Retest Strategy Kya Hay?

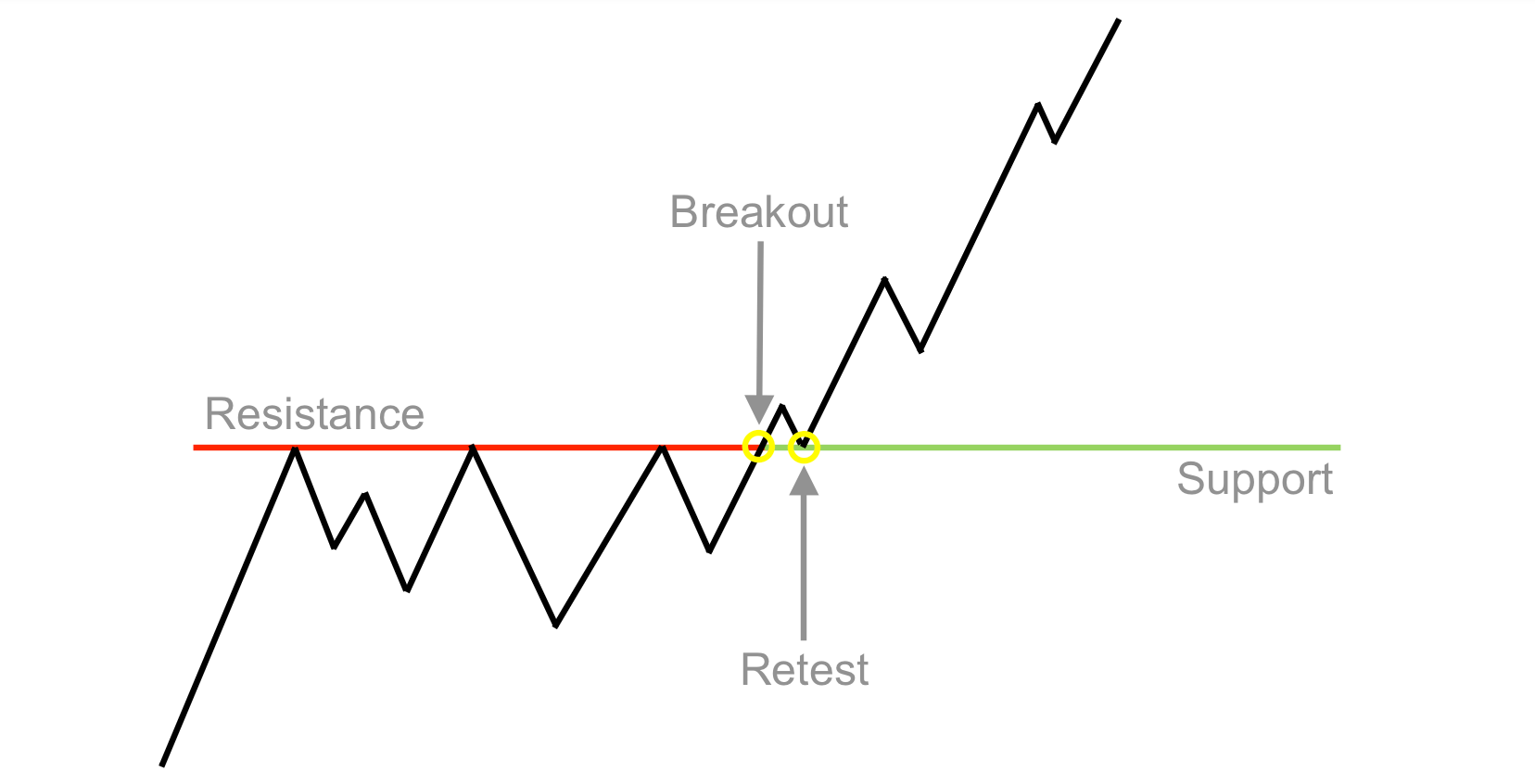

Forex candlesticks chart main retest strategy ek trading strategy hay jo support aur resistance levels ki retest ka fayda uthane ke liye design ki gai hay. Yah strategy is baat per mustamil hay ke jab koi price level support ya resistance se takrata hay to aksar use level ko retest karta hay. Is retest ka istemal trading opportunities ki pahchan karne ke liye kiya ja sakta hay Retest strategy do steps per kam karti hay:

Retest ka intezar karen. Jab koi price level support ya resistance se takrata hay to aksar use level ko retest karta hay. Retest ek aisi situation hay jahan price support ya resistance level ko touch karta hay aur phir wapas palt jata hay.

Following Steps

darje zail steps ko follow kar ke aik trader apne trade ko mahfoz banate hoe acha munafa bana sakta hay

Retest Strategy Ke Fayde:

Retest Strategy Ke Nuksan:

Tips Of Use

Support aur resistance levels ki sahi pahchan karna important hay.

Disclaimer:

Forex trading mein risk shamil hay. Is strategy ka istemal karne se pehle apni research karen aur ek financial advisor se maslahat karen.

Conclusion:

Retest strategy forex trading mein ek effective tool hay. Yah strategy istemal karke, aap profitable trades kar sakte hain.

Forex candlesticks chart main retest strategy ek trading strategy hay jo support aur resistance levels ki retest ka fayda uthane ke liye design ki gai hay. Yah strategy is baat per mustamil hay ke jab koi price level support ya resistance se takrata hay to aksar use level ko retest karta hay. Is retest ka istemal trading opportunities ki pahchan karne ke liye kiya ja sakta hay Retest strategy do steps per kam karti hay:

Support aur resistance levels ki pahchan karen. Support aur resistance levels aise price levels hain jahan price ka movement ruk jata hay ya ulat jata hay. Support ek aisa level hay jahan price ne girna rok diya hay, aur resistance ek aisa level hay jahan price ne badhana rok diya hay.

Retest ka intezar karen. Jab koi price level support ya resistance se takrata hay to aksar use level ko retest karta hay. Retest ek aisi situation hay jahan price support ya resistance level ko touch karta hay aur phir wapas palt jata hay.

Following Steps

darje zail steps ko follow kar ke aik trader apne trade ko mahfoz banate hoe acha munafa bana sakta hay

1 Ek forex pair chunen.

2 Support aur resistance levels ki pahchan karen.

3 Retest ka intezar karen.

4 Trade karen.

3 Retest ka intezar karen.

4 Trade karen.

Retest Strategy Ke Fayde:

1 Yah strategy istemal karne mein aasan 1. hay.

2 Yah strategy bahut effective hay.

3 Yah strategy kam risk wali hay.

2 Yah strategy bahut effective hay.

3 Yah strategy kam risk wali hay.

Retest Strategy Ke Nuksan:

1 Yah strategy hamesha kam nahin karti 1. hay.

2 Yah strategy market volatility ke liye sensitive hay.

2 Yah strategy market volatility ke liye sensitive hay.

Tips Of Use

Support aur resistance levels ki sahi pahchan karna important hay.

Retest ka intezar karne ke liye sabra rakhen.

Trade karne se pehle risk-to-reward ratio ka hisab lagaen.

Disclaimer:

Forex trading mein risk shamil hay. Is strategy ka istemal karne se pehle apni research karen aur ek financial advisor se maslahat karen.

Conclusion:

Retest strategy forex trading mein ek effective tool hay. Yah strategy istemal karke, aap profitable trades kar sakte hain.

تبصرہ

Расширенный режим Обычный режим