Introduction

Rectangle patterns trading strategy ek popular technical analysis tool hai jo traders ko market trends aur price movements ka analysis karne mein madad karta hai. Ye patterns rectangle ya box shape mein hoti hain aur market mein consolidation period ko darust karti hain. Is guide mein, rectangle patterns trading strategy ke mool concepts aur istemal ke tareeqay ke bare mein bataya gaya hai.Rectangle patterns trading strategy ek powerful tool hai jo traders ko market mein price movements ka analysis karne mein madad karta hai. Is guide mein, rectangle pattern ki pehchan, istemal aur trading strategy ke mool tareeqay ko samjha gaya hai. Ye strategy traders ke liye ek ahem tool hai jo unhe market mein trading opportunities ka pata lagane mein madad karta hai.

Rectangle Pattern Kya Hai

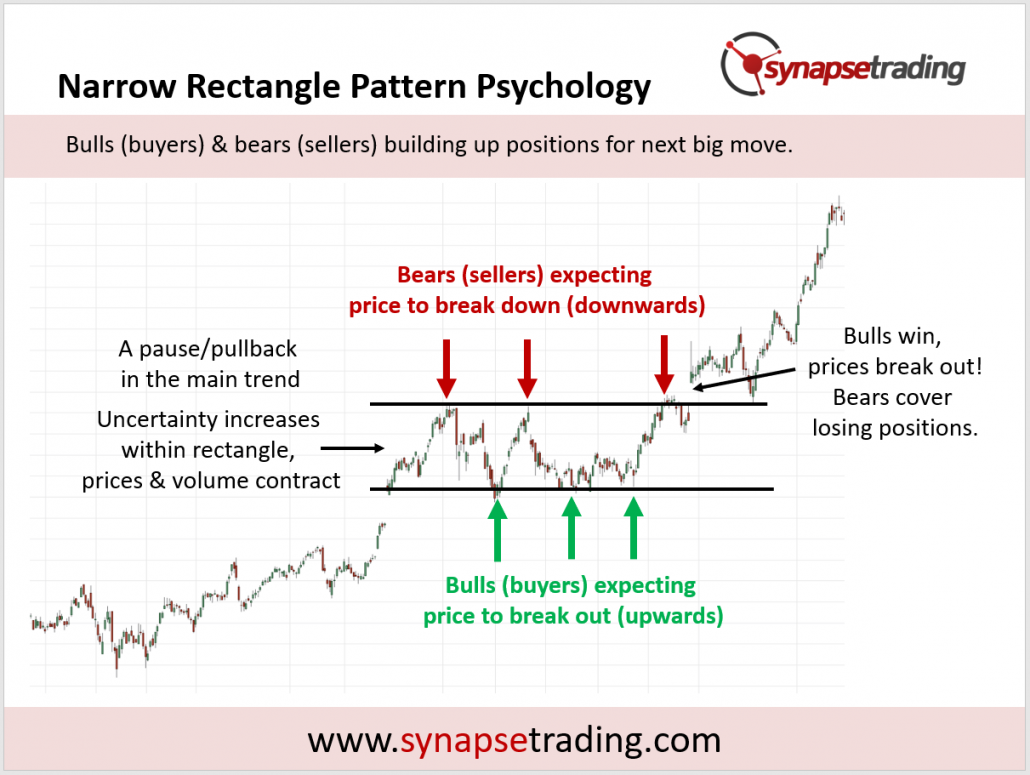

Rectangle pattern ek price action pattern hai jo price movement ko rectangle ya box shape mein darust karta hai. Ye pattern market mein consolidation period ko darust karta hai jab prices ek range mein trade karte hain.

Rectangle Pattern Ki Identification

Rectangle pattern ki pehchan karne ke liye, aapko horizontal support aur resistance lines ko identify karna hota hai jo price range ko define karte hain. Rectangle pattern mein, prices range mein trade karte hain aur support aur resistance levels barabar hote hain.

Rectangle Pattern Ka Istemal

Rectangle pattern ka istemal karne ke liye, aapko entry aur exit points ko identify karna hota hai. Entry point usually rectangle pattern ke breakout ke baad hota hai jab price support ya resistance level ko cross karta hai. Exit point support aur resistance levels ke paas rakha jata hai.

Rectangle Pattern Trading Strategy

Rectangle pattern trading strategy ka istemal karne ke liye, aapko ye steps follow karne hote hain.

- Rectangle Pattern Ki Peahchan: Pehle rectangle pattern ko identify karen.

- Support Aur Resistance Levels Ka Pata Lagana: Rectangle pattern ke support aur resistance levels ko identify karen.

- Entry Point Ka Intezar Karna: Entry point ka intezar karen jab price support ya resistance level ko cross karta hai.

- Stop Loss Aur Take Profit Levels Set Karna: Stop loss aur take profit levels ko set karen support aur resistance levels ke nazdeek.

Rectangle Pattern Trading Ka Example

Maan lijiye aap ek stock ka chart dekh rahe hain aur aapne rectangle pattern identify kiya hai. Support level $50 aur resistance level $60 hai. Agar price $60 ko break kar ke upar jata hai, to aap long position le sakte hain with a stop loss of $55 aur take profit target of $70.

Rectangle Pattern Trading Ki Ahmiyat

Rectangle pattern trading strategy ki ahmiyat ye hai ke ye traders ko entry aur exit points ka pata lagane mein madad karta hai jab market mein consolidation hoti hai. Is strategy ke istemal se traders ko potential profit opportunities mil sakti hain.

تبصرہ

Расширенный режим Обычный режим