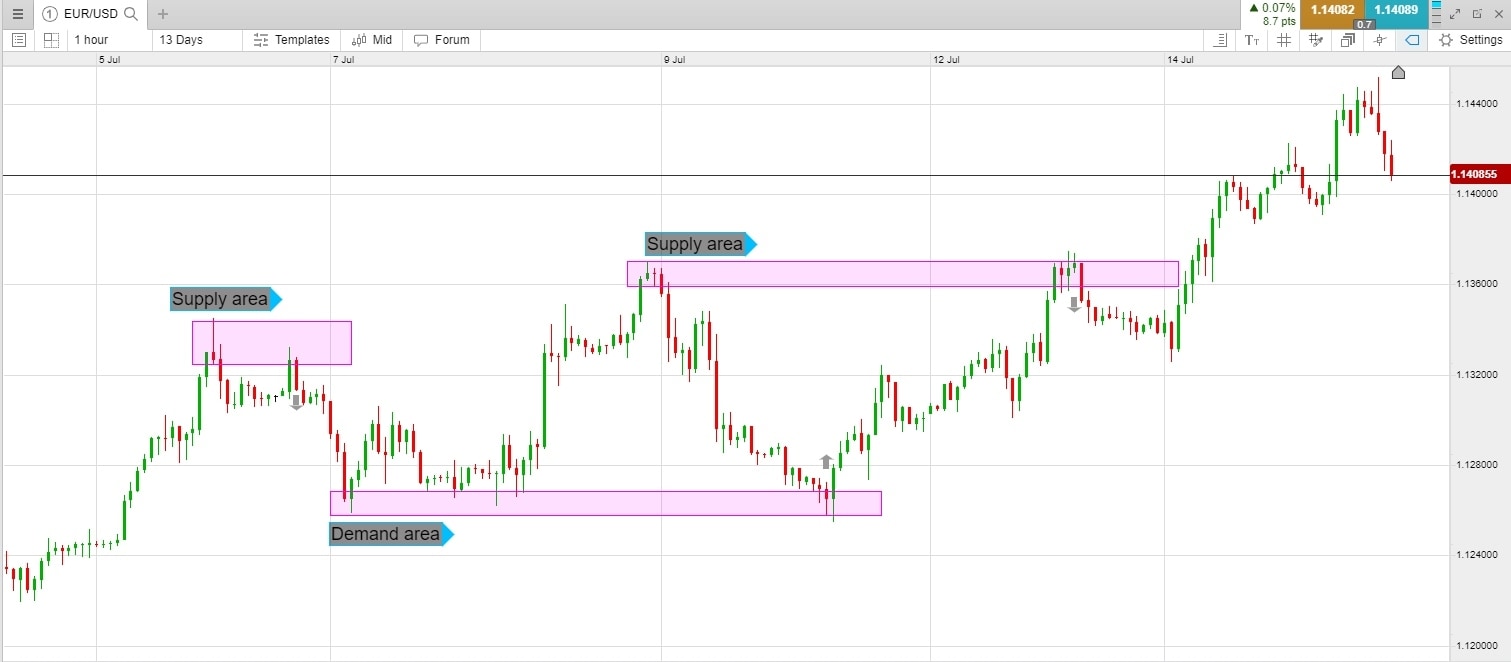

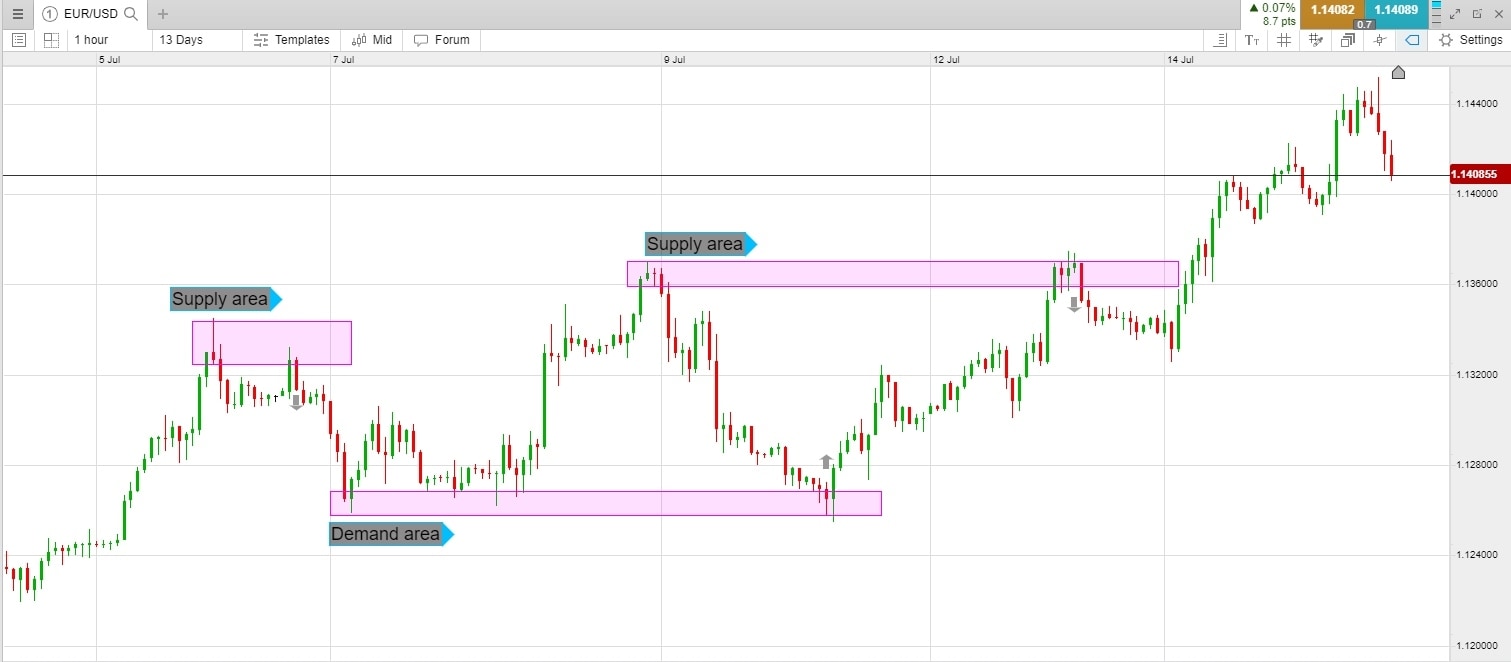

Market structure samajhna price action analysis ke liye bohot zaroori hai, kyun ke ye price movements ka fraimwork bayan karta hai. Support aur resistance levels woh zones hote hain jahan buying aur selling pressures aapas mein milti hain, traders ko strategic entry aur exit points faraham karte hain. In levels ki taqat ko price rejections aur breakouts ke zariye pehchanna traders ko market ke fluctuations mein tezgi se guzarnay ki salahiyat faraham karta hai.

Price action strategies market mein inefficiencies ko exploit karne aur price movements par faida uthane ke liye mukhtalif techniques ka majmooa hote hain. Breakout trading se lekar trend continuation setups tak, har strategy mukhtalif price action principles ka istemal karti hai takay nafahat ko ziada se ziada banaya ja sake. Sabr, discipline, aur risk management price action strategies ko effectively execute karne ke integral hissay hain.

Psychology of Price Action

Technical analysis ke ilawa, price action market participants ke psychology ka izhar karta hai, unke khofat, umeedat, aur biases ko ujagar karta hai. Crow behavior aur sentiment shifts ko samajhna traders ko market reversals ka andaza lagane aur sentiment-driven price movements ka faida uthane mein madad karta hai. Emotional discipline aur resilience price action trading ke psychology ke nuances ko samajhne ke liye shart hai.

Adaptive Nature of Price Action

Price action ka ek pehchaan ye hai ke ye mukhtalif market conditions aur timeframes ke liye mawafiq hai. Chahe woh volatile ya ranging markets hon, price action principles relevant rahte hain, trading decisions par robust framework faraham karte hain. Market context ke mutabiq strategies aur tactics ko adjust kar ke, traders ko market ke harkat ka jawabdeh aur jawabdeh rehne ki salahiyat milti hai.

Forex price action trading ka fun hai, jo conventional indicators aur strategies ko paar kar jata hai. Ye traders ko market dynamics ka gahira understanding faraham karta hai, jahan price movements ko samajhne aur future trends ka andaza lagane ki salahiyat faraham hoti hai. Price action ko maharat hasil karne ke liye dedication aur practice ki zaroorat hoti hai, lekin iske timeless principles forex market ke complexities ko samajhne ke liye bharosemand sahaara faraham karte hain. Price action ke fun ka izhaar aik trading opportunities ka duniya ko kholta hai, jahan intehaiyat, maharat, aur discipline kamiyaabi ko currency exchange ke dynamic daire mein barhawa dete hain.

The Foundation of Price Action

The Foundation of Price ActionApni bunyad par, price action analysis taqreeban future price directions ke liye tareekhi price movements ka mutaala karta hai. Ye manne par mabni hai ke tamaam relevant market information price action mein reflected hoti hai, jo isay sab se bharosemand indicator banata hai. Price action mein mahir traders candlestick patterns, chart formations, aur price trends ko dekhte hain takay market ki jazbat ka andaza lagaya ja sake.

Reading Candlestick Patterns

Candlestick patterns price action analysis ke bunyadi khatoot hote hain, market ki jazbat ke baray mein qeemati isharaat faraham karte hain. Patterns jaise ke engulfing, doji, aur hammer potential reversals, continuations, ya market mein ghair yakeeni ke baray mein ahem maloomat faraham karte hain. In patterns ko pehchanne aur samajhne ki maharat traders ko wakt par aur maqbool faislay karne ki taqat faraham karti hai.

Chart Formations and Patterns

Individual candlestick patterns ke ilawa, price action ke shauqeen chart formations aur patterns ko dekhte hain taakay potential trading opportunities ka pata lagaya ja sake. Chahe woh head and shoulders ho, triangles, ya flags, har pattern ke alag tareeqay hotay hain jin ka price movement par asar hota hai. In formations ko tawajju se dekh kar traders breakouts, trend reversals, aur consolidation phases ka andaza laga sakte hain.

Trend Analysis

Trend analysis price action methodology ka markazi hissa hai, jo traders ko mojooda market momentum ke saath milana sikhaata hai. Uptrends, downtrends, aur ranging markets ko pehchaanne se traders ko potential entry aur exit points ka safar milta hai. Trendlines, moving averages, aur support/resistance levels market trends ko samajhne aur trading opportunities ko exploit karne ke liye laazmi tools hote hain.

Market Structure and Support/Resistance

Market structure samajhna price action analysis ke liye bohot zaroori hai, kyun ke ye price movements ka fraimwork bayan karta hai. Support aur resistance levels woh zones hote hain jahan buying aur selling pressures aapas mein milti hain, traders ko strategic entry aur exit points faraham karte hain. In levels ki taqat ko price rejections aur breakouts ke zariye pehchanna traders ko market ke fluctuations mein tezgi se guzarnay ki salahiyat faraham karta hai.

Price Action Strategies

Price action strategies market mein inefficiencies ko exploit karne aur price movements par faida uthane ke liye mukhtalif techniques ka majmooa hote hain. Breakout trading se lekar trend continuation setups tak, har strategy mukhtalif price action principles ka istemal karti hai takay nafahat ko ziada se ziada banaya ja sake. Sabr, discipline, aur risk management price action strategies ko effectively execute karne ke integral hissay hain.

Psychology of Price Action

Technical analysis ke ilawa, price action market participants ke psychology ka izhar karta hai, unke khofat, umeedat, aur biases ko ujagar karta hai. Crow behavior aur sentiment shifts ko samajhna traders ko market reversals ka andaza lagane aur sentiment-driven price movements ka faida uthane mein madad karta hai. Emotional discipline aur resilience price action trading ke psychology ke nuances ko samajhne ke liye shart hai.

Adaptive Nature of Price Action

Price action ka ek pehchaan ye hai ke ye mukhtalif market conditions aur timeframes ke liye mawafiq hai. Chahe woh volatile ya ranging markets hon, price action principles relevant rahte hain, trading decisions par robust framework faraham karte hain. Market context ke mutabiq strategies aur tactics ko adjust kar ke, traders ko market ke harkat ka jawabdeh aur jawabdeh rehne ki salahiyat milti hai.

Forex price action trading ka fun hai, jo conventional indicators aur strategies ko paar kar jata hai. Ye traders ko market dynamics ka gahira understanding faraham karta hai, jahan price movements ko samajhne aur future trends ka andaza lagane ki salahiyat faraham hoti hai. Price action ko maharat hasil karne ke liye dedication aur practice ki zaroorat hoti hai, lekin iske timeless principles forex market ke complexities ko samajhne ke liye bharosemand sahaara faraham karte hain. Price action ke fun ka izhaar aik trading opportunities ka duniya ko kholta hai, jahan intehaiyat, maharat, aur discipline kamiyaabi ko currency exchange ke dynamic daire mein barhawa dete hain.

تبصرہ

Расширенный режим Обычный режим